EV sales in India hit 1.17 million units in FY2023, charge past 100,000 for six months in a row

EV industry records 155% YoY growth as demand accelerates; over 720,000 two-wheelers and nearly 400,000 three-wheelers sold; demand for electric cars grows by 125% over FY2022.

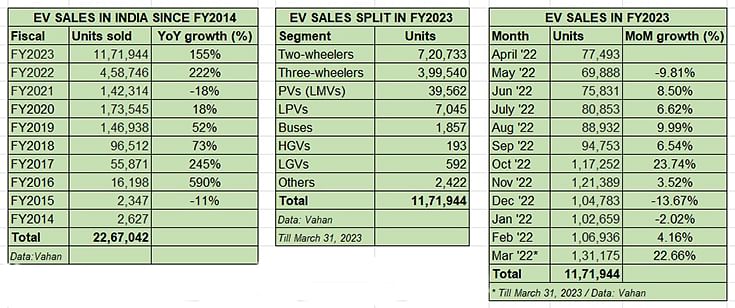

Fiscal year 2023 has ended and sales of electric vehicles (EVs) in India have scaled a new high, charging past the 100,000-units mark for the sixth month in a row. What’s more, they have crossed the million-units milestone over the past 12 months.

As per Vahan data, cumulative sales till 6pm on March 31, 2023 were 11,71,944 units, hitting the million milestone for the first time in a fiscal. In CY2022, EV sales in India had clocked a total of 10,23,735 units.

FY2023’s 11,71,944 units are a robust 155% year-on-year increase on FY2022’s 458,746 units and point to the surge in consumer demand for EVs, in the face of stiff petrol and diesel prices as well as CNG.

The charge of the EV brigade can be gleaned from the fact that sales have scaled a new high for a month in March 2023 – 131,175 units, beating the previous best of 121,389 units in November 2022 (see data table below). The monthly shift to six-figure sales began in festive October 2022 and has continued right till March 2023.

Leading the charge are the two low-hanging fruit of the industry – two- and three-wheelers. Two-wheelers, the most affordable EV sub-segment, with 720,733 units saw YoY growth of 185% (FY2022: 252,539 units) and accounts for 61.5% of total EV sales in India. Electric three-wheelers, across both passenger- and cargo-transporting model, sold a total of 399,540 units, up 47% YoY (FY2022: 188,447 units) and accounted for 34% of total EV sales in FY2023. Thus, combined two- and three-wheeler EV sales comprise an overwhelming 95% of the record EV industry sales (see data table below).

Electric 2-wheelers: 720,733 units / up 185%

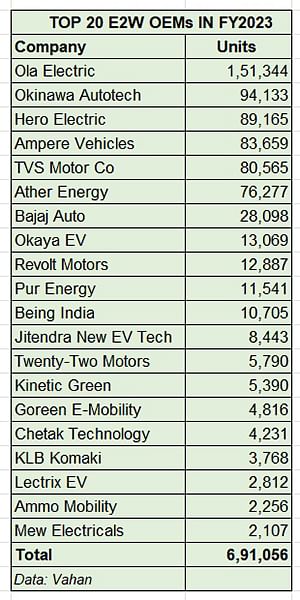

Ola grabs 21% share, Ampere’s strong performance

With 720,733 units in the 365 days of FY2023, the electric two-wheeler industry has chalked

Handsome year-on-year growth of 185% (FY2022: 252,543 ). Ola Electric, with 151,344 units, is the market leader by a huge margin, averaging monthly retails of 12,612 units and ahead of the No. 2 player by 57,211 units – Okinawa Autotech sold a total of 94,133 units and retains the second place it held in FY2022. With this solid performance, Ola now has a 21% share of the e-two-wheeler retail market. It is also the sole player to surpass the 100,000 unit mark and by a big margin.

The top six OEMs have each sold over 75,000 units and their combined sales add up to 575,143 units, which comprises 80% of total sales in FY2023.

Hero Electric, the market leader in FY2022, has slipped to No. 3 position with 89,165 units. It was logging in strong numbers in the beginning of the fiscal but the monthly numbers declined in the second half, possibly due to the impact of the FAME subsidy being withdrawn.

Ampere Vehicles is the surprise package in FY2023 with 83,659 units, breasting ahead of TVS Motor Co. The company is benefiting from its growing product portfolio. While the Magnus EX scooter is its mainstay, the recently launched Zeal e-scooter has emerged as a popular choice amongst youth due to its snazzy design, performance and affordable price. Ampere’s newest scooter is the Primus targeted at millennials. What is helping Ampere is its enhanced customer connect with a fast-growing all-India dealer network across Tier 1 to Tier 4 markets.

TVS Motor Co was expected to take the No. 3 position in FY2023 but has been pipped by Ampere by 3,094 units. Nevertheless, at 80,565 units, and with a single product – the iQube – the company has put on a robust show which can only get better, what with new products set to roll out in FY2024.

Benagluru-based smart e-scooter OEM Ather Energy saw its products go home to 76,277 buyers. Given the strong momentum Ather is seeing, this is yet another OEM which will ride past the 100,000-units mark in FY2024.

Here are the Top 20 electric two-wheeler OEMs. Their combined sales of 691,056 make for 96% of total e-two-wheeler retails in India in FY2023. And they clearly stand out from the 117 manufacturers listed on Vahan.

Electric 3-wheelers: 399,540 units / up 46%

Electric 3-wheelers: 399,540 units / up 46%

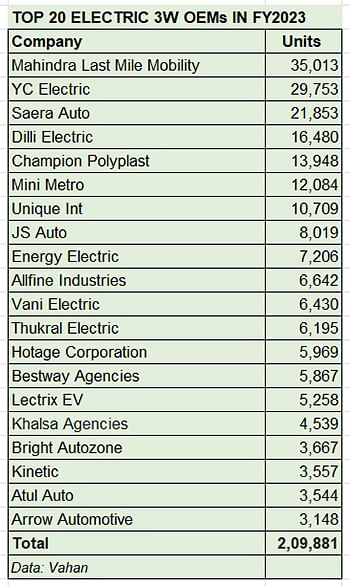

Mahindra Last Mile Mobility takes 9% share

The three-wheeler segment, the other ‘low-hanging fruit’ of the Indian EV industry, clocked retails of 399,540 units, up 46% YoY (FY2022: 183,447 units). This sub-segment, which has all of 453 players and counting, continues to see strong double-digit growth, thanks to sustained demand for passenger transportation and increasingly demand from last-mile operators for e-commerce applications.

Mahindra Last Mile Mobility, with 35,013 units, is the market leader with a 9% share. The company has six EVs on sale – the Treo, Treo Yaari and e-Alfa Mini for passenger transport and the Zor Grand, Treo Zor and the e-Alfa cargo for goods transportation. The focus is on low cost of ownership and high profitability. The Zor Grand cargo EV, launched on August 30, 2022, at Rs 360,000, as per the company, can save up to Rs 600,000 in ownership costs over a five-year period when compared to a diesel-engined cargo three-wheeler and up to Rs 300,000 versus a CNG cargo three-wheeler.

At No. 2 and just 5,260 units behind Mahindra is YC Electric with 29,753 units. A commendable performance for this five-product company which has the Yatri Super, Yatri Deluxe and Yatri for passenger duties and the E-Loader and Yatri Cart for cargo operations. Low initial cost, from Rs 125,000 to 170,000 for passenger EVs, and Rs 130,000 to Rs 165,000, is what is driving demand for YC Electric.

The Top 7 OEMs have each sold over 10,000 units and cumulatively account for 139,840 units and 35% of total sales. Other than the top two, five other OEMs – Saera Auto (21,853), Dilli Electric (16,480), Champion Polyplast (16,480) and Champion Polyplast (13,948) recorded five-figure sales.

The Top 20 in this sub-segment (detailed below) accounted for 209,881 units or 52.50% of total retails.

Electric passenger vehicles: 39,544 units, up 125%

Electric passenger vehicles: 39,544 units, up 125%

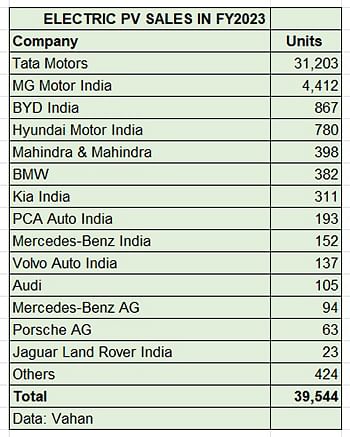

Tata Motors in command with 79% share, MG takes 11%

The electric passenger vehicle industry, as per Vahan, saw retails of 39,544 units, which constitutes strong 125% YoY growth (FY2022: 17,594 units). This translates into 3,295 units retailed every month, a number which can only increase with vehicle manufacturers revving up new product plans for FY2024.

Tata Motors, which has the biggest EV portfolio in India in the form of the Nexon EV, Tigor EV, Tiago EV and the Xpres-T (for fleet buyers), sold 31,203 units for an overwhelming 79% share of total sales. It is followed by MG Motor India with 4,412 units and 11% market share and BYD India with 867 units. The company-wise sales split is detailed below.

India EV growth story revs up

A quick look at Vahan-sourced 10-year EV retail sales data (detailed above) reveals that a total of 22,60,155 units or 2.26 million units have been sold in India since FY2014. Seventy-two percent – 16,23,709 units – of the decadal sales have come in the past two fiscal years, which indicates just how rapidly demand is accelerating for EVs in the country.

The shift from IC engine vehicles to EVs is underway in India, which has outlined EVs to account for 30% of its mobility requirements by 2030. This domestic industry momentum is being driven by the FAME scheme, state subsidies and a growing portfolio of products across vehicle sub-segments.

Growing consumer awareness about the need to use eco-friendly transport and the wallet-friendly nature of EV cost of ownership over the long run is proving to be a big catalyst to adoption of electric mobility.

Given the Union Budget 2023’s focus on this segment of the automobile industry, the increased allocation of the FAME II subsidy should help accelerate sales of EVs. Meanwhile, recognising the huge business potential, component manufacturers are fast upping the ante on localising EV parts, either through full ground-up development or through technology licences. This will lead to enhanced optimisation of costs and in turn EV affordability. All in all, a win-win scenario for the EV industry and consumers.

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

31 Mar 2023

31 Mar 2023

58814 Views

58814 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal