Electric 3W Sales Grow 4% in August to 63,500 Units; Top 25 OEMs Revealed

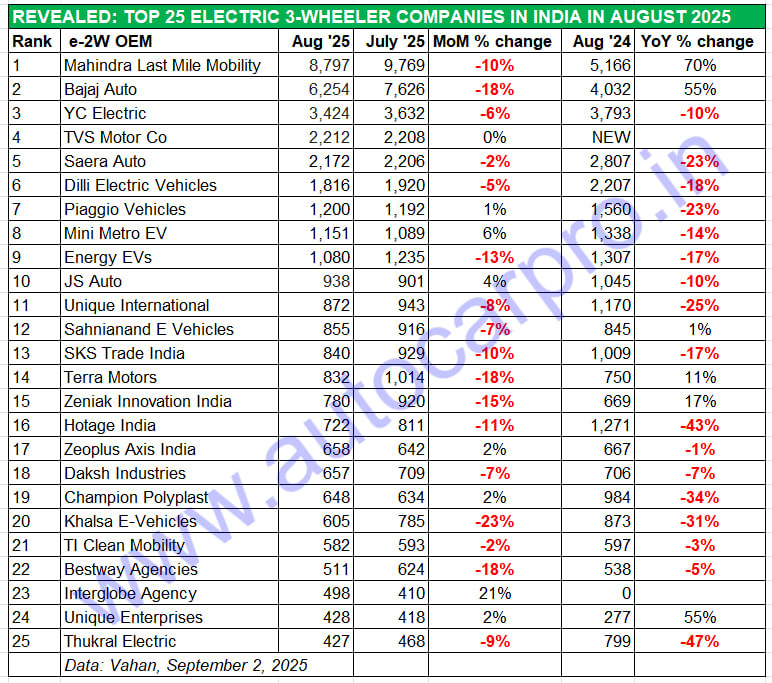

Legacy ICE OEMs that have expanded into electric mobility continue to dominate the e-three-wheeler market. Mahindra & Mahindra maintained its dominance with 8,800 units and 70% year-on-year (YoY) growth in August, while Bajaj Auto sold 6,254 units, securing a 10% market share. Recent entrant TVS Motor captured fourth place among a field of 600 players.

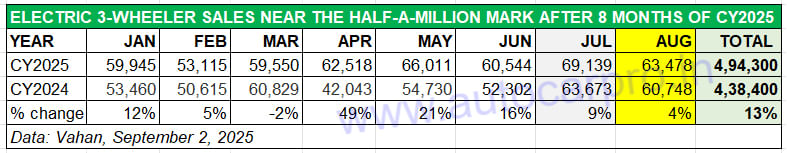

After recording its best-ever monthly sales of 69,139 units in July 2025, the electric three-wheeler industry saw an 8% month-on-month decline in August, with sales falling to 63,478 units. However, year-on-year growth remained positive at 4% (August 2024: 60,748 units), bringing cumulative January–August 2025 retail sales to 494,300 units — a 13% YoY increase (January–August 2024: 438,400 units).

Out of the Top 25 OEMs in August, only eight reported year-on-year sales growth; the remaining 17 experienced declines. This reflects the segment’s slower growth last month and highlights how legacy ICE players expanding into EVs — such as Mahindra & Mahindra, Bajaj Auto, TVS Motor Co, and Piaggio Vehicles — are capturing market share from smaller players and startups.

Retail sales of 63,478 e-3Ws in August 2025 were up 4% YoY but down 8% compared to July 2025’s 69,139 units — the highest monthly sales the Indian e-3W industry has achieved to date.

Retail sales of 63,478 e-3Ws in August 2025 were up 4% YoY but down 8% compared to July 2025’s 69,139 units — the highest monthly sales the Indian e-3W industry has achieved to date.

Longstanding market leader Mahindra Last Mile Mobility (MLMM), according to Vahan data, recorded retail sales of 8,797 units in August 2025, a robust 70% increase YoY (August 2024: 5,166 units). This marks the company’s second-highest monthly sales figure, following July 2025’s 9,769 units, and gives MLMM a 14% market share.

As the first legacy OEM to enter electric mobility nearly a decade ago, Mahindra & Mahindra and MLMM now offer the largest e-3W portfolio, including the Treo, Treo Plus, Treo Zor, Treo Yaari, Zor Grand, e-Alfa Plus, and e-Alfa Cargo.

From January to August 2025, MLMM achieved sales of 56,829 units, up 52% YoY (January–August 2024: 41,811 units). The company reports that, year-to-date, electrification in the L5 EV category stands at 32.2%, with MLMM holding a 36.9% market share in this segment and 40.7% in the L5M EV category. Its overall market share in all L5 3W EVs reached 38.2% in August, on a year-to-date basis for FY2026.

Bajaj Auto, whose production was affected by slower supplies of rare earth magnets in July, sold 6,254 e-3Ws in August — up 55% from 4,032 units a year ago, but down 18% from July 2025’s record high of 7,626 units. This performance gives Bajaj a 10% market share for August 2025. The company entered the e-3W market in June 2023 with two models — the RE E-Tec 9.0 passenger EV and Maxima XL Cargo E-Tec 12.0 — which have since been replaced by the GoGo e-3W brand launched in February 2025. With cumulative eight-month sales of 47,398 units, Bajaj has already surpassed its full-year 2024 total of 41,904 units and is set to launch its first e-rickshaw in the coming months.

YC Electric ranked third in August with 3,424 units, down 10% YoY and 6% month-on-month. Its August market share stood at 5%, unchanged from July but lower than the 6% it held a year ago. The company offers five models: Yatri Super, Yatri Deluxe, and Yatri for passenger transport, and E-Loader and Yatri Cart for cargo operations. YC Electric’s cumulative eight-month sales totaled 28,110 units.

In fourth place is recent e-3W entrant TVS Motor Co, which recorded 2,212 units — its highest monthly e-3W sales to date — capturing a 3.50% share of the 63,478 e-3Ws sold in India last month. TVS’ cumulative sales of 10,044 e-3Ws over the past eight months of CY2025 give it a 2% market share of the total 494,300 units sold.

Saera Electric Auto, manufacturer of the Mayuri brand of electric rickshaws, ranked fifth in the Top 25 list with sales of 2,172 units, down 23% YoY (August 2024: 2,807 units). This reduced its market share to 3% from 4% a year ago. Like several other e-rickshaw makers, Saera Auto has been impacted by the growing presence of legacy OEMs in the e-3W industry. Based in Bhiwadi, Rajasthan — an industrial hub — Saera Auto offers nine models and is a leading supplier of e-rickshaw loader variants such as the Mayuri E-Cart Loader. The company also sells its L5 range of electric three-wheelers, developed in collaboration with Telangana-based Keto Motors for passenger and cargo transportation.

Dilli Electric Auto delivered 1,816 e-3Ws in August, down 18% YoY and 5% month-on-month. The Haryana-based company manufactures electric rickshaws under the CityLife brand — a segment now under pressure as legacy players like MLMM, Bajaj Auto, TI Mobility, and now TVS target it with better-built, safer products.

Piaggio Vehicles ranked seventh in the e-3W segment with 1,200 units, down 23% YoY but up 1% from July 2025’s 1,192 units. In July, the company launched two new models under its Apé Electrik range: the Apé E-City Ultra and Apé E-City FX Maxx.

E-3W INDUSTRY HEADED FOR RECORD SALES IN CY2025

E-3W INDUSTRY HEADED FOR RECORD SALES IN CY2025

The electric 3W industry, the second-largest contributor to EV sales in the country after two-wheelers and the segment witnessing the fastest transition from ICE to e-mobility, is poised to achieve its best-ever annual sales this year.

With 494,300 units sold in the first eight months of CY2025 — a 13% YoY increase (January–August 2024: 438,400 units) — the segment has already reached 72% of its record full-year CY2024 volume of 691,302 units. If it maintains the current growth trajectory over the remaining four months, the industry could surpass the 750,000-unit milestone for the first time in a calendar year.

ALSO READ: India beats China again to be world’s largest electric 3W market

RELATED ARTICLES

TVS iQube Rides Past 800,000 Sales, 100,000 Units Sold in 3 Months

Launched in January 2020, the TVS iQube takes six years to hit the 800,000 sales milestone. While the first 300,000 unit...

Thar Roxx Races Past 100,000 Sales In 16 Months

Launched on September 25, 2024, the five-door Thar Roxx has been a huge success and helped propel the Thar brand into Ma...

India’s Top 30 SUVs, MPVs In CY2025 – Hyundai Creta Pips Tata Nexon To Top Spot

Of the 2.95 million utility vehicles sold in CY2025, the Top 30 models accounted for 2.82 million units (95% share). Mar...

By Ajit Dalvi

By Ajit Dalvi

03 Sep 2025

03 Sep 2025

12393 Views

12393 Views