UV sales grow by 18% in Q1 FY24, Maruti and Mahindra shine, Tata and Kia lose market share

Both Maruti Suzuki and M&M, which account for the bulk of pending orders for popular models, sell over 100,000 units in April-June 2023; Tata Motors and Kia feel the heat of growing competition.

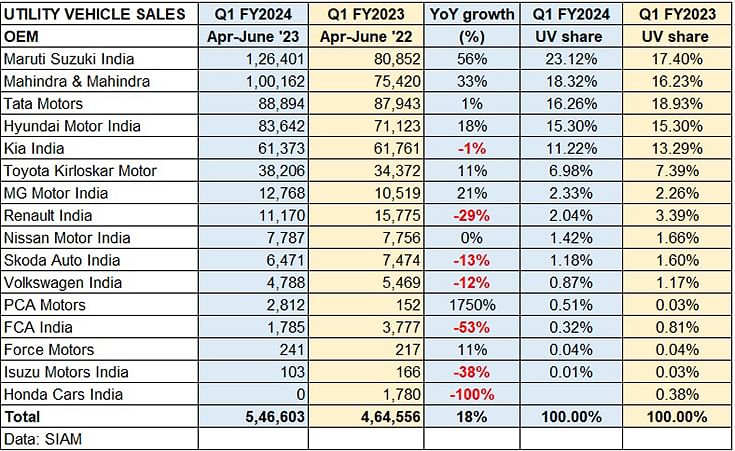

The utility vehicle (UV) sub-segment is powering the overall passenger vehicle (PV) segment, which comprises cars, UVs and vans, like never before. If the PV segment has notched its best-ever first-quarter wholesales of 995,974 units, up 9% YoY – just 4,006 units shy of the million mark – in April-June 2023, then it has UVs to thank. FY2024’s first three months saw wholesales of 546,603 UVs, up 18% YoY, accounting for 55% of overall PV sales, more than the 54% they had in FY2023.

What has helped accelerate sales is a combination of factors like ramped-up production for popular models which have long order backlogs, improving supplies of semiconductors, new models in the market and positive customer and economy sentiment.

Maruti Suzuki ups the ante with new SUVs

A good start in a race is always beneficial and Maruti Suzuki India, the passenger vehicle as well as the utility vehicle (UV) market leader, has just done that. For the first quarter of the ongoing FY2024, the company has despatched a total of 126,401 UVs, up 56% year on year (April-June 2022: 80,852 units), which gives it a lead of 26,239 units over Mahindra & Mahindra, improving upon the 15,420-unit lead it had in April-May 2023. The strong performance has helped it increase UV market share by over 5 percentage basis points to 23.12% from 17.40% in Q1 FY2023.

What is helping Maruti Suzuki is the surging demand for its recently launched SUVs like the Grand Vitara, Fronx (which is become the latest Maruti to get CNG power) and the Jimny. This trio has contributed an estimated 56,814 units or 45% to the company’s Q1 FY2024 UV sales.

Mahindra & Mahindra is benefiting from improved supplies to showrooms as a result of ramped-up production at its plants.

Mahindra & Mahindra is benefiting from improved supplies to showrooms as a result of ramped-up production at its plants.

M&M sells over 100,000 UVs, Tata and Kia feel the heat

Mahindra & Mahindra, which missed grabbing the No. 2 UV OEM rank in FY2023 by a whisker – just 288 units behind Tata Motors – is, like Maruti Suzuki, an outperformer in Q1 FY2024. It is driven ahead of Tata to be the No. 2 UV player – its Q1 sales of 100,162 units mark robust 33% YoY increase (April-June 2022: 75,420 units). This is reflected in M&M’s UV market share gains – now at 18.32% from 16.23% a year ago.

Five much-in-demand SUVs are driving the charge for M&M – Scorpio N/Scorpio Classis (27,583 units), Bolero (25,910), Thar (13,947), XUV700 (19,636) and XUV300 (10,219). Combined sales of these five, at 87,845 units, accounted for 87% of M&M’s total UV sales in Q1 FY2024.

Meanwhile, Tata Motors, which has consistently clocked strong growth over past couple of years, seems to be under pressure – its Q1 wholesales of 88,894 units are a marginal 1.08% YoY growth (Q1 FY2023: 87,943). Clearly, the company, which has a four-model portfolio of the Nexon, Punch, Harrier and Safari, is feeling the heat from a hard-charging, new model-laden Maruti Suzuki and also Mahindra & Mahindra, which has ramped up production. The Nexon, which remains India’s best-selling SUV with 43,252 units, is just 170 units ahead of the Hyundai Creta, the best-selling midsize SUV. The Punch (33,048) remains the fourth best-selling SUV and the second-best compact SUV (after the Brezza). The Harrier (7,126) and Safari (5,468) contributed the rest to the Q1 FY2024 total.

Hyundai Motor India, the No. 2 PV player is the No. 4 UV OEM in Q1 FY2024, the same rank it held in FY2023, with sales of 83,642 units, up 30% (Q1 FY2023: 71,123). The Creta, which was India’s best-selling UV in May and June, sold 43,082 units in Q1 and accounts for 50% of Hyundai’s sales, followed by the Venue (32,161) and the Alcazar (8,599). The company has, on July 10, launched the Exter mini-SUV with which it aims to ruffle the competition and also accelerate its growth.

Kia India, which despatched 61,373 units in the first three months of FY2024, seems to have been impacted by the new competition, particularly in the midsize SUV segment. Also, with the news of the facelifted Seltos to be launched on July 4, demand for Kia’s first product had dropped sizeably in June, which saw numbers down nearly 20% to 19,391 units and thereby impacted its growth curve in Q1 FY2024. However, with the face-lifted Seltos now launched, Kia is targeting sales of around 10,000 units a month from the SUV, even as the Carens MPV, the new growth driver, and the Sonet compact SUV deliver the goods each month.

Toyota Kirloskar Motor, which had a strong FY2023 with sales of 174,015 units, has continued to perform in the same vein and Q1 FY2024 despatches of 38,206 units are an 11% increase (Q1 FY2022: 34,372 units). Its UV market share though has reduced marginally to 6.98% as a result of the expanded market and increased competition.

MG Motor India, with 12,768 units, has registered 21% YoY growth, a performance which gives it a 2.33% share of the UV market.

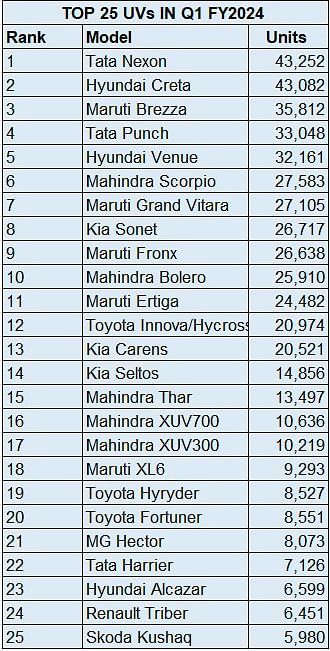

Battle among best-sellers

Sifting through the Q1 numbers reveals that the cumulative sales of the Top 25 UVs add up to 497,093 units or 91% of total UV sales in April-June 2023. The surging demand for compact SUVs continues and the 227,067units sold in Q1 FY2024 mean this category has a strong 41% share of the overall PV market.

The Tata Nexon (43,252 units), which remains India’s best-selling UV as well as compact SUV, is followed by the Maruti Brezza (35,812 units), Tata Punch (33,048 units), Hyundai Venue (32,161 units), Kia Sonet (26,717 units), Mahindra Thar (13,497 units), XUV300 (10,219 units) and the Renault Triber (6,451 units).

Meanwhile, the midsize SUV brigade has shown its growing contribution. The Hyundai Creta (43,082 units) remains India’s best-selling midsize SUV and is just 170 units behind the Nexon. Other strong models in this category were the Mahindra Scorpio (27,583 units), Maruti Grand Vitara (27,105 units), Maruti Fronx (26,638 units).

The three MPVs – Maruti Ertiga (24,482), Toyota Innova / Hycross (20,974) and Kia Carens (20,521) – together (65,977 units) have accounted for 12% of UV sales in Q1.

Growth outlook remains strong

Given that the pending order backlog for the UV segment currently lies in excess of 650,000 units, most of them with the market leaders Maruti Suzuki and Mahindra, expect both these OEMs to keep their assembly lines humming to meet both the existing demand as well as new orders that keep flowing in. Toyota Kirloskar Motor also has a sizeable order booking for its Innova / Hycross MPV.

What keeps consumer interest alive and kicking is a regular inflow of new models and the UV segment is a good example. This year has seen the launch of plenty new models in this category with the Hyundai Exter being the latest.

The GST Council, in its July 11 meeting, has mandated a 2% additional cess on SUVs above 4 metres in length, with engine capacity of 1500cc and above and ground clearance of 170mm and above. This will impact the midsize SUVs, which have seen a new wave of demand in the past six-odd months, as well as MPVs. To what level will sales be impacted remains to be seen in the months to come. But all said and done, it is amply clear that the UV segment is well on its way to power the PV category, which has surpassed 2 million-unit sales for the first time in the first half of a calendar year, to over 4 million units once again.

ALSO READ: CNG car sales fall 5% in first-half CY2023

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

13 Jul 2023

13 Jul 2023

12629 Views

12629 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau