Made-in-India car, 2- and 3-wheeler exports notch 73% growth in April-October

With key global export markets opening up, Indian OEMs are making the most of a surge of demand and shipped over 3.2 million units between April-October 2021.

Even if the passenger vehicle and two-wheeler sales in October 2021, down 27% and 25% respectively, were not exactly what Indian OEMs would have liked in a festive month, they would surely be smiling at the robust exports made-in-India vehicles have notched in the first seven months of FY2022.

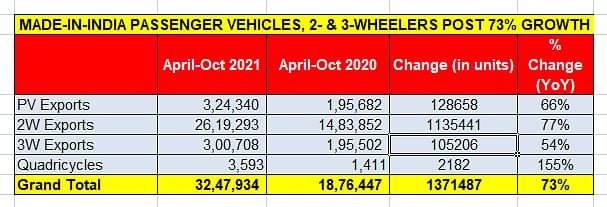

As per apex industry body SIAM, which released the latest sales statistics yesterday, cumulative exports of made-in-India passenger vehicles, two-wheelers, three-wheelers and quadricycles crossed the 3.2 million mark between April-October 2021. At 32,47,934 units, this constitutes handsome 73% year-on-year growth (April-October 2020: 18,76,447), indicating that with the opening up of key global markets, export-led growth is back for India Auto Inc. Let’s take a closer look at the segment-wise performance.

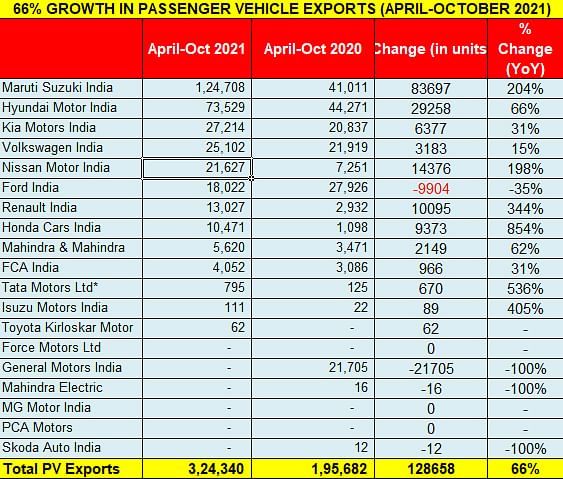

Car exports: 324,340 units / 66% YoY

With total shipments of 324,340 units, PV exports are a strong 66% year-on-year increase (April-October 2020: 195,682 units). Leading the charge is market leader Maruti Suzuki with 124,708 units, which marks solid 204% YoY growth and accounts for 38% of total made-in-India car exports. Expect the Baleno, S-Presso, Dzire, Swift, Vitara Brezza and Jimny to be top six models for the carmaker on the export demand front.

Hyundai Motor India, which wrested the No. 1 made-in-India passenger vehicle (PV) exporter title from Ford India in FY2020, and also took the title in FY2021, is at second position in the PV export rankings but behind Maruti Suzuki by 51,179 units at this stage. The top three export models for the company are the popular new Creta SUV (17,368 units), Grand i10, Verna sedan (16,927). And the company has just begun exporting the Alcazar SUV (1,465).

No. 3 is Kia India with 27,214 units, which gave the company 31% YoY growth. The company’s exports are led by the Seltos (17,992), followed by the Sonet (10,002). Kia has gone ahead of Volkswagen India which was third-placed till April- July 2021. VW India has, in the first seven months of FY2021, shipped 25,102 units which includes the Vento sedan (17,814) and the Polo hatchback (7,288) to register 15% YoY growth.

Nissan Motor India has posted strong growth with 21,627 units, up 198% (April-October 2020: 7,251) with demand mainly for the Sunny sedan (15,665)and the Magnite SUV and Go+ MPV contributing another 4,646 units.

Ford India, which has pulled out of the domestic India market but is continuing export operations, despatched 18,022 vehicles from Chennai Port. Its main export product was, as always the EcoSport SUV with 15,382 units, down 35% YoY. It is the sole OEM to be in negative territory.

Renault India is also seeing demand come its way. With 13,027 units, it clocked strong 300%+ growth albeit on a low year-ago total of 2,932 units. The Kiger-Triber combine with 7,347 units and the Kwid with 5,659 units were its main products for export markets.

For Honda Cars India, which registered 10,471 units in the period under review, the new City with 9,244 units was the star performer.

Two-wheeler exports: 26,19,293 units / 77%

The two-wheeler industry, which is witnessing slackened demand in the domestic market particularly for entry level products, is firing on all cylinders in the export market. Its performance in April-October is indicative of that – 26,19,293 units, up 77% YoY (April-October 2020: 14,83,852).

Powering the segment, not surprisingly, is Bajaj Auto with 12,91,085 units (up 56%) and accounting for 49% of total two-wheeler exports.

TVS Motor Co, India’s No. 2 exporter in this segment, registered a robust performance with 642,854 units (up 92%) and accounting for 24.54% of total exports. This means Bajaj Auto and TVS together command nearly 75% of India’s overall two-wheeler exports.

What’s heartening is that the export growth story is benefiting all the key players. While Honda Motorcycle & Scooter India (HMSI), which exported 212,817 units, posted 117% YoY growth, Hero MotoCorp despatched 176,806 units, posting similar 115% YoY growth. Look at the export sales table below and you will see that all players are seeing strong export sales.

All this is good news for India Two-Wheeler Inc. Judicious management of both domestic and export market sales helps inventory management as well as capacity utilisation. India Yamaha, Suzuki, Royal Enfield and Piaggio have all recorded smart export growth, and with export markets opening up in right earnest, things can only become better for the Indian two-wheeler industry.

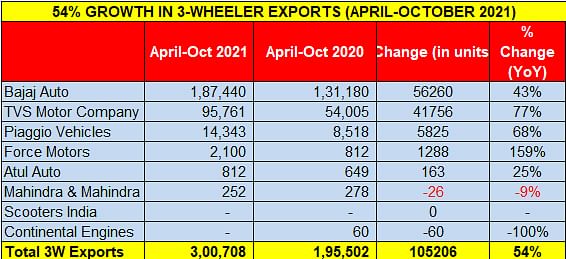

Three-wheeler exports: 300,708 units / 54% YoY

The three-wheeler industry is also making the best of the export demand coming its way. With total shipments of 300,708 units in the first seven months of FY2022, growth has been a solid 54% year on year.

The top two players in this segment are the same as in the two-wheeler segment: Bajaj Auto and TVS Motor Co. While Bajaj Auto with 187,400 units (up 43%) accounts for 62% of total exports, TVS with 95,761 units (up 77%) accounts for 32% of the export market share. At No. 3 is Piaggio Vehicles with 14,343 units (up 68%) has a 4.76% market share.

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

13 Nov 2021

13 Nov 2021

17424 Views

17424 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau