South India Is No. 1 Buyer of Electric 2-Wheelers in CY2025 With 34% Share

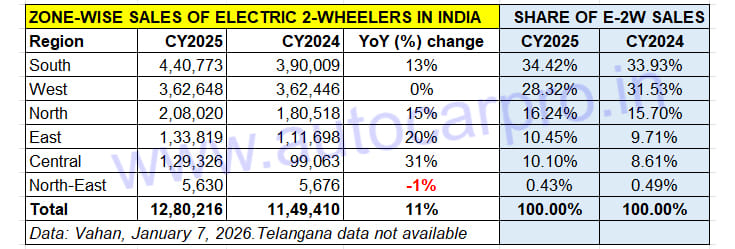

With 440,773 units and a 34% share of all-India sales, the Southern zone had the highest number of electric two-wheeler buyers in CY2025. While the Western zone saw flat sales and a drop in its market share, the North, East and Central India zones registered double-digit growth.

With intense competition in Indian electric two-wheeler market, which has nearly 270 players and is the largest volume sub-segment, it is always interesting to know the regions which are displaying the highest number of sales, the ones which have potential and those who are laggards.

Of the total 22,70,425 electric vehicles (EVs) sold in India across the four zero-emission vehicle sub-segments in CY2025 (up 16% YoY), electric scooters, motorcycles and mopeds accounted for nearly 1.28 million units (up 11% YoY) or 56 percent.

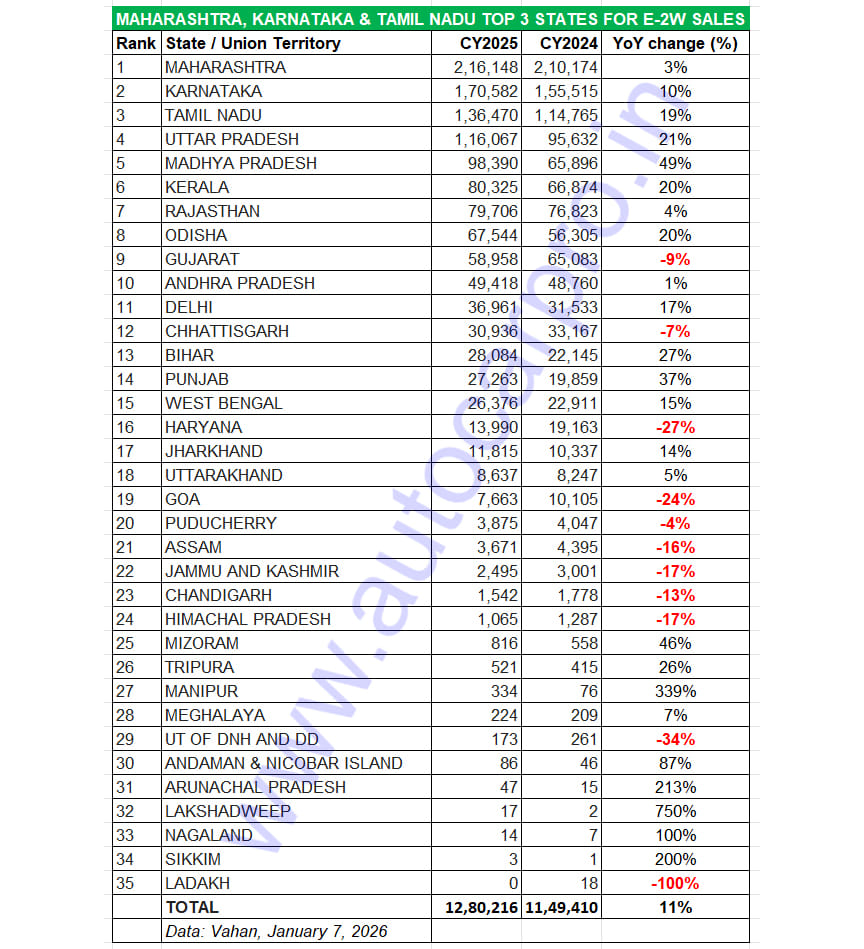

Maharashtra, Karnataka and Tamil Nadu continue to be the top three states in terms of annual sales of e-2Ws, the most affordable sub-segment of the EV industry. Of the record 12,80,216 e-2Ws sold in CY2025 (up 11% YoY), this trio accounted for 523,200 units or a 41% share.

Maharashtra, the overall No. 2 state for EV sales, accounted for 216,148 e-2Ws, up 3% YoY (CY2024: 210,174 units). This constitutes a 17% share of all-India e-2W sales and 81% of its total EV retails (266,524 EVs). The Pune-based Bajaj Auto and its Chetak e-scooter had a stellar year and closed CY2025 with best-ever sales of 269,899 units. Expect a good number of Chetak sales to be in Maharashtra.

Karnataka, which is home to smart e-scooter OEM Ather Energy, is the No. 2 state with 170,582 units, up 10% (CY2024: 114,765 units) and a 13% share. Third on the all-India e-2W podium is Tamil Nadu with 136,470 units, up 19% (CY2024: 114,765 units) which is home to the manufacturing plants of market leader TVS Motor Co, Ola Electric and Greaves Electric Mobility.

In CY2025, the South Zone with 440,773 units and 13% YoY growth, increased its lead over the West Zone which saw flat sales of 362,648 units.

SOUTH-SIDE GROWTH STORY GETS STRONGER IN CY2025

A deep dive into zone-wise retail sales statistics has many interesting takeaways. As it did in CY2024, the Southern India zone accounted for the bulk of e-2W sales in India albeit with a key difference. At 440,773 units, the YoY growth was 13% (CY2024: 390,009 units). This gives it a 34.42% share of all-India e-2W sales, marginally higher than 34% a year ago.

Karnataka (170,582 units, up 10%), Tamil Nadu (136,470 units, up 19%), Kerala (80,325 units, up 20%) and Andhra Pradesh (49,418 units, up 1%) were the top performers. Puducherry (3,875 units, down 4%) saw a YoY decline.

Importantly, Southern India has increased its lead over the Western India zone substantially in the past year. In CY2025, the lead was 78,125 units as compared to 27,563 units in CY2024, reflecting the speedier rate of growth over the second-ranked zone in terms of sales volume.

The Western India zone (Maharashtra, Gujarat, Goa and the UT of Dadra Nagar Haveli and Daman and Diu) registered total sales of 362,648 units, which makes for flat sales (CY2024: 362,446 units). This translates into an addition of only 202 units YoY, seen in the region’s share of all-India e-2W sales dropping to 28% from 31.53% in CY2024.

Other than Maharashtra (216,148 units, up 3%) and Rajasthan (79,706 units, up 4%), the other two states and one UT have posted declines: Gujarat (58,958 units, down 9%), Goa (7,663 units, down 24%) and UT of DNH and DD (173 units, down 34%).

The North Zone has surpassed annual e-2W sales of 200,000 units for the first time. The 208,020 units are a strong 15% YoY increase (CY2024: 180,518 units) and give the region a 16.24% share of all-India e-2W sales, up from the 15.70% a year ago. This is the result of robust sales in Uttar Pradesh (116,067 units, up 21%) which tops the chart, followed by Delhi (36,961 units, up 17%), Punjab (27,263 units, up 37%) and Haryana (13,990 units, down 27%). Uttarakhand is ranked fifth here with 8,637 units, up 5 percent. Sales in the other regions were down YoY – Jammu & Kashmir (2,495 units, down 17%), Chandigarh (1,542 units, down 13%) and Himachal Pradesh (1,065 units, down 17%).

The Eastern Zone also witnessed strong growth with 133,819 units, up 20% YoY (CY2024: 111,698 units). Odisha (67,544 units, up 20%) leads the charge, followed by Bihar (28,084 units, up 27%), West Bengal (27,376 units, up 15%) and Jharkhand (11,815 units, up 14%).

Electric 2W buyers in Central India took delivery of 129,326 units in CY2025, up 31% YoY. This total comprises Madhya Pradesh (98,390 units, up 49%) and Chhattisgarh (30,936 units, down 7%).

In the North Eastern Region which comprises eight states – Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim and Tripura – 5,630 e-2Ws were sold in CY2025, down 1% YoY (CY2024: 5,676 units).

The stiff competition for market share amongst the e-2W manufacturers, particularly the Top 3 – TVS Motor Co, Bajaj Auto and Ather Energy – in CY2025 will only intensify in CY2026. TVS, whose iQube was the best-selling e-scooter in India last year, has recently launched the Orbiter and will be looking to capture sales. While Bajaj Auto is set to launch a new Chetak model on January 14, Ather Energy will debut its first e-scooter built on its new ‘affordable model’ EL platform in the festive season.

With GST 2.0 reducing the price of most IC-engined two-wheelers, the price differential between them and -2Ws has increased. Reason why this year will see a good number of e-2W OEMs launch affordable models and variants and why companies will be scouting hard for new e-2W buyers in existing markets as well as potential growth regions. This state- and UT-wise e-2W sales performance data offers clues aplenty as to just where the consumer demand is currently emanating from as well as the regions which have potential to grow rapidly.

RELATED ARTICLES

Hero, Honda, TVS, Bajaj and Royal Enfield Target India’s Nascent Electric Motorcycle Market

Even as scooters dominate the electric 2W market, legacy ICE motorcycle OEMs are already pushing the innovation and R&D ...

Which is Cheaper over 14 Years of Use: Maruti Suzuki e Vitara or Victoris?

Maruti Suzuki's first EV has arrived, promising low running costs and a clever Battery-as-a-Service plan. But how does t...

Bajaj Chetak Retail Sales Cross 600,000 Units, 227,000 In Last 10 Months

Since the launch of the zero-emission Chetak six years ago, Bajaj Auto has delivered 602,673 units to customers in India...

By Ajit Dalvi

By Ajit Dalvi

09 Jan 2026

09 Jan 2026

3681 Views

3681 Views

Arunima Pal

Arunima Pal