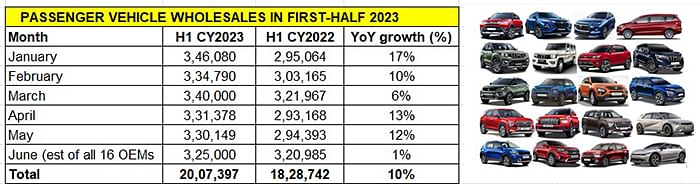

SUV demand drives June sales to 325,000 units, over 2 million PVs sold in first-half 2023

Sustained demand for SUVs and MPVs sees monthly sales cross the 325,000 mark six months in a row in June; cumulative January-June passenger vehicle wholesales surpass 20-lakh milestone for the first time in India.

With eight of the 16 passenger vehicle OEMs in India releasing their wholesale numbers for June 2023, it is clear that the 325,000-unit mark will have been breached for the sixth month in a row. Cumulative sales of nine OEMs add up to 313,360 units, up 6% on their year-ago sales but down 2.47% on May 2023’s 321,308 units.

When apex industry body SIAM releases the final wholesale figures later this month, June is likely to see the lowest number in the first six months of this year – January (346,080 units), February (334,790), March (340,000), April (331,378 units) and May (330,149). With the monsoon season underway and sales usually slower in the July-August period, growth is likely to continue in single digits before the festive season opens in September-October.

Nevertheless, the good news is that cumulative wholesales in the first six months of 2023 would have crossed the 2-million mark for the first time ever in India.

Coming on the back of the record wholesales of 3.8 million units and strong double-digit year-on-year growth of 24% in calendar year 2022, this augurs well for India Auto Inc and India PV Inc, as also the entire automotive ecosystem. This, even as the growth is expected to see growth moderate to single digits in the remaining part of the year. Let’s take a closer look at the top six performers, both in June 2022 and the half-year (January-June).

Maruti Suzuki India

June 2023: 133,027 units – up 8% YoY, down 7.43% MoM

Jan-June 2023: 841,633 units – up 10%

Surging demand for its expanding portfolio of utility vehicles, comprising compact and midsized SUVs and an MPV, means that Maruti Suzuki India has managed to successfully buffer the slackened demand in the entry-level budget hatchback segment. This is sharply reflected in the company's wholesales performance in June 2023.

Its 133,027 units in June 2023 are up 8% YoY (June 2022: 122,685 units) but month-on-month, this is a decline of 7.43% (May 2023: 143,708 units). While second-quarter (April-June 2023) sales of 414,055 units are a 12% increase over Q2 CY2022’s 369,154 units, they are down 13.66% on Q1 CY2023’s 427,578 units.

In June, the robust 130% YoY increase for seven UVs, including the just-launched premium Invicto MPV, has more than made up for the decline in Alto and S-Presso sales. Surprisingly, there has been a 17% YoY decline in ‘compact car’ sub-segment comprising the high-selling Baleno, Swift and Wagon R hatchbacks, which keep company with siblings Celerio and Ignis, as also the Dzire/Tour S sedan. This seven-pack sold 64,471 units last month compared to 77,746 units in June 2022.

Maruti Suzuki has outlined its strategic plan to increase its UV market share and the first two quarters of CY2023 reflect just that. The company’s UV sales in the past six months reveal that Q2’s 126,401 units are up 19.29% on Q1’s 105,957 units.

Maruti Suzuki India, which has been the UV leader for the past two fiscals, has taken an early and strong lead in FY2024. In the first two months of FY2024, the company has increased its UV share to 23% from 20.53% a year ago. Now, it seems well placed to further increase its UV share but will have to contend with slow sales of some of its other models.

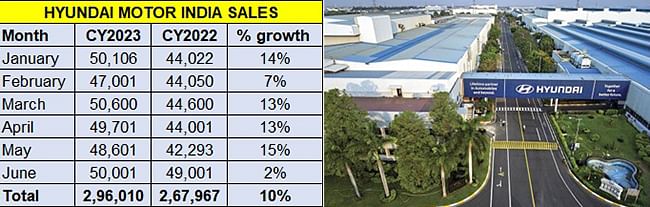

Hyundai Motor India

June 2023: 50,001 units – up 2% YoY, up 2.88% MoM

Jan-June 2023: 296,010 units – up 10%

Hyundai Motor India’s wholesales of 50,001 units in June 2023 are a marginal 2% YoY growth (June 2022: 49,001 units). With this performance, the Chennai-based car and SUV manufacturer has recorded monthly sales of 50,000 units for the third time in the year to date, after January (50,106 units) and March (50,600 units). This takes its first-half (January-June 2023) calendar year sales to 296,010 units, up 10.46% over year-ago sales (January-June 2022: 267,967 units). However, when seen quarter on quarter, Q2 CY2023 (April-June 2023) sales of 148,303 units are flat – only 0.40% up on Q1 CY2023’s sales of 147,707 units.

While the Creta continues to lead the midsize SUV market in India with 28,635 units sold in April-May 2023 (up 21% YoY), the new Verna is also seeing good customer demand – 7,688 units in April-May 2022, and up 238% YoY. Meanwhile, the compact Venue SUV with 20,555 units has seen 23% YoY growth in the first two months of FY2024.

Hyundai, which is set to launch its latest product – the Exter mini-SUV – on July 10, will be looking to grab a slice of the segment with the mini-SUV which gets petrol and petrol-CNG powertrain options and segment-first features like a sunroof and a dashcam.

Tata Motors

June 2023: 47,359 units – up 5% YoY, up 3% MoM

Jan-June 2023: 276,104 units – up 9%

Tata Motors has reported wholesales of 47,359 units in June 2023, which is a 5% YoY increase (June 2022: 45,305 units) and the carmaker’s second-best monthly performance in first-half 2023 after January 2023’s 48,289 units.

Combined Q1 and Q2 sales add up to 276,104 units, up 9% on first-half CY2022 sales of 253,916 units. At halfway stage in CY2023, this number is 52% of the company’s record CY2022 sales of 526,798 units.

Tata Motors, which is among the few PV OEMs with multiple powertrains spanning petrol, diesel, CNG and electric, is driving home the first-mover advantage it has in electric vehicles (EVs). Its EV portfolio comprising the Nexon EV, Tigor EV / Xpres-T and the Tiago EV scaled a new monthly high in June 2023 – 7,025 units – and helped grow the Q2 CY2023 total to 19,346 units, which constitutes robust 105% YoY growth (Q2 CY2022: 9,446 units).

Mahindra & Mahindra

June 2023: 32,588 units – up 21% YoY, up 0.90% MoM

Jan-June 2023: 199,567 units – up 32%

Mahindra & Mahindra, which is the OEM with the strongest SUV portfolio, sold a total of 32,588 units – 32,585 SUVs and 3 e-Veritos in June, up 21% YoY (June 2022: 26,880 units). June was the fourth month in a row this year that M&M sales have surpassed the 32,000-unit mark, with the best monthly performance in first-half CY2023 coming in March: 35,997 units. The year had opened with 33,040 units in January and 30,358 units in February.

First-half CY2023 sales, at 199,567 units, are up a strong 32% YoY (January-June 2022: 151,540) and 59.55% of full-year CY2022’s 335,088 units. With most of its models, especially the flagship XUV700, Scorpio N, Thar, XUV300, Bolero and the all-electric XUV400, witnessing strong demand, expect M&M to up the ante in the coming months as it ramps up production.

The company has already expanded its SUV manufacturing capacity from 29,000 units per month to 39,000 units in December 2022 and plans to further increase it to up to 49,000 units in the current financial year or 600,000 units per annum.

Kia Motors India

June 2023: 19,391 units (est) – down 19% YoY, up 3.3% MoM

Jan-June 2023: 136,108 units, up 12% YoY

While Kia India was yet to release its June 2023 wholesales numbers for June (as of July 4 8pm), extrapolating numbers from Kia Corp’s announcement that Kia India had clocked its best-ever first-half-year sales of 136,108 units, provides a number – 19,391 units. This is 19% down YoY on June 2022’s 24,024 units. Put that June 2023 decline down to buyers holding on to their purchase decision to buy the new Seltos, launched on July 4.

Toyota Kirloskar Motor

June 2023: 18,237 units – up 11% YoY, down 4.41% MoM

Jan-June 2023: 97,816 units, up 31% YoY

Toyota Kirloskar Motor (TKM), which is riding a fresh and sustained wave of demand for its cars, SUVs and MPVs, has registered domestic market wholesales of 18,237 units in June 2023, an increase of 11% (June 2022: 16,495 units).

Month-on-month, sales are down 4.41% on May 2023’s 19,079 units, which was the company’s best-ever monthly performance, when combined with export sales. TKM’s June numbers are its third-best monthly sales in the year to date after May’s 19,079 units and March 2023’s 18,447 units.

In terms of the quarter-wise performance, Q2 CY2023 (April-June 2023) sales of 51,212 units are up 24% year on year (April-June 2022: 41,423 units), and 10% better than Q1 CY2023 (January-March 2023: 46,604 units).

Half-year-wise, TKM has delivered stronger numbers: January-June 2023 wholesales of 97,816 units are up 31% on January-June 2022’s 74,583 units.

Commenting on the June sales, Atul Sood, Vice-President of Sales and Strategic Marketing, TKM, said: “Ever since the launch of Urban Cruiser Hyryder and Innova Hycross, we are witnessing continued high acceptance by our customers. These along with a consistent performance by the entire product portfolio – Camry Hybrid, Fortuner, Legender, Vellfire, Glanza and the newly introduced Hilux – are enabling us to sustain the positive performance.”

What has helped TKM cater to growing demand is the company having commenced a third shift at its Bidadi plant in Karnataka from May 2023. This move has helped ramp up production by an estimated 30 percent.

MG Motor India

June 2023: 5,125 units – up 14% YoY, up 2.39% MoM

Jan-June 2023: 29,038 units – up 21% YoY

MG Motor India has reported retail sales of 5,125 units, which represents 14% year-on-year growth (June 2022: 4,504 units) and a marginal 2.39% increase over May 2023’s 5,006 units.

While the cumulative April-June 2023 sales of 14,682 units are a sizeable year-on-year increase (Q2 CY2022: 10,520 units), Q2 CY2023 sales are up 2.25% on Q1 CY2023’s 14,358 units. MG Motor India’s June sales are its second-best monthly numbers in the first six months of this year, after the 6,051 units in March 2023.

In its statement, the company, which has its plant at Halol in Gujarat, said: “Supplies were disrupted in the wake of cyclone Biparjoy though customer demand should now gain momentum following the monsoons as India gears up for a long festive season.

Among the highlights of June was the carmaker bagging an order for 500 units of the MG ZS EV from BluSmart, the Gurugram-based EV ride-hailing service and charging infrastructure operator. Last month also saw the launch of the StudioZ AR/VR experience centre in Chennai, designed to enhance the sales experience.

New models to liven up the market in H2 CY2023

With six months left in 2023 and monthly growth moderating to single digits, PV manufacturers could be looking at slower growth in the monsoon season before numbers turn livelier in the festive months before the year comes comes to a close. While demand in the entry level hatchback market remains tepid, it is much better in the mid-level and premium hatchback segment and consumer demand for CNG-powered PVs is also on the upswing. The few OEMs, which have electric cars and SUVs, are also seeing demand grow month on month.

India Passenger Vehicle Inc currently has an estimated order backlog of over 750,000 units, most of them with Maruti Suzuki (390,000 units and 50% of them SUVs), Mahindra & Mahindra (292,000 units at the beginning of June), and Toyota Kirloskar Motor (over 100,000 units). With sustained demand for SUVs, assembly lines at most OEMs are humming with activity as OEMs ramp up production. A couple of them – Maruti Suzuki and M&M – continue to be impacted by insufficient supply of chips that go into electronic components.

There continues to be robust demand for new models which has contributed to the positive momentum in the market. July, with the launch of the facelifted Seltos, Hyundai Exter and Maruti Suzuki Invicto, should prove to be a sales accelerator in the second half of CY2023.

ALSO READ:

EV sales in India charge past 700,000 units in first six months of 2023

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

05 Jul 2023

05 Jul 2023

13697 Views

13697 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau