EV sales soar to 139,000 units in October and 1.23 million in first 10 months of 2023

Two- and three-wheelers continue to lead the charge in the transition to electric mobility, even as demand grows for electric passenger vehicles. October turns out to be third-highest-selling month for EV retail sales after May and March 2023; India EV Inc headed for 1.5 million sales this calendar year.

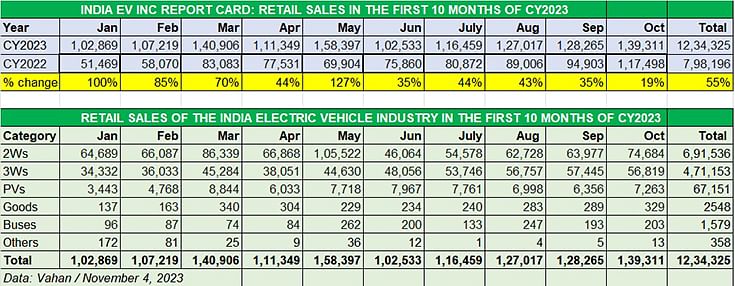

India’s electric vehicle growth story continued its charge in the festive month of October and should repeat, if not better, the same performance in November which has Diwali bang in the middle. Total EV industry retails for October, as per the Vahan website (at 5 am on November 4, 2023) were 139,311 units, up 19% (October 2022: 117,498 units). This makes October the third highest selling month after May 2023 (158,397 units) and March 2023 (140,906 units) in the current calendar year.

Cumulative EV industry sales, comprising the two- and three-wheeler, passenger vehicle and commercial vehicle sub-segments, for the first 10 months of 2023 are 12,34,325 units, which constitutes strong 55% year-on-year growth (January-October 2022: 798,196 units).

October was the 13th month in a row that India EV Inc has surpassed the 100,000-unit sales mark. Having first notched the milestone in October 2022 (117,200 units), the sales momentum continued in November (121,602 units) and December (105,003 units) last year and through each of the first 10 months of CY2023, hitting a high in May 2023 (158,397 units) when e-two-wheeler buyers rushed to buy EVs before the slashed FAME subsidy kicked in from June 1, 2023.

TWO- AND THREE-WHEELER INDUSTRY COMMANDS 94% OF THE INDIA EV MARKET

The volume drivers for the EV industry are the two ‘low-hanging fruits’ – two- and three-wheelers, which are the more affordable segments compared to electric cars, goods carriers or buses.

While electric two-wheelers (691,536 units) account for 56 % of the total EV sales in the January-October 2023 period, three-wheelers (471,153 units) have a 38.17% share of the India EV pie. A total of 67,151 electric cars and SUVs and also vans were also sold, which gives them a 5.44% share, with commercial vehicles comprising goods carriers and buses (1,579 units) getting a 0.12% share (see EV segment-wise retail sales data table above).

Electric two-wheeler industry sales in October, at over 71,000 units, made it the best month after the FAME subsidy was slashed in June. Cumulative sales for the first 10 months of CY2023, at 691,536 units are 41% better than January-October 2022’s 489,726 units.

This also means India e2W Inc has surpassed entire CY2022’s retail sales of 631,174 units, with two months left for the calendar year to come to a close. With the festive season continuing with Diwali and Dhanteras (in November), it can be surmised that the e2W OEMs could wrap up CY2023 with total sales in the region of 750,000 to 800,000 units, which translates into 18% to 25% YoY growth.

In October, Ola Electric maintained its dominance with a 31% market share, TVS Motor Co had 22%. Interestingly, Bajaj Auto sold 8,519 Chetaks to go ahead of Ather Energy, albeit the latter remains the strong No. 3 with cumulative 10-month sales of over 88,390 units versus Bajaj’s 49,077 units.

While the electric scooter and motorcycle segment leads in terms of sheer volumes, the rate of transition to zero-emission mobility is fastest in the three-wheeler market, where now every second product sold is an electric model. October as well as cumulative January-October 2023 retail sales are ample proof of that.

A total of 56,819 electric three-wheelers were sold last month, up 58% YoY (October 2022: 35,906 units). This segment has maintained a consistent growth trajectory, having opened CY2023 with 34,332 units and surpassing the 50,000-unit monthly sales mark for the first time in July with 53,746 units.

Combined sales of passenger-transporting e-rickshaws and cargo-carrying three-wheelers continue to witness strong double-digit growth, thanks to sustained demand for passenger transportation and from last-mile operators for e-commerce applications, food deliveries and other applications.

Compared to fossil fuel or CNG-powered models, the long-term wallet-friendly proposition of electric three-wheelers is drawing both single-user buyers (autorickshaw drivers) as well as fleet operators.

While two- and three-wheelers together account for 94% of sales, demand is growing for electric cars and SUVs. An estimated 7,263 electric passenger vehicles comprising cars, SUVs and vans were sold in October and cumulative sales for January-October 2023 add up to 67,151 units. Electric PV market leader Tata Motors sold 5,465 EVs, up 28% on year-ago sales of 4,277 units. In CY2022, 37,792 ePVs were sold in India; between January and October 2023, 67,151 ePVs have been retailed.

The domestic EV industry’s continuing sales growth in 2023 can be attributed to an increase in the availability of new products, high petrol, diesel and CNG prices, state subsidies and sops offered under FAME II. What’s also helping is the growing consumer awareness about the need to use eco-friendly transport. And, of course, the wallet-friendly nature of the low cost of EV ownership over the long run is a big catalyst towards making a purchase decision for a zero-emission vehicle. Meanwhile, there is gradual expansion in EV charging infrastructure, both from the private and public sector.

INDIA EV INC ON TRACK TO CLOCK 1.5 MILLION SALES IN CY2023

Given the sustained and rapid pace of growth, India's EV industry can be expected to notch consistent progress. While some challenges remain in the form of inadequate charging infrastructure (which is being addressed) and high initial EV prices (which are directly related to battery cost), India EV continues to see robust double-digit growth.

Furthermore, with OEMs’ sharpened focus on localisation with a view to reduce costs and enhance affordability, and battery prices expected to reduce gradually, demand in this eco-friendly vehicle segment can only get better.

At the current high double-digit rate of growth, India EV Inc could be headed towards the 1.5 million units mark in the current calendar year. Compared to the 10,24,801 EVs sold in CY2022, sales in the first 10 months of the year have surpassed that record number with cumulative retal sales of 12,34,325 units. Given the current rapid pace of demand, the industry is well set to clock annual sales in the region of 1.5 million units this year.

ALSO READ:

EV sales between January and September 15 surpass CY2022’s record 1.024 million units

Tamil Nadu accounts for 40% of India’s million EV sales between January and September

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

04 Nov 2023

04 Nov 2023

18305 Views

18305 Views

Shahkar Abidi

Shahkar Abidi