Car and SUV September sales hit record 363,000 units as OEMs look to capture festive demand

With Navratri in the second half of October and Diwali in November, carmakers ramp up dispatches to ensure their showrooms are well stocked with popular models. April-September 2023’s 2 million-plus units are a 6.46% YoY increase and India PV Inc looks well set to clock over 4 million sales this fiscal.

The Indian passenger vehicle industry continues to fire on all cylinders and September 2023 wholesales will, at an estimated 363,000 units, be the best monthly numbers yet, going ahead of August 2023’s 359,648 units.

The big number is due to car and SUV manufacturers ensuring their dealer network across India is well stocked with popular models to cater to demand in the festive season, beginning with Navratri, which begins on October 15 and goes on through to October 24, and is followed by Diwali, the festival of lights, on November 12 this year. The festive season, which began with Onam on August 29, is when India Auto Inc, across segments, banks on stronger demand coming its way and many OEMs offer mouth-watering deals to make the most of the sales momentum.

Given September's record wholesales, cumulative April-September 2023's dispatches at 20,61,996 units are a 6.46% increase over April-September 2022's 19,36,740 units. At half-way stage in the fiscal year, India PV Inc is well set for a record 4-million-plus units for the entire 12-month period.

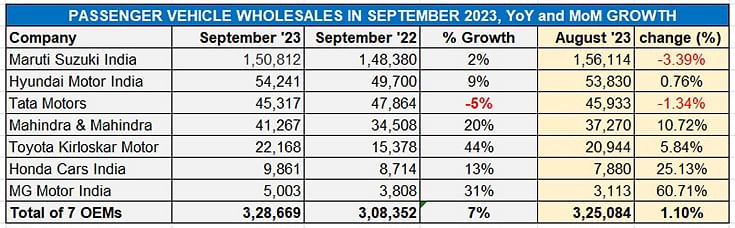

On October 1, seven of the 16 car, SUV and MPV manufacturers in India announced their wholesale numbers for September 2023 – their combined sales of 328,669 units are a 7% improvement over year-ago numbers (see data table above). The remaining 34,301 units will be accounted for by the other 11 carmakers.

September marks the ninth month in a row that PV sales have surpassed the 325,000-unit mark and the third straight month of 350,000-plus sales, a performance which has been powered by sales of the utility vehicle segment which comprises SUVs and MPVs.

With every second car sold in India being a utility vehicle, SUV or an MPV and the rate of growth in this segment far above that of hatchbacks or sedans, the UV sub-segment continues to be the number-driver for nearly all OEMs.

September 2023 also means that six months of the ongoing fiscal year are over and at an estimated 20,60,996 units, YoY growth would be 6.41 percent and also crossing the two-million-units mark. Total sales for the Indian PV industry in FY2023 were 38,90,114 units, up 27% on FY2022’s 30,69,523 units.

Let’s take a closer look at both the September 2023 and first-half FY2024 (April-September 2023) wholesales numbers for the seven OEMs which have released their numbers.

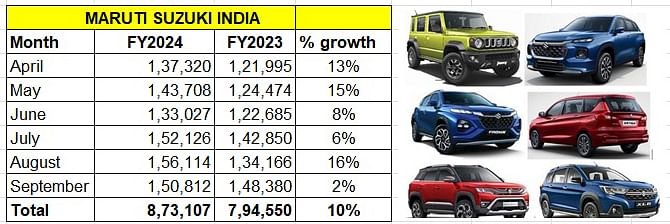

MARUTI SUZUKI INDIA

September 2023: 150,812 units – up 2% YoY, down 3.39% MoM

H1 FY2024: 873,107 units, up 10% YoY

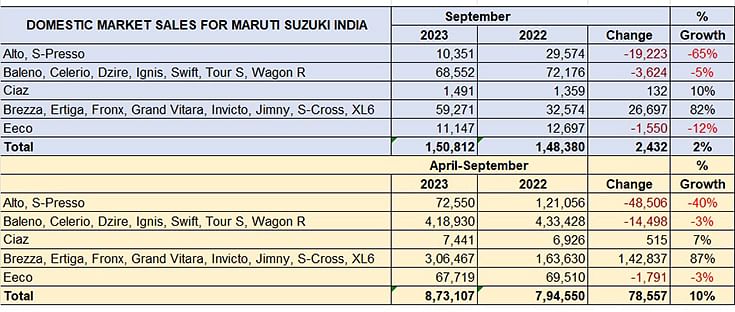

India’s PV market leader is surfing the unabating wave of SUV demand with robust double-digit growth, successfully buffering the slowdown in sales of its budget hatchbacks Alto and S-Presso and its seven compact cars (Baleno, Celerio, Dzire, Ignis, Swift, Tour S, Wagon R).

In September 2023, Maruti Suzuki despatched 150,812 units, up 2% YoY but down 3.39% on August 2023’s 156,114 units. The growth is thanks to its SUV and MPV portfolio of models, particularly the premium Nexa models.

The model-wise sales split, as detailed by Maruti Suzuki, reveals that of its four sub-segments (see data table above), the eight-strong UV portfolio of the Brezza, Ertiga, Fronx, Grand Vitara, Invicto, Jimny, S-Cross and XL6 sold 59,271 units, growing 82% YoY (September 2022: 26,697 units) and accounts for 39% of its total PV sales. A year ago, in September 2022, the UV share in Maruti’s total PV sales was just 22 percent. Powering this growth is the new lot of premium SUVs and MPVs from the Nexa channel.

However, in comparison to the sharp growth in SUVs, demand for the entry-level Alto and S-Presso is down by a massive 65% in September and by 40% in H1 FY2024. Sales of the compact car portfolio (Baleno, Celerio, Dzire, Ignis, Swift, Tour S, Wagon R) are down 5% this September and 3% for the first-half of FY2024.

HYUNDAI MOTOR INDIA

September 2023: 54,241 units – up 9% YoY, up 0.76% MoM

H1 FY2024: 307,075 units, up 8% YoY

The Chennai-based car and SUV Hyundai Motor India despatched 54,241 units in September, up 9% YoY. This constitutes the company’s best-ever monthly sales yet since inception and indicates that it has kept Hyundai dealers well stocked, particularly with the recently launched Exter small SUV which is witnessing robust demand.

For the calendar year to date, the Chennai-based car and SUV OEM has recorded monthly sales of 50,000 units for the sixth time, after January (50,106 units), March (50,600 units), June (50,011 units), July (50,701 units), August (53,830 units) and now in September (54,241).

Cumulative sales for the first six months of FY2024 at 307,075 units are up 8% year on year (April-September 2022: 285,005 units). What has given Hyundai a fresh charge is the July 10 launch of the Exter mini-SUV at an aggressive price of Rs 599,900. Given that it has received over 75,000 bookings for the Exter, the company has ramped up production by 30 percent. It is learnt that with the launch of the Exter, around 64% of Hyundai’s total PV sales emanate from SUVs, which is 10-15% higher than the industry average of 50 percent. The biggest contribution continues to come from the Creta, Hyundai’s best-selling product and India’s best-selling midsize SUV. The Creta surpassed the 900,000-unit sales milestone in July, eight years after launch.

Hyundai Motor India, whose No. 2 ranking had been under pressure from a hard-charging Tata Motors, has successfully protected its turf and has now extended its H1 FY2024 lead to 27,685 units. The company has targeted overall domestic market sales of around 600,000 Exter in CY2022. Achieving this goal will translate into 8.6% year-on-year growth considering Hyundai had recorded its best-ever calendar year sales of 552,511 units in CY2022.

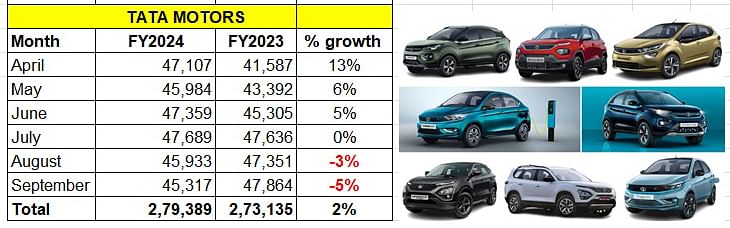

TATA MOTORS

September 2023: 45,317 units – down 5% YoY, down 1.34% MoM

H1 FY2024: 279,389 units, up 2% YoY

Tata Motors’ September 2023 wholesales at 45,317 units, down 5% (September 2022: 47,864) marks the second straight month of a sales decline. Following the flat sales in July (47,689), Tata Motors has reported a sales decline of 3% in August 2023 with 45,933 units.

From the data table below, one can see that the double-digit growth of April has reduced to single digit in May and June, then to nil in July, to -3% in August and -5% in September.

The second quarter of FY2024 has seen the company introduce new CNG (twin-cylinder format) offerings in the form of the Tiago CNG, Tigor CNG and Punch CNG, and on September 14, it launched the facelifted Nexon and the new Nexon.ev.

The Tata Punch CNG, priced between Rs 710,000-Rs 968,000, ex-showroom, is designed to counter the new Hyundai Exter CNG, which costs Rs 824,000 to Rs 897,000 and has drawn over 75,000 bookings. Interestingly, Tata Motors has also introduced a single-pane sunroof on the Punch to make it compete head on with the Exter.

Commenting on the September PV wholesales, Shailesh Chandra, MD, Tata Motors Passenger Vehicles and Tata Passenger Electric Mobility, said: “We had proactively reduced supplies of the

outgoing models this quarter to enable a smooth transition to the new generation models. Going forward, with deliveries commencing of our exciting new generation products, we expect stepped up volumes in this festive season and beyond.”

Tata Motors has, for the past couple of years, recorded strong double-digit gains albeit on a lower year-ago base. It had clocked best-ever fiscal sales of 544,391 units in FY2023, averaging monthly sales of 45,365 units. In the first six months of FY2024, cumulative sales are 279,839 units which translates into monthly average of 46,639 units.

Tata Motors is among the few OEMs with multiple powertrains spanning petrol, diesel, CNG and electric and currently has a seven-model portfolio comprising four SUVs (Nexon, Punch, Harrier, Safari), two hatchbacks (Tiago and Altroz) and one sedan (Tigor).

Meanwhile, on the EV sales front, Tata Motors continues to make solid gains. In September 2023, the carmaker sold 6,050 EVs, up 56% YoY. While its April-September 2023 EV sales add up to 37,961 units, which marks robust 77% YoY growth, total EV sales in the first nine months of CY2023 are 53,921 units, up 75% year on year.

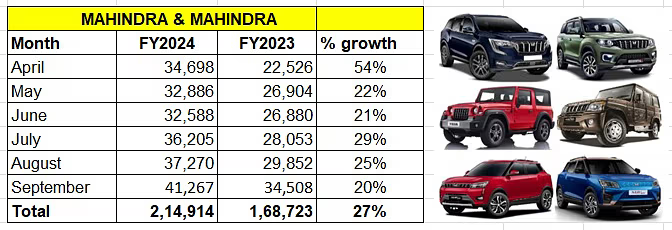

MAHINDRA & MAHINDRA

MAHINDRA & MAHINDRA

September 2023: 41,267 units – up 20% YoY, up 20% MoM

H1 FY2024: 214,914 units, up 27% YoY

Mahindra & Mahindra continue to scale new sales highs each month. The SUV major has notched its highest monthly sales for the third month in a row – after 36,205 units in July 2023, 37,270 units in August and now 41,267 units in September. Last month was also the seventh straight month that M&M sales have surpassed the 32,000-unit mark.

A cursory glance at the wholesales data table below reveals the strong and sustained growth trajectory. The cumulative six-month sales of 214,914 units constitute a robust 27% YoY increase (April-September 2022: 168,723 units). This also means that cumulative H1 FY2024 sales are already 60% of M&M’s record FY2023 sales of 359,253 units.

M&M, which has eight SUVs (Bolero, Bolero Neo, Scorpio, Scorpio N, Scorpio Classic, Thar, XUV300, XUV400 and XUV700) and a sole sedan (eVerito), is among the OEMs riding the surging wave of demand for UVs.

Commenting on September 2023’s sales, Veejay Nakra, President, Automotive Division, M&M, said: “We are excited to achieve our highest ever sale of SUVs for the third consecutive month. In September, we also crossed the 100,000-unit mark for our Bolero Maxx Pik Up trucks, making it the fastest selling pickup in the country to reach that mark. While demand for our key SUV brands continue to be strong, we are keeping a close watch on the availability of semiconductors and select components to meet the strong festive season demand”.

Expect M&M to further up the ante in the coming months as it ramps up production to meet surging demand for most of its models. The company has already expanded its SUV manufacturing capacity from 29,000 units per month to 39,000 units by December 2022 and plans to further increase it to up to 49,000 units in the current financial year or 600,000 units per annum.

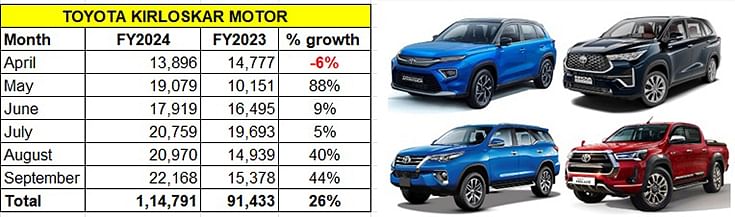

TOYOTA KIRLOSKAR MOTOR

September 2023: 22,168 units – up 44% YoY, up 5.84% MoM

H1 FY2024: 114,791 units, up 26% YoY

Toyota Kirloskar Motor (TKM) has reported sale of 22,168 units in September, up 44% on the year-ago 15,378 units and 5.84% up on August 2023’s 20,970 units.

The Japanese carmaker’s September numbers are its best in the first six months of the fiscal (see data table below) as well as the entire calendar year to date. Cumulative sales in the first six months of FY2024 at 114,791 units are up 26% (April-September 2022: 91,433).

What has energised the monthly numbers is the rollout of new models over the past six months as well as the increased production capacity through three-shift operations to meet growing market demand.

Last month saw Toyota India launch the new luxury Vellfire MPV, priced at Rs 1.20 crore, as well as the Maruti Ertiga-based Rumion MPV priced at Rs 10.29 lakh.

The smart rise in sales is a result of the sustained demand for TKM’s recent models including the Urban Cruiser Hyryder, Innova Hycross, Hilux and the New Rumion, which is the latest addition to the portfolio in the B-MPV segment. TKM states that it “has also maintained its segment leadership with the New Innova Crysta, Fortuner, and Legender models.” Another factor is the brand’s expanding dealer network reach – in the first six months of FY2024, TKM expanded its reach from 577 to 612 touchpoints across the country.

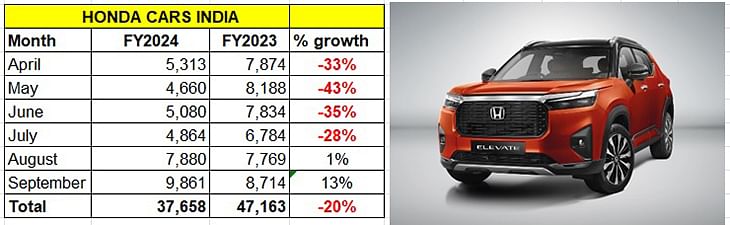

HONDA CARS INDIA

September 2023: 9,861 units – up 13% YoY, up 25.13% MoM

H1 FY2024: 37,658 units, down 20% YoY

Honda Cars India is back in the business of growing numbers and that’s thanks to the recent launch of the Elevate SUV, a segment where the company has been missing out bigtime.

September sales of 9,861 units are its best yet in the ongoing fiscal and a 13% improvement over the year-ago sales (September 2023: 8,714 units) and importantly 25% better than a month ago (August 2023: 7,880). One can pin down the steep MoM increase to the company dispatching a large number of the Honda Elevate SUV to dealers.

Commenting on September sales, Yuichi Murata, Director, Marketing and Sales at Honda Cars India, said: “Honda Cars India is amid an exciting phase with the launch of the all-new Honda Elevate. The new SUV has emerged as a frontrunner and is contributing significantly to the sales momentum during this festive season. The Honda City and Amaze also continue to perform well in their respective segments.”

He added, “The auto industry is experiencing strong demand at the beginning of the festive season. With an extended festive period this year, we expect this momentum to continue, which is very encouraging.”

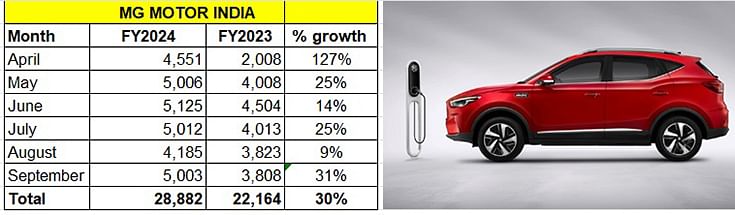

MG MOTOR INDIA

September 2023: 5,003 units – up 31% YoY, up 60.71% MoM

H1 FY2024: 28,882 units, up 30% YoY

MG Motor India has reported retail sales of 5,003 units in September 2023, up 31% on year-ago sales of 3,808 units and 61% up on August 2023’s 4,185 units. For the first six months of FY2024, cumulative sales are 28,882 units, up 30% (April-September 2022: 22,164 units).

MG Motor India has reported retail sales of 5,003 units in September 2023, up 31% on year-ago sales of 3,808 units and 61% up on August 2023’s 4,185 units. For the first six months of FY2024, cumulative sales are 28,882 units, up 30% (April-September 2022: 22,164 units).

As per the company, sales of EVs account for around 25% of its total sales and both the ZS EV with ADAS Level 2 and the recently launched Astor Black Storm have received a positive customer response

INDIA PASSENGER VEHICLE INC DRIVES TOWARDS RECORD 4.15 MILLION SALES IN FY2024

With the wave of surging demand for SUVs continuing to grow, and the two-month festival season having commenced, India PV Inc can be assured of sustained demand in the coming months. With first-half FY2024 sales of over two million units (20,61,996 units) and the current strong momentum, the sector is driving towards over 4 million sales for the entire fiscal. Not only will it surpass FY2023’s record 3.89 million units but it could well set a new benchmark at around 4.15 million units.

What is accelerating sales is recent new product launches and all of them UVs – the facelifted Tata Nexon and Nexon.ev, facelifted Seltos midsize SUV, Maruti Invicto MPV, Hyundai Exter compact SUV, Tata Punch CNG, Toyota Rumion MPV and the Honda Elevate midsize SUV. Each of these UVs have the potential to expand the market as well as eat into rivals’ market share.

What comes as sweet news for India Auto Inc is the improving economy – GDP growth for the first quarter of FY2024 has accelerated to 7.8% from 6.1% in the preceding quarter with rural demand in recovery mode. This should give a fillip to sales in the current quarter albeit growth is expected to moderate subsequently given high inflationary conditions, a below-normal monsoon and high interest rates.

While demand in the entry level hatchback market remains tepid, demand is better in the mid-level and premium hatchback categories. It is expected the coming two months will see numbers improve in these segments as a result of sweetened festive-season deals from OEMs. Consumer demand for CNG-powered PVs had slackened in the first-half of CY2023 albeit that could be due to OEM supply constraints. Demand however has bounced back in the past three months and retail sales of CNG-powered cars and SUVs, at 265,815 units in the January-September 2023 period are up 9% year on year. Meanwhile, the few OEMs, which have electric cars and SUVs, are also seeing demand grow month on month.

India Passenger Vehicle Inc, which currently has an estimated order backlog of over 700,000 units, has ramped up factory production particularly in view of the ongoing festive season. Nearly all carmakers have put the chip crisis behind them and remain confident of significantly improved semiconductor supplies going forward. Clearly, good news for the India PV Inc and the entire automotive ecosystem.

ALSO READ:

CNG vehicle sales rise 32% to 666,000 units in January-September, /

EV sales in H1 FY2024 jump 51% to 738,000 units, fiscal headed for record 1.5 million

RELATED ARTICLES

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

Maruti Wins in Mid-SUV Space with New Models

Maruti Suzuki’s UV1 volumes nearly doubled in four months. The cause is not the GST cut — it is a deliberate product por...

02 Oct 2023

02 Oct 2023

37842 Views

37842 Views

Arunima Pal

Arunima Pal

Shruti Shiraguppi

Shruti Shiraguppi