India’s Best-Selling 2Ws in FY2019 | Activa beats Splendor by just 2,716 units in FY2019, Pulsar and CT100 shine

The battle between the arch rivals came down to a minuscule units? Will the tables be turned in FY2020?

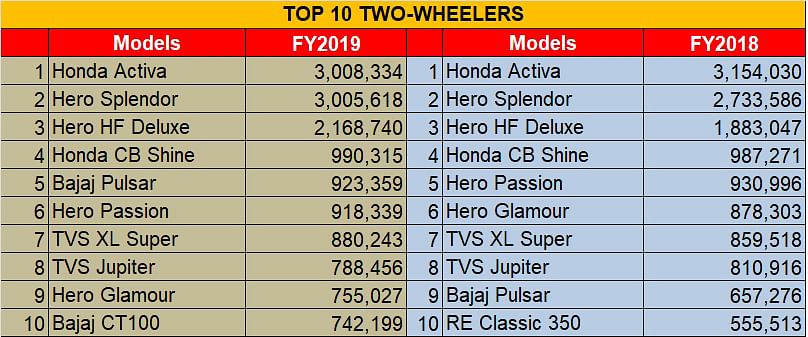

The Honda Activa has once again won the battle to be India’s best-selling two-wheeler. In FY2019, the popular scooter sold a total of 3,008,334 units, barely 2,716 units ahead of the hard-charging and arch rival Hero Splendor, which sold 3,005,618 in the past 12 months. If March had one day more in it, the Hero commuter motorcycle would have gone ahead considering the Splendor averaged daily sales of 8,234 units in FY2019. The fact of the matter is that the Activa has won. But will it in FY2020?

The question is because sales of the Honda Activa are slowing while those of the Hero Splendor are rising. In March 2019, the Activa sold 148,241 units, down 28 percent YoY (March 2018: 207,536) while the Splendor sold 246,656 units last month, down 6 percent YoY but beating the Activa in monthly sales for the seventh straight month.

In FY2018, the Activa had sold a total of 3,154,030 units, which means its FY2019 sales are down 4.6 percent year on year. In comparison, the Splendor had sold 2,733,586 units in FY2018, which translates into 9.95 percent YoY growth. Both products are standout performers for their companies and the industry. For their sheer dominance of the market, together (6,013,952 units) they account for 28 percent of India’s overall two-wheeler market (FY2019: 21,181,390). In fact, the reduced sales of the Honda Activa impacted the overall scooter segment which was the only one to be in negative territory: 6,701,469 units (-0.27%) in FY2019.

At No. 3 and strongly placed at that is the Hero HF Deluxe with 2,168,740 units, which posted 15 percent YoY growth (FY2018: 1,883,047). The 100cc mass commuter motorcycle is benefiting from sustained buying in the marketplace. With the Met predicting a normal monsoon this year, expect to see the HF Deluxe recording stronger numbers in the coming months. According to Hero MotoCorp, the HF Deluxe is seeing an uptick not only sold in the rural and semi-urban markets, but is also witnessing demand in urban India. After all, fuel-sipping two-wheelers are always high up on consumer demand list.

Honda's CB Shine rides in at No. 4 with cumulative sales of 990,315, 9,685 units short of the million mark, a tad over the 987,271 units sold in FY2018.

The big growth achiever in FY2019 is the Bajaj Pulsar family of motorcycles. With total sales of 923,359 units, the Pulsar brand notched handsome 40.48 percent YoY growth (FY2018: 657,276). This sterling performance pushes up the sporty bike from ninth place in FY2018 to fifth place in FY2019. How important the brand is to Bajaj Auto can be gleaned from the fact that it accounted for 36 percent of the company's overall motorcycle sales of 2,541,320. It was among the prime growth drivers for the company and helped Bajaj increase its two-wheeler market share from 9.78 percent in FY2018 to 12 percent in FY2019. This 2.22 percentage-point increase is the highest by a two-wheeler OEM in FY2019. Within the pure motorcycle segment too, Bajaj Auto is the biggest gainer. The company has grown its market share from 15.65 percent in FY2018 to 18.69 percent in FY2019.

The rejig in the Pulsar line-up has evidently fetched good results to the company as the brand has averaged monthly sales of 76,946 units in FY2019, with accelerated demand coming from the new models in the Pulsar range such as the Classic 150 and Twin Disc 150.

At No. 6 is the Hero Passion which is not going out of fashion in a hurry albeit it could do better. While it has slipped one spot from FY2018, this commuter motorcycle sold a total of 918,339 units in FY2019 (-0.82%), averaging monthly numbers of 76,5238 units. Some years ago, the Passion used to sell more than 100,000 units per month. The absence of a clear differentiation in brand perception of the Passion, Splendor and the HF Deluxe within Hero MotoCorp’s motorcycle portfolio seems to have impacted numbers. Secondly, the rise of the HF Deluxe has cannibalised the prospects of the Passion brand in the domestic market along with the usual cut-throat market competition. But the Passion’s return ride to the higher rung of the Top 10 seems to have begun.

The never-say-never spirit of the TVS XL Super moped is seen at No. 7 spot. At 880,243 units sold in FY2019, this moped is alive and kicking, growing 2.41 percent YoY (FY2018: 859,518). But will it be able to weather the BS VI storm that's barely 11 months away?

The second scooter in the Top 10 two-wheelers list is the TVS Jupiter, which is also the second best-selling scooter in India after the Activa. At 788,456 units sold in FY2019, it is down 2.7 percent YoY. Nonetheless, the 110cc scooter remains a strong sales contributor to TVS Motor's overall numbers and helped the company expand its scooter market share to 18.52 percent.

The Glamour is the fourth Hero MotoCorp motorcycle in the bestseller list. At 755,027 units, it is No. 9 on the list but in the span of a year it has slid three spots and is down 14 percent on YoY growth. Unless Hero decides to do something to rev up sales, this product could keep losing its glamour.

Rounding off the Top 10 is the big surprise of the year: the Bajaj CT100. At 742,199 units sold in FY2019, this commuter bike has notched astounding 59 percent YoY growth (FY2018: 466,889). The CT100, along with sibling Platina (which sold 626,781 units / +44%) helped Bajaj register an absolutely solid performance in the domestic market in FY2019.

Growth outlook for FY2020

So, how does the two-wheeler industry foresee sales trends for the new fiscal? As per apex industry body, motorcycle-scooter-moped sales are estimated to achieve 5 to 7 percent YoY growth in FY2020. Nonetheless, given the likely frenetic buying by consumers ahead of the BS VI emission norms implementing on April 1, 2020, when two-wheeler prices will be up by around Rs 7,000 to 10,000 or more, depending on the model, February and March 2020 should give overall industry numbers a huge boost. After FY2019's sales of 21.18 million units, Autocar Professional would hazard an estimate of 23.72 million units or a 12 percent YoY growth, fingers firmly crossed.

Also read: India's best-selling PVs in FY2019 | Maruti Alto pips Dzire by 5,542 units to be No. 1

India's Best-Selling UVs in FY2019 | Gap between leader Vitara Brezza and rival Creta narrows

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

17 Apr 2019

17 Apr 2019

20838 Views

20838 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau