Hero Electric tops July e-two-wheeler sales, Okinawa leads in April-July

With 8,953 units, Hero Electric vaults to the top in July, while Okinawa Autotech with 35,386 units is No. 1 for FY2023's first 4 months.

Electric two-wheeler sales are taking off rather nicely in the ongoing fiscal year. As per the latest retail sales data for July 2022, as released by FADA president Vinkesh Gulati, total e-two-wheeler sales last month were 44,475 units, up 5% on June 2022’s 42,303 units and a massive 232% on the Covid-impacted July 2021’s 13,392 units.

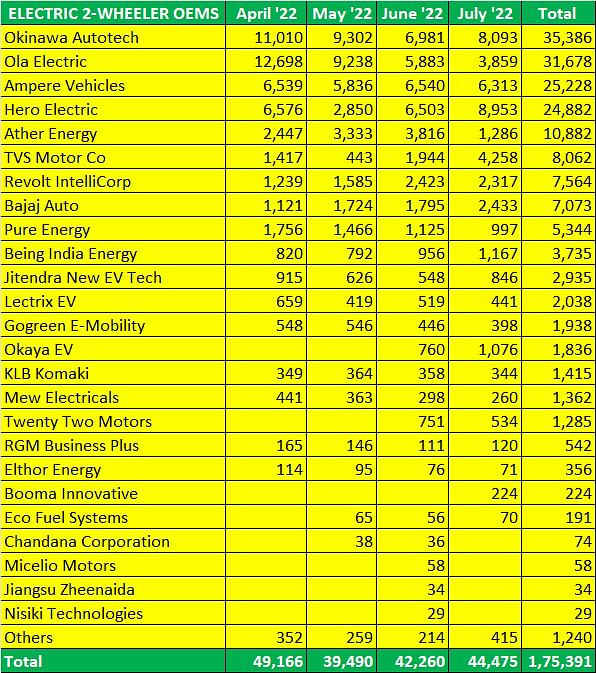

Cumulative sales for the four-month April-July 2022 period have crossed the 175,000-unit mark at 175,391 units. A look at the data table below reveals that the top 5 players account for 128,056 units or 73% of total retail sales in the period under review.

Electric two-wheeler retails have crossed the 175,000 mark in the first four months of FY2023. (Data: Vinkesh Gulati/Twitter).

What is adding tailwinds to sales of the eco-friendly commuters on two wheels is the marked increase in prices of petrol-powered scooters and motorcycles, particularly after the technological upgrade to BS VI in April 2020. As is known, the BS VI mandate has necessitated the use of electronic fuel injection (EFI) technology which is significantly more expensive than the now-defunct carburettor technology. Furthermore, it is understood that apart from the higher acquisition cost of BS VI two-wheelers, the cost of repair is also higher compared to non-EFI products.

Hero Electric powers up in July

Hero Electric, which is fast ramping up manufacturing capacity, is the best-selling EV maker in July 2022, with 8,953 units, 860 units ahead of Okinawa Autotech’s 8,093 units. This strong on-ground performance is a 38% month-on-month increase (June 2022: 6,503 units) and takes the company to No. 4 position in the first four months (April-July 2022) of the ongoing fiscal year.

The company, which is aggressively driving expansion, currently has over 700 sales and service outlets along with a widespread charging network and trained roadside mechanics on EVs. Hero Electric is also investing in expanding the EV charging network. Earlier this year, it began manufacturing and rollout of its Optima and NYX e-scooters from Mahindra Group’s plant in Pithampur, Madhya Pradesh.

Hero Electric will have to sustain as well as better this kind of demand for its products if it to dislodge the top three players. At present, Okinawa Autotech is well placed in the lead with 35,386 units, averaging monthly sales of 8,846 units. With its strong July sales, Okinawa has dislodged Ola Electric, which was the market leader in the April-June 2022 period. Ola Electric sold 3,859 units last month, down 35% on June 2022 and down 69% on April 2022’s 12,698 units. On April 23, Ola had recalled 1,441 of its electric two-wheelers "as a pre-emptive measure", following a fire incident. Ola is the third e-scooter manufacturer, after Okinawa and Pure EV, to announce a recall.

July’s third best-seller is Ampere Vehicles with 6,313 units, down 3% on its June 2022 numbers but takes its four-month total to 25,228 units that also gives it third position in the overall scheme of things.

Smart EV maker Ather Energy has seen a sharp 29% month-on-month decline to 1,286 units (Junre 2022: 2,816 units) and is the only other OEM to cross the 10,000-units cumulative retail sales mark for April-July 2022.

TVS Motor Co, which sold 4,258 units last month, is the one to have clocked maximum month-on-month growth – 119% (June 2022: 1,946 units).

Bajaj Auto, the other ICE OEM in the EV fray, has also recorded good sales at 2,498 units, up 35% MoM (June 2022: 1,795 units).

Growth outlook: 700,000 units in the reckoning for FY2023?

Given the sustained demand in the e-two-wheeler market and the huge market potential, the 700,000-unit sales milestone looks to be in the reckoning in FY2023. Following the incidents of e-scooter fires earlier this year with three OEMs, the government as well as the entire EV industry eco-system is hard at work to ensure top-notch battery and cell management. This is imperative because consumer confidence in electric two-wheelers, one of the low-hanging fruits of the industry along with three-wheelers, remains strong.

India is targeting EVs to account for 30% of its mobility requirements by 2030, driven by the FAME scheme, state subsidies and much increased availability of models across segments. Given the current pace of buying in the overall two-wheeler arena – 3.3 million two-wheelers sold in FY2022 – that could be still some distance away. Nonetheless, given the positive trend, e-two-wheeler OEMs will be looking to make the most of demand coming their way.

ALSO READ

EVs take 3.6% of two-wheeler sales in India in H1 2022

RELATED ARTICLES

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

07 Aug 2022

07 Aug 2022

10125 Views

10125 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal