Kia Motors India closes FY2020 with 84,903 units and 9% UV market share

What was a relatively unknown brand in the Indian market a year ago is now a challenger brand. The Hyundai-Kia combine now have 27.66% of the UV market.

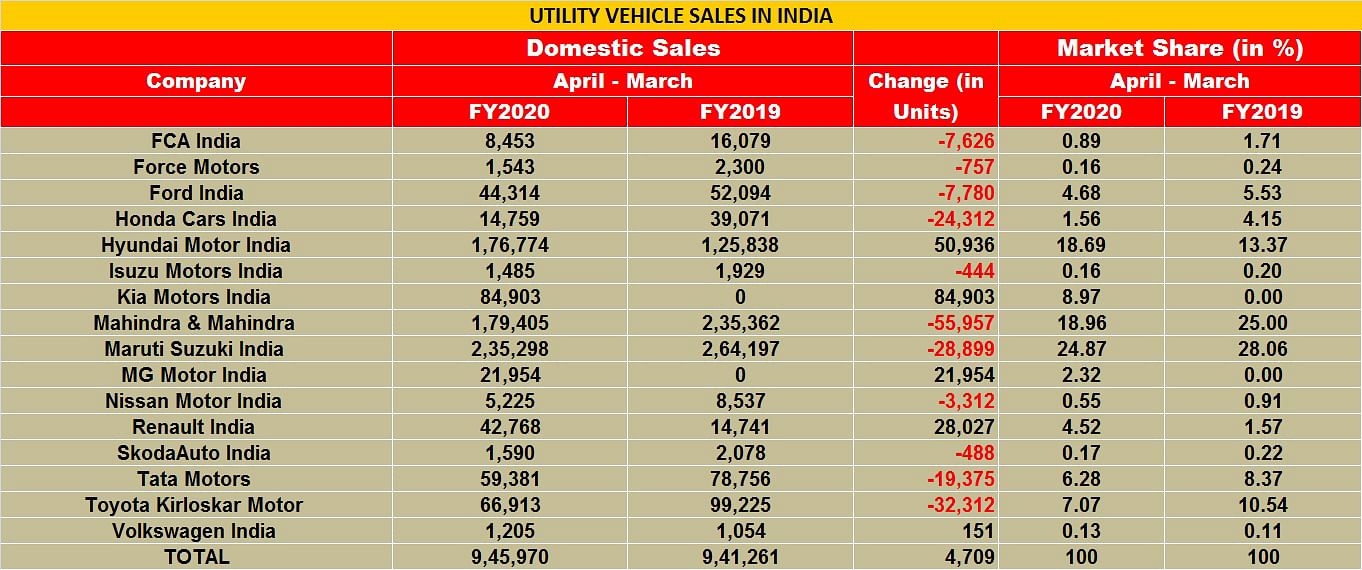

In what was a dismal fiscal for India Auto Inc, which posted a sharp 18% year-on-year overall vehicle sales decline in FY2020, there were only a few redeeming features. One was the utility vehicle (UV) segment, which was the sole sub-segment among passenger vehicles to record positive, albeit flat, growth (0.48%) and the rip-roaring performance of Kia Motors India.

In the short span of a scant 8 months, the Korean carmaker, sister brand to Hyundai Motor India, has grabbed an 8.97% share of the UV market with sale of 84,903 units (81,716 Seltos SUV and 3,187 Carnival MPV), becoming the new No. 4 UV player after Maruti Suzuki India (24.87%), Mahindra & Mahindra (18.96%), Hyundai Motor India (18.69%) and ahead of more well-established OEMs like Toyota Kirloskar Motor (7.07%), Tata Motors (6.28%) and Ford India (4.68%).

Interestingly, put Hyundai and Kia's UV market shares together and what you get is 27.66%, which is a tad higher than market leader Maruti Suzuki. Imagine what Kia's sales and market share would have been in happier times in the Indian automobile market.

Seltos-ing rivals even as Carnival ups the ante

What helped Kia in India was its judicious market and product plan. Right from setting up the 300,000 units per annum state-of-the-art plant in Anantapur district of Andhra Pradesh to launching the Seltos in end-August, across 18 variants and multiple price-points, the company seems to have made the right moves and also caught the competition napping.

From August 2019 to end-March 2020, the carmaker has sold 81,716 Seltos SUVs, which makes for monthly sales of 10,214 units and the No. 1 UV title too. On February 5, 2020, Kia launched its second product for India: the luxurious Carnival MPV. Priced Rs 24.95 lakh (ex-showroom, India) and topping off at Rs 33.95 lakh, the Carnival secured 3,187 units sales in two months.

This remarkable performance, that too in hugely depressed market conditions, has given the Kia brand a new stature in India. What's more, the carmaker's success in India is seeing it rise up in the ladder in Kia Motors' global scheme of things. In February 2020, its domestic market sales of 15,664 units – its highest sales in seven months – saw it account for 8.33% of Kia Motors' global sales of 187,844 units (-5% YoY).

Readying new Sonet for launch in H2 2020

For 2020, Kia Motors is targeting global sales of 2.96 million units, with a ‘golden cycle’ of new models helping the company counter the low-growth trend across the global auto industry. In India, in August this year, the Korean carmaker will launch its third model, the Sonet compact SUV. The tech-laden Hyundai Venue and Maruti Suzuki Vitara Brezza fighter, available with a wide variety of powertrains, is expected to carry a sticker price of about Rs 700,000-11.5 lakh (estimated, ex-showroom).

This year, both calendar and fiscal, is set to see difficult times what with the impact of coronavirus, dampened economic sentiment and what could be a marked shift in consumer preference to the Internet as against visiting showrooms in a time of social distancing. But expect Kia to sort out that challenge as well as a new one from Maruti Suzuki -- the Vitara Brezza's exit from diesel and entry into petrol.

With the country-wide lockdown extended to May 3, April sales will be a washout. But you can be sure that Kia and its UV competition will be strategising ways to snatch market share. Keep watching this space for more.

Also read: Kia plots midsize MPV for India, launch after Sonet compact SUV

RELATED ARTICLES

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

TVS Sells 31,600 e-Scooters in February for a 28% Share; FY2026 to see 1.35 Million e-2W Sales

With 31,600 e-scooters, TVS commanded a 28% market share even as Bajaj Auto, Ather Energy and Hero MotoCorp witnessed st...

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

14 Apr 2020

14 Apr 2020

22875 Views

22875 Views

Ajit Dalvi

Ajit Dalvi