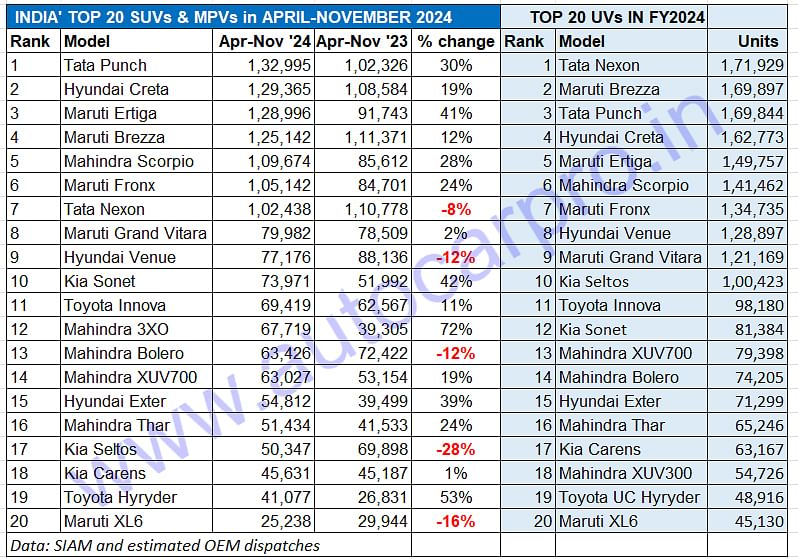

Top 20 UVs in April-Nov: Tata Punch and Hyundai Creta separated by 3,630 units

Of the 1.84 million utility vehicles sold in April-November, these 20 best-selling SUVs and MPVs accounted for 87% of total wholesales. The Tata Punch is currently leading but both the Hyundai Creta and Maruti Ertiga are snapping at its heels. While compact SUVs have a 49% share of these top-sellers, midsize SUVs have a 33% share and four MPVs account for the remaining 17 percent.

The utility vehicle (UV) segment, which comprises SUVs and MPVs, is the most exciting one in the passenger vehicle segment which also includes vans. The UV segment has, for over three years now, been buffering the decline in hatchback and sedan sales. It was the same in November 2024 which saw PV wholesales of 347,522 units (up 4.1% YoY) with the UV segment contributing 231,486 units (up 11% YoY) and accounting for the major 66% share.

The high UV share is the nearly the same for the first eight months of FY2025. As per the latest SIAM industry data, a total of 2.82 million passenger vehicles (up 0.98% YoY) are estimated to have been dispatched to dealers in India in the April-November 2024 period. Of this, UVs accounted for 1.84 million units (18,40,666 UVs, up 12.95% YoY) and constituting a 65% share of overall PV sales.

Of the cars, vans and UV sub-segments, UVs is the most competitive too with every OEM worth its wheel fighting for a share and slice of the action, with the battle for supremacy highest in the compact SUV and midsize SUV categories. These two sub-segments are also where the Top 20 best-selling models reside.

Meanwhile, the UV share of overall PV sales has scaled a new high – 65% vs 58% in April-November 2023. Of the 127 UV models and a mind-boggling 995 variants sold by 32 OEMs (including luxury vehicle manufacturers), the Top 20 best-selling UVs (SUVs and MPVs) for the current fiscal revealed here clearly make a difference in what is a highly competitive marketplace. Let’s take a close look at the movers and shakers and their performance.

INTENSE BATTLE UNDERWAY AT THE TOP

There’s a stiff battle underway at the podium level for UV bragging rights. The Tata Punch (ranked third in FY2024) is currently in the lead with 132,995 units, as it was in H1 FY2025. The Punch, sold in petrol, CNG and electric avatars, has recorded strong 30% YoY growth (April-November 2023: 102,326 units). However, the gap between the Punch and Hyundai Creta – which was 5,404 units in April-September 2024 – has now narrowed down to just 3,630 units.

The Hyundai Creta, which is India’s best-selling midsize SUV and was the fourth best-selling UV in FY2024, is hard on the Punch’s wheels with 1,29,365 units, up 19% YoY. Demand for the Creta has really taken off after the launch of the new-gen model in January this year. What will add tailwinds to the Creta’s sales will be the launch of the Creta EV, which will challenge the Tata Curvv EV and the Mahindra BE 6, in early 2025

Surging customer demand for the Maruti Ertiga (ranked fifth in FY2024) means at 128,996 units (up 41% YoY), means the popular MPV is a whisker away from going past the Creta – just 369 units.

The game-changing Maruti Brezza, which kicked off the compact SUV juggernaut all those many years ago, is No. 4 with 125,142 units, up 12% YoY albeit down on its No. 2 rank in FY2024.

The Mahindra Scorpio, which is currently the best-selling model for the SUV maker in the form of Scorpio N and Scorpio Classic, has moved up one rank from FY2024 to No. 5 with sales of 109,674 units, up 28% YoY.

The Maruti Fronx compact SUV takes No. 6 position with 105,142 units, up 24%, up one rank from No. 7 in FY2024. In September this year, the Fronx became the second Nexa SUV to achieve 200,000 sales, after the Grand Vitara.

The first of the five UVs to see a YoY sales decline is the Tata Nexon. This compact SUV, which has been India’s best-selling SUV for three straight fiscals – FY2024, FY2023 and FY2022 – has dropped all of six ranks to No. 7 position in the April-November 2024 period. At an estimated 102,438 units, the Nexon is down 8% on year-ago dispatches of 110,778 units. The launch of the Nexon CNG in September as well as the Nexon ICE model acing the Bharat NCAP crash test with a 5-star rating were expected to help the Nexon recover market momentum but the move upward the rankings is yet to happen. Sibling Punch has been outselling the Nexon right since January 2024.

Sales growth for the Maruti Grand Vitara, which recently crossed cumulative wholesales of 250,000 units since its launch in September 2022, has been tepid. At 79,982 units sold in the first eight months of FY2025, the YoY increase is only 2 percent. As the No. 8 best-selling UV, the Grand Vitara is one rank above its ninth position in FY2024. There’s a three-row Grand Vitara in the pipeline but it won’t be available till end-2025.

The Hyundai Venue, the Korean manufacturer’s first compact SUV, with 77,176 units, is down 12% YoY and has dropped one rank from FY2024 to ninth position now. Demand has been flagging for the Venue, particularly since sibling Exter rolled in and with the next-gen Venue, which will up the model’s desirability quotient, slated for launch only by end-2025 or early 2026, sales will most likely continue to be tepid in the next 12-odd months.

The Kia Sonet is ranked 10th with 73,971 units, which marks robust growth of 42% YoY. The rollout of a new model has clearly accelerated demand for this compact SUV. The Sonet is now the best-selling Kia model in India.

At No. 11 is the Toyota Innova MPV with its Crysta and Hycross variants – the 69,419 units are up 11% YoY. Demand for the Hycross has been particularly strong this year.

The Mahindra 3XO, the facelifted version of the XUV300, is one of the best performers. The 3XO has jumped to 12th position in April-November 2024 from No. 18 in FY2024 as a result of the 67,719 units sold, up 72% YoY in the current fiscal.

The Mahindra Bolero is the sole SUV from the five Mahindra SUVs in this Top 20 list to see a sales decline. At 63,426 units, demand is down 12% YoY. However, currently ranked No. 13, it is one notch above its FY2024 ranking.

The Mahindra XUV700 flagship SUV continues to witness strong demand, which can also be attributed to the festive season deals M&M had on the popular model. At 63,027 units, sales are up 19% YoY and give it 14th position amongst the Top 20 UVs.

The Hyundai Exter compact SUV maintains the 15th position it had in FY2024 in April-November 2024 with 54,812 units, up 39% YoY.

The Mahindra Thar retains its No. 16 ranking with a strong showing of 51,434 units, up 24%. The recent launch of the five-door Thar Roxx, which won Autocar India’s Car of the Year 2025 award, has given a fresh charge to sales.

No. 17 is the Kia Seltos midsize SUV, having dropped seven ranks from its 10th position in FY2024. At 50,347 units, the Seltos’ wholesales are down by a sizeable 28% YoY and this model has lost its longstanding position as the company’s best-seller to its sibling Sonet, which has outsold it every month since January 2024.

The Kia Carens, the third Kia UV in this list, is at 18th position. Demand seems to have slowed down for this MPV and the 45,631 units are up by a marginal 1% YoY. Nevertheless, with the facelifted Carens, which has been snapped testing and sporting significant design changes, slated for mid-2025 launch, sales should once again take the fast road.

The sporty looking Toyota Urban Cruiser Hyryder midsize SUV, which scores high on fuel efficiency with its strong-hybrid petrol engine, is at No. 19 with a stellar performance – 41,077 units, up 53% YoY. In October, the Hyryder became the second Maruti-rebadged model to surpass the 100,000 sales milestone.

The Maruti XL6 MPV is the fifth model in this list to witness a sales decline: the 25,238 units are down 16% YoY.

COMPACT SUVs SHARE OF UV SALES RISES TO 49%, MIDSIZE SUVs AT 33%, MPVs 17%

The compact SUV segment, which accounted for 909,852 units or 49% of the total 18,40,666 UVs sold in the April-November 2024 period, also lords over the Top 20 best-selling UVs. Starting from the No. 1 model, the Tata Punch, there are all of nine models whose combined wholesales of 802,821 units make up the same ratio – 50% of the total 15,97,011 units these Top 20 models have sold in the first eight months of FY2025.

The midsize SUV segment, starting with the Hyundai Creta, has seven models whose combined wholesales of 524,906 units constitute 33% of the cumulative Top 20 number, up from 33% in April-September 2024. And there are four MPVs – Maruti Ertiga, Toyota Innova Crysta / Hycross, Kia Carens and Maruti XL6 – whose combined sales of 269,284 units give them a 17% share of the Top 20 models.

In terms of OEM model-wise share in these Top 20 UVs in the first eight months of FY2025, Maruti Suzuki and Mahindra & Mahindra have five models each while Korean automakers Hyundai and Kia have three each. Tata Motors and Toyota Kirloskar Motor have two models each.

RELATED ARTICLES

Suzuki Dispatches 703 e-Access Scooters in January, Delivers 201 Units to Customers

Suzuki Motorcycle India’s first electric scooter, priced at Rs 188,000 and among the most expensive two-wheeled EVs, reg...

Honda Sells 5,445 Activa-e and QC1 e-Scooters in 12 Months

Since February 2025, Honda Motorcycle & Scooter India has produced 11,168 e-scooters, dispatched 5,445 units to its deal...

Kia Carens Sells 277,000 Units in Four Years, Clavis And Clavis EVs Power 24% Growth in FY2026

The Carens MPV, which turns four years old today, accounts for a 27% share of Kia India’s sales of 10,43,126 utility veh...

14 Dec 2024

14 Dec 2024

8092 Views

8092 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi