Indian automakers sell nearly 11 million vehicles in first-half FY2022

In a spectacular performance, all vehicle segments witness robust growth; while PVs, CVs and two-wheelers recorded strong double-digit YoY increases, three-wheelers clocked 106% growth.

The Indian automobile industry is firing on all cylinders. The wholesales numbers for the first half of FY2023 at 1,09,88,305 units are a strong 32% year-on-year increase (April-September 2021: 83,05,314 units). What augurs well for the rest of the fiscal is that the growth is in strong double-digits for all four vehicle segments.

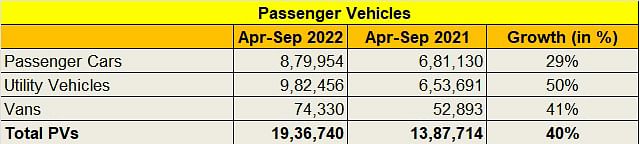

The passenger vehicle (PV) industry, which is notching record sales, has sold over 1.93 million vehicles (19,36,740 units), up 40% YoY (April-September 2021: 13,87,714 units), averaging monthly sales of 322,790 units.

Given the massive demand for SUVs, the UV sub-segment with 982,456 units accounts for 51% of PVs sold, while cars, which are seeing demand return, at 879,954 units (up 29%), have a 45% share. Vans, with 74,330 units, have a 3.83% share of PV numbers. Given this pace of sales and also of new models being launched, the PV market is expected to set a new record of over 3.6 million or more units.

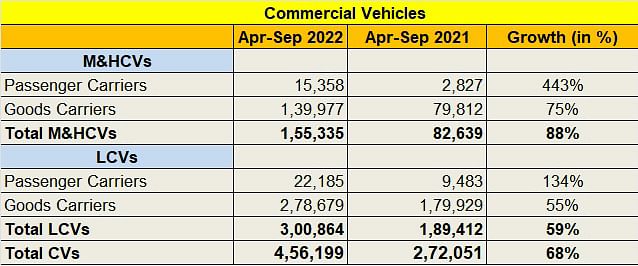

The big news comes from the commercial vehicle (CV) industry. Considered to be the barometer of the economy, the CV sector has reported sales of 456,199 units, up 68% (H1 FY2022: 272,051 units). Importantly, the growth has come across both the medium and heavy CV (M&HCV) and light CV (LCVs) sub-segments.

While the big-ticket spends, by the government and private sector in infrastructure development, is spurring demand for HCVs in the mining, cement and heavy goods sectors, LCVs as well as small CVs are catering to the boom in e-commerce and last-mile logistics.

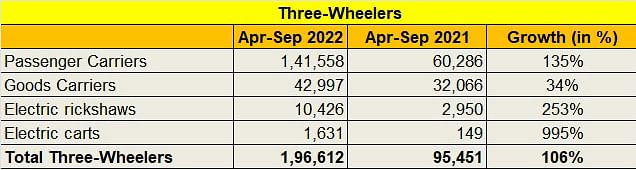

The three-wheeler industry is witnessing rapid growth, amply seen in the 106% YoY increase in sales to 196,612 units. With the country back in offline working mode, demand for passenger transport is on the rise and is reflected in the 135% growth in sales of passenger-carrying three-wheelers: 141,558 units. And, with the successful hub-and-spoke model of last-mile deliveries, three-wheeled goods carrier sales are also thriving – 42,997 units were sold in H1 FY2023 to record 34% growth.

Electrified three-wheelers, the low-hanging fruit of the EV industry in India along with two-wheelers, sold a total of 12,027 units, up 288% over the 3,099 units in H1 FY2022. This performance also reflects their growing share in the overall three-wheeler market. From the 3.24% share it had a year ago, electric three-wheelers now have a 6.13% share – the doubling of its share is indicative of how the low-cost-of-ownership mantra is aggressively driving numbers.

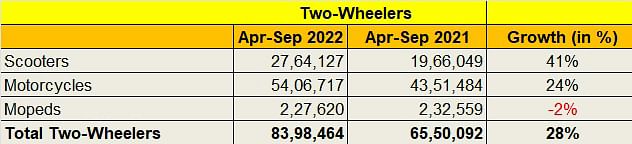

Twenty-eight percent YoY growth for the two-wheeler segment which accounts for over 70% of the total volume of the Indian automobile industry augurs well for the coming six months of the ongoing fiscal. At overall sales of 83,98,464 units, H1 FY2023 sales were up 28% YoY, thanks to the 24% rise in demand for motorcycles (54,06,717 units) and 41% for scooters (27,64,127 units). However, the full sales potential is yet to be tapped because demand from rural India for entry level two-wheelers is still lagging.

Last month, Manish Raj Singhania, President, FADA said the two-wheeler industry is bearing the brunt of increased prices and expensive loans. “Due to increased input costs, two-wheeler OEMs raised prices by five times in the past year. Apart from this, RBI’s fight with inflation saw rate hikes, which continued to make vehicle loans expensive. While India is showing revival signs, Bharat is yet to perform. Two-wheelers, especially entry level vehicles, are finding extremely few buyers.”

Growth Outlook: Pedal to the sales metal

With all four vehicle segments seeing month-on-month growth, and consumer sentiment on the upswing, India Auto Inc is driving towards very strong numbers in FY2023. This strong momentum is powered by the PV and CV segments, both of which are set to record best-ever 12-month sales for any fiscal if they maintain the same growth trajectory displayed in the first six months of FY2023.

Three-wheeler sales are on the upswing and rather fast at that. Growing demand for low cost-of-ownership electric models is driving the shift from ICE to EV in this segment and will grow at a faster pace in the coming years. The humungous demand for last-mile delivery across town and country is also acting as a catalyst for this segment.

The two-wheeler industry’s fortunes are gradually improving but awaits a growth accelerator from rural India, which is a major buyer of entry level motorcycles. However, high petrol prices, regular product price increases and tepid farm yield have been a sales speed-breaker. Will the scenario improve for entry-level two-wheelers in the coming six months of this fiscal? The jury is out on that.

Meanwhile, given India Auto Inc’s sterling performance in the April-September 2022 period, there’s overall consensus that good times are here to stay.

ALSO READ: Resilient India Auto Inc’s production up 23% in H1 FY2023 to 1.36 million vehicles

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

14 Oct 2022

14 Oct 2022

8068 Views

8068 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau