INDIA SALES ANALYSIS CY2015: Two-Wheelers

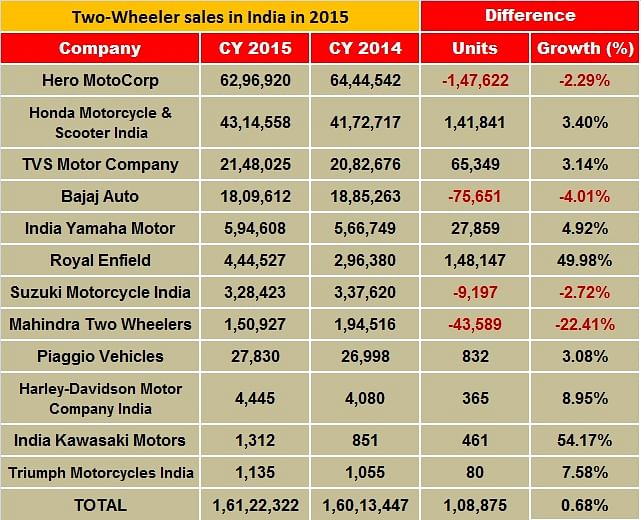

India's two-wheeler industry, which saw meagre 0.68 percent growth in 2015, was particularly hit by the slowdown in sales of commuter motorcycles.

Scooters save the blushes for 2W industry as growth crawls in 2015

Covering up for the countrywide decline in motorcycle sales, the scooter segment gave the Indian two-wheeler industry grace marks to post flat growth of 0.68 percent YoY in CY2015.

A detailed analysis of the domestic sales performance of the two-wheeler industry (specifically the motorcycle and scooter segments) for CY2015 reveals that while motorcycle sales have witnessed a decline year on year (YoY), the scooter segment has consolidated its share.

According to the data compiled by Autocar Professional, total motorcycle sales stood at 1,05,23,909 units in CY2015 as against the overall sales of 1,08,96,687 units in CY2014. This marks a decline of 3.42 percent or sales were down by 372,778 units in value terms.

The data also reveals that total scooter sales stood at 48,80,117 units in CY 2015 as against overall sales of 43,20,925 units in CY2014, marking a healthy growth of 12.94 percent or 559,192 units.

Interestingly, a relative comparison between both the categories reveals that scooter sales were 46.37 percent of the total motorcycle sales in 2015. In the same context, scooter segment sales were 39.65 percent of the motorcycle sales in 2014. This clearly underlines that the market share of scooters in the overall two-wheeler industry has substantially grown in 2015.

The decline in motorcycle sales is mainly due to the slowdown in rural demand, particularly for the mass-market commuter bikes, as also inconsistent rainfall and reduced farm output. Rise in urban demand, on the other hand, has been credited for the growth story of the scooter segment.

The overall two-wheeler industry (including all categories) registered domestic sales of 1,61,22,322 units in 2015 over total sales of 1,60,13,447 units recorded in 2014. This translates into flat growth of 0.68 percent YoY and 108,875 units.

It can be noted that for 2015, while the biggest gainers were Royal Enfield and Honda Motorcycle & Scooter India (HMSI), Hero MotoCorp stood as the most prominent loser in terms of yearly sales. Bajaj Auto, too, saw a substantial downfall in domestic demand for its products.

TVS Motor Company and India Yamaha Motor were other players that saw mild improvements in their respective sales numbers in CY 2015. Mahindra Two Wheelers (MTWL) and Suzuki Motorcycle India (SMIL), on the contrary, saw declining sales and subsequent market share in the industry.

Among the big-bike OEMs, Harley-Davidson Motor Company India, India Kawasaki Motors and Triumph Motorcycles India registered encouraging growth, signalling that the room for premium motorcycles in India is only expanding every year.

Piaggio Vehicles, too, has shown a mild improvement in its yearly sales in 2015, thanks to the new 150cc premium Vespa models. The company clocked mild 3.08 percent growth YoY.

OEMs MAKE MERRY IN OCTOBER

A closer look at the monthly sales for 2015 reveals that while October stood as the best month for the industry, December was the worst. The industry recorded sales of 16,56,235 units in October 2015. In December 2015, total industry sales were only 11,67,633 units. However, cumulative monthly sales highlight that the industry sold an average of 13,43,527 units every month in 2015. Compared to the 2015 number, average monthly sales of the two-wheeler industry in 2014 stood at close to 13,34,454 units.

October 2015 registering the highest industry sales can be attributed to the festive season, which marks peak sales for almost every manufacturer across the domain. December, on the other hand, sees a widespread practice of delayed purchases by the buyers across all communities.

SALES GAP CLOSES BETWEEN HERO & HONDA

A comparative analysis of the domestic sales in 2014 and 2015 reveals that HMSI is slowly – and cautiously – closing on to the industry leader – Hero MotoCorp. In terms of sales numbers, while Hero was ahead of Honda by 22,71,825 units in 2014, this difference reduced to 19,82,362 units in CY 2015.

The Activa brand of scooters and HMSI's newfound traction in the premium commuter motorcycle domain (150cc-200cc) via its 160cc models (CB Unicorn and CB Hornet 160R) has led the charge for this Japanese manufacturer. Hero, on the contrary, struggled with its scooter production capacity for close to a year, and also saw drastically falling sales of its Karizma and other models. The Passion brand, too, saw declining sales in November and December 2015.

However, Hero MotoCorp saw as many as eight months in CY 2015 when its sales crossed the 500,000 unit mark. HMSI sold more than 400,000 units in September and October.

SCOOTERS POWER YAMAHA SALES

For India Yamaha Motor, scooters outsold its bikes in 2015. Its newfound success in the scooter segment helped it cross the 50,000-units mark for the first time in June, and 70,000-sales-mark, its best ever, in October. The ever increasing popularity of the 113cc Fascino scooter, which found instant success, has now made it the best-selling two wheeler from Yamaha.

However, the company is also concerned about the falling sales of its unisex scooter model – the Alpha, and also the Ray variants, which saw stable sales throughout the year until November-December.

ROYAL ENFIELD NEARING HALF-A-MILLION SALES

Perhaps the only company that reported a clean pattern of linear growth in its month-on-month sales performance until November-December 2015 was Royal Enfield. Even for the last two months of CY2015, the company held its sales without reporting any sharp decline unlike every other two-wheeler manufacturer.

As reported, Royal Enfield crossed the 40,000-units sales mark for the first time in August 2015. Total sales in 2015 for the iconic Chennai-based manufacturer stood at 444,527 units as against the total CY2014 sales of 296,380 units. This marked a substantial jump of 148,147 units or close to 50 percent YoY.

While the Classic 350 is the bestseller for Royal Enfield, the company has now readied its first adventure-tourer model named the Himalayan. It is estimated that with the Himalayan model, the company looks at catering to the needs of the young students as well as mature professionals who are passionate about riding long distances. The company, which is not participating in the Auto Expo 2016, plans to commercially roll out the motorcycle just before the mega event.

The new Himalayan stands as a crucial project for Royal Enfield as it marks the company’s second attempt at creating an all-new line-up of motorcycles in its portfolio. The first such attempt is understood to be the Thunderbird cruisers that moved away from the age-old Classic motorcycle category.

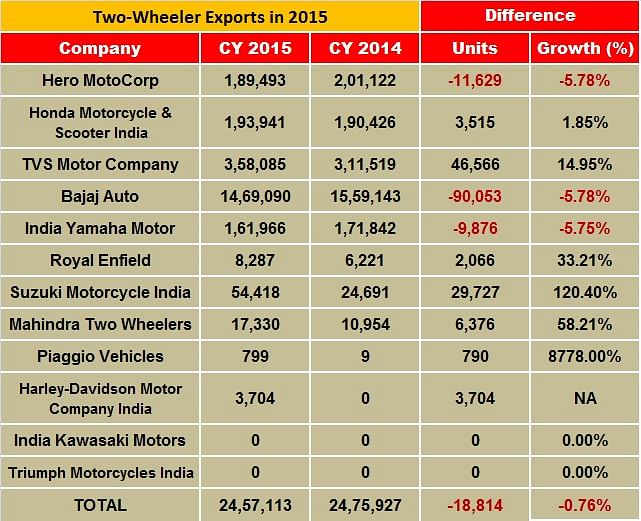

CY 2015 SEES DECLINING 2-WHEELER EXPORTS

CY2015 did not prove to be a progressive year for the two-wheeler industry in terms of export business. The industry registered total exports of 24,57,113 units in 2015 as against the overall reported exports of 24,75,927units in 2014, thereby marking a flat decline of 0.76 percent YoY.

Two new companies began exporting India-built products – Harley-Davidson (Street 750) and Piaggio Vehicles (Vespa models) in CY 2015. While Bajaj Auto, the largest exporter of two-wheelers from India, reported a YoY decline of 5.78 percent or 90,053 units in 2015, TVS Motor stood out as the biggest gainer in value terms.

TVS Motor exported 358,085 units in CY2015, up by 14.95 percent YoY. The second biggest gainer in exports was Suzuki Motorcycles India, which more than doubled its shipment orders. It exported 29,727 units more than its total export volume of CY2014 (24,691 units), thereby marking a growth of 120 percent YoY. Mahindra Two Wheelers, too, marked a significant growth of 58.21 percent YoY in its exports. The company exported 17,330 units in CY 2015.

Recommended:

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

By Amit Panday

By Amit Panday

02 Feb 2016

02 Feb 2016

34962 Views

34962 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau