Electric two-wheeler sales charge past 275,000 units in H1 FY2023, Ola Electric bounces back

Monthly retail sales cross 50,000 units for the second month in a row, April-September 2022 sales jump 404% YoY; Ola regains second spot from Hero Electric; Okinawa reigns supreme. . . for now.

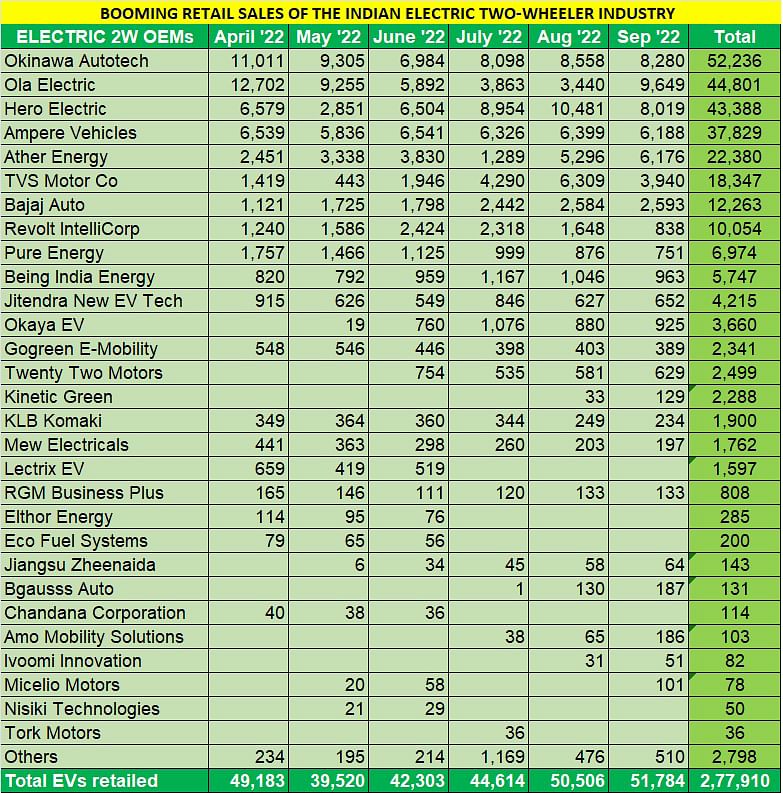

India’s electric two-wheeler growth story is getting better, month on month. If overall retail sales crossed the 50,000-unit mark for the first time in a month to 50,506 units in August 2022, then September retails have done better with 51,784 units, up 2.53%, and a 16% improvement over July’s 44,614 units. Place this performance in perspective to year-ago numbers: April-September 2021 cumulative retails were 55,147 units, albeit in a pandemic-impacted time.

The good news about the segment doesn’t stop there. As per the e-two-wheeler retail numbers, revealed by Vinkesh Gulati, chairman of FADA India Research & Academy, cumulative retails for the first half of FY2023 (April-September 2022) are 277,910 units, a robust 404% growth over H1 FY2022’s 55,147 units. October sales will see the 300,000-unit mark, currently 22,090 units away, being surpassed easily. Suffice it to say, this ‘low-hanging fruit’ of the EV industry is headed towards 600,000-plus sales this fiscal.

A look at the retail sales data table (at the bottom of this analysis) shows that of the 51,784 units sold, the top seven OEMs (with four-digit sales) account for 44,845 units or an overwhelming 86% of total sales. Similarly, on the cumulative front, eight players (with five-digit sales) – Okinawa Autotech, Ola Electric, Hero Electric, Ampere Vehicles, Ather Energy, TVS Motor Co, Bajaj Auto and Revolt Motorcycles – account for 241,298 units or 87% of total retails. Another 20-odd OEMs are fighting for the slice of the action of India’s booming e-two-wheeler market.

Okinawa remains strong No. 1 in first-half FY2023

Okinawa Autotech, which has a large portfolio of both high- and low-speed e-scooters, has crossed the 50,000-unit sales milestone and with 52,236 units in April-September 2022 has averaged monthly sales of 8,706 units.

The company, which is seeing strong demand for its iPraise+ and Praise Pro high-speed models, currently has a network of over 350 dealers in key metro cities and now aims to reach Tier 2-3 cities as well as rural India.

Ola Electric back in No. 2 position after 3 months

Ola Electric, which had opened FY2023 with 12,703 units in April 2022 and 9,255 units in May and held the No. 1 position for Q1 FY2023 with cumulative sales of 27,849 units but saw demand slowing down in June-July-August, has bounced back with a strong performance in September.

With sales of 9,649 units last month, it is not only the best-selling OEM but has also taken the overall No. 2 position from Hero Electric for H1 FY2023 with 44,801 sales in April-September 2022.

Ola had recently announced a number of offers, including a Rs 10,000 cash discount, on its S1 Pro electric scooter, which were valid till October 5. And now, on the back of an encouraging response, the EV start-up has decided to extend the validity of these offers.

Hero Electric slips one rank to No. 3

The industry topper for two consecutive months in July (8,954 units) and August (10,481 units), Hero Electric sold 8,019 units in September, making it third-placed in last month’s rankings and also dropping down to third place in the cumulative scores for H1 with 43,388 units, 913 units behind Ola.

Hero Electric, which is aggressively driving expansion, currently has over 700 sales and service outlets and trained roadside mechanics on EVs. It has also partnered with a various of NBFCs to enable easy finance solutions for EV buyers. Hero is also very actively increasing its EV charging network and has recently tied up with Jio-bp to enable its customers to get access to that widespread charging and swapping network, which is also open to other vehicles.

Hero Electric, which is aggressively driving expansion, currently has over 700 sales and service outlets and trained roadside mechanics on EVs. It has also partnered with a various of NBFCs to enable easy finance solutions for EV buyers. Hero is also very actively increasing its EV charging network and has recently tied up with Jio-bp to enable its customers to get access to that widespread charging and swapping network, which is also open to other vehicles.

Ampere Vehicles: a consistent performer

Ampere Vehicles, with cumulative six-month sales of 37,829 units, has been registering a consistent performance and is averaging 6,304 units a month. In July, Ampere inked a partnership with Flipkart, India’s homegrown e-commerce marketplace, to accelerate sales of the Ampere Magnus EX electric scooter.

In the pilot phase, customers across Bengaluru, Kolkata, Jaipur, and Pune will be able to access the product and also avail of state-specific subsidies and benefits. After placing an order on Flipkart, the customers will be contacted by the local authorised dealership for completion of RTO registration, insurance, and delivery of the scooter. The entire process, from the time of order to doorstep delivery, will be completed within 15 days, says the company.

Ather hits a high in September

September saw smart e-scooter maker Ather Energy notch its highest-ever monthly wholesales of 7,435 units and retails of 6,176 units. Six-month cumulative retails stack up at 22,380 units. What is helping Ather achieve better numbers is the improved supplies to its showrooms across the country.

Speaking to Autocar Professional last month, Ravneet S Phokela, chief business officer, Ather Energy, had said most supply chain challenges have been resolved and the company is aiming at full manufacturing capacity utilisation – 10,000 units per month for the remaining six months of FY2023. It will then graduate to starting off its second production line within the 400,000-unit annual capacity Hosur plant in Tamil Nadu. “With the supply chain ramping up, we are hoping to get the waiting period on our products down to 2-4 weeks depending upon the city,” he said.

TVS takes the lead over Bajaj

As demand for electric two-wheelers continues on its strong growth trajectory in India, ICE two-wheeler and electric scooter rivals Bajaj Auto and TVS Motor Co are also making robust gains with their electric scooters. Interestingly, both companies launched their products – the Bajaj Chetak and TVS iQube – in the same month: January 2020.

In H1 FY2023, TVS has sold a total of 18,347 iQubes, averaging 3,057 units a month. In comparison, the Bajaj Chetak has gone home to 12,263 owners, or 2,043 a month. Both companies are gradually expanding their retail network and customer reach for their electric scooters.

Growth outlook: Charging towards 600,000 units and more in FY2023

What is adding tailwinds to sales of the eco-friendly commuters on two wheels is the marked increase in prices of petrol-powered scooters and motorcycles, particularly after the technological upgrade to BS VI in April 2020.

As is known, the BS VI mandate has necessitated the use of electronic fuel injection (EFI) technology which is significantly more expensive than the now-defunct carburettor technology. Furthermore, it is understood that apart from the higher acquisition cost of BS VI two-wheelers, the cost of repair is also higher compared to non-EFI products.

Given the sustained demand in the e-two-wheeler market and the huge market potential, the 600,000-unit sales milestone should be crossed in FY2023. Following the incidents of e-scooter fires earlier this year with three OEMs, the government as well as the entire EV industry eco-system is hard at work to ensure top-notch battery and cell management. This is imperative because consumer confidence in electric two-wheelers, one of the low-hanging fruits of the industry along with three-wheelers, remains strong.

India is targeting EVs to account for 30% of its mobility requirements by 2030, driven by the FAME scheme, state subsidies and much increased availability of models across segments. Given the current pace of buying in the overall two-wheeler arena – 3.3 million two-wheelers sold in FY2022 – that could be still some distance away. Nonetheless, given the positive trend, e-two-wheeler OEMs will be looking to make the most of demand coming their way. And two-wheeler market leader Hero MotoCorp has launched its much-awaited Vida V1, its first electric scooter. The e-two-wheeler industry dynamics just got more exciting. Watch this space for more.

Images for Okinawa Autotech, Ola Electric, Hero Electric, Ampere Vehicles and TVS Motor Co sourced from their respective Twitter handles

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

07 Oct 2022

07 Oct 2022

22126 Views

22126 Views

Shahkar Abidi

Shahkar Abidi