India auto sales up 13.4% in Q1, but sagging exports a worry

All vehicle segments are in the black and even the LCV segment, which had seen over two years of declining sales, is witnessing a turnaround now.

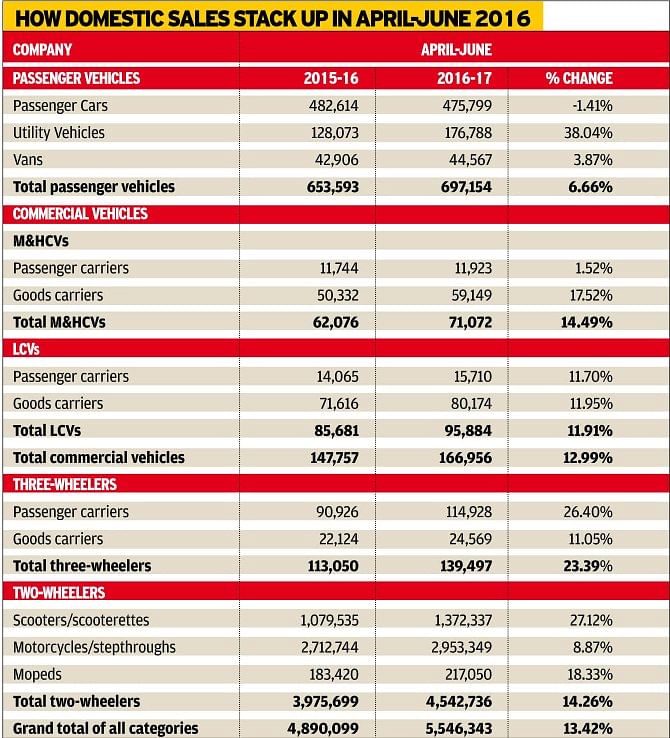

As per the cumulative production, domestic sales and export numbers revealed by the Society of Indian Automobile Manufacturers (SIAM), today, overall domestic sales across vehicle categories, during the first quarter of 2016-17, have notched 13.42% year-on-year growth.

Importantly, all vehicle segments are in the black and even the LCV segment, which had seen over two years of declining sales, is witnessing a turnaround now.

The utility vehicle (UV) segment, which has seen a number of new launches in the recent past, has posted a sterling growth of 38.04% with sales of 176,788 units in the first three months of the fiscal year. Sales in the passenger car segment (475,799 units) though have seen a decline of 1.41%, possibly with some buyers migrating to UVs. Vans sales meanwhile continued to grow by 3.97% and stood at 44,567 units. Overall the passenger vehicle sector – cars, UVs and vans – managed a YoY Q1 growth of 6.6%.

Also read: Selling MPVs in India is no child's play

The overall commercial vehicles segment (M&HCVs and LCVs) registered a growth of 12.99% in April-June 2016. While Medium & Heavy Commercial Vehicles (M&HCVs) registered 14.49% growth (71,072 units) thanks to growing demand from the infrastructure and mining sectors, growth has also filtered down into the Light Commercial Vehicle (LCV) sector, growing by 11.91% during April-June 2016 (95,884 units).

Meanwhile, three-wheelers sales grew by 23.39 percent in April-June 2016 (139,497 units), comprising 114,928 passenger carriers (+26.40%) and 24,569 goods carriers (+11.05%).

The advent of a strong monsoon this year has augured well for the two wheeler industry. In Q1, 2016-17, a total of 4,542,736 two-wheelers were sold, which translates into 14.26% YoY growth. Within the two-wheeler segment, scooters, motorcycles and mopeds grew by 27.12%, 8.87% and 18.33%, respectively in April-June 2016 over April-June 2015.

Slowing exports

Despite the growth in domestic sales, the automotive industry saw a significant decline in the overall exports during Q1. Slowing growth in the passenger car segment (0.7%) and the double-digit decline in motorcycle exports (10.6%) hit the overall performance. Three wheeler exports also reported a sharp fall of 46.6% during the quarter.

According to SIAM, Indian automakers have been impacted due to the withdrawal of export incentives in important markets like Sri Lanka and Bangladesh. Currency fluctuations during the quarter have also weighed on margins during the quarter.

However, a sharp rise in export of UVs (91.7%) and vans (88.8%) provided some fillip to the otherwise weak performance.

Outlook

With the overall GDP growth for 2016-17 expected to improve to 7.9% and the settlement for the seventh pay commission in place now, the outlook for the Indian automotive industry remains positive.

According to the industry body, sales across passenger vehicle, commercial vehicles and two wheeler segments are likely to pick up in the coming months.

A likely favourable decision on the diesel ban along with a boost in consumer spending due to the seventh pay commission will augur well for PV sales.

“Seventh pay commission is expected to provide a boost to consumer spending which is expected to positively impact passenger vehicles. This is also expected to propel the replacement of cars bought 5 years back during the 6th pay commission,” the industry body said.

UV sales are likely to continue leading the growth in PV sales in the coming months, with manufacturers lining up more launches in the segment. However, sedan sales are likely to remain muted as customer preferences shift towards UVs.

In the CV segment, M&HCV’s are likely to continue growing at close to 20% in FY17 as replacement needs and the likely preponement of purchases to Q4 2016-17 due to the pan-India BS IV implementation by April 1, 2017, will fuel demand. Within the M&HCV segment, ICVs and tractor trailers are likely to garner most volumes.

The removal of mining ban and general pick up in infrastructure and construction-related activities will augur well for the tipper segment, SIAM said.

Passenger commercial vehicle segments will benefit from the growing demand for school buses and expected demand for about 1000 buses under JnNURM II, likely to come in by H2 FY17.

With the strong start to the monsoon season this year, demand for two-wheelers from the rural and semi-urban markets is set to go up in the near future. Pent-up demand due to poor rains in the last two years will also fuel growth in the motorcycle segment. The fund infusion due to the seventh pay commission is also likely to drive sales in the industry. Within the two-wheeler segment, scooters are likely to continue to dominate with a strong emphasis of manufacturers on new model launches and aggressive capacity expansion plans, SIAM concluded.

Recommended:

- India Sales Analysis: JUNE 2016

- India auto sales in May in slow growth mode, rural markets likely to pick up by August

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

By Autocar Professional Bureau

By Autocar Professional Bureau

11 Jul 2016

11 Jul 2016

8386 Views

8386 Views

Shahkar Abidi

Shahkar Abidi