India Auto Inc sells record 2.85 million vehicles in November, 16 million in first eight months of FY2024

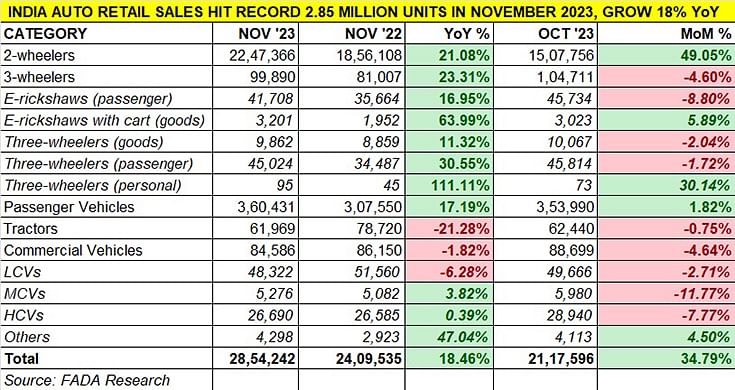

Automobile dealers sold 95,141 vehicles on each day of November 2023 to set a new monthly benchmark of 2.85 million units, bettering the previous best of 2.56 million units in March 2020 by 285,000 units. Two-wheeler and passenger vehicle segments record best-ever monthly sales.

As expected, November 20234 has delivered the goods for India Auto Inc. The month, whose first fortnight housed the last portion of the 42-festive season, recorded 28.54 lakh or 2.85 million vehicles were sold across the country, surpassing the previous best in March 2020 by 285,000 units. March 2020 had witnessed total sales of 25.69 lakh vehicles during the industry's transition from BS-4 to BS-6 emission norms.

Three vehicle categories were the big contributors to the big November total – two-wheelers with 2.24 million units (up 21%), three-wheelers with 99,890 units (up 23%) and passenger vehicles with 360,431 units (up 17%). Tractor sales (61,969 units) were down 21% and commercial vehicles (84,586 units) also down – by 1.82 percent.

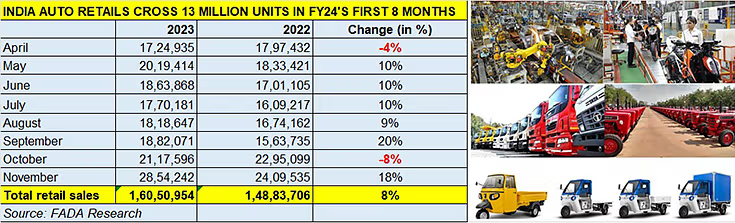

Cumulative sales for the first eight months of the current fiscal at 1,60,50,954 units or 16 million units are up 8% on April-November 2022’s 1.48 million units (see data table below)

Commenting on the best-yet November 2023 numbers, FADA president Manish Raj Singhania said, “November 2023 has become a historic month for the Indian auto retail industry. Apart from this, two-wheelers and passenger vehicles also created new records. The two-wheeler category sold 22.47 lakh vehicles, an increase of 177,000 vehicles compared to the previous high of March 2020 (20.7 lakh units). The PV category also sold 360,000, around 4,000 vehicles more when compared to previous high of October 2022 (357,000 units).”

He also pointed out that among the growth catalysts for India Auto Inc is the ongoing marriage season which has helped accelerate vehicle sales. Between November 23 through to December 15, India will witnessing around 38 lakh marriages, a period that typically sees high vehicle sales, especially in rural India.

Thanks to demand from rural India kicking in as well as the ongoing marriage season, November sales of two-wheelers soared to a record high.

Thanks to demand from rural India kicking in as well as the ongoing marriage season, November sales of two-wheelers soared to a record high.

Two-wheeler sales up 21% to best-ever 2.24 million units

The action is back in the two-wheeler segment as demand from rural India has begun to kick in again, bringing smiles to the motorcycle and scooter OEMs who have witnessed tepid sales for quite some time. November numbers for this segment were the best-ever for a month.

At 22,47,366 units in November 2023, on-ground sales were 391,258 units more than the year-ago 18,56,108 units. Importantly, what is a good indicator of sustained demand in upcoming 2024, November 2023’s sales were all of 49% or 739,610 units higher than October 2023’s 15,07,756 units.

According to Singhania, the two-wheeler category has been “buoyed by the festive excitement of Deepawali and enhanced by strong rural sentiments, thanks to thriving agricultural income. New product launches and better model supply further fuelled the market's growth, while electric vehicle sales demonstrated an encouraging upward trajectory.”

As reported a few days ago, November 2023 saw EV OEMs sell over 91,000 units, recording 19% YoY growth and in the processing registering record 11-month retails at over 780,000 EVs and 38% YoY growth. November EV sales are the best monthly numbers after the FAME subsidy was slashed in June by 25%. The e-two-wheeler industry is headed for record annual sales of over 850,000 units in CY2023.

Electric three-wheelers sold a total of 44,909 units, accounting for 45% of total sales of 99,980 units in November 2023.

Electric three-wheelers sold a total of 44,909 units, accounting for 45% of total sales of 99,980 units in November 2023.

EVs help three-wheelers maintain strong growth trajectory

The three-wheeler segment, which has been maintain double-digit growth, saw sales of 99,980 units in November, up 23%. Electric three-wheelers, comprising passenger-carrying and cargo-transporting models, are now a major force and sold a total of 44,909 units, accounting for 45% of total sales, albeit down marginally from the 46% they had in November 2022.

Interestingly, combined sales of diesel and CNG three-wheelers at 54,981 units rose 27% YoY (November 2022: 43,391 units) and accounted for 55% of total industry sales, compared to 45% a year ago.

SUVs surcharge PV sales to best-ever monthly numbers: 360,431 units

SUVs surcharge PV sales to best-ever monthly numbers: 360,431 units

Like the two- and three-wheeler categories, the passenger vehicle segment too has been firing on all cylinders albeit for much longer than them. In November 2023, car-SUV-MPV manufacturers sold a record 360,431 units, up 17% YoY (November 2022: 307,550 units) and also up 2% on a high 353,990 units sold in October 2022. Do the math – that’s 12,014 SUVs and MPVs sold on each day of November.

Expect SUVs to have contributed more than 50- to 54% of these sales what with the key UV players – Maruti Suzuki, Mahindra & Mahindra, Tata Motors, Hyundai Motor India and Toyota Kirloskar Motor – recording strong gains and powering November 2023 into the best sales month ever for the PV industry.

Singhania said: “November 2023 witnessed a strong surge in the PV category, primarily fuelled by Deepawali and the launch of new and appealing models. The improved supply chains, coupled with new launches, effectively catered to the festive demand, marking the peak point in sales. However, the period following the festivities saw a noticeable slowdown, coupled with a critical challenge of slow-moving inventory due to a mismatch in demand and supply which is still not resolved. This issue casts a shadow over the otherwise positive trends, highlighting the need for strategic adjustments in inventory management."

The FADA president however issued a call to OEMs to reduce PV inventory: “PV inventory has slightly reduced but continues to remain above 60 days. FADA urges PV OEMs to cut back on dispatches of slow-moving vehicles in the entry-level category and to announce extremely attractive schemes that will support year-end buying and help reduce inventory at dealerships.”

Challenging month for commercial vehicle industry

The commercial vehicle segment experienced a challenging November, driven by poor market sentiment. Singhania is of the opinion that “seasonal slumps, exacerbated by unseasonal rains damaging crops and impacting transport demand, coupled with liquidity issues and delayed deliveries, further strained the industry. States going into elections also added to the woes, overshadowing the brief uplift from festive sales and the slight increase in tourism that helped in sales of buses.”

What’s the near-term outlook?

In his near-term outlook commentary, Manish Raj Singhania said: “The two-wheeler industry is poised to benefit from a liquidity boost, particularly in agricultural regions and the ongoing marriage season, with around 38 lakh marriages expected to drive vehicle sales. However, challenges persist as severe weather conditions impacting rabi cultivation might affect rural incomes, potentially dampening sales. In contrast, the CV category is expected to see some recovery, driven by renewed business activities post-elections and positive movements in key sectors like cement and coal. Backlogs in orders might also contribute to a sales boost.”

“The PV sector shows potential for growth with year-end offers and discounts expected to stimulate sales, along with an improved vehicle supply and new product launches. However, the market faces hurdles in terms of a preference for 2024-manufactured vehicles and a notable slowdown in demand and bookings post festivities. The current PV inventory, still above 60 days, underscores the need for OEMs to strategically reduce dispatches of slow-moving vehicles, especially in the entry-level category. Historically, it is recognized that holding inventory beyond 30 days starts to erode dealer profitability as the financial burden is intensified by the high interest costs of inventory funding from financial institutions.”

He concluded by saying, “Overall, while opportunities exist in terms of new product launches and seasonal demands, Indian auto retail must navigate through a complex landscape of consumer preferences, high inventory in the PV category and external economic factors, including potential inflation impacts on vehicle sales in the near term.”

RELATED ARTICLES

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

TVS Sells 31,600 e-Scooters in February for a 28% Share; FY2026 to see 1.35 Million e-2W Sales

With 31,600 e-scooters, TVS commanded a 28% market share even as Bajaj Auto, Ather Energy and Hero MotoCorp witnessed st...

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

06 Dec 2023

06 Dec 2023

6320 Views

6320 Views

Ajit Dalvi

Ajit Dalvi