TVS tops e-2W sales for fifth month in a row in August, Ola and Ather go ahead of Bajaj

TVS Motor with sales of 24,087 units and 36% growth in August continues to hold sway over the electric two-wheeler industry. With Bajaj Auto dropping to fifth rank due to the shortage of rare earth magnets that impacted production, Ola Electric takes second position ahead of Ather Energy and Hero MotoCorp, both of whom achieved best-ever monthly retails.

TVS Motor Co, which topped retail sales of electric two-wheelers for the first time in April this year, continues to hold sway over the 200-plus e-2W players in India for the fifth month in a row since then. At 24,087 units, the TVS and its iQube e-scooter are ahead of the next-best OEM (Ola) by 5,115 units in August 2025, a month that saw slower factory output for some OEMs due to the shortage of supplies of rare earth magnets from China.

Bajaj Auto, whose production of the Chetak had fallen by 47% in July due to constraints caused by global rare earth magnet availability, announced on August 21 that it had resumed supplies of its electric scooter across all dealerships and had begun scaling up production. The temporary supply constraint though was enough to impact Bajaj Auto’s retails in August and, resultantly, a downward shift in the OEM rankings for last month.

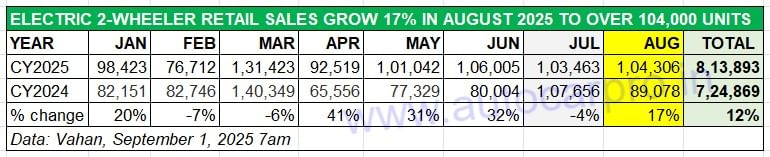

August 2025 retails of 104,306 units (up 17% YoY) are the second highest monthly score in the first eight months of CY2025.

Reduced production in August, however, did little to dampen the enthusiasm of e-2W buyers because the 104,306 EVs retailed last month are the second-best in the year to date (see eight-month sales data table above).

What’s more, cumulative sales for the first eight months of CY2025 are up 12% YoY (January-August 2024: 724,869 units) and already 71% of the record 1.14 million e-2Ws sold in CY2024. Let’s take a quick look at how the Top 10 of the 200-plus players in the e-2W market have fared in August.

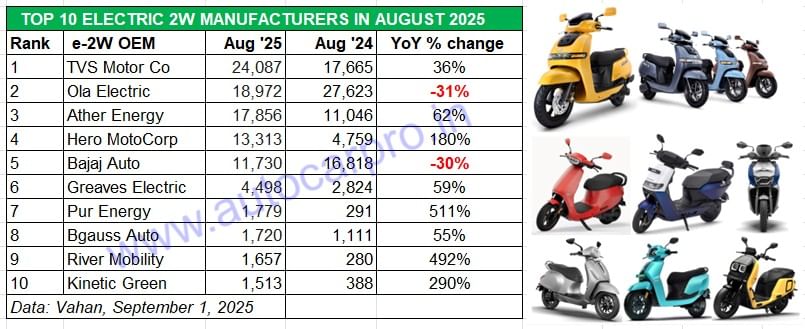

REVEALED: THE TOP 10 E-2W MANUFACTURERS

TVS Motor Co, which had topped monthly e-2W retail sales for the very first time in April 2025, and held onto the No. 1 position in May, June and July, repeated the market-leading act in August with 24,087 units. This gives the company a market-leading share of 23% for the month.

TVS’ cumulative sales for the first five months of FY2026 at 116,749 units are up 64% YoY (April-August 2024: 70,976 units). For the first eight months of CY2025, TVS’s 190,498 units, up 49% (January-August 2024: 127,617 units) are already 86% of its record annual sales of 220,813 units in CY2024.

On August 28, TVS upped the ante with the launch of the new Orbiter at Rs 99,900 (ex-showroom, Bengaluru), inclusive of subsidies, which prices it on par with the base variant of the TVS iQube that features a smaller 2.2kWh battery pack. TVS has capped the Orbiter’s top speed at 68kph which, while slower than performance-focused EVs, should be more than adequate for everyday city commutes. While bookings have commenced, deliveries are expected in the second half of September.

There was a stiff fight for the No. 2 position between Ola Electric and Ather Energy. Halfway into August, Ather was leading Ola by 1,410 units, but the second half of the month saw Ola regain momentum and ride ahead of its rival. Ola, which has become the first EV maker in India to surpass cumulative sales of 900,000 units, delivered 18,972 e-scooters and e-motorcycles in August which gives it an 18% market share. The company, had last topped the monthly sales chart in January 2025 but since then has ceded that position to Bajaj Auto in February and March 2025, and to TVS over the past five months.

The bulk of Ola’s sales come from the 14-variant S1 e-scooter, which straddles multiple price-points starting from entry level mass mobility through to premium (Rs 65,000 to Rs 170,000). The S1 Pro, equipped with a 4kWh battery, has a claimed 142km range on a single charge and has an ex-showroom price of Rs 154,999. Ola also manufactures and sells the Roadster X electric motorcycle which develops peak power of 11 kW, top speed of 125kph and has a range of 501km.On August 15, at its annual event, Ola Electric announced a clutch of new products, next-gen software and announcements about future vehicles and technologies. The company revealed the Ola S1 Pro Sport, which will be the most powerful Ola scooter slated for debut in January 2026.

Ather Energy is currently having a stellar run of the market. The company has moved up one rank to third place, both as a result of its best-ever monthly sales of 17,856 units, up 62% YoY (August 2024: 11,046 units) and also because of Bajaj Auto’s much-reduced production and sales. For August, Ather gets a 17% e-2W market share.

Its flagship Rizta family scooter, which surpassed 100,000 wholesales 13 months after launch in April, remains Ather’s key growth driver and currently contributes over 60% of its sales each month. This is creditable given that the three-variant flagship scooter is a premium product.

For the first eight months of CY2025, its cumulative retails at 116,046 units are already 92% of its entire CY2024 sales of 126,355 units. If it maintains its current rapid pace of sales, expect Ather Energy to go past the 175,000-unit annual mark for the first time in CY2025.

For the second straight month, Hero MotoCorp, the world’s largest two-wheeler manufacturer, has registered its best-ever electric scooter monthly sales. Powered by demand for the new Vida VX2 model, the company delivered 13,313 e-scooters to customers in August, which is a 26% month-on-month increase over the 10,537 EVs sold in July 2025. This is the second time that the company has surpassed the 10,000-unit monthly sales mark since it entered the electric two-wheeler industry in October 2022.

The August 2025 sales, which are an 180% YoY increase (July 2024: 4,759 units), enable Hero MotoCorp to achieve a 10%-plus market share for the second month in a row. In August, its e-2W market share stands at its highest: 13 percent. And it has moved up in the Top 10 e-2W rankings to No. 4, ahead of Bajaj Auto, and behind TVS Motor, Ola Electric, and Ather Energy.

Bajaj Auto, which had topped monthly e-2W sales in February (21,570 units) and March (32,215 units), has been the No. 2 OEM from April to July below TVS Motor. However, in August, it dropped all of two ranks to fifth position mainly due to Chetak production being adversely impacted by the shortage of rare earth magnets (REM). In August, the company sold 11,730 Chetaks, down 30% YoY (August 2024: 16,818 units). As a result, its e-2W market share has dropped to 11 percent last month. The company, which has resumed full production now with REM supplies resuming, is working on two solutions – using light rare earth magnets which are more easily available and also developing new magnet technologies that negate the use of rare earth materials.

Greaves Electric Mobility (GEM), the EV arm of Greaves Cotton which markets the Ampere brand of e-scooters, maintains its sixth rank with 4,498 units – this marks strong growth of 59% YoY and gives it a 4% market share. The company has three key e-scooter brands – Nexus (EX and ST), Magnus (Neo and EX) and Reo (80 and Li Plus). While the flagship Nexus remains the best-selling product for GEM and Ampere Vehicles, the company is seeing growing demand for the new Ampere Reo 80 launched in April at Rs 59,900.

Pur Energy, the Hyderabad-based EV startup incubated from the i-TIC at IIT Hyderabad, is now a regular entry in the monthly Top 10 e-2W OEM list. The company, which has a five-model portfolio has clocked sales of 1,779 units in August, up 511% YoY.

Bgauss Auto, a Mumbai-based startup spawned by electrical solutions major RR Kabel, is also witnessing strong demand for its two products, the RUV 350 and Max C12. In August, Bgauss sold 1,720 units to take the seventh rank.

Another startup which continues to make news is the Bengaluru-based River Mobility, which has a single product – the River Indie. With deliveries of 1,657 units in August, the company has registered its best-ever monthly retail sales since it entered the market in October 2023.

Wrapping up the Top 10 e-2W OEM list for August is Kinetic Green which has three products – the e-Zulu, Zing and the e-Luna moped. The company has clocked retails of 1,513 units last month.

India’s e-2W market, which has around 210 players, remains the preserve of six players – TVS, Bajaj Auto, Ola Electric, Ather Energy, Hero MotoCorp and Greaves Electric Mobility – who between them accounted for 90,456 units or an 87% share of total sales of 104,306 units in the first half of August 2025, reflecting just where the market strength lies.

ALSO READ: Top six e-2W OEMs command 76% share of 3.65 million units sold since 2018

RELATED ARTICLES

TVS iQube Rides Past 800,000 Sales, 100,000 Units Sold in 3 Months

Launched in January 2020, the TVS iQube takes six years to hit the 800,000 sales milestone. While the first 300,000 unit...

Thar Roxx Races Past 100,000 Sales In 16 Months

Launched on September 25, 2024, the five-door Thar Roxx has been a huge success and helped propel the Thar brand into Ma...

India’s Top 30 SUVs, MPVs In CY2025 – Hyundai Creta Pips Tata Nexon To Top Spot

Of the 2.95 million utility vehicles sold in CY2025, the Top 30 models accounted for 2.82 million units (95% share). Mar...

By Ajit Dalvi

By Ajit Dalvi

01 Sep 2025

01 Sep 2025

22744 Views

22744 Views