INDIA SALES ANALYSIS CY2015: Passenger Vehicles

Automakers the world over would give an arm and a wheel to be in India, which has seen its passenger vehicle market post healthy 7.86 percent growth in 2015.

Riding on the economic growth wave in 2015, the Indian passenger vehicle (PV) industry grew from strength to strength and while there were a few pain points, a healthy 7.86 percent growth rate in the year put India right among the fastest growing PV markets in the world.

Increasing disposable incomes, falling interest rates, a barrage of new launches and benign fuel prices drove the growth in car sales as they rose nearly by 10 percent to cross the two-million units mark for the first time in a calendar year.

The Indian PV segment witnessed a salvo of launches in 2015. Scarcely did a month pass by without a brand-new car or a variant being launched. The flurry of new car launches, across a host of segments, platforms and price bands, not only honed the appetite of the Indian car buyer but has also lent a much-needed fillip to the auto industry’s growth momentum.

The growing appetite for new PV purchases was fuelled by the 75 basis points reduction in interest rates by the Reserve Bank of India in 2015. The central bank not only managed to skillfully tackle the growing external economic disturbances, but provided more liquidity to average Indian consumers as timely rate cuts resulted in cheaper loans.

According to the latest data from the RBI, the outstanding personal vehicle loans by Indian banks amounted to Rs 1.38 lakh crore as of November-end, growing by nearly

16 percent year-on-year. This significant growth in vehicle financing was a direct result of the reduction in interest rates, which led to improving consumer appetite for passenger vehicles.

Another positive for the passenger vehicle industry in 2015 was the downward trend in fuel prices. Petrol and diesel prices in India were reduced a total of 12 times last year, with an effective fall of Rs 1.35 a litre. While the reduction in fuel prices was miniscule when compared with the global crude oil prices which touched record lows last year, it still proved to be a catalyst for car buyers in India.

CHALLENGES APLENTY

Apart from the many positives in 2015, the auto industry had to face many stiff challenges. Policy changes like the rollback of excise duty benefits, natural calamities, concern over pollution and recalls dogged the auto industry throughout the year.

There was a fair share of scandals in the year as well, with Volkswagen dieselgate denting the group’s image in the country, which led to the company’s largest recall as well.

In fact, 2015 could be termed as the year of recalls, with the numbers crossing over one million units in the year. Volkswagen India recalled 323,700 vehicles as a result of the global emissions scandal, while Honda Cars India recalled 223,000 vehicles in the year to replace faulty airbag inflators.

GM India recalled over 100,000 units of its Beat diesel hatchback to replace faulty clutch systems and the country’s largest carmaker Maruti Suzuki recalled 33,098 units of its small car models Alto 800 and Alto K10 to rectify defective latches on right-side doors.

As the year came towards a close, devastating floods hit Chennai and coastal Tamil Nadu in November, which resulted in huge losses for the industry. Damage was significant and according to estimates the auto industry saw a production loss of 5-10 percent, or nearly Rs 15,000 crore, as the region reeled under the heaviest rainfall in the century.

Just as the industry had started to recover from these losses, another headwind in the form of the Delhi-diesel ban came forth. The concerns over rising pollution reached threshold point and the auto industry was the first casualty. The Delhi government’s ‘Odd-Even Formula' was not enough, and the Supreme Court stepped in with a three-month ban on diesel vehicles with engine capacity of more than 2,000cc in the Delhi-NCR.

The sudden move affected all the luxury car makers including Audi, Mercedes-Benz, BMW, Jaguar Land Rover as well as mass market players like Mahindra & Mahindra and Tata Motors among others.

TOP PLAYERS CAPITALISE

In 2015, the country’s largest carmaker Maruti Suzuki India witnessed a growth of 11.89 percent with sales of its passenger vehicles at 1.29 million units. The year saw Maruti set its sights on the premium segment, which has proved too tough a nut to crack for the carmaker in the past. It launched a premium showroom channel called Nexa across the country with an aim to provide a personalised and unique experience to the customer. With the S-Cross and the Baleno, Maruti launched its first premium cars under the Nexa channel. While the S-Cross received a tepid response, the Baleno struck the right chord with Indian buyers and edged the past segment leader, Elite i20, to become the most sold premium hatchback in December.

Even as Maruti diversified into premium cars, a bulk of its sales came from the volume driver entry-level segment. Segment-leader Alto remained the best-seller with average sales of above 21,000 units every month, closely followed by the Dzire and the Swift.

For Maruti’s closest rival, Hyundai Motor India, 2015 ended as a record year in terms of sales. Thanks to the handsome consumer response for its Creta SUV, the South Korean carmaker reported a 15.68 percent rise in sales in the year.

Since its launch in July, the Creta played an instrumental role in boosting Hyundai’s domestic sales. The carmaker posted record sales for August, September and October 2015 on the back of strong demand for the SUV. Throughout the year, the Grand i10 with average sales close to 10,000 units a month also proved to be a strong volume driver. However, the company’s most sold car was the Elite i20 which clocked sales of around 12,000-13,000 units every month, and dominated the premium hatchback segment uptil November.

In terms of PV volumes, Mahindra & Mahindra finished third as the automaker benefitted from an aggressive product launch strategy and diversification of its portfolio. The utility vehicle segment, which is the mainstay for the automaker, started showing some signs of recovery in the year. However, tough competition from fresh entrants like Hyundai Motor India resulted in a slight contraction in volumes for the company as sales fell 2.78 percent to 224,189 units. The three-month ban on diesel SUVs also had a negative impact on sales with Delhi-NCR being among the largest markets for the automaker.

Honda Cars India also registered double-digit growth and remained the third largest carmaker in the country with sales of 202,403 units in the year. The launch of the new Jazz and sustained demand for the City and the Amaze sedans contributed to the Japanese carmaker’s good run in 2015.

THE ROAD AHEAD

With the dawn of 2016, what lies ahead for the Indian PV industry is a great opportunity and even greater challenges. The opportunity to leverage the inherent frugal mindset and overlay it with innovation to create a robust automotive ecosystem which would propel the country as a global automotive manufacturing powerhouse. That said, it will not be a cakewalk though. The new 2020 BS-VI deadline could prove to be the toughest test yet for Indian manufacturers and while positives such as likely GST implementation and a downward interest rate cycle would provide the much needed support, specific focus on skill and capability development would be the key.

TOP 10 in DECEMBER

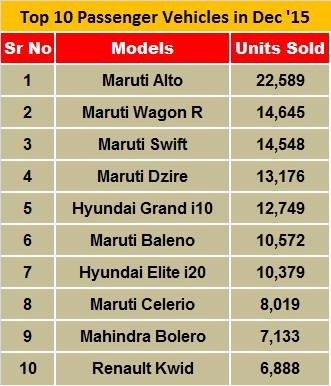

Despite December being a mixed bag in terms of sales for the Indian carmakers, competition heated up in the Top 10 sales list.

While petrol carmakers like Maruti and Hyundai were able to push despatches at the fag end of the year, predominantly diesel passenger vehicle manufacturers like Toyota Kirloskar Motor, Tata Motors and Mahindra & Mahindra saw muted demand, largely due to the selective diesel-car ban in Delhi-NCR. Another sales dampener was the flood-hit Chennai.

Even as Maruti Suzuki continued to populate the list with no less than six of its hot-selling models, the surprise entrant for the month was Renault Motor India, with the Kwid taking the last spot in the list with sales of 6,888 units.

Given the strong response for the Kwid, Renault has substantially increased its sales and service network reach in India, from 14 sales and service facilities in mid-2011 to 190 currently, and will reach 240 facilities by end-2017, which includes expanding its presence in existing and new markets in urban, semi-urban and rural India.

Even as the Kwid has helped in expanding the entry-level hatchback segment, it still comes nowhere close to segment leader Alto, which remained on the top spot for December as well with sales of 22,589 units.

The Wagon R with sales of 14,645 units took the number two spot, beating its other siblings like the Swift (14,548 units) and the Dzire (13,176 units) which followed on the third and fourth spots, respectively.

Hyundai Motor India with its Grand i10 and Elite i20 hatchbacks captured the fifth and the seventh spots on the list. Hefty year-end discounts on the Grand i10 propelled sales to 12,749 units in the month, ahead of the Elite i20, which saw sales of 10,379 units.

Maruti Suzuki’s premium Baleno hatchback, which is seeing huge demand, took the sixth spot on the list with sales of 10,572 units and also became the most sold premium hatchback in the country as it edged ahead of the segment leader i20, for the first time since its launch in October 2015.

The Baleno seems to have struck the right chord with urban Indian car buyers. Another testament to its popularity is the fact that it has been the most searched car online in India since its launch.

Maruti’s Celerio hatchback also featured in the Top 10 list with 8,019 units. This continued performance by Maruti is a pointer to the fact that the company enjoys an overwhelming 52.77 percent market share in the passenger car market.

Interestingly, Mahindra & Mahindra also had a representative in the Top 10 list in December with its ageing Bolero taking up the ninth spot with 7,133 units. The Bolero was also the only UV to feature in the list.

Another surprise was the departure of Honda from the Top 10 list in December. The City, which sold 6,366 units in the month, could not make the cut despite being Honda’s most sold car in the month.

Now with all eyes on the Auto Expo 2016 this month, plenty of fresh model launches are in the pipeline and competition is all set to heat up in the Indian car market. As new models like Honda Cars India’s compact BR-V SUV, Tata Motors’ Zica hatchback and Volkswagen India’s Ameo sub-4-metre sedan look to break through in their respective segments, it would be interesting to see if there are any major upheavals in the Top 10 in the coming months. Stay tuned for the latest updates in Autocar Professional, both online and in print.

Recommended reads:

RELATED ARTICLES

Maruti Fronx sells 135,000 units in 12 months, second best-selling Nexa model in FY2024

Baleno-based Fronx compact SUV with 134,735 units accounts for 21% of Maruti Suzuki’s record utility vehicle sales of 64...

Utility vehicle share of PV sales jumps to 60% in FY2024, cars and sedans hit new low of 37%

Sixty percent of the record 4.21 million passenger vehicle sales in India came from 2.52 million UVs, a big leap from th...

Mahindra XUV300 tops 250,000 sales ahead of XUV3XO reveal

The popular compact SUV, which ranks among India’s Top 20 utility vehicles for FY2024, is among the SUVs which have powe...

By Shourya Harwani

By Shourya Harwani

02 Feb 2016

02 Feb 2016

11755 Views

11755 Views