In India’s growing CV market, OEMs protect their turf

The CV industry is expected to grow during FY2016-17 largely driven by replacement demand, increased infrastructure spend in the country and partial lifting of the ban on mining activities.

After posting double-digit growth in FY2015-16, overall commercial vehicle sales in the first two months of the ongoing fiscal year have maintained the growth curve. At 110,924 units, they are up 17.11% on April-May 2015’s 94,713 units.

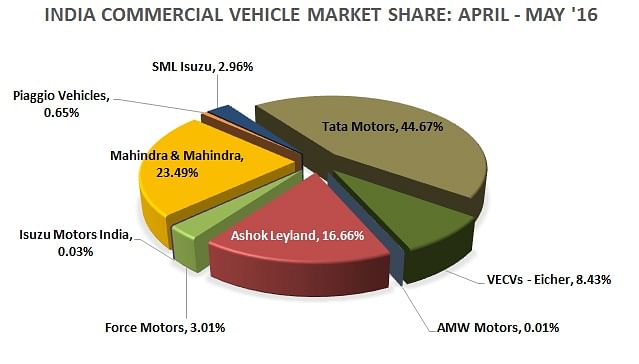

All the players seem to be safeguarding their turf. In the overall CV segment, Tata Motors maintains its leadership with a market share of 44.67%; the company sold 49,554 units as against 42,446 units in April-May 2015.

Mahindra & Mahindra, which has a smaller presence in the heavy commercial vehicle segment, managed second position due to its strong hold in the small commercial vehicle segment. It garnered a market share of 23.49 % with sales of 26,056 units against 22,736 units in April-May 2015.

Ashok Leyland, on the back of higher sales of M&HCVs, registered strong growth during FY2015-16. With a market share of 16.66% in April-May 2016, the Chennai-based company ranks third with sales of 18,484 units during April-May 2016.

Meanwhile VE Commercial Vehicles, despite strong competition, has been penetrating the market rather well over the last few years. Backed by its innovative products and value-for- money proposition, it has boosted its presence in the medium duty segment. However, it is now looking to tap opportunities in the heavy duty segment and has recently launched the 6037 rigid trucks. In the first two months of FY2015-16, the company holds an 8.43% market share by selling 9,346 units.

Force Motors sold 3,339 units to have a market share of 3.01% and SML Isuzu has 2.96% by selling 3,279 units.

The medium and heavy commercial vehicle (M&HCV) good carrier segment, the largest in the terms volume and value and most competitive with domestic and foreign players and heavy discounts on offer, Tata Motor is still clearly dominate the segment with more than half the market share. The first two months of this fiscal, Tata Motors has market share of 55.64%.

Ashok Leyland which second largest player in the segment has long way to go before come close to Tata Motors, the company commands 27.69% markets share in the segment. Interestingly, both the two domestic players still have over 80 percent share in the segment despite other OEMs aggressively trying to challenge their dominance.

VECV has 12.67% market share in the category and trying to expand product range to gain market share. M&M which has less than 2% markets share in the category is appear aggressive of its plan to grow in the segment, the company has launched new BS IV Blazo range of HCVs with promise of higher fuel economy.

In the M&HCV passenger carrier segment Tata Motors is still market leader with 34.86%, while Ashok Leyland up close with 32.98% market share as the company has greater offering in the segment, this is followed by VECV 15.02% and M&M4.46% market share respectively.

The CV industry is expected to grow during FY2016-17 largely driven by replacement demand, increased infrastructure spend in the country and partial lifting of the ban on mining activities. However, the M&HCV segment which grew 30% last year will likely see its growth rate fall to 10-15 percent. The once-struggling LCV segment is expected see new growth at 10-12 percent.

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

By Kiran Bajad

By Kiran Bajad

19 Jun 2016

19 Jun 2016

16245 Views

16245 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau