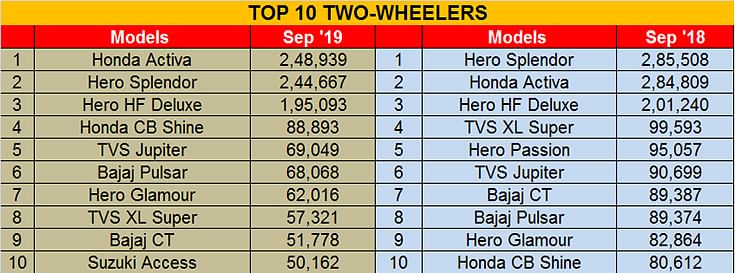

India’s Top 10 Two-Wheelers – September 2019 | Honda Activa pips Hero Splendor by 4,272 units

Considering Hero averaged daily sales of 8,150 Splendors in September, an extra day's work would have made the difference. The Activa-Splendor battle continues and how.

Even as the Indian IC engined two-wheeler industry, the biggest in the world, struggles for growth, and was down 22% year on year in September 2019, the no-holds-no-barred battle between between Hero and Honda, between motorcycle and scooter, continues. The fight to be big boss on two wheels continues between the Splendor and the Activa, both highest sellers in their respective segments.

While the two have regularly traded places at the top, in June the two were separated by barely 6,004 units, with the Hero being the Hero. Three months later, in September, they were separated by only 4,272 units, with the Honda Activa being the winner this time around. Considering both companies sold over 8,150 units every single day, the winning difference meant an extra half-day only!

Activa boss three months in a row, keeps Hero Splendor at bay

The Honda Activa family of scooters is the No. 1 two-wheeler in September with sales of 248,939 units. This performance is better than August's 234,279, July's 243,605 or June's 236,739, which means month on month, the Activa numbers are going up, albeit marginally. A clutch of new products is helping.

In end-May, the company launched the Activa 5G Limited Edition, with prices starting at Rs 55,032 (for the Activa 5G Limited Edition STD) and going up to Rs 56,897 for the Activa 5G Limited Edition DLX). More recently, in mid-September, Honda launched the BS VI Activa 125 – the new Activa 125 – its first BS VI-compliant two-wheeler – in three variants – Standard, Alloy and Deluxe. The Standard is priced at Rs 67,490, while Alloy and Deluxe cost Rs 70,990 and Rs 74,490, respectively (all prices, ex-showroom Delhi). It is powered by a 124cc engine which develops 8.1hp, a slight drop from the 8.52hp on the outgoing model. However, while the BS IV model uses a carburetted engine, the one on the new BS VI Activa is fuel injected.

For the April-September 2019 period, Honda has sold a total of 13,93,256 Activas, down a sizeable 22% YoY (H1 FY2019: 17,86,687), which is also reflected in the scooter segment's H1 sales being down by 16.60% YoY, what with the Activa being the market leader.

The Hero Splendor family of commuter motorcycles recorded its best performance in four months. September's sales of 244,667 units better August's 212,839, July's 178,907 and June's 242,743. The Hero Splendor , whose iSmart variant recently became the country’s first BS VI-certified two-wheeler, remains a strong buy.

Like the Activa, the market slowdown has taken its toll on the Hero Splendor, which is a popular buy particularly in rural India, which is facing troubled times. In H1 FY2020, the Splendor's sales total 13,70,138 units, down by 18% YoY (H1 FY219: 16,70,562). With the motorcycle market leader faring this way, it's no surprise then that the bike sector's numbers for H1 FY2020 are down 23.29% YoY.

The Hero HF Deluxe maintains its No. 3 position with despatches of 195,093 units. While the month-on-month growth is not in the higher percentage, the fact is the commuter bike market is seeing a marginal uptick in sales month on month, despite rural India feeling the pressure of the slowdown.

The Honda CB Shine takes fourth place with sales of 88,893 units. Demand seems to be growing for this motorcycle and in a bid to increase sales, earlier this year, HMSI launched the CB Shine Limited Edition at Rs 59,083 for the drum brake model and Rs 63,743 for the disc brake variant.

TVS Motor Co's best-selling scooter and India's No. 2 scooter after the Activa, the TVS Jupiter, is at No. 5 rank. In an effort to rev up sales, the Chennai-based OEM has been busy launching a flurry of variants of top-selling models, and it looks like the move is working. In September, it launched the new Jupiter Grande, priced at Rs 62,346 (ex-showroom, Delhi). The Bluetooth console-equipped Grande becomes the most expensive one in the range, Rs 2,446 more expensive than the Jupiter Grande Disc SBT at Rs 59,900 and Rs 8,855 more than the standard Jupiter. This variant also gets feature functions like call and text notifications, an over-speeding alert, among other regular data, like the trip and odometer.

Bajaj Auto enters the Top 10 chart with the Pulsar range at No. 6 and 68,068 units. Bajaj Auto, which was the biggest market share gainer in FY2019 and at halfway stage in FY2020 is maintaining a strong position in both domestic and export sales, will be looking to up the ante in the coming months. In H1 FY2020, Bajaj Auto despatched a total of 445,841 Pulsars, which marks a 3.16% year-on-year growth for the company (H1 FY2019: 432,174).

At No. 7 is the Hero Glamour with 57,321 units. The 124.7cc motorcycle was once a strong buy in the market but the company will have to rethink strategy to help the executive commuter bike regain its glamour.

The eighth member of this Top 10 best-sellers' list for September is the toughie on two wheels which refuses to bow out in an era of fast-paced motoring: the TVS XL Super moped with 57,321 units. For H1 FY2020, the XL Super has 332,412 units to its credit, down 25% YoY but that's due to the distressed rural market demand. Earlier this year, TVS Motor Co, the sole moped maker in India confirmed to Autocar Professional that it will make its mopeds BS VI compliant. Not surprising, considering that the company has sold a total of 7.65 million mopeds in India over a decade and remains the most affordable form of mobility on two wheels.

The Bajaj CT entry level commuter motorcycle rides in at ninth place with 51,778 units. The CT, along with the Platina and Discover, has been instrumental in giving Bajaj Auto good traction in difficult market conditions.

Rounding off the Top 10 list is the Suzuki Access, the 125cc scooter which has single-handedly enabled Suzuki to increase its scooter market share to 10.97% in H1 FY2020 and contributed to its growth in two-wheeler market share to 3.77%. The Access 125 has turned out to be a game-changer for the company. This popular buy and Suzuki's best-selling scooter seems to be closing the gap with the Jupiter and is a consistent No. 3, after the Activa and Jupiter. On July 16, Suzuki launched a refreshed version, the Access 125 Special Edition (SE) equipped with a disc brake variant. It is powered by the same all-aluminium, four-stroke, single-cylinder 124cc engine which develops 8.7ps at 7000rpm and 10.2 Nm of torque at 5000rpm.

Will festive October, with Diwali in it, be the harbinger of improved times for the two-wheeler industry? OEMs are keeping their fingers firmly crossed.

Also read: Top 5 Utility Vehicles in September 2019

RELATED ARTICLES

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

20 Oct 2019

20 Oct 2019

35769 Views

35769 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau