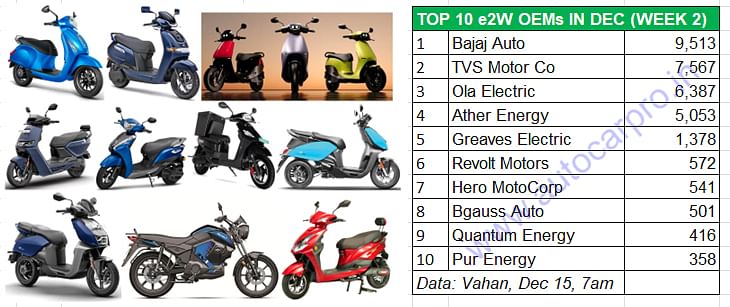

Bajaj Chetak is No. 1 in first-half December, TVS stays ahead of Ola

Bajaj Auto’s electric scooter continues to lead India’s e-two-wheeler market with retail sales of 9,513 units between December 1-14, considerably ahead of the TVS iQube (7,567 units), Ola Electric (6,387 units) and Ather Energy (5,053 units). If it maintains the trend in the last two weeks of December, it will be the first time that the Chetak will be the best-selling EV on two wheels since its launch in January 2020.

The first fortnight of the last month of this year is over. Electric two-wheeler retail sales of 34,770 units between December 1-14, 2024 with two weeks more for CY2025 to dawn are not much to talk of after the 139,973 units in a festival-laden October and November’s 119,314 units. Considering December is usually a month when new vehicle buyers defer purchases to January, it will be good if total e2W retails cross the 85,000-units mark. What’s making the headlines though is the Bajaj Chetak, which continues to top the zero-emission two-wheeler market for the second week in a row.

In terms of market share for the first half of December 2024, Bajaj Auto has 27%, TVS 22%, Ola 18%, Ather 14% and Greaves Electric Mobility 4 percent.

In terms of market share for the first half of December 2024, Bajaj Auto has 27%, TVS 22%, Ola 18%, Ather 14% and Greaves Electric Mobility 4 percent.

As per the latest Vahan data (December 15, 7am), Bajaj Auto’s sole electric scooter, which was the best-selling EV on two wheels in the first week of December with 4,988 units, continues to be the No. 1 e-two-wheeler for the second week in a row. The Chetak has chalked total retail sales of 9,513 units between December 1 and 14, which is 1,946 units ahead of the TVS iQube (7,567 units) and 3,126 units more than Ola Electric’s sales (6,387 units). Fourth-ranked Ather Energy has sold 5,053 units while Greaves Electric Mobility takes fifth position with 1,378 units.

In terms of market share for the first half of December 2024, Bajaj Auto has 27%, TVS has 22%, Ola has 18%, Ather has 14% and Greaves Electric Mobility has 4 percent. These five OEMs combined account for 85%, leaving the balance 15% to 209 other players in this segment of the EV industry.

If the Bajaj Chetak maintains the same growth trend and leadership in the last two weeks of December, this month could see the Chetak become the best-selling electric two-wheeler in India for the first time since its launch in January 2020.

What is surprising is that despite the news that Bajaj Auto is set to unveil the next-gen Chetak on December 20, which usually sees potential buyers defer purchases to the new model, the existing four variants – Chetak 2903, Chetak Blue 3202, Chetak 3201 and Chetak Premium – continue to see strong customer demand, some more than others. Apart from September 2024, when Bajaj Auto sold 19,211 Chetaks to TVS’ 18,243 iQubes, the Pune-based company has through all of CY2024 remained at No. 3 position.

Bajaj Auto, nevertheless, remains No. 3 in terms of cumulative sales this year. This year, till December 14, a total of 184,577 Chetaks have been sold with the best month being October (28,398 units). While Ola Electric remains a yawning distance away with the company being the first Indian EV maker to surpass 400,000 sales in a calendar year (400,099 units), TVS Motor Co (210,666 iQubes) too is ahead of Bajaj on the cumulative 11-and-a-half months’ sales front.

TVS Motor Co, which sold 3,964 iQubes in the first week of this month, maintains its No. 2 position with 7,567 units in the December 1-14 period. This takes TVS’s total sales from January 1 through to December 14 to 210,666 units. The iQube’s best sales month ever since launch in January 2020 has been October 2024 (30,134 units).

Ola Electric is currently ranked No. 3 this month with 6,387 units which has helped the company surpass the 400,000 milestone yesterday, making it the first Indian EV OEM to achieve this big number. In September, Ola became the first Indian EV OEM to surpass 300,000 unit sales in a calendar year.

Ola had opened CY2024 with 32,424 units (up 77%) in January, hit a high of 53,640 units in March (up 150%) and maintained stellar month-on-month growth right from April through to July until the sharp drop in August (27,620 units) and September (24,745 units). It bounced back in October (41,793 units) but sales fell 30% month on month in November (29,222 units). Expect Ola Electric, which launched two new products in November – the S1 Z priced at Rs 59,999 and the S1 Z+ which costs Rs 64,999 – as well as the Ola Gig, a dedicated product for the gig economy, priced at an extremely affordable Rs 39,999, to see a strong 2025. Deliveries of the S1 Z, S1 Z+, Gig and Gig1 are slated to begin only next year, around April-May.

Ather Energy, which has the Rizta, 450S and 450 Apex e-scooters, maintains its No. 4 rank in December Week 2 with 5,053 units. Cumulative retails from January till December first-half are 120,721 units. The Rizta family e-scooter launched in April at a starting price of Rs 109,999 (Rizta S) through to Rs 149,999 (Rizta Z) is witnessing growing demand. While the S version (2.9 kWh battery) has a 123km range, the Z variant (3.7 kWh) has a 160km range. The Rizta’s highlights include the largest two-wheeler seat in India and storage space aplenty.

Greaves Electric Mobility, which is seeing growing traction for its Nexus e-scooter, is ranked fifth with 1,378 units, followed by electric motorcycle maker Revolt Motors (572 units) which has moved up one rank from seventh position in the first week of December. Revolt is seeing strong demand coming its way, particularly after the launch of the RV1 and RV1+ and clocked 2,000 sales (up 197% YoY) in November.

Hero MotoCorp, which launched the new Vida V2 on December 4, is at No. 7 with retails of 541 units.

Bgauss Auto, which was ranked eighth in December Week 1, maintains the same position with 501 units while Quantum Energy, ranked sixth in Week 1, has slipped to No. 9 with 416 units.

The Indian electric two-wheeler industry has had a good year and at 1,109,432 units retailed between January 1 and December 14, it has registered robust 29% YoY growth over CY2023’s 860,417 units, with a fortnight still left to go before CY2024 comes to an end. With each of the Top 5 OEMs – Ola Electric, TVS Motor Co, Bajaj Auto, Ather Energy and Greaves Electric Mobility comfortably surpassing their CY2023 sales, this was only expected. As a result of e2W Inc’s strong contribution, will India EV Inc hit the 2-million sales milestone this year? Stay plugged in firmly as we bring you the latest sales updates from the world of zero-emission mobility.

ALSO READ:

Scooter sales jump 21% in April-November, slower 10% growth for motorcycles

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

15 Dec 2024

15 Dec 2024

28043 Views

28043 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau