CRISIL ANALYSIS: Gst Cuts, Higher Crop Price, Good Rains Boost Tractor Prospects

Measures such as higher rabi MSPs and increased crop procurement have improved farmers’ cash flows, while the GST cut on tractors to 5% has nudged demand toward higher-horsepower models.

The Indian tractor industry has exhibited a remarkable growth trend in recent years, underscoring the pivotal role of the agricultural industry in India's economic landscape. The Indian tractor industry, which is one of the largest in the world, has been a key driver of the country's agricultural growth, providing employment opportunities and contributing meaningfully to the nation's GDP.

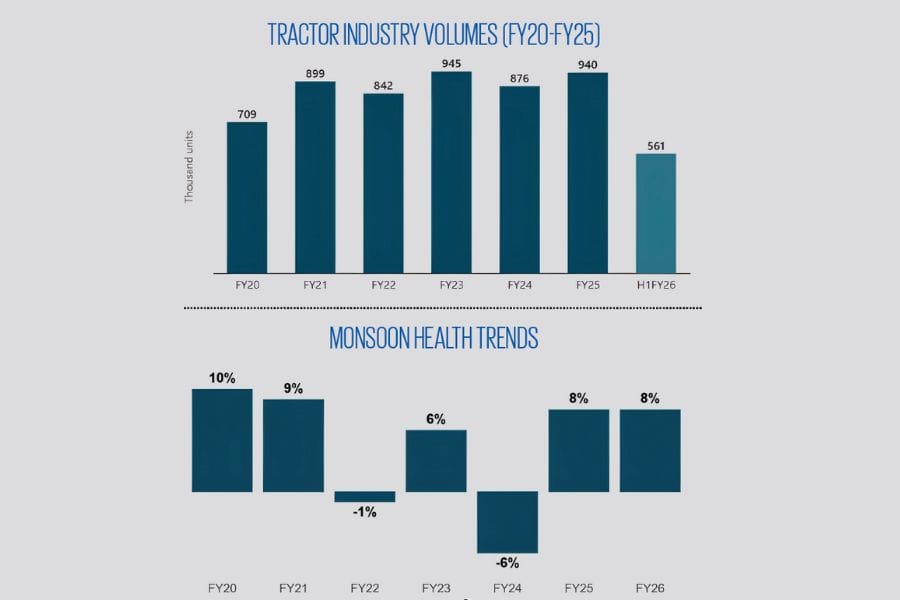

Domestic tractor demand in India witnessed fluctuations over fiscals 2022-2024. After a robust 26.8% growth in fiscal 2021, demand declined by 6.3% in fiscal 2022 due to price hikes by OEMs, high inventories, low commercial demand, and weak farmer sentiment driven by the lingering impact of Covid-19 pandemic leading to rising cultivation costs and reduced fertilizer availability.

In fiscal 2023, the sector rebounded with a 12.2% growth, reaching a record ~945,000 units, supported by favourable monsoon, healthy crop prices, higher MSPs, and strong festival demand; though growth in eastern states was constrained due to restrictions on illegal sand mining. However, in fiscal 2024, sales again contracted by 7.4% to ~875,724 units amid erratic monsoons, low reservoir levels, uneven rainfall, and subdued farmer sentiment, leading to weaker festive and retail demand, particularly due to reduced rabi acreage and low water availability.

The overall tractor industry registered a CAGR of 5.8% between FY2020 and FY2025. In fiscal 2025, with an above normal monsoon season aiding farmer sentiments, domestic tractor sales grew by 7.3% onyear reaching 939,713 units. An estimated 8% on-year increase in volumes up for replacement has supported growth in the fiscal. Favourable rainfall boosted kharif crop output, with higher reservoir levels aiding rabi crop profitability to further support the sales.

Government measures, including increased crop procurement and higher minimum support prices (MSP) for the rabi season, have boosted farmers’ cash flow thereby leading to healthy retail momentum. In first half of fiscal 2026 tractor industry registered a growth of 18.8% compared to last year during the same period, majorly driven by above-average monsoon season, with rainfall at 8% above normal which has bolstered agricultural conditions and, in turn, tractor sales.

The recent reduction in GST rates on tractors from 12% to 5% implemented from. 22nd September, coupled with festive demand and ongoing government financing schemes, has further stimulated tractor demand.

Monsoon Metronome

The south-west monsoon (Jun-Sep) and to some extent the north-east monsoon (Oct-Dec) are critical to the Indian agriculture sector as the overall yields is dependent on the rains. A poor monsoon with uneven geographical spread and an unseasonal rainfall can severely impact the farm output, impacting the farmers’ income and denting the rural economy.

This, in turn, affects tractor demand. Monsoon, therefore, is the biggest factor impacting the tractor industry. In fiscal 2021, 9% above normal monsoon and positive retail sentiments contributed towards a substantial 27% on-year increase in tractor sales. In fiscals 2022 and 2023, monsoon had been normal, thereby contributing towards higher tractor sales, although in fiscal 2023 unseasonal rainfall in March damaged rabi crop to some extent impacting the farmer income and overall crop production.

In fiscal 2024, south-west monsoon was delayed in many states and was below normal with long term departure of -6% impacting the outlook for kharif and overall drop in the rabi crop acreage and profitability as reservoir levels were down. In fiscal 2025, an above normal monsoon season with 8% long term departure aided farmer sentiments.

Favourable rainfall boosted kharif crop output, with higher reservoir levels which aided rabi crop profitability further supporting the sales. In fiscal 2026, country has witnessed above normal monsoon with 8% long term departure leading to positive outlook for Kharif season and in turn boosting the reservoir storage levels at 91% as of 23rd October 2025 thus leading to positive outlook for Rabi season as well.

Taxation’s Tailwind: GST Rationalization and its Pricing Dividend

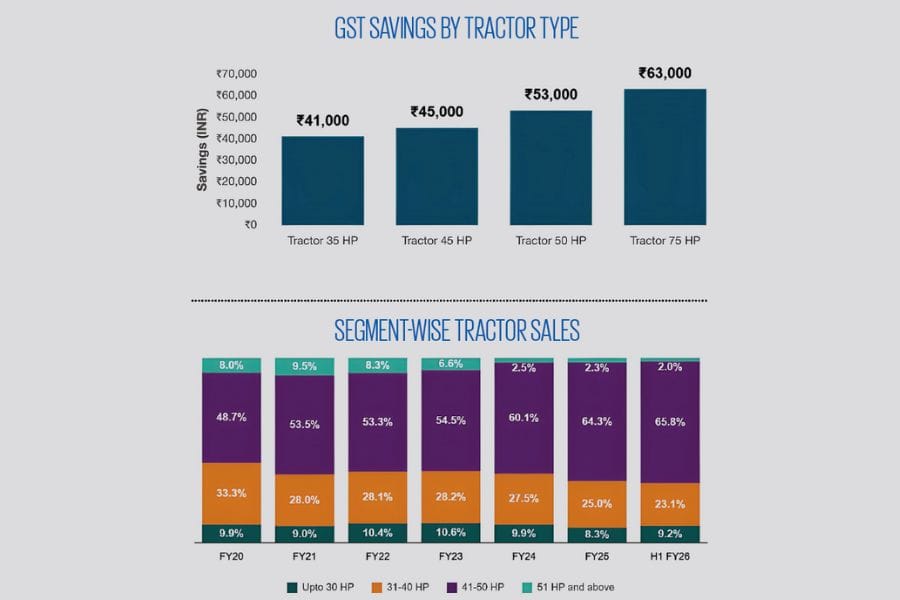

The Indian government’s recent decision to reduce the Goods and Services Tax (GST) on tractors and agricultural equipment to 5% has provided significant relief to farmers across the country. This measure aims to enhance affordability of tractors and essential farm machinery, thereby stimulating growth in the agricultural sector while easing the financial burden on farmers.

Previously, tractors and related spare parts attracted GST rates ranging between 12% and 18%, making them costly, particularly for small and marginal farmers. The revised rate has resulted in a substantial reduction in tractor prices across India, especially for models with engine capacities below 1800 cc. The lower GST rate will also help enable existing owners to save on spare parts, tyres, tubes, hydraulic pumps, and other critical implements.

India is already witnessing strong momentum in the tractor market, with tractor sales recording a 45% year-on-year growth in September 2025 after the introduction of new GST rates from 22nd September. The reduction in GST is anticipated to further bolster demand in the coming months as lower prices are likely to encourage more farmers to invest in new tractors and modern agricultural equipment.

This reduction in GST rates is further being supported by the festive season, thus September-October-November (SON) period is expected to register record sales, potentially marking one of the strongest festive seasons for the tractor industry in recent years.

Horsepower Horizon: Shifting Segment Preferences Amidst Regulatory Tides

Since fiscal 2021, a structural shift towards higher HP tractors was observed mainly due to increased usage of implements which require higher HP tractors to operate, with increased affordability of farmers on the back of government support and lack of any other investment opportunities amid pandemic.

Tractors in the sub-20 HP category target specific applications such as orchard farming and inter-cultivation. However, owing to economic and functional considerations, these tractors also popular among farmers with 0.8-2.0 hectares of land. With application of TREM IV emission norms in 2023, the price of more than 51 HP tractors has gone up by INR 1-1. lacs thereby dampening demand.

Thus, the share of >51 HP tractors had gone down to 2.4% in fiscal 2024 while the average for last 20 years has been 8% and then further slipping to 2.3% in FY25 on account of the further price increase. The share of 51 HP and above tractors has also declined over last few years as they are less amenable to multi-purpose applications, unlike the 41-50 HP tractors.

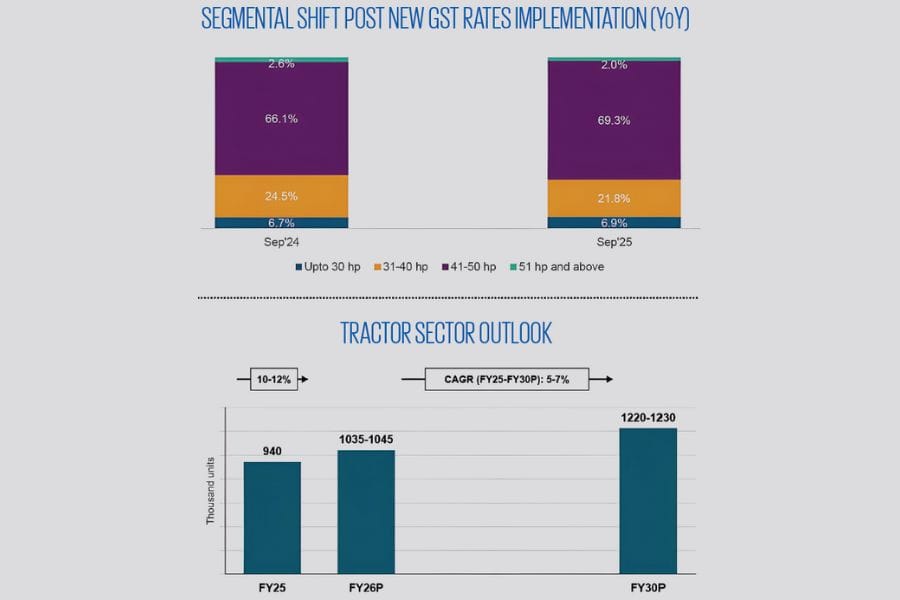

Therefore, in FY25 the share of 41-50 HP segment rose to ~64%. This has also been supported by rising demand for tractor mounted farm equipment, causing demand to shift from smaller HP tractors to 41-50 HP segment. After the introduction of new GST rates there has been a visible increase in the share of tractors in the 41-50 HP segment, rising from 66.1% in September 2024 to 69.3% in September 2025.

This shift indicates a growing preference among farmers for higher HP tractors, which offer a balance between power, efficiency, usability and affordability. The reduction of GST on tractors and agricultural equipment to 5% has played a crucial role in this trend, making higher capacity models more accessible to farmers who previously opted for lower horsepower variants due to cost constraints.

Conversely, the 31-40 HP segment witnessed a decline in its market share from 24.5% to 21.8% during the same time period, while the up to 30 HP and 51 HP and above categories remained relatively stable, showing only marginal changes. This suggests that farmers are upgrading from lower HP models to the more versatile 41-50 HP range, driven by the affordability benefits arising from the revised GST structure.

The increased demand for this segment reflects not only improved purchasing power among farmers but also a broader shift towards mechanization and productivity enhancement in agriculture. Overall, the reduction in GST has successfully spurred movement toward higher HP tractors, which are better suited for diversified agricultural and commercial applications.

CRISIL’s Long-Term View on Tractor Industry

At the start of fiscal year 2026, CRISIL Intelligence projected tractor demand to grow by 5-7% on-year in fiscal 2026, assuming a normal monsoon season and stable agricultural conditions. The forecast has been revised to 10–12% growth on‑year in fiscal 2026, driven by above‑normal monsoon and reduced GST rates.

This growth is also expected to be supported by an increase in farmers’ disposable income, resulting from a strong rabi harvest, higher Minimum Support Prices (MSPs), and an anticipated rise in government crop procurement. Favourable rural liquidity, aided by timely payments to farmers and improved credit availability, is also expected to support tractor sales.

Additionally, sustained investment in rural infrastructure and mechanization trends is expected to provide further momentum to tractor demand. Thus, CRISIL Intelligence projects domestic tractor sales to expand at 5-7% CAGR during fiscals 2025 to 2030, after factoring in one to two years of erratic monsoon during the period.

Updates on the implementation of the TREM V emission norms, set to take effect in the coming months, are being closely monitored, with the regulations expected to further support industry growth in fiscal 2026. These regulations along with reduction in GST rates could influence buying patterns, potentially leading to pre-buying ahead of the deadline as farmers and dealers look to purchase tractors before price increases.

Hemal Thakkar is Senior Practice Leader and Director, and Arpita Mathur is Associate Director, Mobility, Crisil Intelligence.

RELATED ARTICLES

Hero, Honda, TVS, Bajaj and Royal Enfield Target India’s Nascent Electric Motorcycle Market

Even as scooters dominate the electric 2W market, legacy ICE motorcycle OEMs are already pushing the innovation and R&D ...

Which is Cheaper over 14 Years of Use: Maruti Suzuki e Vitara or Victoris?

Maruti Suzuki's first EV has arrived, promising low running costs and a clever Battery-as-a-Service plan. But how does t...

Bajaj Chetak Retail Sales Cross 600,000 Units, 227,000 In Last 10 Months

Since the launch of the zero-emission Chetak six years ago, Bajaj Auto has delivered 602,673 units to customers in India...

09 Jan 2026

09 Jan 2026

2145 Views

2145 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal