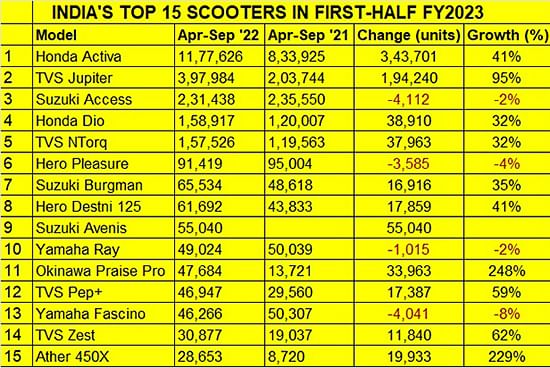

Two EVs in India’s Top 15 scooters for H1 FY2023

Proof of the growing demand for e-scooters is the Okinawa Praise Pro and Ather 450X entering the list of best-selling scooters. While the Honda Activa remains unassailable, 125cc models pick up sales pace.

Here’s proof of the growing demand of electric vehicles, particularly in the affordable eco-friendly mobility segment of two-wheelers in India. Two electric two-wheelers – Okinawa Praise Pro and Ather 450X – have entered the Top 15 list of best-selling two-wheelers, shaking handlebars with their petrol-powered brethren. They occupy the 11th and 15th positions on the rankings table but serve to show the gradual and increasing shift of scooter buyers to electric vehicles.

As per SIAM’s wholesales market data for the first six months of FY2023 (April-September 2022), the scooter segment sold a total of 27,64,127 units, up 41% year on year, marking a revival of sorts. Like in all vehicle segments, there are the movers and shakers here too and the Top 15 account for 26,46,627 units which is 96% of the overall sales in H1 FY2023.

Of this 15, the top five products – Honda Activa, TVS Jupiter, Suzuki Access, Honda Dio and the TVS NTorq – are the ones with six-figure cumulative sales and together constitute 77% of overall scooter industry sales. Here’s looking closer at how each brand performed.

The Honda Activa, the unchallenged scooter market leader, is well entrenched with 11,77,626 units, recording 41% YoY growth (H1 FY2022: 833,925 units). Honda Motorcycle & Scooter India (HMSI) currently has a 48.56% market share, which in turn means the Activa on its own has a 43% share of India’s scooter market!

The TVS Jupiter, which has nearly doubled its volumes YoY, registered sales of 397,984 units in H1 FY2023, posting strong 95% growth and has a 14% share of the market. TVS sold a total of 657,703 scooters in the first-half of this fiscal, which gives it a 24% market share.

At No. 3 is the Suzuki Access with 231,438 units and an 8% market share. With excellent all-round capabilities, the Suzuki Access 125 sits comfortably atop the 125cc family scooter segment but has seen demand slowing down particularly with the Jupiter 125 eating into its market. Its numbers are down 2% YoY and it is one of four scooters along with the Hero Pleasure, Yamaha Ray and Yamaha Fascino to see a sales decline.

No. 4 and No. 5 positions have seen a tough fight. The Honda Dio with 158,917 units is ahead of the TVS NTorq’s 157,526 units by 38,910 units. And, interestingly, both have logged exactly the same YoY increase – 32% – which means the coming months should see the battle for supremacy between the two intensifying.

The Hero Pleasure with 91,419 units, is down 4% on year-ago cumulative sales of 95,004 units. Nevertheless, it is still ahead of the No. 7 player by a fair margin.

The maxi-styled 125cc Suzuki Burgman is riding the wave of demand for 125cc scooters, which can be seen in the 35% growth it had notched with sale of 65,534 units. That’s just what the next player, Hero Destni 125 has done too – 61,692 and a 41% YoY increase.

Suzuki is doing well with the 125cc Avenis, the third scooter to be rolled out on the Suzuki platform and No. 9 on the Top 15 list. Its most striking aspect and the biggest way in which it differs from the Accessis the design. With an edgy look full of cuts and creases, the Avenis cuts a rather sporty figure and is definitely striking looking. It was launched on November 19, 2021 at Rs 86,700 which means it has been on sale for less than a year. The Avenis has sold 55,040 units over the past six months, which makes for a monthly average of 9,173 units but way below the 125cc market leader NTorq which has a monthly average of 26,254 units.

Both the Yamaha scooters – Ray and Fascino – are under feeling the heat of the growing competition. While the Ray sold 49,024 units, down 2%, the Fascino with 46,266 units is down 8% on year-ago 50,307 units and is in 13th position.

The Okinawa Praise Pro, the first electric scooter in India’s Top 15 scooters, checks in at No. 11 with 47,684 units. The eco-friendly product, which has a range of 88km, has been instrumental in giving Okinawa Autotech the No. 1 position in the electric scooter market.

The diminutive TVS Zest takes No. 14 position with 30,877 units and has clocked 62% YoY growth.

Wrapping up the Top 15 best-sellers’ table is the Ather 450X with 28,653 units. Mirroring the same trend as the overall e-scooter market, which has notched retails of over 275,000 units in H1 FY2023 (up 404%), the Ather 450X has sold a total of 28,653 units averaging 4,775 units a month.

While this India market scooter industry analysis is specific only to nine SIAM member companies which now include EV OEMs like Okinawa and Ather, it is to be noted that Ola Electric has registered strong retail numbers in the April-September 2022 period. Ola Electric, which is not a SIAM-member company, retailed a total of 44,801 S1 Pro scooters in H1 FY2023.

ALSO READ: Electric two-wheeler retails charge past 275,000 units in H1 FY2023, Ola Electric bounces back

RELATED ARTICLES

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

25 Oct 2022

25 Oct 2022

16317 Views

16317 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi