Maruti Suzuki opens CY2023 with 14% growth, sales of 147,348 cars in January

This is the company’s second-best monthly performance in the ongoing fiscal year after the 148,380 units in festive September 2022; entry level Alto and S-Presso see revival of demand.

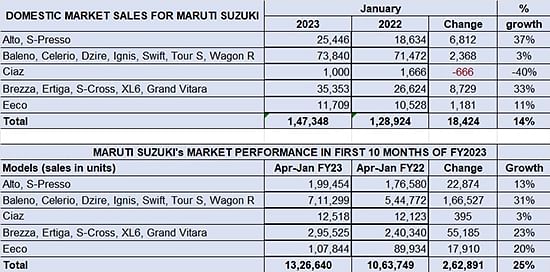

Having closed CY2022 with its lowest monthly sales last year – 112,010 units in December 2022 – Maruti Suzuki India saw its sales recover smartly to 147,348 units in January 2023. This constitutes 14% year-on-year growth (January 2022) and is the second-best monthly performance in the ongoing fiscal year after the 148,380 units in festive September 2022.

What has helped the passenger vehicle market leader is the return of demand for its entry-level cars – the Alto and S-Presso – 25,446 units, up 37%. Following the company’s launch of the CNG variant of the S-Presso in October 2022 and the third-generation Alto K10 in November, both models are seeing increased customer interest.

Maruti Suzuki’s six-pack comprising the Baleno, Celerio, Dzire (and Tour S), Ignis, Swift and Wagon R sold a total of 73,840 units, up 3% (January 2022: 71,472) while the premium Ciaz sedan continued to fall – 1,000 units, down 40% (January 2022: 1,666)

The UVs – new Brezza, Ertiga, XL6 and the new Grand Vitara – contributed 35,353 units, up 33% on year-ago 26,624 units. Maruti Suzuki is witnessing strong demand for the new Grand Vitara (which now also has a CNG variant) and the new Brezza. The Eeco van with 11,709 units cl growth: 10,581 units, up 15% on year-ago wholesales of 9,165 units.

On the cumulative 10-month (April 2022 to January 2023), Maruti Suzuki has clocked 25% YoY growth with all vehicle categories other than the Ciaz recording strong double-digit growth.

It is understood that the company currently has an order backlog of around 350,000 PVs. Over the past couple of months, production was constrained intermittently by inadequate chip supplies. Given the stiff competition, particularly in the UV market, it will have to speedy rollout of vehicles if it is to capitalise on market demand.

Hyundai Motor India surpasses 50,000 sales for the second time this fiscal in January

Tata Motors achieves best-ever monthly sales in January: 47,987 units

Kia India records best-ever monthly sales of 28,634 units in January

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

01 Feb 2023

01 Feb 2023

5179 Views

5179 Views

Autocar Professional Bureau

Autocar Professional Bureau