India's Best-Selling UVs – April 2019 | Vitara Brezza maintains lead, Ertiga notches 42% growth

While both passenger cars and vans recorded a high double-digit decline in sales, demand for utility vehicles helped reduce the blow to some extent.

Utility vehicles, which have been the movers and shakers in the passenger vehicle industry for quite some time, have lately been seeing a rough patch filled with sales speedbreakers in the form of rising fuel prices, uncertainty in the longevity of diesel fuel and high acquisition costs.

Selling a UV over its hatchback or sedan sibling rings the profit bells for most car companies, but tough times seem to be coming up for OEMs. The UV segment, which was accelerating at over 20 percent by end-FY2018, came down crashing this March to a meagre 2 percent with people becoming conscious of the drinking habits of these heavier machines in times of rising petrol and diesel prices in the country.

In April 2019, the overall PV segment clocked sales of 247,541 units (-17.07%), comprising 160,279 cars (-19.93%), 73,854 UVs (-6.67%) and 13,408 vans (-30.11%).

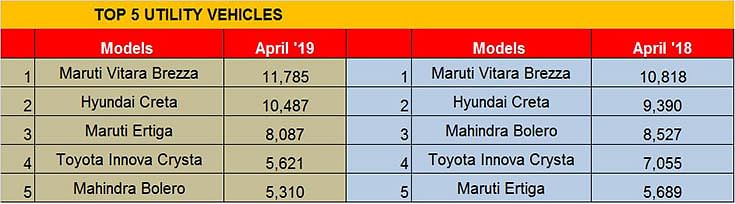

Quite surprisingly, while the demand for UVs should have picked up during the elections and their campaigning phase over the last two months, demand for big UVs, essentially the Toyota Innova and the Mahindra Bolero has shrunk significantly, with only the Maruti Vitara Brezza, Hyundai Creta and the Maruti Ertiga – all popular urban movers sustaining their sales even amidst a limping market. In a nutshell, where demand for the true-blue off-roaders was weak, it was compensated by the soft-roaders and the crossovers to take the total volumes garnered by the Top 5 UVs in April to 41,290 units, remaining flat to 41,479 units sold in April 2018. Here’s a closer look at the top performers last month.

At the No. 1 spot is the Maruti Vitara Brezza which went home to 11,785 buyers and maintained its lead in the UV segment with a 9 percent growth. The compact crossover had sold 10,818 units in the corresponding month last year. The diesel-only Vitara is under Maruti’s top focus to get a petrol transplant as the carmaker switches off the dirtier fuel entirely from April 2020 in the wake of BS VI emission norms.

The Hyundai Creta closely followed the Maruti at the No. 2 spot with the popular feature-loaded UV going home to 10,487 buyers, a 11 percent increase in its volumes (April 2018: 9,390).

The value-packed Maruti Ertiga rightly secured the No. 3 position and jumped two positions to garner cumulative sales of 8,087 units and registering growth of a staggering 42 percent (April 2018: 5,689).

The much-loved people-mover across fleet and private buyers, the Toyota Innova Crysta took a strong beating with the MPV recording 20 percent de-growth in its performance. Surprisingly, election campaigns didn’t bring a boost to the Innova’s sales which were pegged at 5,621 units (April 2018: 7,055) last month.

The Mahindra Bolero closed the tally at the No. 5 position, but dropping two positions from last year. The robust UV sold 5,310 units and also slumped 37 percent (April 2018: 8,527) like the Toyota, a dismal performance considering both have strong word of mouth going for themselves. With safety norms becoming stricter, Mahindra is said to be working on an updated version loaded with a driver’s airbag, seat-belt alert reminder and parking sensors on the Bolero.

Even as the demand might have slowed down, companies are not giving up on the UV format this easy. Hyundai Motor India has launched the new Venue compact SUV at a very aggressive starting priced of Rs 650,000, MG Motor India is set to introduce the Hector SUV in June, followed by Kia Motor India’s SP2i Concept. Will the UV space revive once more? We will keep a close watch.

Also read: India's best-selling Passenger Vehicles

RELATED ARTICLES

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

Mahindra Sells 600,000 SUVs in 11 Months of FY2026, Goes ahead of Tata Motors

Mahindra’s 600,004 SUV wholesales put it ahead by 34,809 units over Tata Motors’ 565,195 passenger vehicles in the first...

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

21 May 2019

21 May 2019

10682 Views

10682 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi