Scooter sales jump 21% in April-November, slower 10% growth for motorcycles

Though the scooter share of overall two-wheeler volumes at 34% is far below motorcycles’ 63%, growing demand from urban India as well as for half-a-million electric scooters has helped them register 21% growth compared to the motorcycle segment’s 10%, while the humble moped sees demand increase by 12 percent.

The Indian two-wheeler industry is clipping along at a decent pace in the current fiscal. At 13.93 million motorcycles, scooters and mopeds dispatched to dealers in April-November 2024, two-wheeler OEMS have registered 13.7% year-on-year growth (April-November 2023: 12.25 million units). While motorcycles continue to have the giant share of the sector at 63% and have sold 4 million units more than scooters (2W market share: 34%), their rate of growth in the current fiscal at 10.2% is half that of scooters’ 20.8%. The humble moped, with 358,096 units (2W market share: 3%), has clocked 12.1% YoY growth.

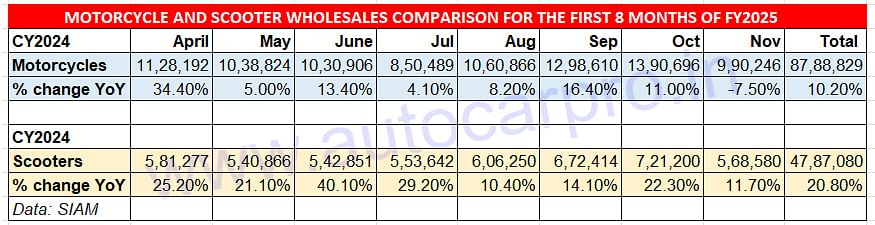

Scooter manufacturers have registered double-digit growth in each of the first eight months of FY2025.

Scooter manufacturers have registered double-digit growth in each of the first eight months of FY2025.

A quick comparison of the month-wise wholesales data for the motorcycle and scooter segments reveals that other than September, where motorcycle sales rose 16.40% versus scooters’ YoY growth of 14.10%, OEM scooter dispatches saw better comparative growth for the other seven months. What’s more, motorcycle wholesales fell below the million-units mark for the first time in seven months to 990,246 units in November, a YoY decline of 7.50 percent. March 2024 (980,100 units) was the last month when sales had fallen below a million units.  SCOOTER WHOLESALES: 47,87,080 UNITS, UP 21%

SCOOTER WHOLESALES: 47,87,080 UNITS, UP 21%

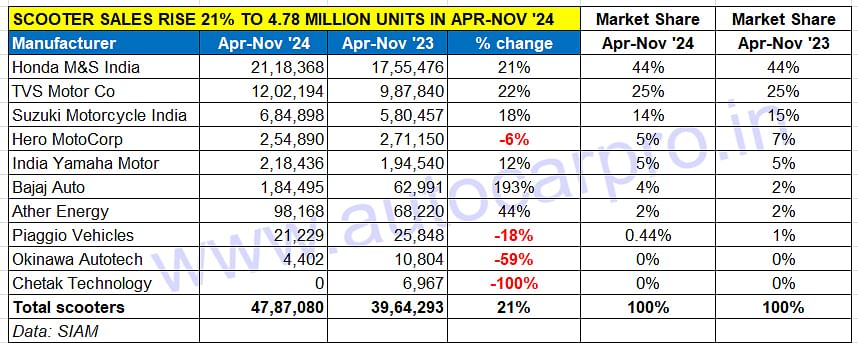

Honda, TVS and Suzuki log strong double-digit growth, Bajaj Auto's scooter share doubles with Chetak EV

Honda Motorcycle & Scooter India (HMSI) remains the ‘Maruti’ of the scooter industry with a massive lead over its competition. The Activa 110 and 125cc scooters reign supreme and with 2.18 million units sold (up 21% YoY) in April-November 2024, HMSI maintains its 44% market share. HMSI, which has announced its entry into the EV market with the Activa-e and QC1, will see additional volumes from this category starting next year.

TVS Motor Co, the longstanding No. 2 player, dispatched 1.20 million scooters, up 22% YoY, which gives it a 25% market share – the same as in the year-ago period. While the Jupiter 110 and 125cc flagship scooters account for the bulk of the sales, the NTorq 125 is the second best-selling model for TVS. The company has sold 177,839 iQube electric scooters, up 34%, which gives it a 15% EV penetration level or share of its total scooter dispatches.

Suzuki Motorcycle India, whose portfolio comprises the popular Access 125, Avenis and Burgman Street models, clocked wholesales of 684,898 units, up 18% for a 14% market share, down 1% year on year.

Hero MotoCorp, which has the 110cc Pleasure and Xoom models, is the sole legacy player to see a sales decline. The 254,890 units are down 6% YoY, which has led to its scooter market share falling to 5% from 7% a year ago. The company’s sales include 37,261 units of the Vida e-scooter, up 188% YoY, which means EV sales accounted for a 15% share of its total scooter sales, similar to TVS.

India Yamaha Motor, which is ranked fourth with 218,436 units (up 12%) maintains the same 5% market share as of April-November 2023.

Bajaj Auto, which is riding a wave of demand for its Chetak e-scooter and is set to launch a new model on December 20, dispatched 167,746 Chetaks in the first eight months of FY2025, up 166% on a year-ago base of 62,991 units, and 16,750 Yulu Version 3.0 e-bikes. The company, which is currently leading the e2W retail market in the first week of December, has doubled its wholesale scooter market share to 4 percent.

Ather Energy, the other electric scooter OEM to see strong growth, saw dispatches of 98,168 units, up 44%, which gives it the same 2% scooter market share it had a year ago.

What has helped accelerate demand for scooters is a combination of growth-driving factors. This includes growing sales in urban India due to rapid urbanisation, greater acceptance by female riders compared to bikes, and electric mobility. The scooter industry’s sales in April-November 2024 include 502,165 electric scooters, which makes for a 10.49% share of total scooter sales.

MOTORCYCLE WHOLESALES: 87,88,829 UNITS, UP 10%

MOTORCYCLE WHOLESALES: 87,88,829 UNITS, UP 10%

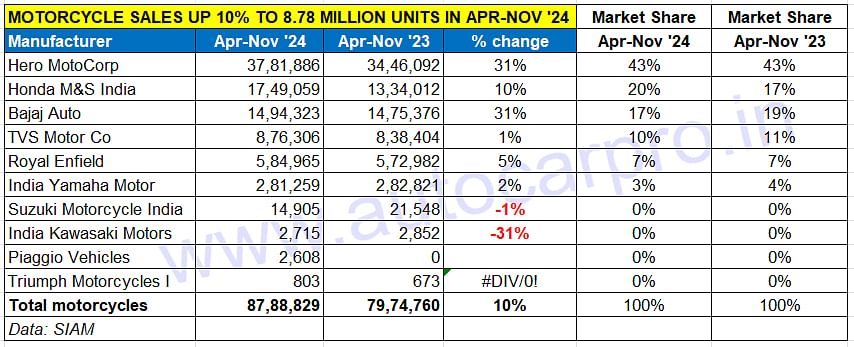

Hero MotoCorp maintains 43% market share, Honda share rises to 20% and is the sole motorcycle OEM to register an increase

The motorcycle segment with dispatches of 8.78 million units registered year-on-year growth of 10%, which is marginally less than the 10.51% YoY growth it had clocked in April-November 2023 (79,74,760 unis vs 72,15,905 units of April-November 2022). After eight months in the current fiscal, the motorcycle segment is 2.86 million units away from surpassing its FY2024 total of 1,16,53,237 or 11.65 million units (up 14% on FY2023).

Growth in the largest volume category of 100-110cc fuel-sipping bike segment has been slow – up 6.5% YoY at 41,44,773 units, which accounts for 52% of the total bike market wholesales. Hero MotoCorp, with 32,07,469 units (up 7.70%), has the giant’s share here – all of 77% – followed by Bajaj Auto (3,82,004 units, down 11% YoY), Honda (3,06,194 units, up 28%) and TVS (2,49,105 units, down 1% YoY).

The 125cc motorcycle segment is the one which is witnessing the strongest growth. At 25,74,475 units, the YoY increase is 17% YoY and accounts for a 32% share of the overall bike market. Honda, with 11,15,077 units and stellar 29% YoY growth, has a 43% share of the 125cc market, up from 39% a year ago. Bajaj Auto is also a strong performer with 6,41,859 units, up 7.40% and a 125cc bike market share of 25% this fiscal – albeit down from the 27% it had a year ago. While Hero MotoCorp, with 5,21,675 units, is up 25% for a market share of 20%, TVS Motor Co dispatched 2,95,863 units of the Raider 125, down 6% YoY for a market share of 11.49 percent.

The 150cc bike segment has clocked dispatches of 4,97,573 units, up 52% YoY (April-November 2023: 327,831 units) and accounts for a 6% share of the overall bike market. Bajaj Auto, with its Pulsar 150 and the new Pulsar NS150, has sold 2,02,404 units – up 16% YoY – and has a 41% share of this segment. Honda has sold 1,76,741 units of the 149cc Unicorn, which gives it a 36% share, and India Yamaha Motor has clocked sales of 1,09,292 FZ and FZ S bikes, down 18% YoY. Hero MotoCorp sold 9,134 units.

TVS Motor is the boss of the 150-200cc segment which has registered wholesales of 8,02,930 units, down 3.71% YoY, and accounts for 10% of the overall motorcycle market. TVS sold 3,08,654 Apaches, up 20% YoY, which gives it a 38% share of this segment. At No. 2 here is India Yamaha Motor with 1,71,788 units, up 15%, followed by Bajaj Auto (1,60,361 units, down 14%). Honda, with 1,22,710 units, is down by 32% YoY, which means both HMSI and Bajaj’s sales declines have dragged down this category’s sales into negative zone in April-November 2024.

The other volume driver is the 250-350cc segment, which saw flat sales or zero growth of 5,57,549 units. Royal Enfield, which dominates this category with its Bullet 350, Classic 350, Hunter 350 and Meteor 350, dispatched a total of 5,25,568 units in April-November 2024, up by just 0.5% YoY (April-November 2023: 535,300 units), to have a segment share of 94 percent. HMSI, with 27,935 units, and TVS Motor Co, with 3,258 units, are the other OEMs in this category.

2W INDUSTRY GROWTH OUTLOOK: CAUTIOUSLY OPTIMISTIC

2W INDUSTRY GROWTH OUTLOOK: CAUTIOUSLY OPTIMISTIC

The wedding season, which drives considerable demand across India, is currently underway and has helped drive two-wheeler demand to some extent. Dealer association FADA is cautiously optimistic about this sector’s growth outlook. Dealer opinion is that while some buyers remain hesitant — either awaiting new-year models or influenced by subdued post-festive sentiment — others could be drawn by potential year-end discounts and stable rural demand. Although momentum may not be robust, incremental schemes and easing inflation could lend mild support.

ALSO READ: Top 20 UVs in April-Nov: Tata Punch and Hyundai Creta separated by 3,630 units

RELATED ARTICLES

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

14 Dec 2024

14 Dec 2024

14395 Views

14395 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi