SUV and MPV sales hit 2 million units in FY2023, Maruti Suzuki keeps Tata Motors at bay, M&M drives ahead of Hyundai

Maruti Suzuki has won the no-holds-barred battle for honours in the utility vehicle market, driving ahead of Tata Motors by 8,880 units; Mahindra misses No. 2 spot by just 288 units; top four OEMs sell over 300,000 units each in best-ever fiscal for UVs.

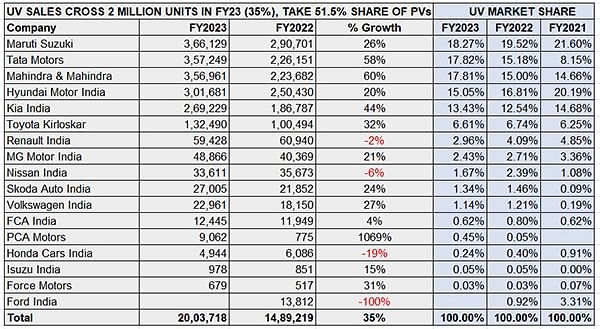

The vehicle segment that has done all the heavy lifting for the past three-odd years has recorded its best-ever fiscal year sales. As per FY2023 industry wholesales data released by apex industry body SIAM on April 14, sales of utility vehicles (UVs) rose 35% year on year to 20,03,718 units (FY2022: 14,89,219 units). This marks the first time that UVs – which include SUVs and MPVs – have surpassed the 20 lakh or 2-million wholesales milestone in a fiscal year or 12 months.

What’s more, this big number means that the UV share of the overall passenger vehicle (PV) segment (cars, UVs and vans) has touched a new high – 51.50% of total PV sales of 38,90,114 units, beating FY2022’s 48.51%. Average monthly UV sales in FY2023 were 166,976 units or 5,489 units being sold every day from April 1, 2022 through to March 31, 2023. Little wonder all carmakers worth their wheel are expanding their SUV portfolios with a vengeance.

Like they did in FY2022, six OEMs – each with six-figure sales – once again dominated the UV segment in FY2023. Their combined sales of 17,83,739 units accounted for an overwhelming 89% of total UV sales in the domestic market, improving upon the 86% they had in FY2022. All six have strong UV portfolios and each has registered high double-digit growth, thereby helping expand this segment.

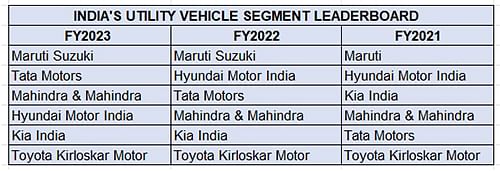

While Maruti Suzuki has retained its crown, FY2023 has seen a shift in the next three positions – Tata Motors takes No. 2 position (up from No. 3 in FY2022 and No. 5 in FY2021), Mahindra & Mahindra is at No. 3 (up from No. 4 in FY2022 and FY2021) and Hyundai is at No. 4 (down from No. 2 in FY2022 and FY2021). Kia India and Toyota Kirloskar Motor maintain their No. 5 and No. 6 rankings respectively.

At the end of December 2022 and nine months into FY2023, Tata Motors was the UV segment leader, threatening to usurp the crown from Maruti Suzuki – it had 268,570 units to Maruti’s 260,172 units – a lead of 8,398 units. But a strong Q4 (January-March 2023) performance from Maruti Suzuki has seen it keep a hard-charging Tata Motors at bay by only 8,880 units. The battle will continue in FY2024.

In just seven months of FY2023, the Grand Vitara has clocked 51,315 units and is the third best-selling Maruti SUV after the Brezza compact SUV (145,665 units) and the Ertiga MPV (127,819 units).

In just seven months of FY2023, the Grand Vitara has clocked 51,315 units and is the third best-selling Maruti SUV after the Brezza compact SUV (145,665 units) and the Ertiga MPV (127,819 units).

Maruti Suzuki India: 366,129 units / up 26%

UV market share: 18.27%, down from 19.52% in FY2022

Maruti Suzuki India, the overall PV market leader, has done well to protect its turf in FY2023 which saw the company’s production impacted by semiconductor supply chain issues. The company despatched a total of 366,129 UVs to record 26% YoY growth (FY2022: 290,701). However, its pace of growth is slower than both Tata Motors and M&M, both of whom also have plenty more UV models. So this meant that despite retaining its No. 1 position, its UV share is down to 18.27% in FY2023 from 19.52% in FY2022.

However, expect the company to claw back UV market share – the five-door soon-to-be-launched Jimny and Fronx SUVs have already generated a huge amount of consumer interest while the new Grand Vitara – the Autocar Car of the Year 2023 – is already firing on all cylinders. In just seven months of FY2023, the Grand Vitara has clocked 51,315 units and is the third best-selling Maruti SUV after the Brezza compact SUV (145,665 units) and the Ertiga MPV (127,819 units). Combined sales of these three models add up to 324,799 units and they account for 88% of the company’s UV sales last fiscal. The XL6 is estimated to have sold 36,423 units in FY2023.

In a span of just three years, Tata Motors has more than doubled its share of the India UV market share to 18% in FY2023 from 8% in FY2021.

Tata Motors: 357,249 units / up 58%

UV market share: 17.82%, up from 15.18% in FY2022

Tata Motors, which has four SUVs – Nexon, Punch, Harrier and Safari, in its seven-model portfolio which includes the Tiago, Tiago and Altroz, maintained a high level of double-digit growth throughout FY2023. It has registered wholesales of 357,249 units, up 58% YoY (FY2022: 226,151).

The carmaker was in No. 1 position right till January, when it had cumulative sales of 298,747 UVs to Maruti Suzuki’s 295,525 units but the latter’s much-improved performance in February and March has pipped Tata to the top spot . . . by just 8,880 units.

Where Tata Motors has made gains is in its UV market share – 18% in FY2023 compared to 15% in FY2022 and 8% in FY2021. That means in a span of just three years, Tata has more than doubled its UV market share. It has a market advantage in that it has the largest EV portfolio – Nexon, Tigor, Tiago – and products with petrol, diesel and EV powertrains.

The Nexon, India’s best-selling UV, has sold an estimated 172,138 units, accounting for 48% of Tata’s overall sales and 8.59% of all-India UV sales. It is followed by the Punch compact SUV (133,819), Harrier (30,633) and Safari (20,659).

M&M, which is understood to have a sizeable order backlog, is ramping up manufacturing capacity to reduce the waiting period for its popular SUVs.

M&M, which is understood to have a sizeable order backlog, is ramping up manufacturing capacity to reduce the waiting period for its popular SUVs.

Mahindra & Mahindra: 356,961 units / up 60%

UV market share: 17.81%, up from 15% in FY2022

Mahindra & Mahindra has missed grabbing the No. 2 UV OEM rank by a whisker – just 288 units behind Tata Motors! The company sold a total of 356,961 units, up 60% of FY2022’s 223,682 units.

Like Tata, M&M is also an outperformer increasing its UV share by three percentage points to 17.81% from 15% a year ago.

The Bolero, with estimated sales of 100,577 units, is the top-selling product and accounts for 28% of M&M’s sales, followed by the Scorpio (70,486), XUV700 (66,473), XUV300 (61,386) and the Thar (47,108). Meanwhile, the all-electric XUV400, whose sales kicked off in January 2023, sold 2,202 units in FY2023.

M&M, which is understood to have a sizeable order backlog, is ramping up manufacturing capacity to reduce the waiting period for popular models like the flagship XUV700, Scorpio N and Scorpio Classic, Thar, Bolero and Bolero Neo and the XUV300.

While Hyundai sold 301,681 UVs, the much higher pace of growth for Tata and M&M has seen the company drop two ranks to fourth place in FY2023.

While Hyundai sold 301,681 UVs, the much higher pace of growth for Tata and M&M has seen the company drop two ranks to fourth place in FY2023.

Hyundai Motor India: 301,681 units / up 20%

UV market share: 15.05%, down from 16.81% in FY2022

Hyundai Motor India has had to face the new product-led power of the leading triumvirate and has slipped from its No. 2 position of FY2022 and FY2021 to No. 4 in FY2023. While the company sold 301,681 UVs, an increase of 20% YoY (FY2022: 250,430), the much higher pace of growth for Tata and Mahindra has pushed it down.

The bulk of the company’s sales have come from the midsized Creta, India’s second-best-selling UV with 150,372 units, and the Venue compact SUV (120,653 units). The premium Alcazar SUV sold 26,696 units in FY2023.

Like Maruti Suzuki, Hyundai’s slower rate of growth compared to faster-growing rivals like Tata and Mahindra mean that its UV market share has reduced to 15.05% from 16.81% in April 2021-February 2022.

The Seltos remains Kia’s best-seller with 100,132 units, followed by the Sonet (94,096), Carens (70,314), Carnival (4,257) and all-electric EV6 (430).

The Seltos remains Kia’s best-seller with 100,132 units, followed by the Sonet (94,096), Carens (70,314), Carnival (4,257) and all-electric EV6 (430).

Kia India: 269,229 units / up 44%

UV market share: 13.43%, up from 12.54% in FY2022

At fifth place in the India UV OEM rankings, Kia India clocked sales of 269,229 units to achieve 44% YoY growth. Like its Korean sibling Hyundai Motor India, Kia too clocked its best-ever sales for a fiscal but stiff market competition means its market share growth remains marginal.

The Seltos midsize SUV remains Kia’s best-selling product with 100,132 units, followed by the Sonet compact SUV with 94,096 units, the Carens MPV (70,314), Carnival MPV (4,257) and all-electric EV6 (430).

Clubbing the two Korean carmakers’ UV market share gives 28.48%, which is more than the combined 8.52% share of three Japanese players – Toyota, Nissan and Honda – in the Indian marketplace.

Toyota's Hyryder has sold 22,839 units in seven months since launch.

Toyota Kirloskar Motor: 132,490 units / up 32%

UV market share: 6.61%, down from 6.74% a year ago

The sixth player with six-figure sales and also sixth in the UV rankings, Toyota Kirloskar Motor has sold a total of 132,490 units, up 32% YoY. The bulk of the sales came from the popular MPV, the Innova Crysta clubbed with the recently launched Hycross (55,574), Fortuner (30,688), the discontinued Urban Cruiser (April-September 2022: 22,839) and the recently launched Hyryder which has sold 22,839 units in seven months since launch The company also retails the Land Cruiser and Vellfire, which have sold a total of 1,231 units.

Growth outlook: It's SUV-ival of the fittest

Growth outlook: It's SUV-ival of the fittest

By driving past the 2-million UV sales mark for the first time, FY2023 achieved what CY2022 didn’t, having fallen short of the big number by 77,234 units with sales of 19,22,766 units. FY2024 should see the surge of demand for SUVs, MPV and UVs continuing, despite the higher rates of bank interest and the likelihood of petrol and diesel prices increasing given the recent trend of Brent crude oil moving upwards of US$86 a barrel.

The big positives for the UV segment are that consumers are spoilt for choice – be it styling, powertrain and even fuel. Automakers are fast expanding buyer options. In early January, Maruti had launched the Grand Vitara CNG, followed by Toyota Kirloskar Motor with its Hyryder CNG. And in early March, the Maruti Brezza became the first compact SUV in India to get CNG power. With the recent slashing of CNG prices, demand for CNG-powered UVs will only increase.

While compact SUVs continue command the bulk of demand, there is a growing shift towards midsize SUVs. This year will see at least 10 new SUVs being launched and there’s one for every budget, ranging from Hyundai's Ai3 sub-compact SUV to Honda's midsize SUV and through to the premium Lexus RX.

With a much-improved supply chain for semiconductors and an estimated backlog of around half-a-million UVs (most of them with the top five OEMs), vehicle manufacturers are putting their shoulder to the production wheel to keep their assembly lines busy and cater to demand. FY2024 should be yet another big-number year for the UV industry in India. While the YoY growth may not match that of FY2023 (35%) or FY2022 (40%) because of the large base, market size per se will expand. Stay tuned in updates from this extremely exciting albeit hugely competitive marketplace where the mantra for success is SUV-ival of the fittest.

ALSO READ:

India Auto Inc clocks 20% growth in FY2023 with 21m units, PVs and CVs on a roll

Car and SUV sales accelerate to 3.88m units in FY2023, five OEMs clock best-ever fiscal figures

RELATED ARTICLES

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

Mahindra Sells 600,000 SUVs in 11 Months of FY2026, Goes ahead of Tata Motors

Mahindra’s 600,004 SUV wholesales put it ahead by 34,809 units over Tata Motors’ 565,195 passenger vehicles in the first...

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

14 Apr 2023

14 Apr 2023

13362 Views

13362 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi