Tata, Mahindra gain UV share in H1 FY2023, Maruti, Hyundai see declines

Booming utility vehicle market sees all players record strong growth but record volumes see Tata Motors increase its market share to 18.47% while Mahindra with 17% pips Maruti to No. 2 spot.

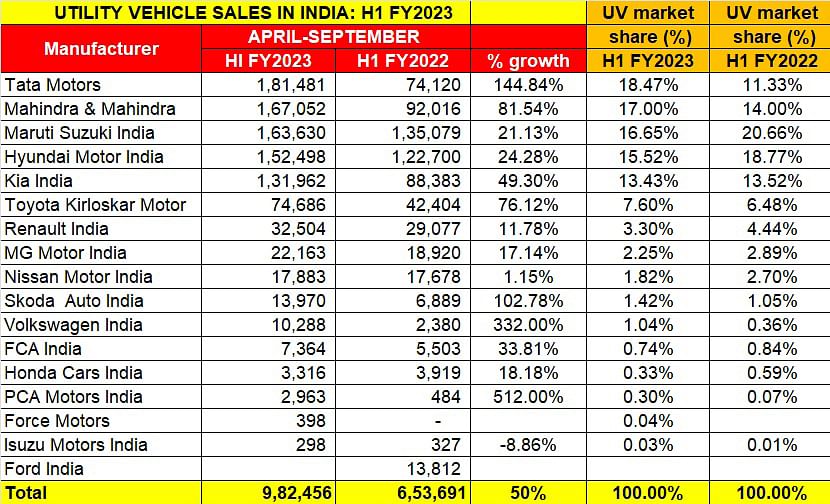

If India’s passenger vehicle market is on a roll with 40% year-on-year growth in April-September 2022, it is thanks to the surging wave of demand for utility vehicles (UVs). Of the over 1.93 million PVs sold (19,36,740 units), the UV sub-segment with 982,456 units and 50% YoY growth accounts for a 51% share, followed by cars with 45% share (879,954 units / up 29%), and vans, (74,330 units) with a 3.83% share.

Every OEM worth its wheel is fighting for its share of the booming UV market and the extent of the 50% YoY growth in the segment can be seen in the fact that of all the 16 players in the fray, all but one has posted strong gains.

A quick look at the UV segment’s sales in first-half FY2023 also reveals that the top five OEMs with six-figure sales – Tata Motors, Mahindra & Mahindra, Maruti Suzuki, Hyundai Motor India and Kia India – account for 796,623 units or 81% of total UV sales (see sales data table below).

Tata and Mahindra up the UV ante

A closer analysis of the sales numbers reveals that of these top five UV players, the No. 1 (Tata Motors) and No. 2 (Mahindra & Mahindra) have increased their market share while the next three have lost some of theirs. Tata Motors, with 181,481 units has increased its share in the segment to 18.47% from 11.33% in April-September 2021. Tata has made the maximum UV market share gains with a 7 percentage-point increase. Tata Motors, whose Nexon is currently India’s best-selling UV and the Punch at No. 4 in the Top 10 best-selling UVs list, posted robust 145% increase over year-ago sales. The company also has the EV advantage over its UV rivals.

Mahindra & Mahindra, with 167,052 units, has also increased its share – by three percentage points to 17% from 14% a year ago – and recorded strong 82% growth. What’s common to both companies is that their portfolio is SUV-dominated and both recorded their best-ever monthly sales in September 2022, which has given a charge to their Q2 and H1 sales.

M&M, which currently has a strong order book for a number of high-selling UVs like the XUV700, XUV300, Scorpio N, Scorpio Classic and the Thar, can be expected to register strong growth in the coming month.

Maruti Suzuki, Hyundai feel the heat of growing competition

Maruti Suzuki India, the overall PV market leader with a 41% market share, which had the No. 2 UV position in Q1 FY2023 behind Tata Motors, has ceded that slot to a hard-charging Mahindra, which has pipped it to second place by 3,422 units.

While sale of 163,052 units translates into 21% YoY growth for Maruti Suzuki, the speedier rate of growth for Tata and Mahindra, as well as a fresh charge from Skoda Auto India and Volkswagen India on teh back of new models like the Skoda Kushaq and the VW Taigun, and healthy gains from Toyota Kirloskar Motor, mean that Maruti Suzuki’s UV share has reduced by four percentage points to 16.65% from 20.66% a year ago.

However, the company can be expected to claw back UV market share with its recently launched new Grand Vitara along with sustained demand for the new Brezza (the best-selling UV in September 2022) and the Ertiga, both of which are regulars in the Top 10 UVs list.

Hyundai Motor India maintains its No. 4 position in the rankings with 152,498 units, up 25% YoY. The bulk of the company’s UV sales come from the Creta, the No. 2 best-selling UV in India, and the Venue compact SUV. The first six months of the ongoing fiscal have seen its UV market share reduce to 15.52% from 18.77% in H1 FY2022.

Meanwhile, fifth-placed Kia India, which sees a marginal decline in market share to 13.43% from 13.52% a year ago, sold a total of 131,962 units to record 49% growth.

Will UV sales cross 2 million units in FY2023?

Utility vehicle sales in India had crossed a million units in a fiscal for the first time in FY2021 (10,60,750 units) and jumped by 40% to 14,89,178 units in FY2022. The first six months of FY2023 have already seen 66% of FY2022’s record total being achieved.

With the current momentum amid the surging wave of demand and a flurry of new models in the market, will UV sales this fiscal cross the 2-million mark? It's a mighty exciting time for the UV segment. Stay tuned in.

ALSO READ:

CV sales to surpass FY2018’s 850,000 units: SIAM president

Resilient India Auto Inc’s production up 23% in H1 FY2023 to 1.36 million vehicles

RELATED ARTICLES

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

TVS Sells 31,600 e-Scooters in February for a 28% Share; FY2026 to see 1.35 Million e-2W Sales

With 31,600 e-scooters, TVS commanded a 28% market share even as Bajaj Auto, Ather Energy and Hero MotoCorp witnessed st...

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

19 Oct 2022

19 Oct 2022

15209 Views

15209 Views

Ajit Dalvi

Ajit Dalvi