India's 2W industry matches CVs and PVs in 88% sales plunge in March, 27% in FY2020

Covid-19 impact lays two-wheeler segment low in March, as it did the commercial and passenger vehicle segments.

Sales numbers and vehicle segment statistics often throw up interesting data which makes market analysis so much more exciting. That's just the case in the coronavirus-hit March 2020. As per the sales numbers released by some OEMs and analysed by Autocar Professional, all three vehicle segments – passenger vehicles, commercial vehicles and two-wheelers – have seen their sales plunge by 88% in March and by 27% in FY2020.

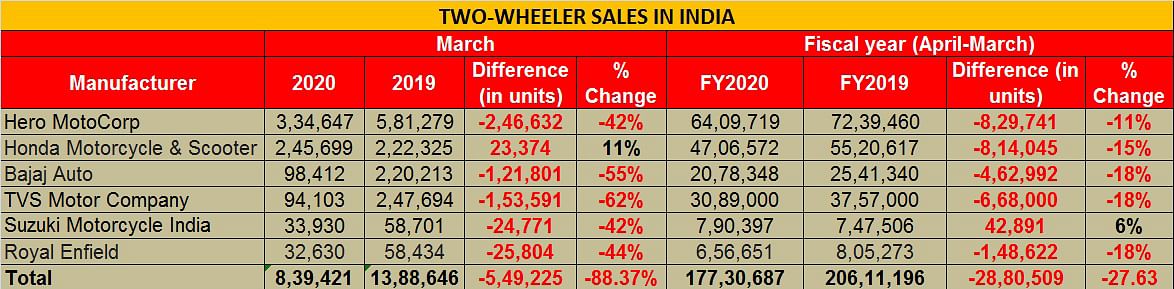

As per the sales despatch numbers released by 6 two-wheeler OEMs, their cumulative numbers in March 2020 at 839,421 units constitute a massive 88% year-on-year decline (March 2019: 13,88,646). The scenario is similar for FY2020 albeit the rate of decline lower: 177,30,687 units, which is 27% down YoY (FY2019: 206,11,196).

Like the PV and CV segments, the two-wheeler industry has been badly hit by a cocktail of growth-impacting factors including slackening liquidity, rise in insurance rates, 10-15% price increases in BS VI-compliant motorcycles and two-wheelers, and of course the prolonged economic slowdown in the country. Not surprisingly, nearly all OEMs are in the red in FY2020. Here's taking a closer look at their performance in March.

Hero MotoCorp: down 42% in March and FY2020

Hero MotoCorp, which has 37.74% of the two-wheeler market share, it would like to forget March and FY2020 sales numbers in a hurry. At 334,647 units, last month's sales are a sizeable 42% down on year-ago figures (March 2019: 581,279). And considering that the industry slowdown has lasted for over a year and impacted sales of commuter motorcycles, wherein Hero has a stranglehold, the FY2020 numbers are understandably low: 11% down YoY at 64,09,719 units (FY2019: 72,39,460).

In a statement, the company said: "In March 2020, the auto industry and the entire global economy has been faced with unprecedented disruption, owing to the novel coronavirus. COVID-19 has resulted in interrupted supply chains, halted production and lock-down, leading to no retails."

Honda: March sales up 11%, down 15% in FY2020

Honda Motorcycle & Scooter India, the No. 2 industry player in two-wheelers with 27% market share, recorded domestic market sales of 245,699 units in March 2020, up 11% (March 2019: 222,325). It wrapped up FY2020 with total sales of 47,06,572 units, which constitute a YoY decline of 15% (FY2019: 55,20,617).

Speaking on the current market scenario, Yadvinder Singh Guleria, Director – Sales and Marketing, HMSI, said, “Honda was the first two-wheeler manufacturer to lead the BS-VI transition almost six months ahead of the deadline with the Activa 125 BS-VI in September 2019. Despite all efforts, 2019-20 has been a challenging year in more ways than one. The COVID-19 impact derailed industry’s plans and has severely impacted the automobile ecosystem – right from the supply chain to dealers.”

Bajaj Auto: down 55% in March and 7% in FY2020

Bajaj Auto, is the fourth placed in the OEM chart with 12% market share, saw its domestic market sales fall by a sharp 55% in March to 98,412 units (March 2019: 220,213) and to 2,078,348 units in FY2020 as compared to 2,541,340 units in FY2019, indicative of an 18 percent YoY drop. Total exports witnessed a 10 percent increase with 1,869,220 units exported in FY2020.

TVS Motor Co: 62% slide in March, 18% in FY2020

The Chennai-based motorcycle and scooter manufacturer, which is the No. 3 in the industry by virtue of its 14% market share, has also been mauled by the slowdown. Check this out: March 2020 sales of 94,103 units are a sharp 62% slide over year-ago numbers of 153,591 units. And, in FY2020, total sales of 30,89,000 constitute an 18% decline over FY2019's 37,57,000 units.

"There has been a huge impact on the company’s production and sales this month because of COVID-19 lockdown across the country. The company started the transition to BS VI in Q3 of FY2020 and this effective planning helped the company in complete readiness of BS-VI vehicle supplies in Q4. These new vehicles have been well received and there are adequate stocks already in the market when it reopens. International market demand was also good for both two-wheeler and three-wheeler categories. However, due to the lockdown, there was a significant loss in production, and also vehicle stock in the factory for both domestic and international markets, which could not be dispatched," the company stated.

Suzuki Motorcycle India: 42% down in March but 6% up in FY2020

Concluding FY2020 on a positive note, Suzuki Motorcycle India, possibly the only OEM to do so, has registered a 5.7 percent growth in FY2020 over FY2019 with 790,397 units compared to 747,506 units in FY2019. The Access 125, the best-selling 125cc scooter in India, will be the biggest contributor to total numbers.

Commenting on the sales performance, Koichiro Hirao, Managing Director, Suzuki Motorcycle India said, “We are pleased to close this financial year on a positive note with 5.7 percent growth amid the precautionary measures taken in the wake of the Covid-19 pandemic. At present, our first and foremost priority is to ensure the health and safety of the employees and all stakeholders. As the industry fights the Covid-19 pandemic by implementing shutdowns and taking precautionary measures, we believe that industry will overcome this difficult time and bounce back with positive growth in the coming months.”

Royal Enfield: down 41% in March, 16% in FY2020

Midsized motorcycle manufacturer Royal Enfield registered sales of 35,814 motorcycles in March 2020 compared to 60,831 in March 2019, a 41 percent drop. And in FY2020, total sales were 695,947 units versus 82,6098 in FY2019. This is a 16 percent decline.

Commenting on the results, Vinod Dasari, CEO at Royal Enfield said, "It has been a challenging year for the industry, from subdued market sentiment in the initial quarters, to the current global pandemic situation. Royal Enfield, however, continues to remain invested in bringing greater innovation in products and processes. We have seen a very encouraging response in our new motorcycle variants that we launched, our personalisation and customization initiative - Make Your Own - has seen a tremendously positive reaction from consumers, new Ride concepts like the Astral and Rongbuk ride have seen more enthusiastic riders participate, and overall there has been robust growth in our digital community."

Royal Enfield has sold out all existing inventory of its BS IV motorcycles across dealerships and from March 21 began retailing only BS VI motorcycles, thereby becoming one of the first automotive brands in India to fully transition to the new emission norm, ahead of time.

"We have recently completed sales of our entire BS-IV motorcycle stock ahead of the regulatory deadline, and that is testament to our focused approach and strategic planning. While the industry currently continues to face headwinds, we are confident that in the long-term, there will be slow and steady recovery. Astute planning and agility will be the key to sustained recovery," concluded Dasari.

FY2021 has opened. April and BS VI have kicked in. The country-wide lockdown is on. Will India Auto Inc have to engage in crystal ball gazing to see what's in store in the new fiscal? Watch this space.

READ MORE

Passenger Vehicles sales analysis: March & FY2020

Commercial Vehicles sales analysis: March & FY2020

RELATED ARTICLES

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

04 Apr 2020

04 Apr 2020

19313 Views

19313 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi