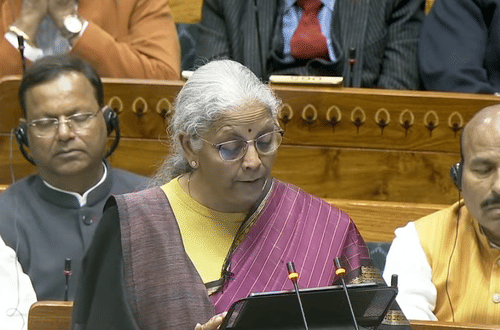

HIGHLIGHTS OF UNION BUDGET 2026-27

Highlights of the Union Budget Speech 2026-27 presented by Union Finance Minister Nirmala Sitharaman

These are the highlights of the Union Budget Speech 2026-27 presented by Union Finance Minister Nirmala Sitharaman in Parliament today:

- To establish a new National Institute of Design to boost design education and development in the Eastern region of India.

- Support will be provided to strengthen domestic manufacturing. Sectors will be identified and facilitation groups comprising senior officials and industry representatives will be constituted for select products and supply chains.

- To set up East Cost industrial corridor with provision of 4,000 ebuses.

- To set up a Centre of Excellence for Artificial Intelligence in Education with an outlay of ₹500 crore.

- To launch Bharat Vistar, a multilingual AI tool that can integrate the agri stack portals with AI systems to enhance farm productivity.

- To issue identity cards and e-Shram registration for gig workers on online platforms, along with health cover under PM Jan Arogya Yojana.

- To set up dedicated ₹10,000 crore SME growth fund. Enterprises to be based on select criteria.

- India must remain deeply integrated with global markets — exporting more and attracting stable long-term investments.

- To establish new dedicated freight corridors connecting Dhanpuri in the East to Surat in the West

- 20 new national waterways to be operationalised over the next 5 years, starting with National Waterway 5 in Odisha to connect mineral-rich areas.

- To set up seven high speed rail corridors between cities--Mumbai to Pune, Pune to Hyderabad, Hyderabad to Bengaluru, Hyderabad to Chennai, Chennai to Bengaluru, Delhi to Varanasi, Varanasi to Siliguri.

- India must remain deeply integrated with global markets — exporting more and attracting stable long-term investments.

- To establish a new National Institute of Design to boost design education and development in the Eastern region of India.

DIRECT TAX PROPOSALS

- Income Tax Act 2025 will come into effect from 1st April 2026.

- Simplified income tax rules and forms will be notified shortly.

- Interest awarded by the motor accident claims tribunal to a natural person will be exempt from income tax.

- To provide safe harbour to non-residents for component warehousing in a bonded warehouse at a profit margin of 2% of the invoice value.

- To provide tax holiday till 2047 to any foreign company that provides cloud services to customers by using data centre services from India.

- Revised returns can now be filed by Mar 31, instead of Dec 31.

INDIRECT TAX PROPOSALS

- To provide basic customs duty exemption to the import of capital goods required for the processing of critical minerals in India.

- To exclude the entire value of biogas while calculating the central excise duty payable on biogas blended CNG.

- To extend duty exemption given to capital goods used for manufacturing lithium ion cells to those used for manufacturing lithium cells for energy storage systems.

- To exempt basic customs duty on import of sodium antimonate for use in manufacture of solar glass.

IN DEPTH COVERAGE

RELATED ARTICLES

HL: Budget Slashes Excise Burden on Bio-CNG Mix

Full excise relief on biogas in CNG promises lower fuel costs, stronger green gas uptake and reduced oil import dependen...

Trucks and CVs may gain the most from Budget 2026–27

Higher infrastructure capex, freight corridors, waterways, mining-led industrial corridors and state-backed bus procure...

Budget 2026‑27: Govt Extends Customs Duty Exemption for Capital Goods Used for Li‑Ion Cell Manufacturing

Budget move to extend duty exemption on capital goods for lithium‑ion cell manufacturing aims to cut costs, spur investm...

By Shruti Shiraguppi

By Shruti Shiraguppi

01 Feb 2026

01 Feb 2026

468 Views

468 Views

Autocar Professional Bureau

Autocar Professional Bureau