CNG price hits Rs 80 a kg, up by 62% in 18 months

With the narrowing of the price differential between CNG and petrol-diesel, the rationale of much-cheaper cost of ownership is now seriously coming under threat. Is it advantage EVs then?

As July 12 turned into July 13, the CNG-using motorist of both personal and commercial vehicles has just been dealt another wallet-busting blow. The price of the eco-friendly fuel has been hiked by Rs 4 per kg in Mumbai, the 10th price increase over 18 months. Since February 2021, CNG price has risen by 62% – from Rs 49.40 per kg to Rs 80 per kg today (July 13). This even as petrol and diesel prices saw a reduction from the Central government earlier this year.

Billed as an eco-friendly and cheaper alternative to fossil fuels, CNG is now Rs 31.35 cheaper than a petrol litre (Rs 111.35) and Rs 17.28 cheaper than a diesel litre (Rs 97.28) in Mumbai.

In a statement regarding the latest price hike, Mahanagar Gas said: “In order to meet the shortfall in domestic gas allocation, MGL is sourcing additional market priced natural gas to cater to the increasing requirement of CNG and Domestic PNG segments. Further, there is rise in domestic gas price as well as increase in foreign exchange rate which are also impacting MGL's input gas cost. This combination has resulted in a significant increase in the cost of gas being procured by MGL.”

Will continuing price hikes impact CNG vehicle demand?

With the narrowing of the price differential between CNG and costly petrol-diesel, the raison d’etre of what was the much-cheaper cost of ownership of a CNG vehicle is now seriously coming under focus. The continuous price hikes could even be seen to be driving some CNG vehicle buyers to electric vehicles, which while have a higher initial price are very economical and wallet-friendly.

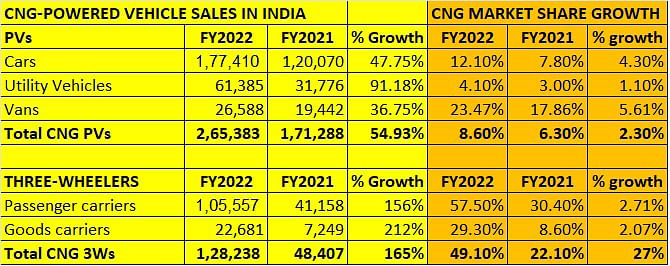

The smart year-on-year uptick in demand for CNG vehicles across the passenger vehicle and three-wheeler segments has been amply seen in FY2022 (see data table below). The PV segment, where car owners are looking to get maximum mileage for their money, saw CNG-powered sales clock near-55% YoY growth with sales of 265,383 units, which comprises 8.64% of the total PV sales of 3,069,499 units vs 6.30% in FY2021.

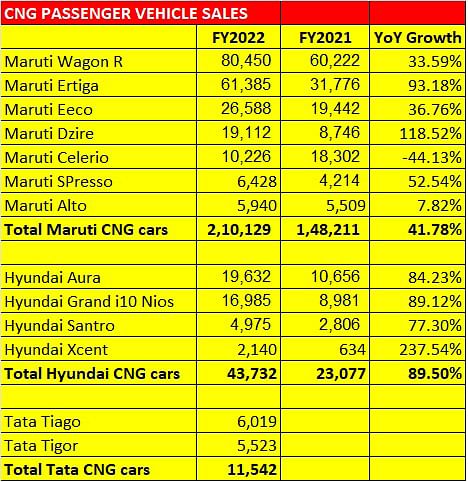

Maruti Suzuki India, which has the first-mover advantage in the CNG arena, and Hyundai Motor India are reaping dividends from their CNG portfolio. Maruti, whose departure from diesel has been filled by handsome demand for its CNG offerings – Alto, S-Presso, Wagon R, Celerio, Dzire, Ertiga, Eeco, Super Carry and Tour-S – has cumulatively crossed a million CNG vehicle sales. The company is also considering offering a CNG option for its Nexa range, which could mean a CNG option for its Baleno, Ciaz and other premium models. Interestingly, a survey conducted by the company has indicated that offering a CNG option does not impact the aspirational quotient of the cars sold under Nexa.

Of Maruti’s current order backlog of 305,000 units, CNG variants account for 39% or around 125,000 units. Earlier this year, Shashank Srivastava, senior ED, Marketing & Sales, MSIL, told Autocar Professional: “CNG is doing very good numbers for MSIL, and almost 17% of our portfolio’s sales are being contributed by CNG variants. In the models, where we have a CNG option, the contribution is about 33 percent.”

Hyundai and Tata Motors have also recognised the potential of CNG sales and are offering CNG cars in higher-spec variants such as the Hyundai Grand i10 Nios, Aura, and Tata Tiago and Tigor respectively.

Speaking to Autocar Professional, Tarun Garg, Director – Sales & Marketing, Hyundai Motor India, said: “The demand for CNG vehicles is still good with its higher fuel efficiency compared to petrol. Last year, our monthly CNG average sale in H1 CY2021 was 3,000 units; we have already crossed the 5,000-unit mark in H1 CY2022. We are targeting 6,000 CNG units in the coming months.”

He added, “While a decline in CNG sales would give an impetus to petrol and diesel options, keeping the customer within the Hyundai portfolio, but from a customer perspective, a rise in CNG fuel prices always brings in challenges and this is something we really need to watch out for.”

Apex industry body SIAM too has voiced its concern about high CNG prices. On July 13, Rajesh Menon, Director General, SIAM said, “Recently the government has taken significant measures to ease the inflationary pressure and help the common man by reducing central excise duty on petrol and diesel and changing the duty structure to moderate prices of steel and plastic. The Indian automobile industry appreciates and thanks the government for these efforts. Industry also keenly looks forward to similar support on CNG prices which have seen exponential increase in the last 7 months. Support on CNG prices would help the common man, facilitate public transport and will enable a cleaner environment.”

Sustained growth for CNG commercial vehicles

Like their PV brethren, demand is up for CNG-powered CVs, particularly three-wheelers. FY2022 saw 128,238 CNG three-wheelers being sold, marking 165% YoY growth Importantly, the share of CNG three-wheelers has grown three-fold across the fuel mix of petrol, diesel, LPG and electric – to 49.10% from 22.10% in FY2021. While demand for petrol 3Ws has dropped to 3% from 5.4%, that for diesel has slid to 28% from 60% two years ago. In contrast, demand for LPG 3Ws has grown to 11% and that for electrics has more than doubled to 8.8% from 3.1 percent.

What has drawn car and small CV buyers to CNG are that the running costs are significantly lower compared to either of the fossil fuels as a vehicle inherently gives better fuel economy when driven on CNG.

A few challenges remain though – refuelling takes longer due to a fewer number of CNG stations and highway driving requires additional planning in terms of trying to take a route with a CNG station. Also, servicing costs of CNG-powered cars are higher compared to petrol siblings with the CNG filter requiring scheduled replacement in factory-fitted CNG kits. Nonetheless, car buyers as well as CNG CV users, who have heavy day-to-day, usage are finding that it makes wallet sense in choosing the CNG fuel option. But, if the price hikes continue, that CNG advantage will be lost. The CNG industry’s loss could be the EV industry’s gain.

(With inputs from Mayank Dhingra)

Also read

EV sales in India cross 210,000 units in Q1, charge towards new record in FY2023

SIAM lauds government move to open 166 CNG stations in 14 states

EVs account for 3.6% of two-wheeler sales in India in H1 2022

RELATED ARTICLES

Bajaj Auto Sells More Electric 3Ws Than Mahindra in January 2026, TVS in Third Place

With 8,510 units, Bajaj Auto, which entered the e-3W market in June 2023, has outsold market leader Mahindra Last Mile M...

Kia Seltos Sells 600,000 Units in India, Second-Gen Model off to a Good Start

Kia’s first made-in-India SUV, which shook up the midsize SUV segment after launch in August 2019, registers new sales m...

Tata Motors Well Set to Sell 600,000 Cars and SUVs, 100,000 EVs in FY2026

Bolstered by its highest monthly sales of 70,222 units in January, Tata Motors with 10-month dispatches of 502,866 passe...

13 Jul 2022

13 Jul 2022

36825 Views

36825 Views

Ajit Dalvi

Ajit Dalvi