EV sales in India hit record 965,868 units in first 8 months of CY2023

India EV Inc is all set to surpass a million units for the second year in a row and also CY2022’s record sales of 10,24,781 units in the first fortnight of September. At the end of August 2023, the difference was just 58,913 units. Retail sales of electric two- and three-wheelers, PVs and CVS revealed with company-wise stats.

India’s electric vehicle growth story keeps getting better, month on month. Latest retail sales numbers (as of September 4), from the government’s Vahan website, reveal that total sales are just 58,913 units shy of entire CY2022’s record sales of 10,24,781 EVs. Total EV retails between January and August 2023 at 965,868 units constitute robust 65% year-on-year growth (January-August 2022: 585,781 units).

CY2022 was the first year when EV sales in India had charged past the million-unit mark. Given that the monthly average of the January-August 2023 period works out to 120,733 units or 4,024 EVs sold every day across the country, CY2022’s record should be surpassed in the first fortnight of September 2023 itself, which is less than nine months of the ongoing year and indicative of the accelerating demand for EVs in the country. This, even as the festive season in India has commenced and the next few months should see numbers further accelerate.

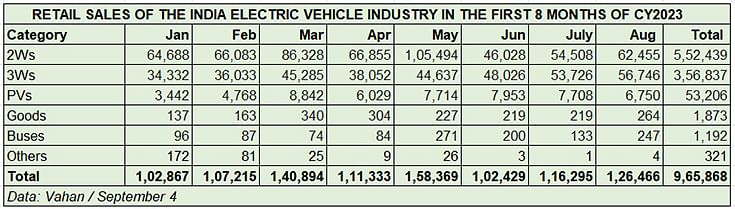

August 2023’s retails of 126,466 units is the 12th month in a row that EV sales have gone past the 100,000-unit mark. Having first notched the milestone in October 2022 (117,200 units), the sales momentum continued in November (121,602) and December (105,003) and through all eight months of CY2023, hitting a high in May 2023 (158,369 units). The data table below reveals just how the sales have grown this year, maintaining strong double-digit growth.

August 2023’s retails of 126,466 units is the 12th month in a row that EV sales have gone past the 100,000-unit mark. Cumulative million-sales milestone set to be crossed in September.

August 2023’s retails of 126,466 units is the 12th month in a row that EV sales have gone past the 100,000-unit mark. Cumulative million-sales milestone set to be crossed in September.

That the 100,000-sales mark continues to be surpassed easily each month is proof that the maturing Indian EV market, particularly for electric two-wheelers, has absorbed the sharp 25% reduction in the FAME II subsidy for e-two-wheelers, which kicked in from June 1. Monthly EV sales in the past 10 months had dropped to their lowest in June (102,429 units) but the recovery is underway as seen in the improved July (116,295 units) and August (126,466 units) numbers.

The biggies in terms of EV market share are the two ‘low-hanging fruits’ of the industry and the more affordable segments compared to electric cars, goods carriers or buses. While electric two-wheelers (552,439 units) account for 57.19% of the total EV sales, three-wheelers (356,837 units) have a 37% share of the India EV pie. A total of 53,206 electric cars and SUVs were also sold, which gives them a 5.50% share, with commercial vehicles comprising goods carriers and buses (3,065 units / getting a 0.31% share with 3,065 units (see EV retail sales data table below).

Let’s now take a deep dive into each of the four sub-segments of the EV industry: two- and three-wheelers, passenger vehicles and commercial vehicles comprising goods and passenger transports.

ELECTRIC 2-WHEELERS: OLA COMMANDS 30% SHARE, TVS SELLS OVER 100,000 iQUBES

August 2023: 62,455 units, up 20% YoY, up 14.57% MoM (July 2023: 54,508 units)

Jan-Aug 2023: 552,439 units, up 54% YoY (Jan-Aug 2022: 359,170 units)

EV sales on two wheels have bounced back. August 2023 has turned out to be an august month for the electric two-wheeler industry. At 62,455 units and month-on-month growth of 14.57% (July 2023: 54,508 units), August 2023 is ample proof that India EV Inc on two wheels is back in action. Sales have revived after the 56% MoM crash in June and a 11-month low of 45,734 units, following the slashing of the FAME II subsidy by 25 percent.

Look at the data table above and you can see the MoM growth in July and August. Cumulative sales for the first eight months of CY2022 are 552,439 units, up 54% (January-August 2022: 359,170 units). This total is already 87% of the record 631,169 units in CY2022.

With another four months to go for the year to end and the festive season having begun with Onam and continuing through to October, it can be surmised that the electric two-wheeler industry could close CY2023 with total sales in the region of 750,000 to 800,000 units, which translates into 18% to 25% YoY growth. Monthly retails can only get better, which is good news for e-scooter and motorcycle manufacturers.

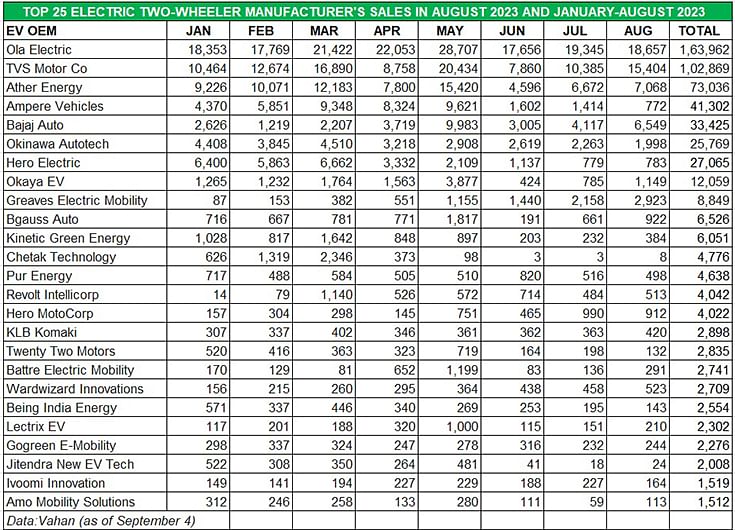

While there are over 150 players in the market, the bulk of the sales are cornered by 10% of them. Of the Top 25 OEMs (see Top 25 company-wise sales table below), the Top 10 account for 494,862 units in January-August 2023 or an overwhelming 90% of total sales. Only two players – Ola Electric and TVS Motor Co – have sales in excess of 100,000 units.

Market leader Ola Electric, which recently launched its refreshed S1 series of e-scooters and has already garnered over 75,000 bookings, has a market-stranglehold position with 163,962 units. Other than May, which was the best month for most OEMs, Ola’s strong position can be seen in the three months after June when the FAME subsidy was slashed by 25 percent – July (17,656), July (19,345) and August (18,657). Given the surge in demand for its products, expect Ola to clock in excess of 20,000 units a month from September onwards. Ola currently has a 30% market share.

TVS Motor Co, with a total of 102,869 units in January-August 2023, has an 18.62% share of the EV pie and that too with a single product – the iQube. Last month saw the company launch its new and premium EV flagship, the TVS X, priced at Rs 250,000, at a mega event in Dubai.

In third place is Bengaluru-based smart e-scooter OEM Ather Energy with 73,036 units, which gives it a 13% share. Ather Energy is among the EV OEMs making moves to enable easy finance to potential buyers. In July, the company announced 100% on-road financing for its e-two-wheelers, barely a month after it introduced a 60-month loan product, resulting in monthly EMIs as low as Rs 2,999, in collaboration with IDFC First Bank, HDFC Bank, Hero FinCorp, Bajaj Finance, Axis Bank, and Cholamandalam Finance.

Ampere Vehicles, with 41,302 units, is positioned fourth and has a 7.47% market share. The company seems to be seeing good traction for its Ampere Primus e-scooter launched in February. Powered by a mid-mounted motor that develops peak output of 4kW, Ampere claims the Primus can do 0-40kph in 4.2 seconds and has a top speed of 77kph. The Ampere Primus is equipped with three riding modes – Power, City and Eco – as well as a Reverse mode.

Bajaj Auto, which has sizeably ramped up production of the Chetak scooter and is also expanding its network, has 33,425 units to its credit, which gives it a 6% share. After a tepid start to the year, Chetak sales have picked up and the 6,549 units in August offer a clue to much better numbers likely to come up in the festive season.

Next up is Okinawa Autotech with 25,769 units. Considering the company had opened CY2023 with 4,408 units in January, it is clearly feeling the heat of slowed-down sales. It’s a similar story with Hero Electric. With 27,065 units, Hero Electric is ranked seventh and has a 5% share of the market. A look at the data table reveals that after a strong start to the year, sales have fallen to three figures in July and August.

While eighth-ranked Okaya EV has done well to shift 12,059 e-scooters in the first eight months of this year, Greaves Electric Mobility saw 12,059 units being bought in the January-August period. Wrapping up the Top 10s is Bgauss Auto with 6,526 units.

ELECTRIC 3-WHEELERS: MAHINDRA LAST MILE MOBILITY LEADS, YC EV, SAERA AUTO, DILLI ELECTRIC AUTO & PIAGGIO SHINE

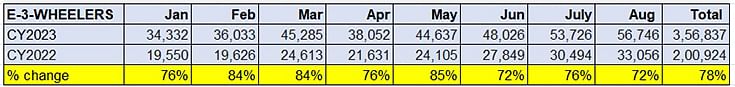

August 2023: 56,746 units, up 72% YoY, up 5.62% MoM (July 2023: 53,726 units)

Jan-Aug 2023: 356,837 units, up 78% YoY (Jan-Aug 2022: 200,924 units)

While two-wheelers are always the ones grabbing the headlines in the EV industry, the real growth is seen in their three-wheeled brethren. Look at the data table above – average monthly sales of 44,604 units in January-August 2023 (compared to 25,115 units in Jan-Aug 2022) are worth a smile and more. The cumulative retails of 356,837 units are a sterling 77.59% better than the year-ago 200,924 units. And things can only get better in the months to come.

This sub-segment, which sells passenger-transporting e-rikshaws and cargo-carrying three-wheelers, continues to witness strong double-digit growth thanks to sustained demand for passenger transportation and from last-mile operators for e-commerce applications, food deliveries and other applications.

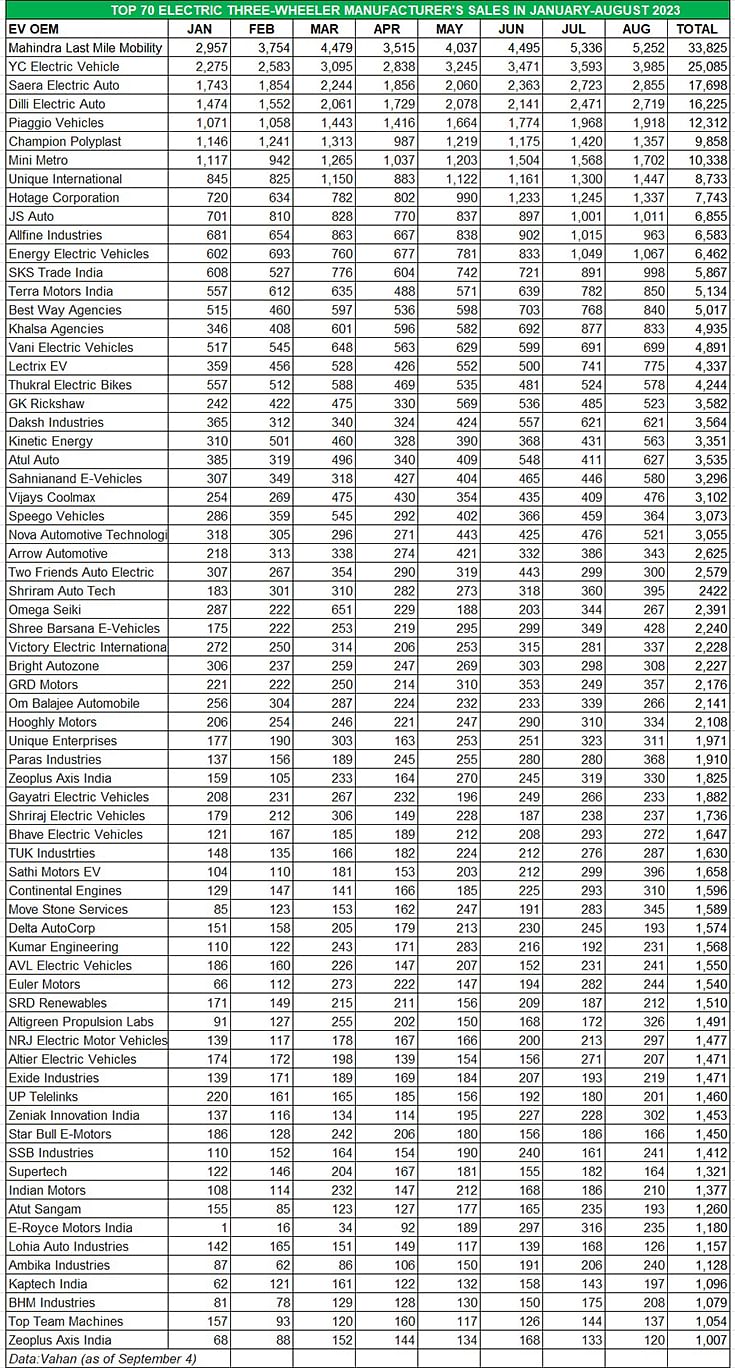

Of the nearly 460 players in the market, we have shortlisted the Top 70 OEMs in terms of sales and Mahindra Last Mile Mobility (MLMM), the market leader in FY2023 with over 35,000 units and a 9% share, maintains its leader position status with 33,825 units in January-August and a 9.47% share of the total pie. This total is already 96% of MLMM’s CY2022 sales of 35,013 units. The company, which expanded manufacturing capacity in April with a new line for its Treo e-three-wheelers at the Haridwar plant, currently has six EVs on sale – the Treo, Treo Yaari and e-Alfa Mini for passenger transport and the Zor Grand, Treo Zor and the e-Alfa cargo for goods transport.

At No. 2 rank is YC Electric Vehicles with 25,085 units – 8,740 units behind MLMM – and a 7% share. YC EV has five products – the Yatri Super, Yatri Deluxe and Yatri for passenger duties and the E-Loader and Yatri Cart for cargo operations. Low initial cost, from Rs 125,000 to 170,000 for passenger EVs, and Rs 130,000 to Rs 165,000, is what is driving demand for this OEM.

Saera Electric Auto with 17,698 units and a 5% share, followed by Dilli Electric with 16,225 units (4.54% share) and Piaggio Vehicles with 12,312 units (3.4% share).

The Top 10 OEMs cumulatively account for 148,672 units and 42% of total sales, leaving the balance 58% to the other 440 OEMs to battle it out. And that’s happening too – a close look at the comprehensive Vahan-derived sales data table reveals that the battle down the line is intense, with many OEMs separated by just a few units.

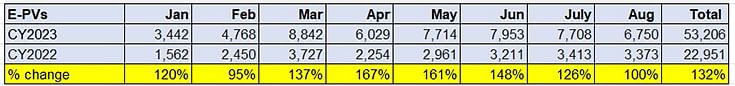

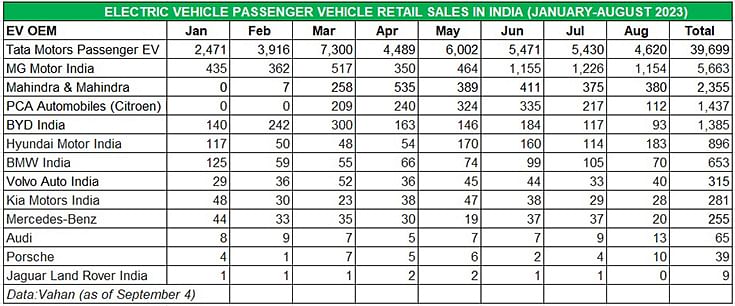

ELECTRIC CARS & SUVs: TATA MOTORS' E-PV MARKET SHARE AT 76%, MG INDIA ACCOUNTS FOR 10% SHARE, CITROEN INDIA DRIVES AHEAD OF BYD INDIA

August 2023: 6,750 units, up 100% YoY, down 12.42% MoM (July 2023: 7,708 units)

Jan-Aug 2023: 53,206 units, up 132% YoY (Jan-Aug 2022: 22,951 units)

An indication of the growing transition to e-mobility on four wheels is seen on our roads in the form of green-plated SUVs, sedans and more recently hatchbacks. A growing number of passenger vehicle buyers are preferring to put their money on a wallet-friendly EV, despite the higher initial price compared to their petrol or diesel brethren.

This movement is reflected in the retail sales. As per Vahan, a total of 53,206 electric PVs were sold in the first eight months of CY2023, up 132% YoY (January-August 2022: 22,951 units). What’s more, this total is already more than that of entire CY2022 – 38,215 units.

The data table above is indicative of the sustained demand through the year to date. While FY2023-ending March 2023 (8,842 units) was the best month, May (7,714), June (7,953) and July (7,708) have all seen sales in the 7,500-unit region. August though saw numbers dip to 6,750 units but with the festive season underway, September should see e-PV sales back on a high. Given the sales momentum, this segment should hit a new high, likely driving past the 85,000-unit mark for the full year.

Electric PV market leader Tata Motors, which has the largest portfolio comprising the Nexon EV, Tigor EV, Tiago EV and the Xpres-T (for fleet buyers), has sold 39,699 units, which gives it a 74.61% market share. Its market share used to be in excess of 80% but has now reduced due to the expanding and dynamic EV market which now has wider product choice from rivals.

MG Motor India, with 5,663 units comprising the ZS EV and Comet EV, is the firm second-ranked ePV OEM. MG’s performance in the first eight months of 2023 gives it a notable market share of 10 percent.

Mahindra & Mahindra, with 2,355 units, is in third position having gained traction with the launch of the all-electric XUV400 – the first real rival to the high-selling Tata Nexon EV – in January. The company, which also retails the eVerito sedan, currently has a 4.42% EV market share.

Interestingly, PCA Automobiles India (Citroen India), which has only recently entered the EV market, has driven ahead of BYD India. Total sales of the Citroen eC3, the electric version of the C3 hatchback, are 1,437 units in six months since launch in end-February at Rs 11.50 lakh. This gives PCA India an EV market share of 2.70%, slightly ahead with BYD India’s 2.60% – very creditable for a recent entrant and a pointer that e-hatchbacks will see demand going foward.

BYD India, which sells the Atto 3 SUV and e6 MPV, is now in fifth position with total sales of 1,385 units and a market share of 2.60 percent.

The Korean siblings – Hyundai Motor India and Kia India – together sold 1,177 units. While Hyundai, which retails the Kona and the Ioniq 5, posted sales of 896 units, the Kia EV6 went home to 281 buyers.

As per the Vahan data, luxury carmakers in India accounted for 1,336 units or 2.51% of total ePV sales in January-August 2023. BMW India leads the luxury carmakers with 653 units, followed by Volvo Auto India (315), Mercedes-Benz (255), Audi (65), Porsche (39) and Jaguar Land Rover (9).

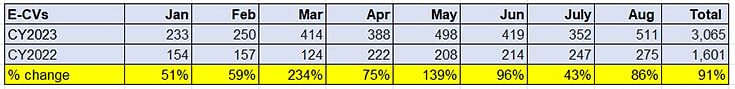

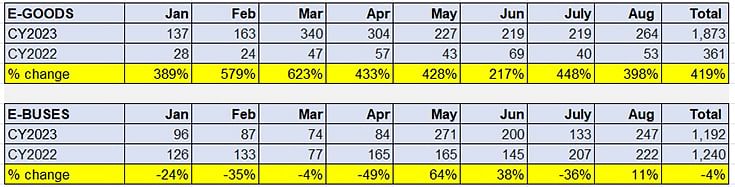

ELECTRIC CVs: TATA MOTORS TOPS WITH 38% MARKET SHARE, PMI ELECTRO MOBILITY RANKED SECOND

August 2023: 511 units, up 91% YoY, up 45% MoM (July 2023: 352 units)

Jan-Aug 2023: 3,065 units, 91% YoY (Jan-Aug 2022: 1,601 units)

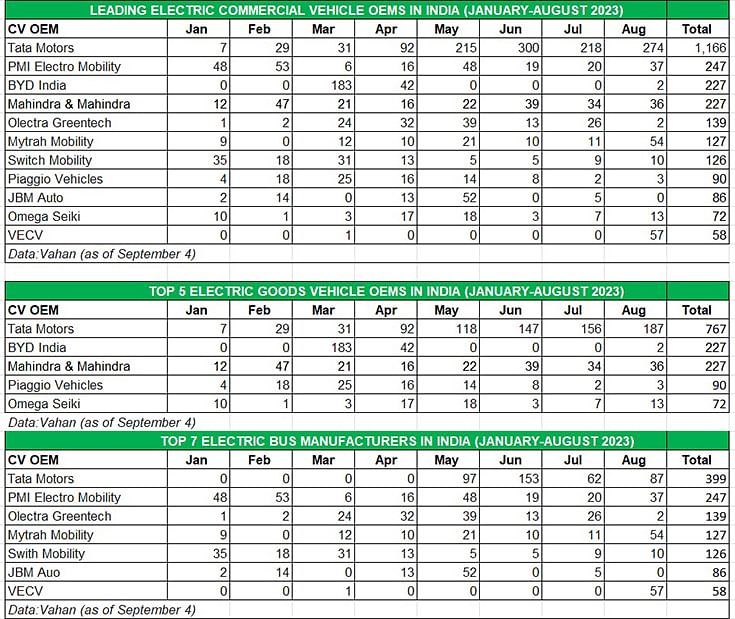

The commercial vehicle industry, where electric mobility makes eminent and wallet-friendly TCO sense given the much larger number of kilometres driven, compared to personal EVs, has registered cumulative sales of 3,065 units, up 91% YoY on a low-year ago base. The CV sector essentially comprises goods carriers and passenger-transporting buses. As per Vahan, electric goods carriers accounted for 1,873 units and electric buses for 1,192 units, corresponding into 61% and 39% respectively of the total e-CV pie (see sub-segment splits below).

In the combined sales tally of goods carriers and buses, Tata Motors leads with 1,166 units, which makes for a strong 38% market share. PMI Electro Mobility is now the second-ranked e-CV OEM with 246 units and an 8% share, ahead of BYD India and Mahindra Last Mile Mobility, both of whom have sold 227 units for an equal 7.40% share of the overall e-CV market.

Olectra Greentech (139), Mytrah Mobility (127) and Switch Mobility (126) are the three other OEMs whose e-CV sales run into three figures in the first eight months of CY2023.

What will give a major boost to sales of electric buses in the coming months and year will be the government’s recent move to allocate a big-ticket spend of Rs 57,613 crore for 10,000 electric buses.

INDIA EV INC FIRMLY PLUGGED INTO GROWTH ROAD

India is targeting EVs to account for 30% of its mobility requirements by 2030, driven by the FAME scheme, state subsidies and a larger portfolio of products across vehicle segments.

The Ministry of Heavy Industries-formulated five-year Faster Adoption and Manufacturing of Electric Vehicles in India Phase II (FAME India Phase II) Scheme, with a total budgetary support of Rs 10,000 crore, comes to a close on March 31, 2024. FAME II is mainly focused on supporting electrification of public and shared transportation, and support through demand incentive for 7,090 electric buses, 500,000 e-three-wheelers, 55,000 passenger vehicles and 10 lakh e-two-wheelers. Creation of EV charging infrastructure is also supported under the scheme.

Given the likelihood of the FAME subsidy scheme not being extended, OEMs and EV buyers will have to contend with the fact that market dynamics will take over even as OEMs and their component and technology supplier ecosystem are hard at work to reduce developmental and product costs to enhance EV affordability compared to IC-engined two-wheelers.

The domestic EV industry’s sales growth in 2023 can be attributed to an increase in the availability of products in the market, high petrol, diesel and CNG prices, state subsidies and sops offered under FAME II. It also helps that there is growing consumer awareness about the need to use eco-friendly transport. And, of course, the wallet-friendly nature of EV cost of ownership over the long run is a big catalyst.

Given the pace of growth, the EV industry can be expected to notch consistent progress in the in the second half of the year. Some challenges remain in the form of inadequate charging infrastructure and high initial EV prices, which is directly related to the battery cost. Nevertheless, with OEMs’ sharpened focus on localisation with a view to reduce costs and enhance affordability, and battery prices expected to reduce gradually, there is cautious optimism for this eco-friendly form of mobility.

Given that India EV Inc is set to cross a million units in just nine months this year, the October-December 2023 period could deliver an additional 375,000 units, what with the festive season having begun. This would translate to an estimate of 1.3-odd million units and 25% YoY growth (CY2022: 10,24,808 EVs). In CY2022, EVs accounted for 5% of total India Auto Inc’s sales of 2,07,52,305 units. Will CY2023 raise the bar on the India EV front? Stay plugged into this space.

Data source: Vahan

ALSO READ:

India has over 2.8 million EVs on its roads, Central and South India dominate EV ownership

Maharashtra tops in car and CV sales in Q1 FY2024, Uttar Pradesh in two- and three-wheelers

RELATED ARTICLES

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

TVS Sells 31,600 e-Scooters in February for a 28% Share; FY2026 to see 1.35 Million e-2W Sales

With 31,600 e-scooters, TVS commanded a 28% market share even as Bajaj Auto, Ather Energy and Hero MotoCorp witnessed st...

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

06 Sep 2023

06 Sep 2023

32759 Views

32759 Views

Ajit Dalvi

Ajit Dalvi