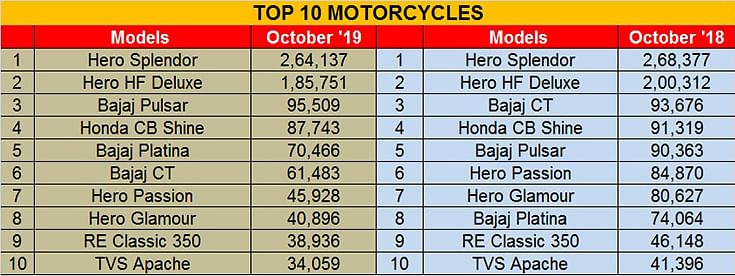

Top 10 Motorcycles – October 2019 | Hero Splendor bounces back, Bajaj Pulsar clocks 40% growth over September

Although the overall motorcycle sector is down 16% YoY, growth is returning in the form of an uptick for commuter bikes.

Hero MotoCorp's Splendor is back in form as seen in the latest top 10 India motorcycles chart. The country's best-selling family of commuter motorcycles looks to be getting its momentum back. In October 2019, with sales of 264,137 units, the Splendor clocked its best performance in five months, bettering September's sales of 244,667 units, August's 212,839, July's 178,907 and June's 242,743. The Hero Splendor , whose iSmart variant recently became the country’s first BS VI-certified two-wheeler, remains a strong buy particularly for bikers whose aim is to stretch every litre of petrol to its maximum.

Riding in second is the Splendor sibling, Hero HF Deluxe with sales of 185,751 units, down on September's 195,093 units. Put this down to the fact that demand from rural India is yet to pick up following a delayed threshing season. Expect demand for the HF Deluxe to pick up in November and December.

Bajaj Auto enters the Top 10 chart with the Pulsar range at No. 3 and a very strong performance of 95,509 units, which is a robust 40% month-on-month increase. Bajaj Auto, which was the biggest market share gainer in FY2019 and is maintaining a strong position in both domestic and export sales, will be looking to up the ante in the coming months. In H1 FY2020, Bajaj Auto despatched a total of 445,841 Pulsars, which marks a 3.16% year-on-year growth for the company (H1 FY2019: 432,174).

The Honda CB Shine takes fourth place with sales of 87,743 units, a marginal decline over the 88,893 units in September. Demand seems to be growing for this motorcycle and in a bid to increase sales, earlier this year, HMSI launched the CB Shine Limited Edition at Rs 59,083 for the drum brake model and Rs 63,743 for the disc brake variant.

Bajaj Auto's Platina commuter bike is at No. 5, three ranks above its position a year ago with sales of 70,466 units, one of the few products to better year-ago numbers (October 2018: 74,064) considering the overall motorcycle segment is down 16% year on year.

Its sibling the CT100, which takes sixth rank in the Top 10 list, sold 61,483 units, improving three ranks on its September's ninth place with 51,778 units, which marks solid 19% month-on-month growth. The CT, along with the Platina and Discover, has been instrumental in giving Bajaj Auto good traction in difficult market conditions. Things can only turn better from now on, given that demand from rural India is set to return.

At No. 7 is the Hero Passion with 45,928 units. The Passion, not so long ago, used to sell in much bigger numbers and has since slowed down considerably. Hero MotoCorp will have to rethink its selling strategy if it wants the Passion to not go out of fashion.

Another Hero product, the Glamour, rides in to take eighth spot with 40,896 units, down 28% on the 57,321 units sold in September 2019. The 124.7cc motorcycle was once a strong buy in the market but the company will have to rethink strategy to help the executive commuter bike regain its glamour in the marketplace.

Royal Enfield thumps into the Top 10 at No. 9 position with the Classic 350's count of 38,936 units. In August, Royal Enfield launched more affordable iterations of the Bullet 350 and the 350 ES. The bikes came in a blacked-out theme, devoid of excessive chrome and with some other cost-cutting measures. A month later, the manufacturer did something similar with the Classic 350, and called the more affordable bike the Classic 350 S – the ‘S’ supposedly denoting the single-channel ABS, unlike the regular bike that gets a dual-channel unit. The bike, priced at Rs 145,000, is around Rs 9,000 cheaper than the standard Classic 350, which is priced at just under Rs 154,000 (all prices, ex-showroom, Chennai). It looks like the move has worked with buyers.

The sole TVS in the bestsellers list is the Apache family of bikes. It wraps up the Top 10 list with a tally of 34,059 units, clearly indicating that there is potential to achieve a lot more.

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

20 Nov 2019

20 Nov 2019

35547 Views

35547 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau