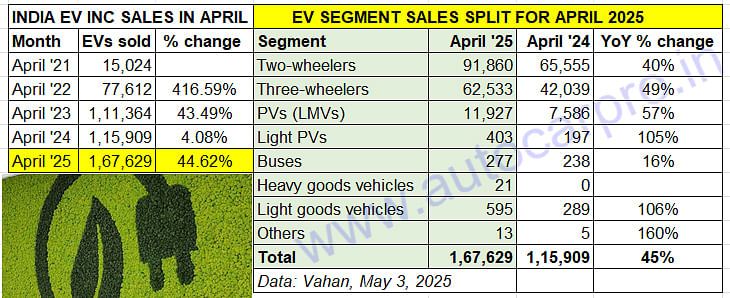

India records best April for EV sales: 167,629 units and 45% growth

With all-four sub-segments of electric two- and three-wheelers, passenger and commercial vehicles registering robust sales and high double-digit YoY growth, April 2025 sets the tone for a new fiscal which promises to set a new benchmark for India EV Inc which missed the 2-million milestone in FY2025 by a whisker.

India’s electric vehicle market recorded its strongest April when it registered total retail sales of 167,629 units last month. This represents a robust 45% year-on-year increase (April 2024: 115,909 units), according to figures published on the Vahan portal. Retail sales of e-PVs had driven past the 100,000 milestone for the first time for the month of April in CY2023 (111,364 units)

April 2025’s strong EV industry sales, which cover the two- and three-wheeler, passenger vehicle and commercial vehicle segments, come on the back of India EV Inc hitting its best-ever fiscal year sales of 1.96 million units in FY2025.

If the trend of April sales, which is usually a lean month as it is the first month of the new fiscal, continues, then the industry could be looking at even better numbers in FY2026. What is helping demand is the favourable market sentiment, a positive monsoon outlook by the IMD, and importantly a good number of new product launches across the two-wheeler and passenger vehicle segments.

TWO-WHEELERS: 91,791 units, up 40% YoY

After wrapping up FY2025 with record sales of 1.14 million units, 21% YoY growth and a 58% share of India EV Inc’s retail sales, electric two-wheeler manufacturers in India have registered robust retail sales of 91,791 units in April 2025, up 40% YoY (April 2024: 65,555 units). This makes April 2025 the best April yet for electric two-wheelers, ahead of April 2023 (66,878 units) and April 2024 (65,555 units). This is as per the latest retail sales data available on the Vahan portal (7am – May 1, 2025).

What will also help the industry is Maharashtra’s bold and dynamic new Electric Vehicle Policy 2025, which has given a host of benefits to the EV industry and aims for further accelerate sales in the state. In FY2025, Maharashtra had the bragging rights for being No. 1 state in India for retail sales of electric two-wheelers, electric cars and SUVs, and also e-CVs. It was ranked second overall, after Uttar Pradesh, on the all-India EV ownership scale with 246,221 units and a 12.52% share of India EV sales in FY2025. Of the 11,49,641 e-two-wheelers sold in FY2025, Maharashtra with 211,880 units, up 15%, had the largest share of 18 percent.

Of the total 91,791 e-2Ws sold in April 2025, the Top 10 e-2W manufacturers together accounted for 86,587 units or an overwhelming 93%, while and the Top 4 – each with five-figure sales – 71,613 units or 78 percent. To know the movers and shakers of this segment for April, when TVS became No. 1 for the first time in a month, CLICK the Top 10 e-2W OEMs list.

THREE-WHEELERS: 52,533 units, up 49% YoY

The e-three-wheeler segment, which is the second largest EV volume provider after two-wheelers, has also packed a punch in April. The e-3W industry has witnessed retail sales of 52,533 units, an increase of 49% YoY (April 2024: 42,039 units) and sets the growth agenda for a strong fiscal. This segment had hit record sales of 699,073 units in FY2025 and accounted for 57% of the 1.22 million three-wheelers sold across all powertrains.

The e-three-wheeler segment, which is the second largest EV volume provider after two-wheelers, has also packed a punch in April. The e-3W industry has witnessed retail sales of 52,533 units, an increase of 49% YoY (April 2024: 42,039 units) and sets the growth agenda for a strong fiscal. This segment had hit record sales of 699,073 units in FY2025 and accounted for 57% of the 1.22 million three-wheelers sold across all powertrains.

Of all the vehicle segments, it is the electric three-wheeler industry which is witnessing the fastest transition to electric mobility. In April 2025, a total of 99,771 three-wheelers (across all powertrains comprising electric, CNG, diesel, LPG and petrol) were sold across India (other than Telangana), as per Vahan data.

Electric 3Ws (62,533 units) accounted for the bulk of sales – 63% – increasing their share YoY by 11% from 52% in April 2024. Demand for CNG variants dropped by 6% YoY to 23,622 units with the CNG share of 3W sales dropping by 9% YoY to 23% in April 2025 – this can be attributed to CNG price increases in recent times, adding to the total cost of ownership. This also means e-3Ws are taking away market share from CNG-powered models. Meanwhile, diesel 3Ws

Like the e-two-wheeler industry, there’s fierce competition too in this segment, albeit amongst the Top 6 players – Mahindra Last Mile Mobility (MLMM), Bajaj Auto, YC Electric Vehicles, Saera Electric Auto, Dilli Electric Auto and Piaggio Vehicles. And TVS Motor Co has plugged into this segment only recently. The Top 10 OEMs, which comprise these six along with Mini Metro, Energy EV, Unique International and Hotage India, together sold 288,302 units or 41% of total sales in FY2025. However, the real battle is being fought at podium level between Mahindra Last Mile Mobility, Bajaj Auto and YC Electric Vehicles. In April, the difference between Mahindra and Bajaj Auto was just 131 units – CLICK to know the Top 25 e-3W OEMs for April 2025 as well as FY2025.

PASSENGER VEHICLES: 12,330 units, up 58% YoY Indian electric passenger vehicle manufacturers have sold 12,330 units in April 2025, a strong YoY increase of 58% (April 2024: 7,783 units), which translates into an additional 4,547 e-PVs sold last month. That’s not all – as per Vahan retail sales statistics, April 2025 is now the new e-PV sales benchmark, having surpassed the previous best of April 2024, which in turn had bested April 2023 (6,039 units) and April 2022 (2,255 units) by a fair margin and reflected the growth of this zero-emission vehicle segment.

Indian electric passenger vehicle manufacturers have sold 12,330 units in April 2025, a strong YoY increase of 58% (April 2024: 7,783 units), which translates into an additional 4,547 e-PVs sold last month. That’s not all – as per Vahan retail sales statistics, April 2025 is now the new e-PV sales benchmark, having surpassed the previous best of April 2024, which in turn had bested April 2023 (6,039 units) and April 2022 (2,255 units) by a fair margin and reflected the growth of this zero-emission vehicle segment.

This strong performance comes on the back of the record e-PV industry retail sales of 108,370 units in FY2025, up 19% YoY (FY2024: 91,320 units). April 2025 has been quite an opener for FY2026 and sees the market leader’s monthly market share drive to a record low of 36% while the challenger’s share has jumped to 28%, even as the well-entrenched SUV manufacturer with two new electric origin SUVs has hit its best-ever monthly sales of 3,002 units which gives it a 24% share.

For complete details on each of the 14 electric car, SUV and MPV manufacturers including luxury EV OEMs, CLICK this link.

COMMERCIAL VEHICLES: 893 units, up 68% YoY  Like the other three sub-segments of the EV industry, the commercial vehicle segment’s performance too was a robust one in April. Total retails of 893 units were up 69% YoY (April 2024: 527 units). Sales of zero-emission passenger buses rose 16% to 277 units and 21 heavy goods vehicles were also bought during the month.

Like the other three sub-segments of the EV industry, the commercial vehicle segment’s performance too was a robust one in April. Total retails of 893 units were up 69% YoY (April 2024: 527 units). Sales of zero-emission passenger buses rose 16% to 277 units and 21 heavy goods vehicles were also bought during the month.

The real growth for the e-CV category came from electric light goods vehicles which, with 595 units, more than doubled their sales (April 2024: 289 units) and points to demand being generated from last-mile mobility and logistics requirements from across the country.

ALSO READ:

Exclusive: UP, Maharashtra, Karnataka and Tamil Nadu drive double-digit EV sales growth in FY2025

RELATED ARTICLES

Suzuki Dispatches 703 e-Access Scooters in January, Delivers 201 Units to Customers

Suzuki Motorcycle India’s first electric scooter, priced at Rs 188,000 and among the most expensive two-wheeled EVs, reg...

Honda Sells 5,445 Activa-e and QC1 e-Scooters in 12 Months

Since February 2025, Honda Motorcycle & Scooter India has produced 11,168 e-scooters, dispatched 5,445 units to its deal...

Kia Carens Sells 277,000 Units in Four Years, Clavis And Clavis EVs Power 24% Growth in FY2026

The Carens MPV, which turns four years old today, accounts for a 27% share of Kia India’s sales of 10,43,126 utility veh...

04 May 2025

04 May 2025

31953 Views

31953 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi