Exclusive: Bajaj Auto sells 75,000 electric 3Ws in two years, readies to launch e-rickshaw

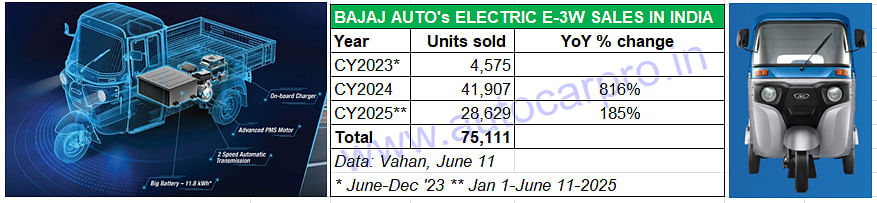

India’s largest three-wheeler manufacturer and exporter, which entered the electric 3W market in June 2023, clocks new retail sales milestone. From 4,575 units in CY2023, when it was ranked No. 28 in a field of 550 players, Bajaj Auto catapulted to No. 3 in CY2024 with 41,907 units. In the first five months of CY2025, it has captured a 9% market share and No. 2 rank. Now, it is all set to enter the electric rickshaw segment which should give it more muscle in the e-3W market.

Bajaj Auto, India’s largest three-wheeler manufacturer as well as exporter, has clocked retail sales of over 75,000 electric three-wheelers. This is as per the latest statistics on the government of India’s Vahan portal (June 11, 2025). This sales milestone comes just about inside two years of the Pune-based company entering this sub-segment of the electric vehicle market in June 2023 with its RE E-Tec passenger model and the Maxima XL Cargo E-Tec 12.0 model.

Bajaj Auto surpassed the 75,000-unit retail sales mark on June 11, 2025, just about two years after it entered the electric two-wheeler market.

Bajaj Auto surpassed the 75,000-unit retail sales mark on June 11, 2025, just about two years after it entered the electric two-wheeler market.

Bajaj Auto’s growth trajectory in the electric three-wheeler market is similar to its journey in the electric two-wheeler market, which it entered in January 2020 in tandem with TVS Motor Co. While initial sales were very low, the last couple of years have seen the company lock horns with TVS Motor and Ola Electric. In FY2025, Bajaj Auto sold 230,808 Chetaks, to be ranked behind Ola Electric and TVS Motor Co.

It may be recollected that Autocar Professional had, within six months of the Pune-based three-wheeler major’s entry into manufacture and sale of electric 3Ws, pointed out that Bajaj Auto was the dark horse in this segment. Two years since its entry, the company is hard on the heels of the e-3W market leader, Mahindra Last Mile Mobility even as another legacy player – TVS Motor Co – has recently entered this segment and also registering early gains.

Six months after market entry, in November 2023, with 1,232 units sold, Bajaj Auto was ranked eighth in a field of nearly 500 players. In May 2025, which marks two years of Bajaj e-3Ws, the company is firmly positioned as the No. 2 OEM. In CY2023’s last seven months, Bajaj Auto sold 4,575 units, which gave it a 0.78% share of the 582,721 units the e-3W industry sold that year and No. 28 rank. With sales rising month on month and a production ramp-up, CY2024 sales at 41,907 units were a huge 816% YoY growth albeit on a very low year-ago base. Nevertheless, this strong performance meant that Bajaj Auto’s ranking in the industry catapulted to No. 3 in CY2024, but on the podium after market leader Mahindra Last Mile Mobility (68,000 units) and YC Electric (43,977 units).

Cumulative sales of 27,742 units in the first five months of CY2025, up 179% YoY (January-May 2024: 9,953 units) and a 9% market share have seen Bajaj Auto become the new No. 2 – just 3,196 units behind Mahindra, which maintains its lead in the first five months of this year with 30,938 units, up 24% YoY (January-May 2024: 24,872 units) and a 10% market share. And in the first 11 days of June 2025, Bajaj Auto has registered retail sales of 1,586 units, which sees it surpass the 75,000-unit milestone.

Rolled out in February 2025, the Bajaj GoGo is the company’s attempt to redefine last-mile mobility, for both passenger and cargo operations.

Rolled out in February 2025, the Bajaj GoGo is the company’s attempt to redefine last-mile mobility, for both passenger and cargo operations.

BAJAJ GOGO GIVES A FRESH CHARGE TO SALES

What has given Bajaj Auto a fresh charge is the launch of the GoGo brand in February 2025 in the form of three passenger variants with a certified range of up to 251km. The Bajaj GoGo e-3Ws are the company’s attempt to redefine last-mile mobility, for both passenger and cargo operations.

The GoGo portfolio comprises two models under the P Series – P70s and P50s – and three variants (P5009, P5012 and P7012), While ‘P’ stands for passenger category, ‘50’ and ‘70’ indicate size, while ‘09’ and ‘12’ reflect the battery capacity of 9 kWh and 12 kWh, respectively. Key product highlights are a claimed best-in-class range of 248km, a 5-year battery warranty, and first-in-class tech features like auto hazard and anti-roll detection. While the Bajaj GoGo P5009 has an ex-showroom price of Rs 327,000, the P7012 costs Rs 383,000. Bajaj Auto is likely to launch the GoGo cargo series later this year.

MLMM, which sold a record 68,099 e-3Ws in CY2024 and led the market with a 10% share, continues to do well what with cumulative January-May 2025 retails of 30,938 units and maintaining its 10% market share. Now, come July, it will have to contend with Bajaj Auto expanding its e-3W portfolio by launching an electric rickshaw, under the GoGo brand, in July this year.

BAJAJ ELECTRIC RICKSHAW COMING SOON

Bajaj Auto is expected to enter the big-volume e-rickshaw by early July 2025. Demand for this segment is strongest in North India, particularly in UP and Delhi.

Bajaj Auto is expected to enter the big-volume e-rickshaw by early July 2025. Demand for this segment is strongest in North India, particularly in UP and Delhi.

The electric rickshaw market continues to be populated by a plethora of smaller players and only a handful of legacy OEMs. As per SIAM wholesales data for FY2025, three legacy OEMs with electric rickshaws sold a total of 18,474 units, down 41% YoY (FY2024: 31,290 units). Of this trio, Mahindra & Mahindra topped with 10,509 units and a 57% market share, followed by Atul Auto (4,969 units, 27% share) and Baxy (2,996 units, 16% share).

Having recognised a 'white spot' or a business opportunity to cater to likely unmet customer requirements in this sub-segment of the growing e-3W market, Bajaj Auto is all set to introduce its own brand of electric rickshaws.

Speaking in an analyst call last month (May 2025) after the company’s Q4 and FY2025 results, Rakesh Sharma, executive director, Bajaj Auto said: “We will launch an e-rick by early July. The segment is fragmented, operating largely with sub-par-quality products. We want to change the paradigm for both the drivers and passengers by bringing a well-engineered and reliable solution to an important last-mile mobility challenge. I expect the new e-rick, under a new brand, to open up a segment of almost 40,000 units, which we will hopefully upgrade over the next few years.”

While there is little doubt that the new Bajaj e-rickshaw will eat into the sales of small and medium enterprises, the new product will pose new competition to Mahindra’s e-rickshaws (e-Alfa Plus and Treo Yaari) which to date gave it the overall sales lead over the No. 2 e-3W OEM Bajaj Auto (which was absent from this e-rick sub-segment). Nevertheless, it is only to be expected that market leader Mahindra Last Mile Mobility will already have a competitive strategy up its sleeve to protect its turf.

As the economy improves, there is growing demand for low-cost passenger transportation in the form of electric rickshaws. Compared to conventional ICE products, zero-emission rickshaws benefit from far lower maintenance and easy-on-the-wallet charging, which suits this sub-segment which generally has single owners across town and country. Last-mile connectivity for daily commuters and office-goers, particularly from metro stations in urban India, is being fulfilled by such EVs.

Delhi and Uttar Pradesh are key growth markets for passenger-ferrying electric rickshaws.

Delhi and Uttar Pradesh are key growth markets for passenger-ferrying electric rickshaws.

Demand for electric rickshaws is strongest in North India, particularly Uttar Pradesh and Delhi. It could be surmised that Bajaj Auto will plot a strategic marketing game-plan for this region which is a large buyer of passenger e-rickshaws.

What will be par for the course is that a fair number of the electric rickshaw manufacturers in the 550-strong e-3W arena will feel the heat of an established OEM like Bajaj Auto entering the fray. Clearly, exciting times are in store for this sub-segment of the EV industry in India, and the overall e-3W market which has the distinction of being the largest in the world for the second year running, having beaten China for the first time in CY2023.

ALSO READ:

Mahindra and Bajaj battle for e-3W top spot in May, TVS sells 1,582 units

RELATED ARTICLES

TVS iQube Rides Past 800,000 Sales, 100,000 Units Sold in 3 Months

Launched in January 2020, the TVS iQube takes six years to hit the 800,000 sales milestone. While the first 300,000 unit...

Thar Roxx Races Past 100,000 Sales In 16 Months

Launched on September 25, 2024, the five-door Thar Roxx has been a huge success and helped propel the Thar brand into Ma...

India’s Top 30 SUVs, MPVs In CY2025 – Hyundai Creta Pips Tata Nexon To Top Spot

Of the 2.95 million utility vehicles sold in CY2025, the Top 30 models accounted for 2.82 million units (95% share). Mar...

12 Jun 2025

12 Jun 2025

15096 Views

15096 Views

Ajit Dalvi

Ajit Dalvi