Hyundai-Tata Motors battle for No. 2 rank revs up in FY2024, Q1 difference only 5,221 units

Hyundai Motor India has sold 148,303 units to Tata Motors’ 143,082 units in April-June 2023. While Hyundai has the better of Tata in car sales, the latter leads in SUVs. Will the new Exter mini-SUV increase the sales gap or will Tata deliver a mean punch?

With FY2024’s first-quarter wholesale numbers out and the passenger vehicle industry registering dispatches of 995,974 units and year-on-year growth of 9%, the battle for the No. 2 position at the top of the ladder continues. While market leader Maruti Suzuki remains unassailable, the longstanding No. 2 player Hyundai Motor India and a hard-charging Tata Motors are having a slug-fest when it comes on the sales front.

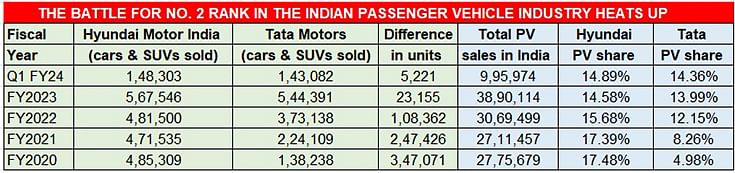

In the ongoing fiscal year’s first quarter (April-June 2023), the difference between the two car and SUV manufacturers is only 5,221 units in favour of Hyundai, which has sold 148,303 units to Tata Motors’ 143,082 units. In FY2023, Hyundai had a lead of 23,155 units with cumulative sales of 567,546 units to Tata Motors’ 544,391 units.

It is only in the past 15 months that the tussle for the No. 2 rank has become intense. In FY2022, Hyundai had a lead of 108,362 units, albeit lower than the 247,426-unit lead in FY2021 and a yawning gap of 347,071 units in FY2020 (see sales comparison table below).

As per industry wholesales numbers for the April-June 2023 period, Hyundai has a slender lead of 5,221 units over Tata Motors.

As per industry wholesales numbers for the April-June 2023 period, Hyundai has a slender lead of 5,221 units over Tata Motors.

The hugely reduced gap over the past 51 months is a result of Tata Motors bouncing back into the passenger vehicle game since FY2021 when it registered 62% YoY growth to clock 224,109 units. Since then, thanks to its ‘New Forever’ portfolio, Tata has gone on to better its performance with 66% growth in FY2022 (224,109 units) and bettered that score in FY2023 with 46% improved sales of a record 544,391 units.

Tata Motors’ resurgent drive has been led by the Nexon compact SUV, which is available with petrol, diesel and electric powertrains and has been India's best-selling utility vehicle since the past two years.

Tata Motors’ resurgent drive has been led by the Nexon compact SUV, which is available with petrol, diesel and electric powertrains and has been India's best-selling utility vehicle since the past two years.

Tata Motors’ resurgent drive has meant that it has seen a 188% improvement in its PV market share since FY2020 from 4.98% to 14.36% in Q1 FY2024 – and as a result has also risen in the OEM rankings to third place from fourth four years ago.

In comparison, Hyundai Motor India’s sales trajectory has been somewhat more sedate, given the larger base and like, Tata Motors, also recorded its best-ever fiscal year sales of 567,546 units in FY2023. However, the slower rate of growth in a PV market, where sales have risen 40% from 2.7 million units in FY2020 to 3.89 million units in FY2023. And amidst plenty of new competition and a slackening market for hatchbacks, Hyundai’s market share has reduced to 14.89% at present from 17.48% four years ago.

Hyundai has launched the Exter at an aggressive Rs 600,000 and aims to outpunch the Tata Punch, which has sold over 200,000 units in 20 months.

Battle to turn even more exciting with Exter

Four months into FY2024, the neck-and-neck race between Hyundai and Tata Motors looks set to get even more exciting. With the launch of the Exter mini-SUV, which is squarely targeted at Tata Motors’ second best-selling product, the Punch compact SUV, Hyundai has taken the battle straight into the Tata Motors’ camp. At Rs 600,000, the Exter undercuts the Tata Punch by Rs 25,000. Hyundai clearly wants to outpunch the Punch, which was India’s fourth best-selling utility vehicle in FY2023, has sold over 200,000 units in 20 months since launch, and continues to maintain this position in Q1 FY2024

While Hyundai Motor India currently retails nine products – six SUVs (Creta, Venue, Alcazar, Tucson, Kona, Exter), two hatchbacks (i10 Grand Nios, i20 Elite) and two sedans (Verna, Xcent /Aura), Tata Motors sells seven – four SUVs (Nexon, Punch, Harrier, Safari), two hatchbacks (Tiago and Altroz) and one sedan (Tigor).

While Hyundai is ahead of Tata Motors in passenger car sales in Q1, Tata's utility vehicles sales are higher in the first three months of the ongoing fiscal.

Trading places – PVs and UV market shares

Both companies, which have hugely benefited from the surging demand for SUVs in the Indian market, have two high-selling products each – the Creta and Venue for Hyundai, and the Nexon and Punch for Tata. While the Creta remains the unrivalled midsize market leader, the Nexon is India’s best-selling UV.

When it comes to UV sales, Tata Motors at present has the better of Hyundai – in Q1 FY2024, it has dispatched 88,894 UVs compared to Hyundai’s 83,642 UVs and is ahead by 5,252 units, which gives Tata a UV market share of 16.26% to Hyundai’s 15.30 percent.

But Hyundai turns the table on the passenger car front – with 64,661 cars sold in Q1 FY2024, it is 13,435 PVs ahead of Tata Motors’ 51,226 units. This effectively means Hyundai has a car share of 15.6% to Tata Motors’ 12.38 percent. Tata Motors also sold 2,962 vans, a segment where Hyundai is not present.

Make-In-India power

Make-In-India power

When it comes to output, Hyundai is considerably ahead of Tata Motors in the first three months – the Chennai-based OEM rolled out 180,662 cars and SUVs from its Sriperumbudur plant compared to Tata’s 143,601 units. It is to be noted that Hyundai is also India’s No. 2 PV exporter and between April-June 2023 shipped 35,100 units. In comparison, Tata Motors has far lesser overseas shipments (Q1 FY2024: 3,750 units), which enables it to focus more on the domestic market.

Cognisant of the critical demand-supply dynamic in a booming market, Hyundai Motor India has increased its manufacturing capacity by 50,000 units, thereby expanding its total annual capacity to 825,000 units from July 2023. In March 2023, Hyundai signed a term sheet with General Motors to explore the likelihood of buying GM India’s plant in Talegaon, Pune.

In comparison, Tata Motors has a manufacturing capacity of an estimated 780,000 units per annum at its Pune and Sanand plants. And the carmaker is set to get a capacity boost of 300,000 units and scalable to 420,000 units per annum when its newly acquired Sanand plant of Ford India goes on stream.

Product differentiation and strategy

To protect its turf and No. 2 position, Hyundai clearly is pulling all the punches – of the six product launches planned for 2023, it has already launched the sixth-gen Verna and the Punch-rivalling Exter, with the facelifted Creta, Grand i10 Nios, Aura and the all-electric Ioniq 5 slated for rollout later this year.

Tata Motors has the EV advantage with the Nexon, Tigor and the Tiago EVs, which have helped it garner a 77% share of the retail EV market in the first six months of CY2023. What’s more, in an effort to expand its target buyers, Tata has upped the ante on CNG models by launching the Altroz CNG. When the Punch CNG is launched, the range will increase to four models including the Tiago and Tigor. The company has outlined an ambitious sales target of 150,000 CNG cars and SUVs units per annum within the next couple of years.

With the just-launched Exter, Hyundai has signalled its intention to take the battle into Tata Motors’ camp, hoping to outpunch the Punch in the numbers game. Expect Tata Motors to maintain the successful five-pronged strategy it has deployed for the past few years – an aspirational product portfolio, EV network and ecosystem development, front-end reimagination, operational debottlenecking and product quality enhancement.

ALSO READ:

Hyundai stays ahead of Tata Motors in CY2022

Tata Motors aims to capture PV, EV, CV demand in FY2024 amid growing competition

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

14 Jul 2023

14 Jul 2023

22487 Views

22487 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal