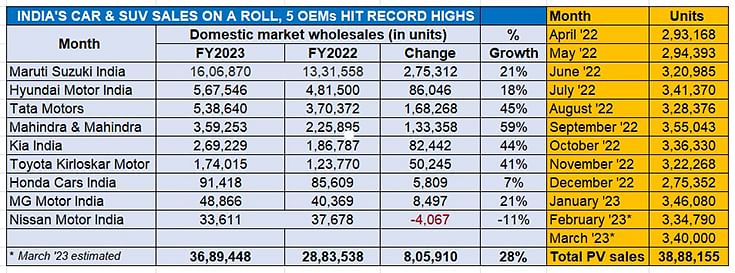

Car and SUV sales accelerate to 3.88m units in FY2023, five OEMs clock best-ever fiscal figures

Sustained and strong demand for SUVs and much-improved production power PV sales to record high; Hyundai, Tata Motors, Mahindra, Kia and MG Motor notch best-ever fiscal year sales.

India Passenger Vehicle Inc has just gone and upped the sales bar for the industry. Three months after it clocked near-3.8 million units (37,92,356) in CY2022, FY2023’s 12-month domestic market sales are expected to surpass that by another 90,000-odd units to an estimated 38,88,155 units, clocking 27% year-on-year growth (FY2022: 30,69,499 units).

Sales in March 2023, the last month of FY2023, are expected to be around 345,000-oodd units, marking the ninth month that PV numbers have gone past the 300,000-unit mark in the past 12 months. What has helped drive the momentum in March can be put down to multiple growth-driving factors: new vehicle purchase before fiscal closure, potential RDE price hike from April 2023, the improving demand-supply scenario and at least four festivals – Holi, Gudi Padwa, Ugadi and Navratri – in the month.

While demand is yet to pick up sustainably in the entry-level car market, that gap has been more than filled in by the sustained demand for UVs, SUVs and MPVs, which should clock nearly 2 million sales in FY2023. The specific numbers will be known once apex industry body SIAM releases the official wholesales data for the industry later this month. Retail sales body FADA will reveal its FY2023 numbers today.

The wholesales numbers announced by nine out of the 16 PV OEMs in India add up to a total of 36,89,448 units, YoY increase of 28%. The remaining seven players should add another 190,000 to 200,000 units. But what stands out from the nine carmakers is that at least five of them – Hyundai Motor India, Tata Motors, Mahindra & Mahindra, Kia India and MG Motor India – have clocked their best-ever fiscal year sales. What’s common to all is their SUV-heavy product portfolios.

The Top 6 OEMs – Maruti Suzuki India, Hyundai, Tata, M&M, Kia and Toyota Kirloskar Motor – together account for 35,15,553 or 3.5 million units, which is 90% of the record sales in FY2023. Let take a closer look at how each in this six-pack has fared.

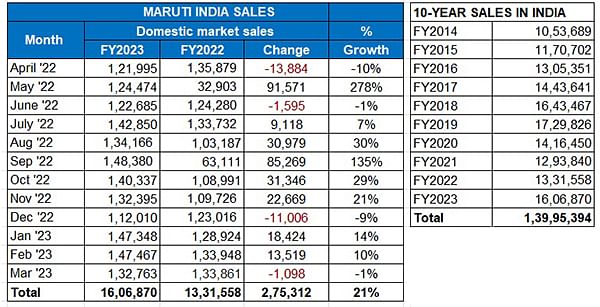

Maruti Suzuki India: 16,06,870 units / up 21%

Market leader Maruti Suzuki India reported total wholesales of 1.6 million units, up 21% YoY (FY2022: 13,31,558). It would have logged additional sales if it weren’t for production being intermittently disrupted due to supply chain issues specific to electronic components.

A close look at 10-year sales data reveals that while Maruti Suzuki’s FY2023 sales have bettered FY2022 (13,31,558), FY2021 (12,93,840) and FY2020 (14,16,450), they are still below that of FY2018 (16,43,467) and 122,956 units less than the best-ever sales of 17,29,826 units in FY2019.

The seven-model pack of the Baleno, Celerio, Dzire, Ignis, Swift, Tour S, Wagon R did the heavy lifting with 863,029 units, up 22% YoY (FY2022: 704,881).

The seven-model pack of the Baleno, Celerio, Dzire, Ignis, Swift, Tour S, Wagon R did the heavy lifting with 863,029 units, up 22% YoY (FY2022: 704,881).

Proof that demand for entry-level models is yet to pick up is the sales of the Alto and S-Presso: 232,911 units, up 10% YoY (FY2022: 211,762). The company would have no such issue with the Eeco van which, with 131,191 units, posted 21% growth (FY2022: 108,345). The premium Ciaz sedan though remains a concern – the carmaker sold 2,259 fewer units in FY2023: a total of 13,610 versus FY2022’s 15,869 units.

With its cumulative sales of 1.6 million PVs, Maruti Suzuki remains the unrivalled market leader but with an estimated order backlog of 380,000 PVs and a hugely competitive marketplace, the company will have to put its shoulder to the production wheel.

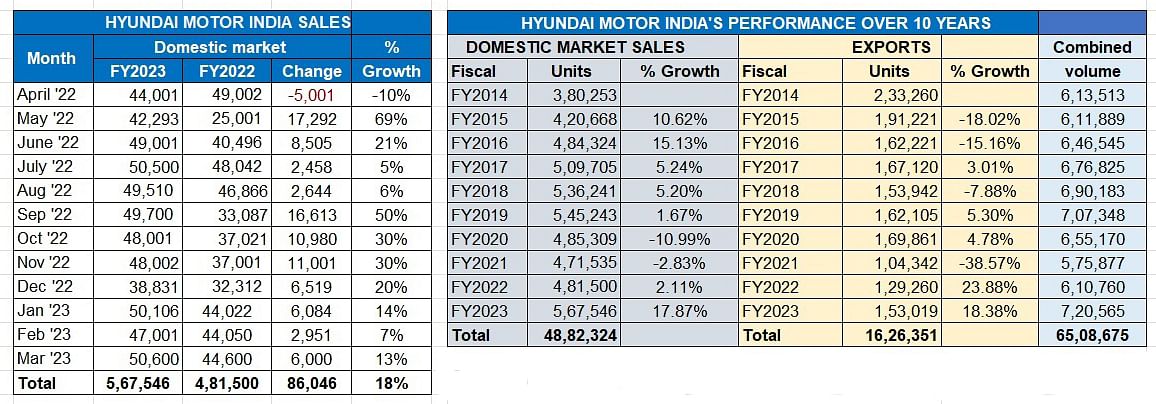

Hyundai Motor India: 567,546 units / up 18%

The Chennai-based Korean carmaker, which retails a total of nine products in India – five SUVs (Creta, Venue, Alcazar, Tucson, Kona), two hatchbacks (i10 Grand, i20) and two sedans (Verna, Xcent /Aura) – sold a total of 567,546 units, up 18% (FY2022: 481,500 units). This performance is its best-ever in a fiscal year in the domestic market, beating the previous best of 545,243 in FY2019 (see 10-year sales table below). March 2023 wholesales of 50,600 units were also its best in the past 12 months.

According to the company, key contributors to growth in FY2023 were Hyundai’s longstanding best-seller, the Creta, along with the Venue compact SUV, Alcazar and Tucson midsize SUVs, Aura sedan and Grand i10 Nios hatchback. All six models recorded their best-ever fiscal year sales albeit the company has not provided specific model-wise data.

According to the company, key contributors to growth in FY2023 were Hyundai’s longstanding best-seller, the Creta, along with the Venue compact SUV, Alcazar and Tucson midsize SUVs, Aura sedan and Grand i10 Nios hatchback. All six models recorded their best-ever fiscal year sales albeit the company has not provided specific model-wise data.

In early March, Tata Motors drove past the 5 million passenger vehicle production milestone. The last million units have rolled out in just 30 months.

In early March, Tata Motors drove past the 5 million passenger vehicle production milestone. The last million units have rolled out in just 30 months.

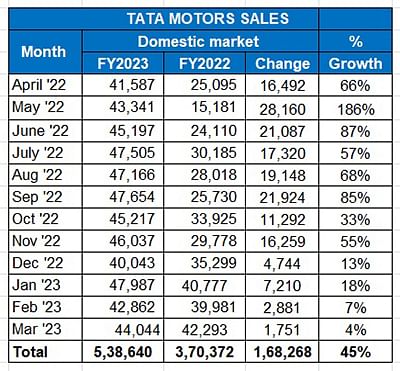

Tata Motors: 538,640 units / up 45%

Tata Motors has done an encore. Having clocked half-a-million wholesales in CY2022 – 526,789 units and 59% YoY growth – the carmaker has now gone ahead and bettered that in FY2023.

The company has reported total wholesales of 538,640 units, which is a 45% YoY increase over FY2022’s 370,372 units, and 2.5% better than CY2022’s 12-month sales, albeit in a fiscal-to-calendar year comparison. This translates into average monthly sales of 44,886 units, the highest Tata has achieved. January 2023, with 47,987 units, has been its best-ever monthly performance. An interesting statistic is Tata Motors’ cumulative 10-year PV sales have hit the 2.39 million mark.

The company, which retails seven PVs – Altroz, Tigor, Tiago, Nexon, Punch, Harrier and the Safari – in the domestic market, has capitalised on surging demand for its SUVs, particularly the Nexon and the Punch compact SUVs which were the No. 1 and the fifth-highest-selling SUVs in India in CY2022.

With the tailwind of SUV demand firmly behind it, Tata Motors saw its quartet – Nexon, Punch, Harrier and Safari – contribute an estimated 355,810 units or 66% of total sales in FY2023.

What has also helped Tata Motors’ accelerated growth is its first-mover advantage in the fast-growing electric vehicle market, where it has an over 80% market share. The company currently retails the Nexon EV, Tigor EV and Xpres-T (for fleet buyers) and the recently launched Tiago EV. As per the company, it has logged wholesales of 50,043 EVs in FY2023, which marks strong 154% YoY growth (FY2022: 19,668 EVs).

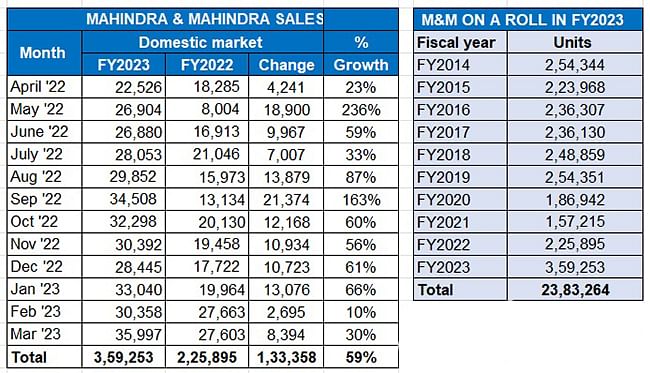

Mahindra & Mahindra: 359,253 units / up 59%

Mahindra & Mahindra (M&M) has wrapped up FY2023 on a very strong note. The company’s passenger vehicle division has reported total wholesales of 359,253 units, which constitutes handsome 59% year-on-year growth (FY2022: 225,895 units).

The FY2023 total marks the company’s highest-ever sales in a fiscal, accelerating ahead of FY2019’s 254,351 units (see 10-year sales data below). And M&M also achieved its monthly best sales yet in March 2023 – 35,997 units (up 30%) and best SUV sales too: 35,976 units.

Given that all but one (eVerito) of the company products are utility vehicles, M&M has also clocked its best-ever SUV sales at 356,961 units, up 59% YoY. Given the surging demand for UVs in India which now sees every second car sold being a UV, the company, whose portfolio includes popular models like the Bolero/Bolero Neo, Scorpio/Scorpio Classic/ Thar, XUV300, XUV700, XUV400 and the Marazzo, has seen demand drive in spades. Most of these models currently have a sizeable waiting period.

Given that all but one (eVerito) of the company products are utility vehicles, M&M has also clocked its best-ever SUV sales at 356,961 units, up 59% YoY. Given the surging demand for UVs in India which now sees every second car sold being a UV, the company, whose portfolio includes popular models like the Bolero/Bolero Neo, Scorpio/Scorpio Classic/ Thar, XUV300, XUV700, XUV400 and the Marazzo, has seen demand drive in spades. Most of these models currently have a sizeable waiting period.

M&M was clearly headed for a record year. In fact, cumulative sales of 231,413 units in the first eight months of FY2023 (April-November 2023) had already gone past FY2022’s 225,895 units. The next four months saw additional sales of 127,840 units.

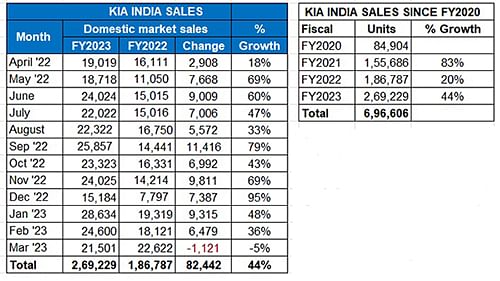

Kia India: 269,229 units / up 44%

Kia India has recorded its best-ever fiscal with total sales of 269,229 units in FY2023, which constitutes 44% year-on-year growth (FY2022: 186,787 units).

In the process, the company, which retails five products – three SUVs (Seltos, Sonet, EV6) and two MPVs (Carens and Carnival), taken its cumulative four-fiscal total to 696,606 units – just 3,394 units shy of the 700,000 units milestone in the domestic market.

The Seltos midsize SUV, Kia India’s first product launched in August 2019, remains its best-seller and sold 100,132 units, accounting for 37% of FY2023 sales. It is followed by the Sonet compact SUV with 94,096 units and the Carens MPV with 70,314 units.

The Carens is fast turning out to be the new growth driver for Kia India. Launched 13 months ago, the premium MPV has sold a total of 83,006 units till end-March 2023 including 70,314 units in the April 2022-March 2023 period. In FY2023, the Carens accounts for 26% of the company’s total sales, which is indicative of the high level of demand it enjoys in a competitive market. Proof of its speedy progress can be seen in the fact that in CY2022, the Carens with 62,756 units was ranked 11th among India’s Top 25 utility vehicles.

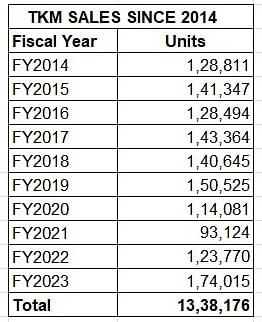

Toyota Kirloskar Motor: 174,015 units / up 41%

Toyota Kirloskar Motor’s 174,015 units in FY2023 constitute 41% YoY growth (FY2022: 123,770 units) and are its best-evr sales in a decade.

The fiscal year-ending month of March 2023 with 18,670 units was its best in FY2023 and helped accelerate sales. The fourth quarter (January-March 2023) saw cumulative sales of 46,843 units, up 41% over Q4 FY2022’s 33,204 units.

As per the company, the growth trajectory is reflective of sound market performance for all its products across segments with major contributions coming from the recently launched Innova Hycross, Urban Cruiser Hyryder, New Innova Crysta and the Hilux.

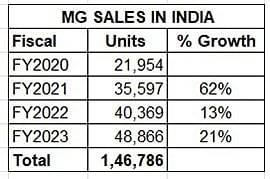

MG Motor India: 48,866 units / up 21%

MG Motor India has opened FY2024 on a good note by announcing its best-ever retail sales of 6,051 units in March 2023, a growth of 28% over the same month last year (March 2022: 4,721 units).

As per the company, the strengthening of semiconductor supplies through a number of localisation initiatives and the easing of logistical bottlenecks have been key factors in this achievement. This momentum is expected to sustain and improve in the near future as well.

Over the past 12 months, the company, which markets a total of five SUVs – the Astor, Gloster, Hector 5-seater, Hector Plus and the ZS EV – has sold a total of 48,866 units, up 21% year on year (FY2022: 40,369 units).

India PV Inc's growth outlook for FY2024

Year-on-year growth in the new fiscal year 2024 will be factored on a high base of 3.88 million units in FY2023, which means while in percentage terms YoY increase will slow down, the numbers per se should be good, given the low PV penetration levels across the country, particularly in town and country as compared to urban India.

The SUV boom is here to stay in India and globally and every OEM worth its wheel is doing all it can to keep its portfolio SUV-strong. While demand for compact SUVs remains big, consumer interest in midsize models is growing at a rapid pace and FY2024 will see a fair number of them rolling out. The midsize sedan market too is seeing an uptick and Hyundai’s new sixth-generation Verna has already seen strong consumer interest within a fortnight of its launch.

Challenges to growth include inflation-driven pressures on consumer spend, high interest rates and the slackened rural market, which doggedly refuses to come out of the slowdown. In the event of El Nino conditions this year, India could see a weaker monsoon this year which does not bode well for rural auto market sales on two, four or more wheels. However, this could be slightly balanced out by the speedier recovery in urban India.

And the transition to electric vehicles will pick up speed. The third day of FY2024 saw a sharp spike of over six percent in Brent crude oil prices to $84.80. So, that puts paid to any hope for motorists in India to benefit from lower petrol and diesel prices in the near future.

ALSO READ: Indian PV market posts 27% growth in FY2023, growth to slip to 5-7% in FY2024

EV sales in India hit 1.17 million units in FY2023, charge past 100,000 for six months in a row

RELATED ARTICLES

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

04 Apr 2023

04 Apr 2023

12838 Views

12838 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi