Mahindra and Bajaj battle for e-3W top spot in May, new entrant TVS sells 1,582 units

With 66,018 units retailed, May 2025 turns out to be second highest sales month for the electric 3-wheeler industry. While Mahindra and Bajaj were separated by 400 units, TVS with 1,582 King EV Max 3Ws grabs a 2% share in the 560-player market which is witnessing a shakeout with buyers preferring to buy better-built models from well-established legacy OEMs which command a stronger sales and service network.

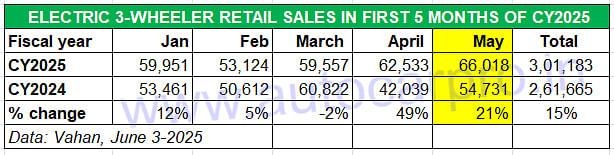

May 2025, the second month of the current fiscal, has turned out to be the second-best month ever for the electric three-wheeler industry. At 66,018 units, up 21% YoY, May 2025 is just 1,162 units behind October 2024 (67,180 units). That’s not all the news.

First five month sales have already gone past 300,000 units. If the same growth trajectory continues, the e-3W industry is set for record sales in 2025.

First five month sales have already gone past 300,000 units. If the same growth trajectory continues, the e-3W industry is set for record sales in 2025.

Cumulative five-month January-May 2025 retail sales, as per the Vahan portal, have already crossed the 300,000-mark and are already 43% of CY2024’s record sales of 691,302 units. If the industry maintains the same growth trajectory, India e-3W Inc will surpass the 700,000 retail sales milestone for the first time in CY2025.

ELECTRIC 3-WHEELERS TAKE AWAY CNG MARKET SHARE

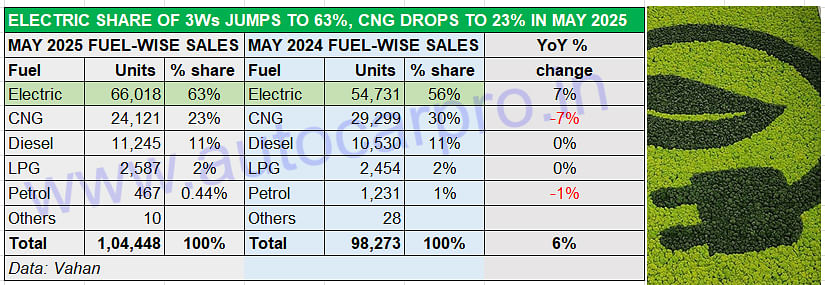

Of all the vehicle segments, it is the electric three-wheeler industry which is witnessing the fastest transition to electric mobility. In May 2025, a total of 104,448 three-wheelers (across all powertrains comprising electric, CNG, diesel, LPG and petrol) were sold across India (other than Telangana), as per Vahan data.

In May 2025, 104,448 three-wheelers across all powertrains were sold in India. Of this, e-3Ws accounted for 63% (66,018 units), increasing their share from 56% in May 2024. A YoY decline in CNG 3W sales sees the CNG share of the 3W market down to 23% from 30% a year ago.

In May 2025, 104,448 three-wheelers across all powertrains were sold in India. Of this, e-3Ws accounted for 63% (66,018 units), increasing their share from 56% in May 2024. A YoY decline in CNG 3W sales sees the CNG share of the 3W market down to 23% from 30% a year ago.

The sustained demand for electric 3Ws is seen in their growing share of the overall 3W market. In May, 66,018 e3Ws accounted for the bulk of sales – 63% – increasing their share YoY by 7% from 56% in May 2024. In contrast, demand for CNG 3Ws dropped by 7% YoY to 24,121 units with the CNG share of 3W sales also dropping by 7% YoY to 23% in May 2025 – this can be attributed to CNG price increases in recent times, adding to the total cost of ownership. This also means e-3Ws are eating into the CNG 3W market. Meanwhile, diesel 3Ws continue to see demand, what with 11,245 units sold last month to maintain their 11% share of the overall 3W market.

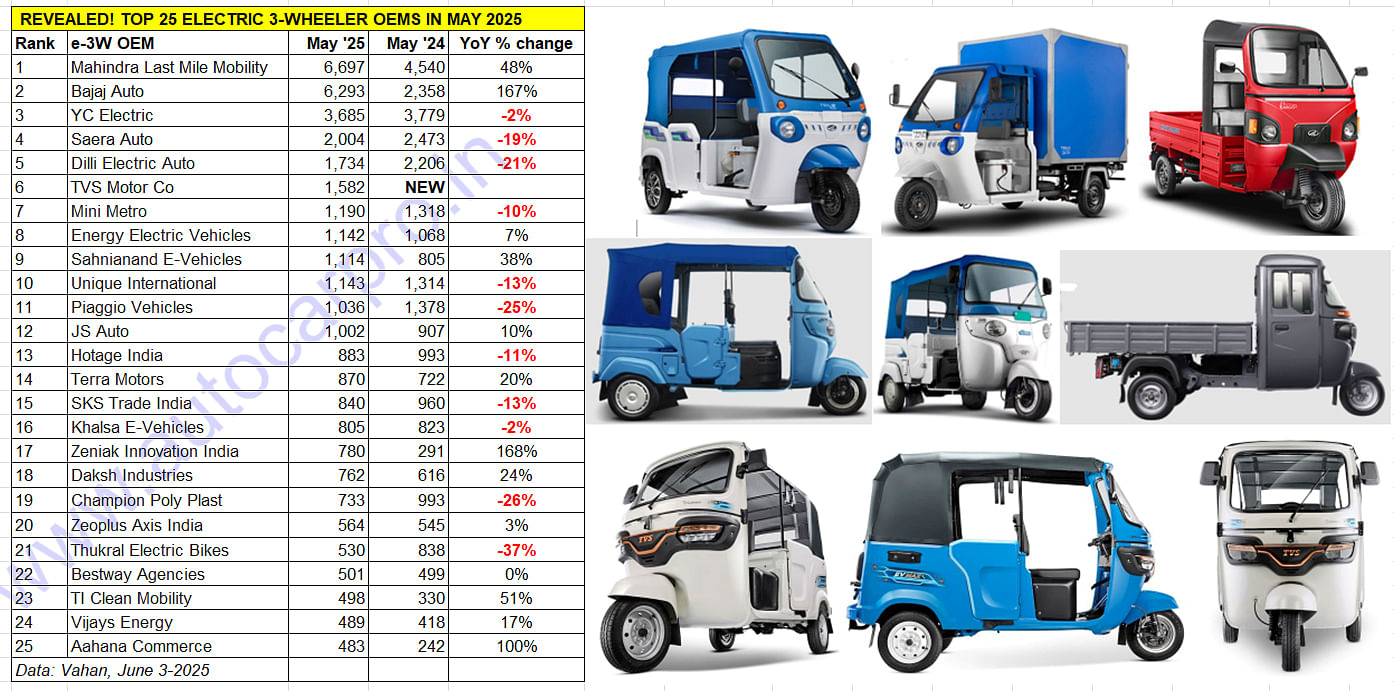

Similar to the e-two-wheeler industry, the e-3W segment too is witnessing fierce competition albeit the real fight is underway amongst the Top 6 players – Mahindra Last Mile Mobility (MLMM), Bajaj Auto, YC Electric Vehicles, Saera Electric Auto, Dilli Electric Auto and Piaggio Vehicles. And TVS Motor Co, which has plugged into this segment only recently, has already grabbed No. 6 rank. As the Top 25 e3W OEM data table for May 2025 (given below) depicts, legacy OEMs are impacting well-entrenched players. No. 4 (Saera Auto) and No. 5 (Dilli Electric Auto) have both registered YoY sales declines in May.

MAHINDRA AND BAJAJ BATTLE FOR E3W CROWN TO HEAT UP EVEN MORE. . .

Mahindra Last Mile Mobility (MLMM), the longstanding market leader in this segment of the EV industry, is witnessing fast-growing competition from Bajaj Auto, which entered the market only two years ago in June 2023. It may be recollected that Autocar Professional had, within six months of the Pune-based 3W major’s entry into e-3Ws, pointed out that Bajaj was the dark horse in this segment.

This has been proven right, what with Bajaj Auto’s e-3W sales picking up from 4,575 units in the last six months of CY2023 to 41,904 units in CY2024, a performance which catapulted it from No. 28 rank to No. 3 and its market share to 6% from a less-than-one-percent share. In CY2025, it is the firm No. 2 player and is hard on the heels of Mahindra.

What has given Bajaj Auto a fresh charge is the launch of the GoGo brand in February 2025 in the form of three passenger variants with a certified range of up to 251km.

MLMM, which sold a record 68,099 e-3Ws in CY2024 and led the market with a 10% share, continues to do well what with cumulative January-May 2025 retails of 30,938 units and maintaining its 10% market share. Now, come July, it will have to contend with Bajaj Auto expanding its e-3W portfolio by launching electric rickshaws in July.

Speaking in an analyst call last month after the company’s Q4 and FY2025 results, Rakesh Sharma, executive director, Bajaj Auto said: “We will launch an e-rick by early July. The segment is fragmented, operating largely with sub-par-quality products. We want to change the paradigm for both the drivers and passengers by bringing a well-engineered and reliable solution to an important last-mile mobility challenge. I expect the new e-rick, under a new brand, to open up a segment of almost 40,000 units, which we will hopefully upgrade over the next few years.”

While there is little doubt that the new Bajaj e-rickshaw will eat into the sales of SMEs, the new product will pose new competition to Mahindra’s e-rickshaws (e-Alfa Plus and Treo Yaari) which to date gave it the overall sales lead over Bajaj Auto (which was absent from this e-rick sub-segment). Expect market leader Mahindra Last Mile Mobility to come up with a strategy to protect its turf. Clearly, the second half of CY2025 is set to be even more exciting.

MAHINDRA LAST MILE MOBILITY

MAHINDRA LAST MILE MOBILITY

May 2025: 6,697 units, up 48%

E3W market share: 10%

Mahindra Last Mile Mobility, the longstanding market leader in this EV segment, sold 6,697 units in May 2025, up 48 YoY. This gives it a 10% market share for the month. MLMM has the largest e-3W portfolio in the industry comprising the Treo, Treo Plus, Treo Zor, Treo Yaari, Zor Grand, e-Alfa Plus and e-Alfa Cargo which cater to multiple mobility operations in the passenger and cargo domains.

The Treo, Treo Plus and e-Alfa Plus are passenger-transporting models, the last being an e-rickshaw. While the Treo is powered by a 7.4 kWh lithium-ion battery which delivers an ARAI-certified range of 110km, the Treo Plus with a 10.24 kWh battery can travel 150km per charge. Both have a similar 55kph top speed with driver and three passengers. The E-Alfa Plus e-rickshaw has a 100km range with driver and 4 passengers.

There are three cargo-transporting models – the e-Alfa Cargo (310kg payload / 95km range), the Zor Grand (400kg payload / 90km range) and Treo Zor (500kg payload / 80km range) – designed for multiple operations.

BAJAJ AUTO

BAJAJ AUTO

May 2025: 6,293 units, up 167%

E3W market share: 9.53%

At 6,293 units sold in May, Bajaj Auto was 404 units behind MLMM, and its market share of 9.53% slightly less than the market leader’s 10.14 percent. The YoY increase is 167% on a year-ago base (April 2024: 2,358 units).

Bajaj Auto, India’s No. 1 3W manufacturer and exporter which entered the e3W market in June 2023, has rapidly moved up the ranks to take the No. 2 position and is hard on the heels of Mahindra. In FY2025, it jumped 11 ranks to secure No. 2 position and a 7% market share. With the launch of the GoGo brand earlier this year, and plans to launch its first e-rickshaw in July, Bajaj is looking to further up the ante.

Bajaj Auto has two products – the RE E-Tec 9.0 passenger EV and Maxima XL Cargo E-Tec 12.0 in the fray. The Maxima XL Cargo E-Tec 12.0, which develops 5.5 kW power and 36 Nm, has a bigger battery and higher range of 183km per charge than the RE E-Tec 9.0 passenger model. In February 2025, Bajaj Auto launched the GoGo e3W brand designed to redefine last-mile mobility, for both passenger and cargo operations. Key highlights are a best-in-class range of 248km, a 5-year /120,000km battery warranty, and first-in-class tech features like auto hazard and anti-roll detection. There are two GoGo models for passenger transport (P70s and P50s) and three variants (P5009, P5012 and P7012). While the P5009 has a 9 kWH battery, the P5012 and P7012 are equipped with a 12 kWh unit.

YC ELECTRIC

YC ELECTRIC

May 2025: 3,685 units, down 2%

E3W market share: 5%

YC Electric has sold 3,685 units in May, down 2% (May 2024: 3,779 units) albeit this score is better than its April sales of 3,385 units. YC Electric has five models on sale – the Yatri Super, Yatri Deluxe and Yatri for passenger duties and E-Loader and Yatri Cart for cargo operations – which give it a market share of 5.54%, below MLMM’s 10% and 4% below above Bajaj Auto’s 9 percent. YC, which was the longstanding No. 2 e-three-wheeler OEM, lost its position to a hard-charging Bajaj Auto in FY2025.

Along with its Mayuri brand of e-rickshaws, Saera Auto also sells an L5 range of electric three-wheelers for passenger and cargo transport.

Along with its Mayuri brand of e-rickshaws, Saera Auto also sells an L5 range of electric three-wheelers for passenger and cargo transport.

SAERA AUTO

May 2025: 1,795 units, down 9%

E3W market share: 3%

Like a number of other e-rickshaw players, Saera too has been impacted by the advance of legacy OEMs in the e-3W industry. In May, Saera sold 2,004 units, 11% more than in April 2025 (1,795 units) but down 19% on its year-ago retails (May 2024: 2,473 units).

Saera Electric Auto, the manufacturer of the Mayuri brand of electric rickshaws, has all of nine models in the market. Based in the industrial hub of Bhiwadi, Rajasthan, it is the leading supplier of e-rickshaw loader models like the Mayuri E-Cart Loader. Saera Auto also sells its L5 range of electric three-wheelers, built in association with the Telangana-based Keto Motors for passenger and cargo transportation.

The company has three manufacturing plants. While the Bhiwadi plant has a production capacity of 24,000 units per annum, the Bawal (Haryana) plant has a 36,000 units per annum capacity. And the third facility at Kosi in Uttar Pradesh has recently commenced production.

DILLI ELECTRIC AUTO

DILLI ELECTRIC AUTO

May 2025: 1,734 units, down 21%

E3W market share: 2.62%

In fifth place is Dilli Electric Auto with 1,734 units, which is 21% down on its year-ago sales of 2,206 units. This Haryana-based company manufactures electric rickshaws (CityLife brand), a category which is now under pressure as legacy players target sales with better-built, safer products. Dilli Electric had sold 24,207 units in FY2025, down 7% YoY (FY2024: 26,163 units). Despite being available in only a few states like Uttar Pradesh, Bihar, Jammu & Kashmir, Delhi and Bengal, the TVS King EV Max sold 1,207 units in April.

Despite being available in only a few states like Uttar Pradesh, Bihar, Jammu & Kashmir, Delhi and Bengal, the TVS King EV Max sold 1,207 units in April.

TVS MOTOR CO

May 2025: 1,582 units

E3W market share: 2.39%

TVS Motor Co, the latest legacy OEM to plug into the e-3W market, has improved upon its April 2025 performance (1,207 units) by 31% in May 2025 (1,582 units), a performance which gives it the sixth rank amongst 564 players and a market share of 2.39 percent.

The zero-emission King EV Max, whose styling is close to the petrol-engined TVS King sibling, is powered by a 9.7 kWh lithium-ion LFP battery pack claimed to deliver a travel range of 179km per charge and a top speed of 60kph. The TVS King EV Max, which develops maximum power of 11 kW and 40 Nm of torque, has three riding modes with different top speed limits – Eco (40kph), City (50kph) and Power (60kph). As per the TVS King EV Max’s tech specs, 0-100% charging takes three-and-a-half hours while a 0-80% charge takes two hours and 15 minutes.

SIX COMPANIES SELL OVER 1,000 UNITS EACH

In May 2025, after the Top 6 OEMs detailed above, there are another six players which sold over 1,000 units each. They are Mini Metro (1,190 units, down 10%), Unique International (1,143 units, down 13%), Energy EV (1,142 units, up 7%), Sahnianand E-Vehicles (1,114 units, up 38%), Piaggio Vehicles (1,036 units, down 25%) and JS Auto (1,002 units, up 10%).

Meanwhile, in a manner akin to Bajaj Auto’s speedy growth in the e-3W industry, Murugappa Group company TI Green Mobility (Montra Electric) is fast climbing up the ranks. In May, Montra Electric sold 498 e-3Ws, up 51% YoY (May 2024: 330 units). The company, which entered the e3W market in July 2023 and clocked annual sales of 6,089 units in FY2025, up 115% on FY2024’s 2,832 units, was ranked No. 24 last fiscal and No. 23 in May 2025.

Compared to the electric two-wheeler market which has only a few legacy players (TVS, Bajaj Auto, Hero MotoCorp, Honda Motorcycle & Scooter India, and Suzuki India), the electric 3W industry has eight – Mahindra & Mahindra, Kinetic Group, Atul Auto, Piaggio Vehicles, Omega Seiki, Bajaj Auto, Murugappa Group and TVS Motor Co. Other than these well-established legacy OEMs, the e-3W segment is currently populated by small and medium enterprises and the Vahan website lists the total number at 564 players in May 2025.

The shakeout in the overall e-3W market is clearly underway with buyers preferring to buy better-built models from well-established legacy OEMs, which have a much stronger marketing, sales and service network as well as financial capabilities. This is also evident in the fact that of the Top 25 OEMs (see data table below) 10 of such MSMEs have registered YoY sales declines in May.

ALSO READ: Electric car and SUV sales jump 44% in first 5 months of 2025 to 60,000 units

RELATED ARTICLES

TVS iQube Rides Past 800,000 Sales, 100,000 Units Sold in 3 Months

Launched in January 2020, the TVS iQube takes six years to hit the 800,000 sales milestone. While the first 300,000 unit...

Thar Roxx Races Past 100,000 Sales In 16 Months

Launched on September 25, 2024, the five-door Thar Roxx has been a huge success and helped propel the Thar brand into Ma...

India’s Top 30 SUVs, MPVs In CY2025 – Hyundai Creta Pips Tata Nexon To Top Spot

Of the 2.95 million utility vehicles sold in CY2025, the Top 30 models accounted for 2.82 million units (95% share). Mar...

04 Jun 2025

04 Jun 2025

13643 Views

13643 Views

Ajit Dalvi

Ajit Dalvi