Scooters power two-wheeler sales to 9.23% YoY growth in April-July 2017

Consistently growing demand for gearless scooters, both from urban and rural India, is setting the foundation for strong sales in the ongoing fiscal.

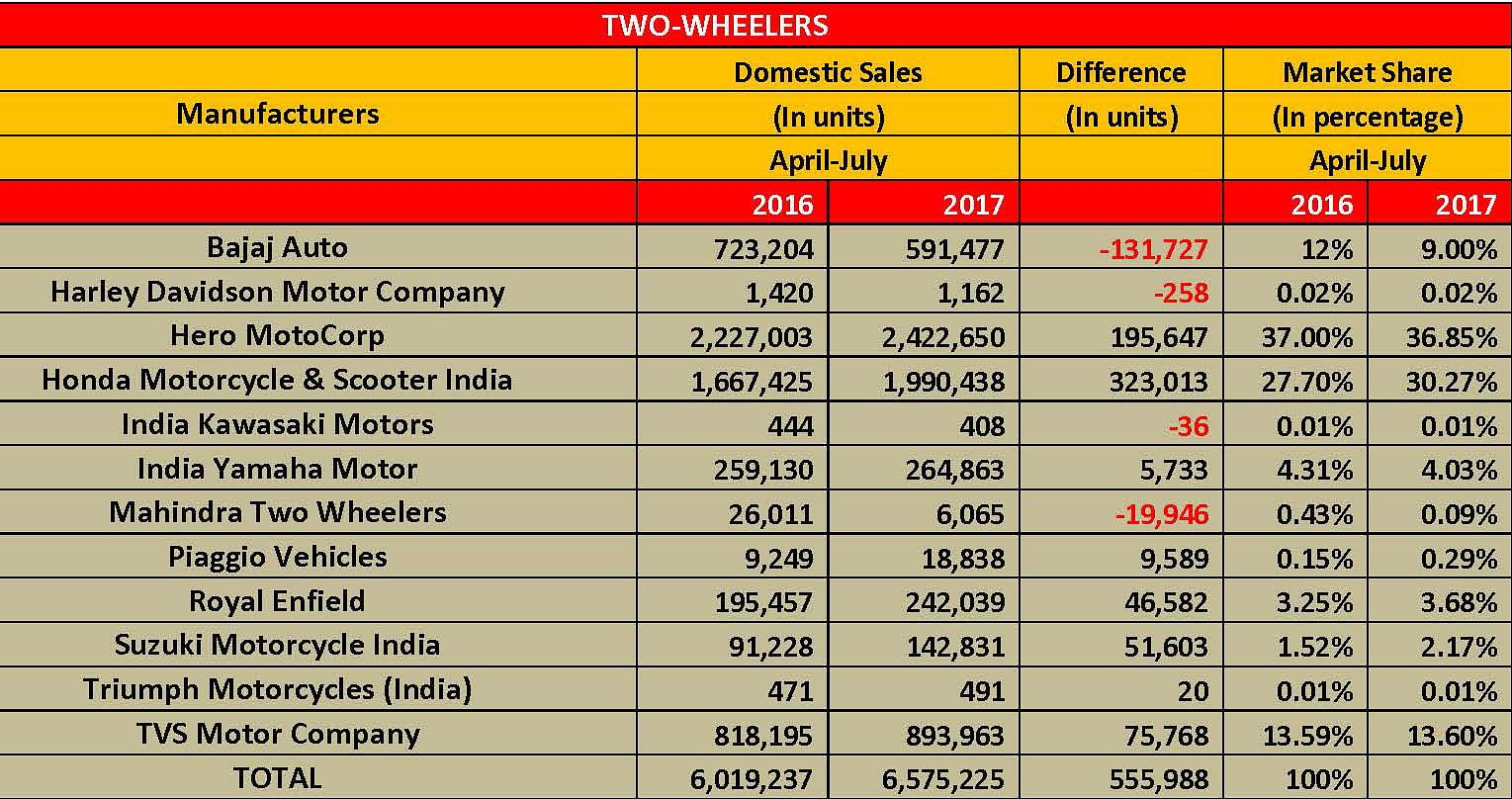

The two-wheeler industry is headed for a good ride in the ongoing fiscal year. For the April-July 2017 period, total sales have increased from 6,019,237 units in April-July 2016 to 6,575,225 units, up 9.23 percent YoY.

Barring Bajaj Auto and Mahindra Two Wheelers in the commuter segment and Harley-Davidson India and India Kawasaki Motors in the premium segment, all the other companies have reported YoY growth.

Honda Motorcycle & Scooter India (HMSI) stands out as the biggest volume gainer. The second largest player in the domestic two-wheeler industry, after Hero MotoCorp, gained additional volumes of 323,013 units over year-ago sales, reflecting gowth of 19.37 percent. The company’s share in the total domestic market has increased from 27.70 percent (April-July 2016) to 30.27 percent for April-July 2017.

Hero MotoCorp, India’s largest two-wheeler manufacturer, is the second largest gainer in terms of additional volumes. It gained 195,647 units above the 2,227,003 units sold during April-July 2016, which is a growth of 8.78 percent YoY. However, the company has witnessed a marginal decline in its market share from 36.99 percent (April-July 2016) to 36.84 percent.

The country’s third largest two-wheeler player, TVS Motor Company has reported sales of 893,963 units during April-July 2017. This marks a YoY growth of 9.26 percent. Given that TVS Motors’ growth is nearly the same as that of the overall two-wheeler market, its market share during the four-month period for the last fiscal as well as for the ongoing fiscal remains the same.

Bajaj Auto is the only company of its scale in the domestic market that has reported negative results. The company has seen its volumes decline from 723,204 units (April-July 2016) to 591,477 units in April-July 2017. This marks a YoY decline of 18.21 percent. This also reflects in Bajaj Auto’s market share, which has dropped from 12.01 percent (April-July 2016) to 8.99 percent in April-July 2017.

Suzuki Motorcycle India and Royal Enfield are the other two sizable volume gainers for the four-month period this fiscal. While Suzuki reported a YoY growth of 56.56 percent, Royal Enfield recorded 23.83 percent growth in its volumes during April-July 2017.

India Yamaha Motor, which failed to grow with the market momentum during the said period, has reported a decline in its market share from 4.30 percent in April-July 2016 to 4.02 percent during the same period this year. Notably, Yamaha has grown by 2.21 percent YoY during this four-month period (in 2017) as against the two-wheeler industry’s growth of 9.23 percent.

Scooter market notches 18.16 percent YoY growth

The fast-growing scooter segment has recorded YoY growth of 18.16 percent during April-July 2017, which saw total domestic sales of 2,217,499 units. Honda undoubtedly is the largest volume gainer with additional sales of 211,326 units, a YoY growth of 19.10 percent.

Honda’s market share in the scooter category has increased from 58.95 percent (April-July 2016) to 59.42 percent in April-July 2017. This is expected to further increase as Honda plans to roll out its most affordable scooter model – 110cc Cliq across several rural markets in the coming days.

TVS Motor Company is the second largest volume gainer in this segment, selling 338,723 units including additional sales of 90,214 units and growing market share from 13.24 percent to 15.27 percent YoY. TVS has planned new model launches, which includes a new scooter, in the coming months. Therefore, it is understood that it will look to consolidate its market share in the scooter category going forward.

The third largest volume gainer is Suzuki, which has sold 118,037 units in April-July 2017, adding 47,211 units to its April-July 2016 sales of 70,826 units. Suzuki’s share has grown from 3.77 percent to 5.32 percent in the scooter market.

Yamaha, on the other hand, has lost market share which has declined from 7.47 percent to 6.43 percent in April-July 2017. This can be attributed to its near-flat growth in a fast-growing market.

Piaggio Vehicles is continuing to fare well with steadily increasing sales. Its Aprilia brand is catching favour with young scooter customers as the SR150 is increasingly seen on the roads now. The company, which manufactures and retails scooters under the Vespa and Aprilia brands in India, has reported sales of 18,838 units in April-July 2017, up by 103.67 percent, albeit on a low base.

The company has planned another scooter, likely to be a 125cc model, under its Aprilia brand in near future. This clearly indicates that the two brands will continue to gain volumes as Piaggio looks at increasing its production capacity at its manufacturing plant in Baramati, near Pune.

Hero MotoCorp is the only major scooter manufacturer which has reported a decline during the said period. The company reported sales of 277,159 scooters, down by 2.17 percent YoY. Just like TVS, Hero MotoCorp too is planning to roll out several new models, which includes new scooters and motorcycles. The company is understood to be planning an aggressive assault in the scooter segment in the months to come.

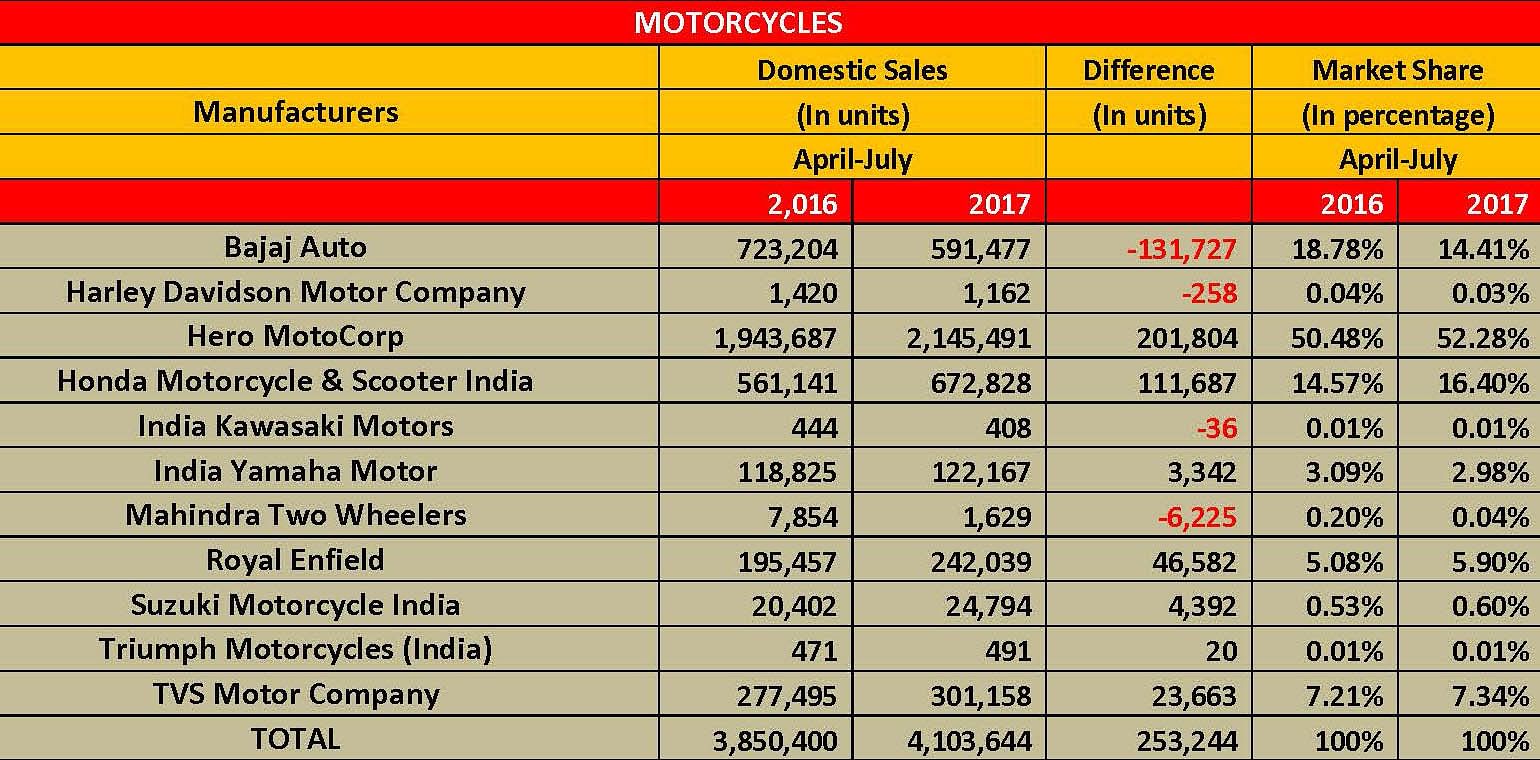

Motorcycles grow by 6.57 percent YoY

Hero MotoCorp remains the dominant player in the motorcycle segment with its market share increasing from 50.48 percent (April-July 2016) to 52.28 percent in April-July 2017. The company has added 201,804 units of new sales to its April-July 2016 sales of 1,943,687 units. The company has reported growth of 10.38 percent YoY in the motorcycle segment, which is its strong domain.

Honda, which has overtaken Bajaj Auto to become the second largest player in the domestic motorcycle market, has sold 672,828 units during April-July 2017 (up by 19.90 percent YoY). As a result, its market share has increased from 14.57 percent to 16.39 percent in April – July 2017.

Bajaj Auto, the third largest motorcycle player, has reported a decline of 18.21 percent YoY. This has impacted its market share, which has dropped from 18.78 percent to 14.41 percent during April-July 2017.

TVS Motor continues to move steadily with YoY growth of 8.53 percent in its motorcycle sales (for April-July 2017). As a result, it is witnessing its market share rising from 7.20 percent to 7.33 percent during the same period.

Royal Enfield, which is the fifth largest motorcycle company in the domestic market, has reported a market share of 5.89 percent.

India Yamaha, Harley-Davidson and Kawasaki are among the other companies that have recorded declines in their respective market share in the motorcycle segment. On the other hand, Suzuki and Triumph Motorcycles have sold additional volumes over their respective April-July 2016 sales. While the Gixxer family is driving the motorcycle sales for Suzuki, Triumph has been consistent in rolling out new premium models along with opening new stores to drive its growth in India.

The coming months before and after the festive season will be interesting as almost all major two-wheeler companies have scheduled new product launches. The fast-growing scooter segment will continue to see deeper penetration in to the rural pockets, as the motorcycle industry now appears to be growing higher in the value chain in terms of bigger engines and premium features than sheer numbers.

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

16 Aug 2017

16 Aug 2017

15689 Views

15689 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal