India Auto Inc reels under continuing sales slowdown, July numbers jolt industry

With no respite in sight, the Indian automobile industry sees yet another month of sharp sales decline, making it the 10th straight month of dwindling numbers,

Coming on the back of nine straight months of declining sales, it is no surprise that July 2019 sales numbers across vehicle segments – passenger vehicles, two-wheelers and commercial vehicles – are not worth shouting about. Instead, they point to the urgent need for India Auto Inc to receive a growth stimulus – ideally a GST rate cut from the existing 28 percent to 18 percent – to revive sales. Else, the Indian automobile industry which, not too long ago, was chugging along to No. 4 global rank will fall behind in the global scheme of things.

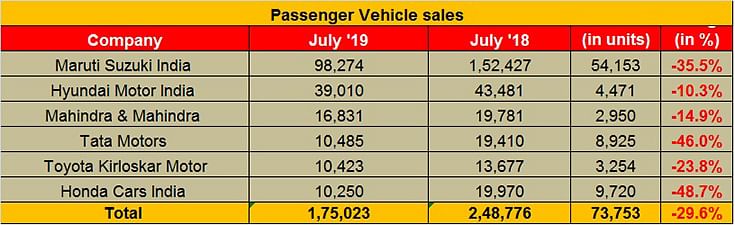

Passenger vehicle sales fall sharply

Despite ample discounts going for a fair number of models and also a gaggle of new SUVs, passenger vehicle buyers are still not loosening their wallets. The government's tilt towards EVs in the form of plentiful sops and incentives as well as the short run-up to BS VI, now barely eight months away, has made potential buyers hesitant.

Passenger vehicle market leader Maruti Suzuki India, which has been recording monthly sales declines since March 2019, saw its sales fall below the 100,000-unit mark after a very long time. At 96,478 units, the company’s July 2019 sales/despatches in the domestic market are 36.3 percent down on year-ago sales (July 2018: 152,427). The hit on the company’s sales is so bad that all PV sub-segments are down in double digits. Add the 1,796 units of the rebadged Baleno that Maruti Suzuki sells to Toyota Kirloskar Motor as the Glanza and the overall domestic market total rises to 98,274 units, which translates into a negative 35.52 percent for July 2019.

No. 2 PV player Hyundai Motor India reported despatches of 39,010 units, down 10.28 percent (July 2018: 43,481). The Korean carmaker, which is seeing surging demand for its recently launched Venue compact SUV, is also feeling the pressure of the continued downturn. The company has announced that it has crossed the 50,000-unit bookings mark since the launch of the Venue on May 21, 2019. The company also says it has delivered 18,000 units of the SUV. The Venue drove into the Top 5 best-selling UVs chart both in May (in fourth place) and June, when it came tantalisingly close to going past the No. 1 UV, the Maruti Vitara Brezza.

Mahindra & Mahindra sold a total of 16,831 vehicles in July 2019, down 14.91 percent (July 2019: 19,781). Commenting on the performance, Veejay Ram Nakra, chief of sales and marketing, Automotive Division, M&M, said, “The headwinds faced by the automotive industry continue as a result of subdued consumer sentiment, triggered by various factors. The industry needs stimuli to help revive consumer demand and conversions. We hope that the overall buying sentiment will improve in the run-up to the festive season and with the monsoon turning out to be better than initially anticipated.”

Tata Motors reported sale of 10,485 units in July 2019 which, when compared ro SIAM's July 2018 sales data of 19,410 units, marks a 46 percent YoY decline in sales, According to a company statement, "In July 2019 despite the challenging market condition, the Passenger Vehicles retail sales was marginally better than whole sales, resulting in a slight reduction in the dealer stock. We worked on increasing our retail sales by increasing our footprints. In April-July 2019, we added 48 new sales points across country, which includes 30, added in July 2019. Dealer network has added over 2600 sales executives in our quest to increase sales."

Toyota Kirloskar Motor sold a total of 10,423 units in the domestic market in July 2019, down 23.77 percent (July 2018: 13,677). Commenting on the sales performance, N Raja, Deputy Managing Director, Toyota Kirloskar Motor, said, “The industry is deeply concerned with the increasing pressure of low customer sentiment faced by the sector. The high insurance costs, rise in taxes and liquidity crunch across the non-banking finance segment, tightening of lending norms have significantly affected the domestic sales in the last few months. We are trying to lend maximum support to our dealers through the hard times faced by the industry by maintaini a lean inventory."

“However, despite the existing slowdown, we are happy to note that our products in the IMV segment – Innova and Fortuner – continue to hold their segment leadership. The Innova Crysta’s market share in May-June 2019 was 45 percent compared to 43 percent a year ago. We hope that the upcoming festive season brings in a breather for the industry with spur in customer sentiments. Also, we expect the government will step in to take necessary steps for improving liquidity in the market by capital infusion in the banks. The Industry also expects the GST level to be rationalised to a lower level (28% to 18%) to accommodate the downturn in sales,” added Raja.

Honda Cars India registered monthly domestic sales of 10,250 units in July 2019, down 48.67 percent (July 2018: 19,970). However, it is to be noted that July 2019 results are on a higher base of July 2018 when the new second-generation Amaze sedan was in its third month of launch and had clocked its highest sales in a month.

Commenting on the overall auto industry performance, Rajesh Goel, senior vice-president and director, Sales and Marketing, Honda Cars India, said, “The de-growth in the automobile industry further intensified last month amidst weak buying sentiment and overall slowdown. We are also witnessing a lot of postponement of purchases. It is extremely worrisome since the July 2019 decline is more severe than the Q1 decline and that too when the industry had de-grown in July last year as well."

SUZUKI 2-WHEELERS SHINE BUT THE OTHERS DO NOT

Like the PV market, the two-wheeler segment, the most affordable form of motorised mobility, has not been spared either.

Hero MotoCorp, the world’s largest two-wheeler manufacturer and the market leader in India, sold 535,810 units of motorcycles and scooters in July 2019. The sluggish market environment prevalent in the first quarter has continued in the beginning of the second quarter as well and its impact is visible in the dispatch volumes. The outlook for the rest of the year will be dependent on multiple factors, including the progress of monsoon and festive season offtake, as well as improvement in the liquidity situation.

Honda Motorcycle & Scooter India, the No. 2 two-wheeler player in the Indian market, closed July 2019 with sales of 455,000 units in the domestic market, which constitutes a YoY decline of 10.53 percent (July 2018: 508,589). The company, which currently has a 26.80 percent share of the two-wheeler market, is making many an effort to revive sales in the current depressed market. It is accelerating its sales drive in semi-urban and rural markets. Last month, HMSI tied up with Cholamandalam Investment & Finance Co for offering retail finance. What will help is Cholamandalam’s strong nationwide presence with over 1,000 branches, most of them rural and semi-urban areas, and a base of a million consumers.

TVS Motor Co sold a total of 208,489 two-wheelers in July 2019, down 15.72 percent (July 2018: 247,382. While motorcycle comprised 108,210 units, down 10.88 percent (July 2018: 121,434), scooter sales registered 105,199 units, down 11.60 percent (July 2018: 118,996).

Pune-based motorcycle manufacturer Bajaj Auto sold a total of 170,978 units, down 15 percent (July 2018: 201,433).

Suzuki Motorcycle India, which is one of the very few OEMs reporting growth in a time of downturn, has clocked 17.5 percent growth with sale of 62,636 units in July 2019 (July 2018: 53,321). Commenting on the performance, Devashish Handa, vice-president, Suzuki Motorcycle India, said, “July was an exciting month at Suzuki Motorcycle India as we launched new products and variants in both motorcycle and scooter category, further strengthening our product offerings for Indian consumers. We are steering ahead with full throttle to add more customers to the Suzuki family.”

July saw Suzuki launch the new Suzuki Gixxer and also the MotoGP edition of the new Gixxer SF. On the scooter front, it introduced the Access 125 Special Edition, aiming to accelerate sales of the popular premium scooter.

Midsized motorcycle manufacturer Royal Enfield has reported sale of 49,182 units, down a sizeable 26.6 percent over the 67,001 units sold in July 2018.

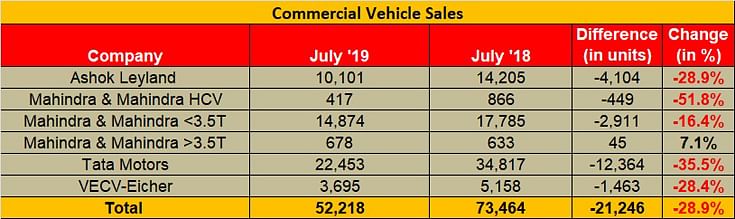

COMMERCIAL VEHICLE SALES TAKE A MAJOR HIT

The subdued Q1 FY2020 results announced by truck makers in the past week or so are a clear indication of the prevailing depression in CV and are in line with an overall fall in the Indian automotive market. Tata Motors, Ashok Leyland and VE Commercial Vehicles have all registered double-digit declines in their April-June quarter, which continues in July 2019.

However, notwithstanding the overall negative sentiment in the market, the first quarter of the fiscal, typically, means slow offtake for CVs. The CV slowdown as such began in July 2018, when the revised axle load norms were introduced. They came at a time when CV sales were at their peak and ended up creating 15-20 percent excess capacities in the industry, especially in the M&HCV segment. An overall negative rural sentiment and sluggish freight movement has resulted in the M&H CV segment going into free-fall mode.

The CV industry is pinning its hopes on pre-buying before BS VI kicks in from next April but this is likely to be limited and largely driven by replacement buying. The next few months will see the CV sector, as also the other vehicle segments, experience a rather bumpy ride.

While this is not the first instance of a slowdown impacting industry, the CV segment, more than the others, is well-versed with the phenomenon of cyclicality.

In the next 8-12 months, infrastructure-driven sales will make or break the M&HCV industry and a lot rides on the continuing government focus on buildings roads across the country which will spur demand for construction equipment and tippers. The monsoon is alive across the country, albeit some regions are inundated with too much rain. It will be another three months or so before the CV sector benefits from rural growth.

Providing his outlook on future growth, Vinod Aggarwal, MD and CEO, VECV, said, “Overall, the industry’s sentiments are down with an increase in fuel prices, lower availability of loads due to a slowdown in the economy and consequently low replacement demand. We expect some pick up to happen from September with the onset of the festive season and also anticipate seeing some positive impact of pre-buying with BS VI norms becoming applicable from April 1, 2020.”

According to Tata Motors, “The market continues to exhibit subdued demand sentiment as customers are postponing purchases given the poor freight availability, and the falling freight rates are impacting their viability. The slowing economy, excess capacity created on account of increased axle load norm, the slowdown in execution of infrastructure projects over past few quarters, drop-in discretionary consumption and poor liquidity conditions in tight financing environment have led to severe contraction in total industry volumes across segments.”

How the OEMs fared in July

Market leader Tata Motors, which has a 43 percent CV market share, is not insulated from the free-fall across segments. In July, its sales in the domestic market were down by a sharp 36 percent to 22,453 units in the month. The key M&HCV truck segment has come under pressure, plunging by 46 percent to 5,465 units. ILCV numbers dropped by 21 percent to 3,167 units. Demand for Tata’s cargo SCVs and pickups is down 30 percent to 10,936 units while the commercial passenger carrier (bus) numbers fell 42 percent to 2,884 units.

Ashok Leyland registered a 29 percent drop in its overall domestic sales in the month to 10,101 units. (July 2018: 14,205). M&HCV sales skidded by 41 percent to 6,018 units; its trucks are down 47 percent while bus sales dipped by 5 percent. LCV numbers were nearly flat at 4,083 units (July 2018: 4,053).

Mahindra & Mahindra’s overall CV sales were down by 17 percent to 15,969 units (July 2018: 19,284). The M&HCVs declined 52 percent to 417 units. The below-3.5T GVW segment sold 14,874 units down 16 percent. (July 2018:17,785), and those in the above-3.5T GVW segment were on positive up 7 percent with a sale of 678 units.

VE Commercial Vehicles' sales declined by 28.4 percent in the month; the company sold 3,695 units in the domestic market. (July 2018: 5,158 units).

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

01 Aug 2019

01 Aug 2019

16986 Views

16986 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau