UV sales cross a million units in first 7 months of FY2023, Tata and M&M shine

Utility vehicle sales have surpassed a million units in a fiscal for the third time but in the shortest period. Compared to 12 months in FY2021 and nine in FY2022, the big number has come up in a scant seven months with Tata Motors and Mahindra making the maximum gains.

Sales of utility vehicles (UVs) in India have driven past the million-units mark once again, but with a difference. The million UVs sales milestone was first crossed in FY2021 when a total of 10,60,750 units were sold in FY2021. FY2022 numbers went up 40% to record 1,489,178 units in FY2022. The difference is that the latest million units have come up in just seven months (April-October 2022) compared to the nine months it took in FY2022 and 12 months in all of FY2021.

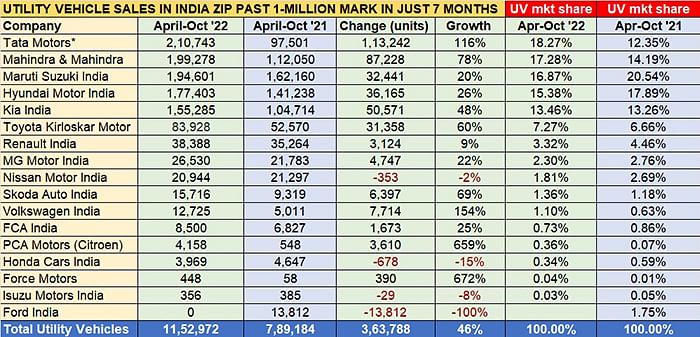

Given the consistently surging demand for SUVs, it is not surprising that India’s passenger vehicle (PV) segment is also accelerating towards a record fiscal. In the first seven months of the ongoing fiscal, over 2.27 million (22,73,070) PVs have been sold with industry notching 39% year-on-year growth. Of the three sub-segments – cars, utility vehicles (UVs) and vans – the UV segment with 11,52,972 units is by far the best performer with 46% YoY growth (11,52,972 units). Cars, with 10,36,838 units, has logged 30% YoY growth and vans, with 83,263 units, up 31%.

Suffice it to say that the sterling growth of the overall PV sector is thanks to the SUV-charged demand. Of the total 22,73,070 PVs sold, UVs account for 51% which means one out of every two cars sold in India is an SUV.

Every OEM worth its wheel is fighting for its share of the booming UV market and the extent of the strong double-digit growth in the segment can be seen in the fact that of all the 16 players in the fray, all but three has posted strong gains.

The top five OEMs with six-figure sales – Tata Motors, Mahindra & Mahindra, Maruti Suzuki, Hyundai Motor India and Kia India – account for 937,310 units or 81% of total UV sales (see sales data table below), maintaining the ratio as seen in H1 FY2023.

A booming but also competitive UV market means that 13 out of 16 OEMs have made strong year-on-year gains. The Top 6 have 88% of the total UV market.

Tata Motors and Mahindra increase market share

The sales numbers of the Top 5 shows that Tata Motors and Mahindra & Mahindra are the ones who have made the maximum gains in the period under review, both in terms of units sold as well as UV market share.

Tata Motors, with 210,743 units has increased its UV share to 18.27% from 12.35% in April-October 2021. The company, which has four UVs on offer – the Nexon, Punch, Harrier and Safari – has sold 113,242 units more than in the year-ago period, which sees it record 116% YoY growth and an increase of six percentage points to maintain its No. 1 ranking in the UV chart.

The Nexon (99,964 units), which remains India’s best-selling UV and ahead of the Hyundai Creta (87,362 units), and Punch (77,033 units) are Tata’s best-sellers, followed by the Harrier (20,199 units) and the Safari (13,544 units).

Tata Motors, which has the EV advantage over its PV rivals with the Nexon EV and Tigor EV, at present has a lead of 11,465 units over the No. 2 UV OEM, Mahindra & Mahindra.

Mahindra & Mahindra, with 199,278 units, is also performing equally strongly. In fact, in October 2022, it led the monthly sales table with 32,226 UV units. The period under review sees M&M increase its UV share – by three percentage points to 17% from 14% a year ago – and record robust 80% growth.

Expect M&M, which currently has a 260,000 units order book, and is ramping up manufacturing capacity to reduce to waiting period, to further up the ante in the coming months. The large pending order bank is essentially made up of five models led by the recently-launched Scorpio N and Scorpio Classic (130,000 units), XUV700 (80,000 units), Thar (20,000 units), Bolero and Bolero Neo (13,000 units) and the XUV300 (13,000 units).

Maruti sees UV share decline as does Hyundai

Tata Motors and M&M’s gains have most likely come at the expense of two other major players – Maruti Suzuki India and Hyundai Motor India. Maruti Suzuki, the overall PV market leader, which had the No. 2 UV position in Q1 FY2023 behind Tata Motors, has ceded that slot to a hard-charging Mahindra, which has pipped it to second place by 3,422 units.

In the ongoing fiscal, although Maruti has done well to sell 194,601 UVs in April-October 2022 (up 20%), its pace of growth is much slower than Tata and M&M, both of whom also have plenty more UV models. This means its UV share is down to 17% from 20.54% a year ago.

The company has, YoY, sold 32,441 units more which is less than what No.4 player Hyundai, which sold 36,165 units more, or Kia India, which sold 50,571 units more in April-October 2022 compared to the year-ago period.

However, the company can be expected to claw back UV market share with its recently launched new Grand Vitara along with sustained demand for the new Brezza (the best-selling UV in September 2022) and the Ertiga, both of which are regulars in the Top 10 UVs list.

Hyundai Motor India maintains its No. 4 position in the rankings with 177,403 units, up 26% YoY. The bulk of the company’s UV sales have come from the Creta, the No. 2 best-selling UV in India with 87,362 units, and the Venue compact SUV (69,871 units). These two SUVs together constitute 89% of Hyundai’s total UV sales. The company’s UV market share has reduced to 15.38% from 18% a year ago.

Kia India, at No. 5 in the UV rankings, has done well to clock 48% YoY growth at 155,285 units albeit, despite this performance, stiff market competition means its market share growth remains marginal: 134.46% from 13.26% a year ago.

Other players of note are Toyota Kirloskar Motor with 83,928 units – this is a 60% increase YoY which gives it a market share of 7.27% vs 6.66% a year ago. Then there’s Skoda Auto India and Volkswagen India, both of whom are benefiting from their Kushaq and Taigun respectively. While Skoda India has sold 15,716 units, up 69%, to grow its share to 1.36%, VW India with 12,725 units has registered 154% growth and raised its UV share to 1.10% from 0.63% a year ago.

Gunning for the 2 million-units milestone in FY2023

When a segment averages monthly sales of 164,710 units with YoY growth of 46%, it offers enough reason to believe that the coming months would be as good, if not better. However, with the festive month of October, which had both Navratri and Diwali, over it is felt that the month-on-month rate of growth might see some level of tapering off.

At 11,52,972 units, the first seven months of UV sales make up already 77% of FY2022’s 14,89,178 units. Each day of the past seven months (cumulatively, 214 days) has seen around 5,388 UVs being sold in India. With the current momentum amid the surging wave of demand and a flurry of new models in the market, the 2-million-units milestone could be in sight – at this stage, the UV industry is 847,028 units short of that big number.

While Toyota India has launched the Urban Cruiser Hyryder in a CNG avatar earlier this month, the remaining days of November and December 2022 are set to see new models being launched including the BYD Atto 3 electric SUV, Toyota Innova Hycross and MG Hector facelift. The Mahindra XUV400, which will be open for test drives from December and get officially launched in January 2023, will be the first proper rival to the high-selling Tata Nexon EV. Come April 2023, Maruti Suzuki will launch its very own Brezza CNG but those sales will have to be factored in the new fiscal year 2024. Till then, continue to stay plugged into India’s exciting UV sales story.

ALSO READ India auto retails soar 48% in festive October, all vehicle segments register double-digit growth

Tata Motors only 9,220 units behind Hyundai India halfway into FY2023

RELATED ARTICLES

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

Maruti Wins in Mid-SUV Space with New Models

Maruti Suzuki’s UV1 volumes nearly doubled in four months. The cause is not the GST cut — it is a deliberate product por...

13 Nov 2022

13 Nov 2022

10427 Views

10427 Views

Arunima Pal

Arunima Pal

Shruti Shiraguppi

Shruti Shiraguppi