Two-wheeler despatches in speed mode this October but is the growth story real?

With OEMs pumping up volumes and increasing dealer inventory in anticipation of festive sales, October numbers were not surprisingly good. The real growth story lies in December and beyond.

It was known that the most affordable form of motorised transport would benefit from the increased demand for personal transportation in a time of Covid. Even as two-wheeler OEMs pumped up their inventories in anticipation of festive sales, the fact is also that a number of first-time owners put down their money on two wheels. Thus, not surprisingly, most of the OEMs with commuter motorcycles in their portfolio have notched smart growth, be in terms of despatches or sale.

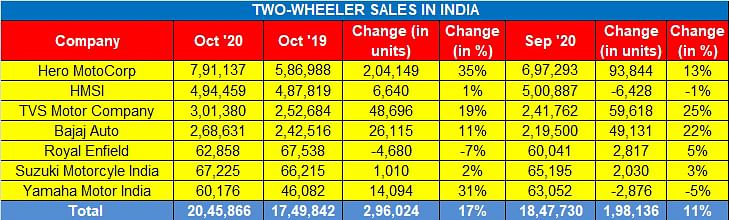

Hero MotoCorp: 791,137 units / 35%

Just 8,863 units short of the 800,000 unit mark in monthly despatches is a huge achievement, there’s no doubt about that. In October, that worked out to a stupendous 25,520 units sold every day! It also marked strong 35% year-on-year growth for the world’s largest two-wheeler OEM and its highest-ever monthly tally thus far.

On a month-on-month basis, Hero’s numbers are up by 13% compared to September 2020’s 697,293 units. With a view to make the most of the ongoing festive season, Hero MotoCorp launched four new product refreshes in October – 125cc Glamour Blaze, an all-black Splendor+, Stealth Edition Maestro Edge 125 and Hero Pleasure Plus Platinum edition. Suffice it to say that all its five manufacturing plants in India are operating with nearly 100 percent production capacity.

Honda Motorcycle & Scooter India: 494,459 units / 1%

India’s No. 2 player, Honda Motorcycle & Scooter India (HMSI) sold 494,459 units in October 2020, compared to 487,819 units in October 2019, which marks flat growth of 1%. When compared to September 2020’s 500,887 units, HMSI witnessed a 1% month-on-month sales decline.

A month ago, HMSI announced its foray into the middle-weight, midsized motorcycle segment in India with the launch of the H’ness 350

Commenting on the October 2020 sales and the prevailing market sentiment, Yadvinder Singh Guleria, Director – Sales & Marketing, HMSI. said, “Ending October, nearly 100% of our network is opened and is recording YoY increase in retails during the first 2Ds (Durga Puja and Dussehra). Riding into the festive season on a high note, our newly launched H’ness-CB350 has garnered a great response in a short span of time. In less than a month of start of sales of our debut 350ccc midsize motorcycle, our production is booked till November, even as new bookings continue to rise. With the comeback of positive sentiments in the market, Honda is all geared up for final 2Ds of the festive season – Dhanteras and Diwali – with strict safety measures in place across all our touch-points.”.

TVS Motor Co: 301,380 units / 19 %

Chennai-based TVS Motor Company registered sales of 301,380 units in October 2020, with a growth of 19% YoY (October 2019: 252,684 units). Compared to September (241,762 units), this marks 24% growth and indicates that the worst is behind for the two-wheeler industry per se. Total two-wheeler sales also had witnessed a growth of 24% with the sale of 382,121 units. Around 173,263 motorcycles and 123,138 scooters were sold in October.

On October 12, the company announced that its Apache premium motorcycle brand has raced to the four million unit sale milestone globally. This premium brand was launched in 2005, which makes it the ride from zero to 4,000,000 units has taken 15 years. Interestingly, the last million or 10 lakh unit unit sales have come in just two years. The TVS Apache crossed the three-million-sales milestone on September 10, 2018.

Bajaj Auto: 268,631 units / 11 %

Pune-based motorcycle manufacturer Bajaj Auto registered 11% growth with October 2020 sales at 268,631 units (October 2019: 242,516 ). On a month-on-month basis, October numbers are a 22% increase (September 2020: 219,500).

The company recently registered its highest ever sale of Pulsars for both domestic and export markets. The nine-model Pulsar family – Pulsar 125, Pulsar 150, 150 Neon, 150 Twin Disc, Pulsar 180F, Pulsar 220, NS160, NS200, and RS200 – contributed over 170,000 units or 63% of total sales. Interestingly, October 2020’s Pulsar numbers are the best-ever monthly sales for Bajaj Auto.

What could have helped drive Pulsar sales was the rollout of the refreshed Pulsar NS and RS series on October 16. While the Pulsar NS 200 costs Rs 131,219, the Pulsar NS 160 is priced at Rs 108,589 (ex-showroom-New Delhi). They went on sale on October 23.

Also, in a bid to rev up festive season sales, end-October saw Bajaj Auto launch a new version of its commuter motorcycle, the CT100 priced at Rs 46,432 (ex-showroom Delhi). This makes it the most affordable entry level motorcycle in the country.

Suzuki Motorcycle India: 67,225 units / 2%

Suzuki’s two-wheeler arm in India sold a total of 67,225 units to see only marginal growth of 2% (October 2019: 66,215 units). In September, the company had sold 65,195 units, which indicates growth of 3% on a month-on-month basis.

Commenting on the sales numbers, Devashish Handa, vice-president, Suzuki Motorcycle India said, “Suzuki’s growth curve has continued into October as well. In addition to the introduction of the Gixxer Series in the new liveries, we also launched our Bluetooth-enabled Access 125 and Burgman Street Scooters which we are confident will further support our growth.”

Yamaha Motor India: 60,176 units / 31%

Yamaha Motor India sold 60,176 units in October 2020. This is a 31% increase compared to October 2019 (46,082 units). The company has been reporting growth in its sales volumes consecutively over the past four months, following the lifting of the Covid-driven lockdown. Yamaha is also hopeful that the festive season sales during November will provide an uptick.

Royal Enfield: 62,858 units / -7 %

Chennai-based Royal Enfield sold 62,858 motorcycles in October 2020, registering a sales decline of 7% (October 2019: 67,538 units). However, last month’s sales are a 2% month-on-month increase, with 60,041 units sold in September. The company expects its soon-to-be-launched cruiser, Meteor 350 to give a fillip to sales.

Growth outlook: cautiously optimistic

Two-wheeler OEMs and their dealers across the country clearly are going all out to make the most of the ongoing festive season. The strong October numbers are also indicative of the fact that OEMs have despatched increased volumes to ensure ready stock. However, it is understood that the on-ground market reality could be a tad different, given that the Indian economy continues to be down, there have been sizeable job losses across the country and consumer sentiment is nowhere near what it was a year ago.

Speaking to a leading television channel yesterday, Vinkesh Gulati, president of FADA, said: “The ground reality is not that buoyant. We have seen a good nine days sale but overall the month (October) hasn’t been that great. We will have to wait for the exact (retail) figures in a week when FADA releases the data but overall the data that we are getting from the dealers at the ground level is that, except for the tractor category, every other category is still in the red. No green shoots yet for the month of October.

The FADA president said sales in the premium motorcycle segment (125-150cc) are better but the 100cc commuter segment is not seeing growth, which is likely because the financial distress is more in the latter segment and both enquiries as well as deliveries are down.

With Dhanteras on November 14, the month might bring in the festive numbers followed by a small uptick in December but the real proof of the sales pudding will be in January 2021 and the months to follow. Is the growth story organic and real?

READ MORE

Car makers get festive season-led charge in October, SUVs light up the numbers

CV OEMs see glimmer of hope in modest October sales

Two-wheeler despatches in speed mode in October but is the growth story real?

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

04 Nov 2020

04 Nov 2020

9823 Views

9823 Views

Shahkar Abidi

Shahkar Abidi