Electric two-wheeler sales surpass 91,000 units in November, record 11-month retails at 780,000 EVs

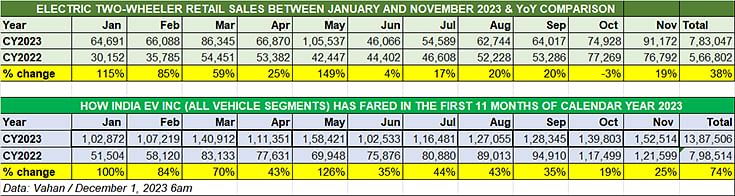

India’s e-two-wheeler retail sales story just got better. At over 91,000 units, November clocks best monthly numbers after the FAME subsidy was slashed in June; cumulative 11-month sales at 783,047 units make for strong 38% YoY growth; industry headed for record annual sales of over 850,000 units in CY2023.

As expected, November 2023, whose first fortnight comprised the end of the 42-day festive season in India, has delivered the goods in terms of sales of electric two-wheelers. At 91,172 units, as per the retail sales data available on the government of India’s Vahan website at 6am on December 1, November sales are up 19% on October’s 74,928 units (see data table below), making it the best month for the e-two-wheeler industry this calendar year after the FAME subsidy was slashed by 25% in June. May 2023, with 105,537 units, remains the best-ever month as a result of buyers rushing to buy e-two-wheelers before June 1.

November's 91,172 units make it the best month for the e-two-wheeler industry this calendar year after the FAME subsidy was slashed by 25%. This segment's share of total India EV sales was 56 percent in November 2023.

As many as 393,516 EVs have been sold since June 2023 at higher prices, followed the reduced FAME subsidy. It may be recollected that e-two-wheeler sales had crashed to an 11-month low of 46,066 units in June 2023 after the FAME subsidy was slashed by a fourth.

Cumulative sales for the first nine months of CY2023, at 783,047 units are 38% better than January-November 2022’s 566,802 units. In October 2023 itself, India E2W Inc had surpassed entire CY2022’s retail sales of 631,174 units. With 31 days of December still to go for calendar year 2023 to come to a close, it can be surmised that the Indian electric two-wheeler industry could close CY2023 with total sales likely to surpass 850,000 units, which translates into robust 35% YoY growth.

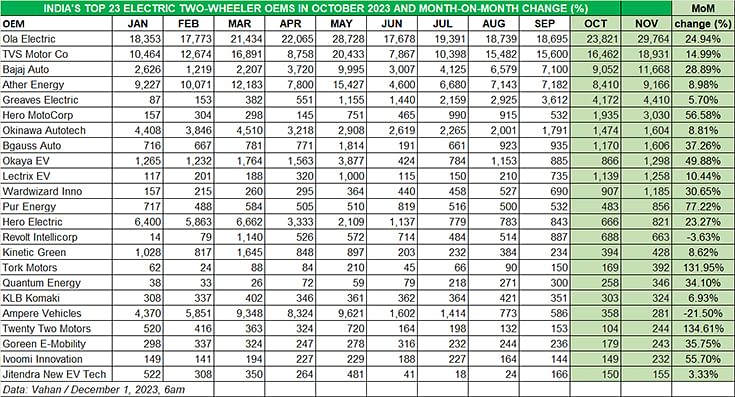

While Ola and TVS have been clocking sales in thousands each month for quite some time now, Bajaj Auto is the latest company to do so, having recorded its best-ever monthly sale of 11,668 units in November 2023.

OLA SELLS 29,764 UNITS, TVS' SHARE at 21%, BAJAJ AUTO AHEAD OF ATHER ENERGY FOR SECOND MONTH IN A ROW

A deep dive into the Vahan retail sales data reveals that of the 170-odd OEMs in India’s very competitive e-two-wheeler market, the top 10 EV makers have each sold more than 1,000 units each and cumulatively sold 83,920 units, accounting for 92% of the total sales in November 2023.

There are three EV OEMs – Ola Electric, TVS Motor Co and Bajaj Auto – with retail sales in five figures. While Ola and TVS have been clocking sales in thousands each month for quite some time now, Bajaj Auto is the latest company to do so, having recorded its best-ever monthly sale of 11,668 units in November 2023.

Market leader Ola Electric continues its dominance and how. At 29,764 units, its November sales are up 25% on October’s 23,821 units and the second-best in the year to date after May’s 28,728 units. The company’s market share has grown to 32% in November. What’s more, the company has clocked cumulative sales of 236,441 units in the first 11 months of 2023 and will easily cross the 250,000 mark for the year, making it the first OEM in India to do so. The company is benefiting from its refreshed S1 series of e-scooters and has already garnered over 75,000 bookings, so expect it to maintain the strong momentum in the months ahead.

Like Ola, TVS Motor Co too had recorded its second-best monthly sales in November – 18,931 units, which is a month-on-month growth of 15% and gives it a market share of 21%. Between January and November, TVS has sold 153,960 iQubes. In September, the iQube rode past the cumulative 200,000 sales milestone in 45 months since launch in January 2020. In August, the company had launched its new and premium EV flagship, the TVS X, priced at Rs 250,000, at a mega event in Dubai.

The industry’s eyes are on Bajaj Auto, which had gone past the longstanding No. 3 OEM Ather Energy in October. The legacy player, which entered the EV market in January 2020 (just like TVS), maintains its newly-claimed No. 3 rank with best-ever monthly sales of 11,668 units, up 29% month on month (October 2023: 9,052 units). Demand for the Chetak, Bajaj Auto’s sole electric scooter, is rising with every passing month, which has helped the company move from fourth rank to a new and strong No. 3. The Bajaj Chetak had a market share of 13% in November, quite a jump from the 4% it had in January 2023. The company is looking to ramp up production as well as expand its network of exclusive Chetak showrooms. Expect Bajaj Auto to be among the EV newsmakers in the months to come.

The Chetak network, which has a presence in 141 cities across India, is to be expanded top 250 cities by March 2024. Bajaj Auto is also gearing up to expand the Chetak range with new variants very soon. Autocar India has revealed that a likely more affordable Bajaj Chetak variant, called Chetak Urbane and positioned below the Chetak Premium that’s on sale currently, is in the works. .

In a media interaction in mid-October, Rakesh Sharma, executive director, Bajaj Auto, had said: "We will be launching a new model post-festive season under the Chetak family. Post that, every quarter you will see something new on Chetak every quarter. By the same time next year, we will have a decent portfolio and reach to grow the EV business.”

Ather Energy saw retail sales of 9,166 last month, up 9% on October’s 8,410 units, and currently has a 10% market share. On the cumulative 11-month sales front, Ather remains the strong No. 3 with 97,889 units compared to Bajaj Auto’s 61,298 units. It is also making moves to protect its turf from a hard-charging Bajaj Auto. On November 22, Ather co-founder Tarun Mehta officially confirmed via a social media post the launch of two new electric scooters – a family-oriented EV and an evolution of the existing 450X – in 2024. The new Ather could be tuned to deliver greater range and gentler performance and also likely be priced below the existing 450 range to make it accessible to a wider audience. “It's designed with your entire family in mind, offering comfort, ample size, and a whole lot more – all wrapped up in one fantastic package. We're ensuring it's affordable, making the Ather family experience accessible to more people,” said Mehta.

In fifth position is Greaves Electric Mobility which has delivered its best monthly performance – 4,410 units – in November, going ahead of the 4,050 units in October. Greaves’ sister EV arm, Ampere Vehicles is ranked 19th with November sales of 281 units. Combined sales of the two EV divisions would add up to 4,691 units, which still puts in fifth rank.

Hero MotoCorp, which is seeing a surge in demand for its ICE commuter motorcycles as a result of the rural market bouncing back, has delivered a strong showing in November, its best monthly sales yet. It has maintained its sixth rank ahead of Okinawa Autotech, selling 3,030 Hero Vidas and improving 56% on October’s 1,935 units.

Now ranked seventh, Okinawa Autotech’s sales of 1,604 units, up 9% on October’s 1,474 units but given that the company had opened CY2023 with 4,408 units in January, it is clearly feeling the heat of slowed-down sales and much increased competition.

Some of the other OEMs which recorded strong MoM growth include Bgauss Auto (1,606 units), Okaya EV (1,298 units), Lectrix EV (1,258 units), and Wardwizard Innovations (1,185 units).

ELECTRIC TWO-WHEELER INC SET FOR RECORD 850,000-PLUS SALES IN CY2023

While the sales momentum for the electric two-wheeler industry was expectedly robust in the festive months of October and November, expect numbers in the last month of the year to be somewhat less.

With cumulative January-November 2023 retails at a record 777,323 units and accounting for 56% of total EV sales of 13,78,300 units in India, the e-two-wheeler industry should be able to get near the 850,000 sales milestone for CY2023. What is helping this EV segment is greater availability of new products and also expansion of the electric charging infrastructure, both in the private and public sectors.

While the initial cost of an electric scooter or motorcycle remains higher than its petrol-engined sibling, what is making a growing number of riders make the transition to e-mobility is the wallet-friendliness of EVs in the long term.

There is also sustained demand for last-mile deliveries from urban India as well as town and country, which is acting as a sales catalyst for cargo-transporting electric two-wheelers and a number of EV manufacturers are benefiting from bulk orders.

It is also likely that in the absence of clarity about the FAME subsidy being extended beyond April 2024, personal EV buyers as well as fleet buyers could be advancing their purchases. This could translate into strong demand for EV OEMs in the first three months of CY2024.

EV sales soar to 139,000 units in October and 1.23 million in first 10 months of 2023

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

01 Dec 2023

01 Dec 2023

24537 Views

24537 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal