Tata Motors Climbs to No. 2 in Q3 FY26, Powered by Nexon and Early Sierra Traction

Tata moved ahead of Mahindra and Hyundai, both of which reported lower volumes in the October–December quarter.

Tata Motors Passenger Vehicles Ltd. rose to become India’s second-largest passenger vehicle maker in the October–December quarter of fiscal 2026, overtaking Hyundai and Mahindra, as strong demand for its Nexon compact SUV and early traction from the new Sierra model lifted volumes, according to government vehicle registration data.

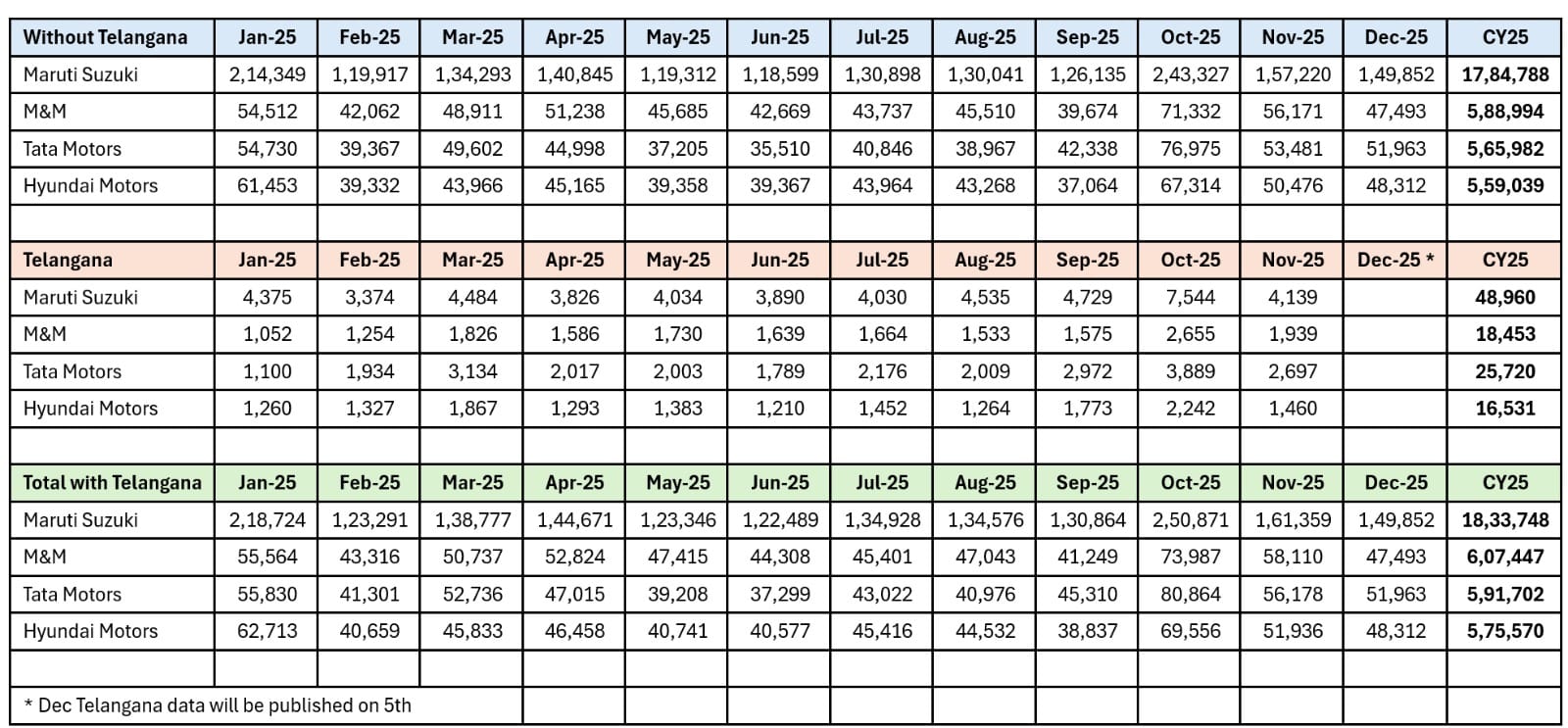

The automaker sold 1.89 lakh units in Q3 FY26, ahead of Mahindra & Mahindra’s 1.80 lakh units and Hyundai Motor India’s 1.70 lakh units, according to Vahan data. Tata also ranked second in December 2025, reinforcing the momentum seen in the latter half of the year.

For the full calendar year 2025, however, Tata Motors finished third, behind Maruti Suzuki and Mahindra, with total sales of 5.92 lakh units. Mahindra ended the year at 6.07 lakh units, while Maruti remained the market leader.

Tata’s improved performance in the second half was driven primarily by the Nexon, which emerged as India’s best-selling passenger vehicle in both October and November 2025. The model continued to deliver strong volumes across petrol, diesel and electric variants.

Tata’s improved performance in the second half was driven primarily by the Nexon, which emerged as India’s best-selling passenger vehicle in both October and November 2025. The model continued to deliver strong volumes across petrol, diesel and electric variants.

The company also began to see incremental contributions from the Sierra, which entered the market in the latter part of the year. While volumes remain limited, the model has started adding incremental demand, particularly in urban markets, and has contributed to Tata’s stronger Q3 showing.

In December 2025, Tata Motors reported 51,963 units, compared with 48,312 units for Hyundai and 47,493 units for Mahindra, according to Vahan data.

The performance marks a turnaround after a softer first half of the calendar year, when Tata faced pressure from rising competition and uneven demand. Improved supply execution, a broader SUV portfolio and steady electric vehicle sales helped the company regain momentum in the latter part of the year.

Despite finishing CY2025 behind Maruti Suzuki and Mahindra, Tata Motors’ Q3 showing signals a shift in competitive dynamics as the company enters the final quarter of FY26 with stronger volumes and a more balanced product mix.

RELATED ARTICLES

Gulf Oil, Mahindra Tractors Renew Multi-Year Partnership

Gulf Oil to continue to supply lubricants to Mahindra’s tractor division and hold the largest share of business for the...

Punch EV Pushes Closer to the Mainstream With 355 km Real-World Range: Anand Kulkarni

Tata Motors says the upgraded Punch.ev, with higher real-world range, faster charging and its new Acti.ev platform, is a...

Tata Motors PV Expects 30–50% Jump in Punch.ev Volumes After New Launch

Automaker bets on higher range, faster charging, and accessible pricing to lift EV adoption in the entry segment.

01 Jan 2026

01 Jan 2026

27360 Views

27360 Views

Arunima Pal

Arunima Pal

Darshan Nakhwa

Darshan Nakhwa