Tata Motors leads the charge in India's fast-growing CV market

The commercial vehicle segment – considered the barometer of the country’s economy – has notched handsome growth (+57.44%) and the growth is coming through in both the M&HCV (+114.79%) and LCV (+34.27%) segments.

With the first two months of fiscal year 2019 over, India Auto Inc is happily cruising in growth lane and all four vehicle segments – passenger vehicles, commercial vehicles, three-wheelers and two-wheelers – are clocking double-digit year-on-year growth.

What’s notable is that the commercial vehicle segment – considered the barometer of the country’s economy – has notched handsome growth (+57.44%). Importantly, the growth is coming through in both the M&HCV (+114.79%) and LCV (+34.27%) segments.

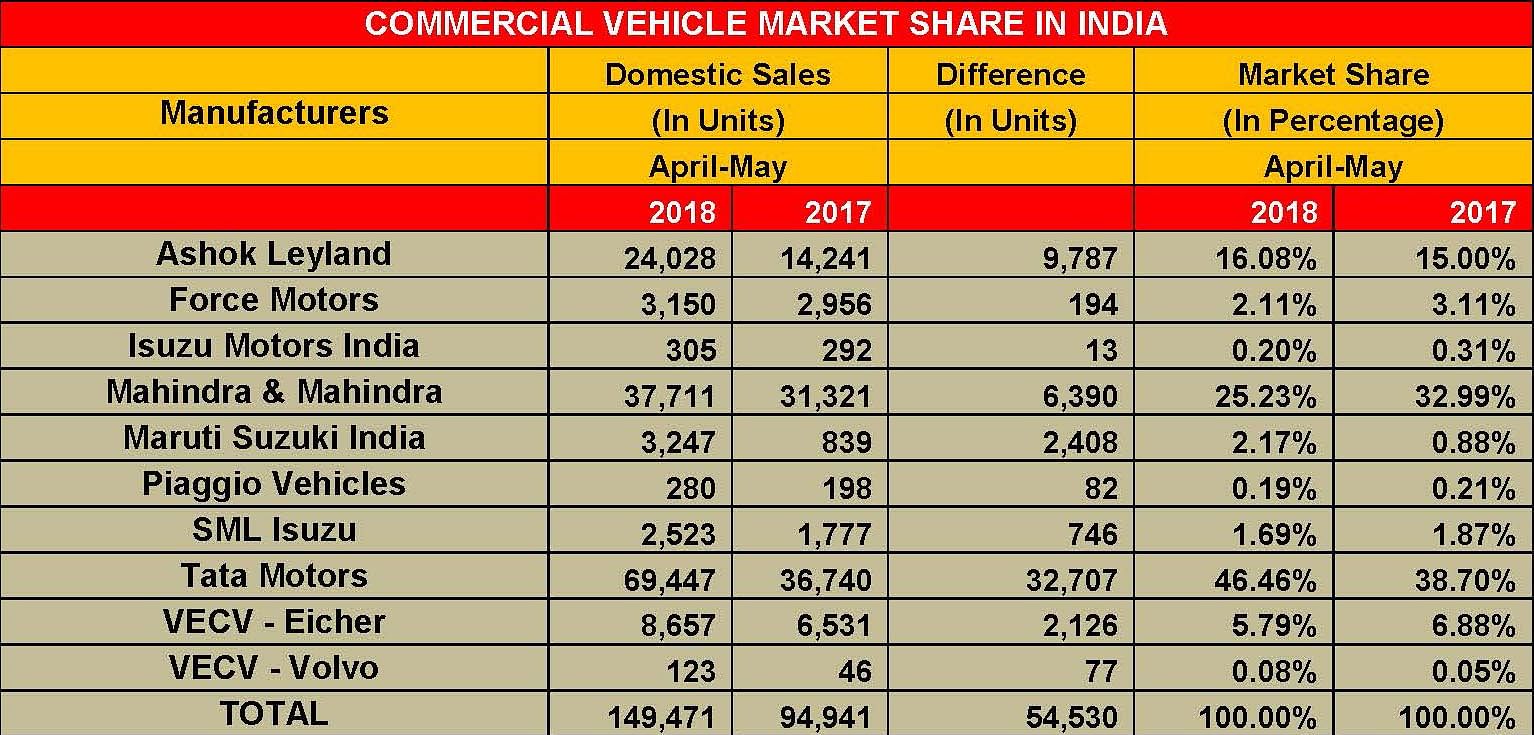

While some may argue that the numbers are on a low year-ago base, due to BS IV implementation, the fact of the matter is that overall CV sales in April-May 2018 are barely 529 units short of the 150,000 unit mark – 149,471 units.

Going by the last two months’ sales, it is expected that the overall CV sector is likely to remain buoyant as the economy improves, stronger replacement demand takes hold and industry benefits from the increasing efficiencies in the transportation, logistics and supply chains. Industry analysts believe that the CV industry is likely to remain strong in FY2019 and FY2020, mainly as a result of the strong governmental push and spend on infrastructure.

Tata Motors’ overall CV market share grows to 46%

Take a close look at the industry statistics and it is amply clear that CV market leader Tata Motors is increasing its hold on the market. In overall CV sales for April-May 2018, Tata Motors has sold 69,447 units (+89% YoY) to gain a market share of 46 percent, thus gaining 8 percentage points in the two-month period. During this time, although the CV market size expanded, most other CV makers sold more vehicles compared to April-May 2017 but saw their market share dip.

Mahindra & Mahindra, the second largest player in the overall CV segment, sold 37,711 units (+20.40% YoY) for a market share of 25 percent, losing nearly 7 percentage points. Ashok Leyland with total sales of 24,028 units (+68.72% YoY) with a market share of 16 percent has gained less than a percentage. VE Commercial Vehicles sold 8,657 units (+32.55%), with a market share of 5.7 percent, lost more than one percentage point market share. Maruti Suzuki India, with its single product in the CV segment, the Super Carry, gained 1.5 percentage points. Meanwhile, other players like Force Motors, SML Isuzu and Piaggio Vehicles saw their market share decline (see detailed market share table below).

Ashok Leyland tops in M&HCV buses, Tata rules in goods carriers

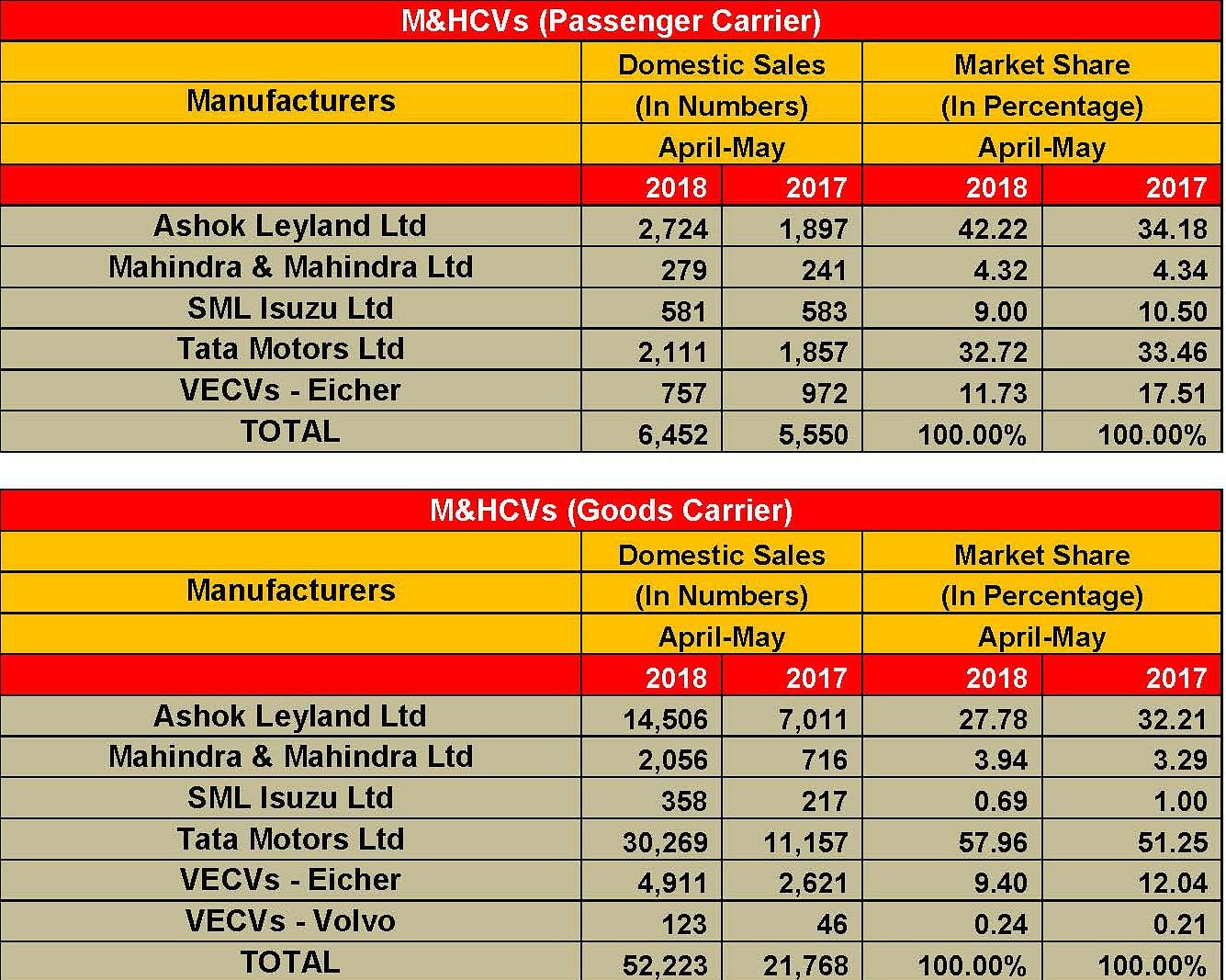

The M&HCV passenger carrier segment (9-tonne and above buses) is dominated by Tata Motors and Ashok Leyland with an over 75 percent market share.

Ashok Leyland has emerged as the largest player in the segment, selling 2,724 units in April-May 2018. This gives it a market share of 42 percent, gaining nearly 8 percentage points over April-May 2017. In comparison, Tata Motors sold 2,111 buses for a 32.7 percent market share, down 1 percent. VECV and M&M sold 757 and 279 buses respectively; while VECV lost close to 6 percentage points in market share, M&M’s market share growth was almost flat.

The M&HCV goods carrier segment is where the real action lies and where the biggies play. This segment not only comprises the largest pie of the overall CV segment but is also the most profitable one for OEMs. Here, Tata Motors has gained sizeable market share and has taken a substantial lead over the competition. In April-May 2018, Tata sold 30,269 units that gives it a 58 percent market share, up nearly 6 percentage points compared to same period last year. Ashok Leyland, the second largest player in the segment, sold 14,506 units for a market share of 27.7 percent, down by around 5 percent. VECV and M&M sold 4,911 and 2,056 units respectively.

Tata narrows LCV goods carrier gap with Mahindra

There is a battle underway in the LCV segment (goods carrier segment), particularly between M&M and Tata Motors. Mahindra has, for long, been driving gains with its Bolero range but Tata Motors is fighting to regain market share and is succeeding.

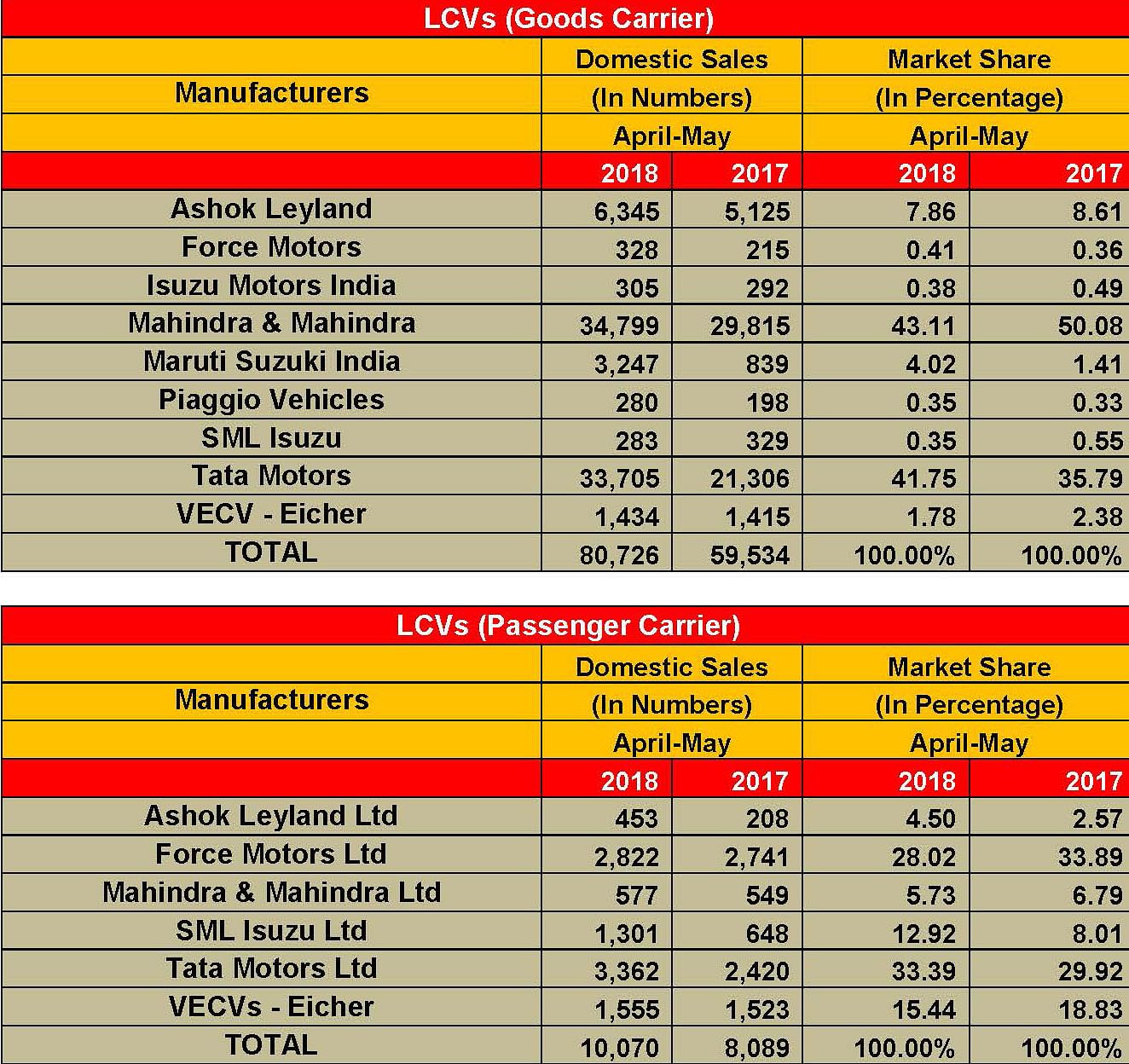

In April-May 2018, Tata Motors has not only achieved higher sales than the year-ago period but also gained sizeable market share in both the passenger and goods carrier segments. In the passenger carrier segment, the company has emerged as the largest player with sale of 3,362 units that gives it a 33 percent market share, gaining close to 3 percent. M&M, the second largest player, sold 2,822 units that gives it a market share of 28 percent (down 5 percentage points). Other than Ashok Leyland and SML Isuzu, VECV and Force Motors have lost market share.

In the LCV goods carrier segment, which M&M has ruled for some time now, Tata Motors is breathing down M&M’s neck and in the April-May 2018 period, only 1,094 units separate the two OEMs. M&M, which benefits from its popular Bolero pickup range, sold 34,799 units but shed close to 7 percentage points. In comparison, Tata Motors sold 33,705 units for a market share of 41.7 percent and gained 6 percentage points.

Ashok Leyland is a distant third with sales of 6,345 units and a market share of 7.86 percent. Ashok Leyland is expected to soon up the ante in this segment where it currently has only the Dost SCV and its variant. The Chennai-based company is working on a plan to expand its range of products, aiming to be a serious player.

In this segment with the exception of Maruti Suzuki, all the other players including Force Motors, Isuzu Motors, Piaggio Vehicles, SML Isuzu and VECV have all lost market share.

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

21 Jun 2018

21 Jun 2018

47696 Views

47696 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau