EV sales in India hit all-time high for May amid rare earth magnet supply uncertainty

With the electric 2- and 3-wheeler, passenger and commercial vehicle segments registering robust sales and high double-digit YoY growth, highest-ever retail sales in May improve upon April 2025’s 169,003 units and set the foundation for a fiscal which promises to achieve the 2-million milestone for the first time. But a spoiler looms ahead in the form of disrupted supplies of rare earth magnets from China, which could hamper production and impact sales later this year.

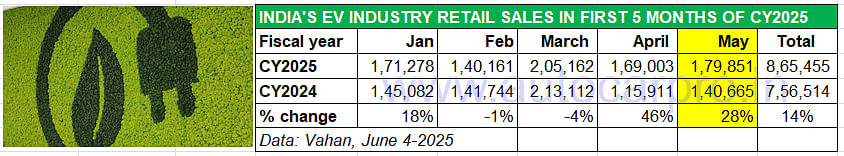

Today – June 5 – is World Environment Day 2025 and the biggest international day for the environment. India’s EV industry, which is among the many sectors doing their bit for protecting the environment, has had a stellar opening to FY2026. Following April 2025’s record retail sales of 169,003 units and robust 46% YoY growth, the numbers in May 2025 are even better – at 179,851 units.

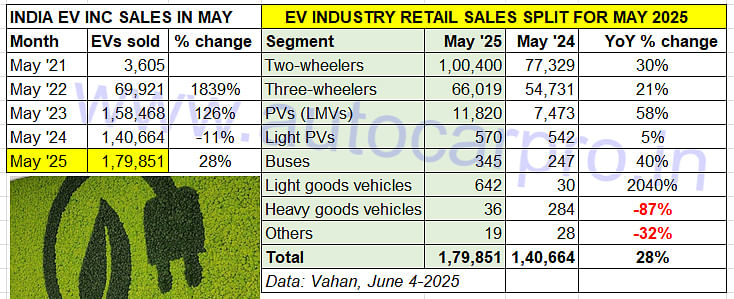

May 2025 saw the combined sales of electric two- and three-wheelers, as well as passenger and commercial vehicles rise 6% month on month and 28% year on year (May 2024: 140,664 units). This performanc comes on the back of India EV Inc hitting its best-ever fiscal year sales of 1.96 million units in FY2025.

Combined April-May 2025 sales at 348,854 units are up 74% YoY (April-May 2024: 256,576 units) and 18% of FY2025’s record 19,67,278 EVs which had missed the 2-million EV milestone by a whisker –32,722 units.

Best-ever sales for the month of May (179,851 units, up 28%) account for 21% of cumulative January-May 2025 retails of 865,455 EVs, up 14% YoY.

India EV Inc’s growth trajectory on the calendar year front is also solid. Cumulative January-May 2025 retail sales at 865,455 units are up 14% YoY (January-May 2024: 756,514 units) and already 44% of CY2024’s 1.95 million units (19,50,615 units) with seven months still to be counted in this year. What is helping drive demand for EVs is the favourable market sentiment, a positive monsoon outlook by the IMD and, importantly, a good number of new product launches across the two-wheeler and passenger vehicle segments.

Despite geopolitical tensions along with global trade uncertainties that the automotive as well as other industries are grappling with, India’s GDP rose by 7.4% in FY2025’s fourth quarter (January-March 2025), helping the country maintain its status as the world’s fastest-growing economy and is on track to transform into the world’s fourth largest economy by the end of the current fiscal (FY2026).

While initial estimates for first couple of months of FY2026 point to a softness in urban demand, an upbeat rural market could act as a buffer and provide the ammo for the rest of the year and beyond. However, a growth spoiler is looming ahead in the form of disruption of critical rare earth materials used in the manufacturer of EV motors (detailed at the bottom of this analysis). ELECTRIC TWO-WHEELERS: 100,400 units, up 30% YoY

ELECTRIC TWO-WHEELERS: 100,400 units, up 30% YoY

The Indian electric two-wheeler industry is in good nick. After hitting record monthly sales of 92,345 units and 45% YoY growth in April 2025, the retail sales numbers for May 2025 are better. At 100,400 units, demand rose 30% YoY (FY2024: 77,330 units).

The Top 10 electric 2W manufacturers together accounted f an overwhelming 93%, while the Top 4 – each with five-figure sales – 77,669 units or 77 percent. TVS Motor Co topped the monthly sales chart for the second month in a row, even as Bajaj Auto and Ather Energy registered strong gains. CLICK for Top 10 e-2W OEMs in May 2025

ELECTRIC THREE-WHEELERS: 69,019 units, up 21%

ELECTRIC THREE-WHEELERS: 69,019 units, up 21%

Of all the vehicle segments, it is the electric three-wheeler industry which is witnessing the fastest transition to electric mobility. In May 2025, a total of 104,448 three-wheelers (across all powertrains comprising electric, CNG, diesel, LPG and petrol) were sold across India (other than Telangana), as per Vahan data.

The sustained demand for electric 3Ws is seen in their growing share of the overall 3W market. In May, 66,019 e3Ws accounted for the bulk of sales – 63% – increasing their share YoY by 7% from 56% in May 2024. In contrast, demand for CNG 3Ws dropped by 7% YoY to 24,121 units with the CNG share of 3W sales also dropping by 7% YoY to 23% in May 2025 – this can be attributed to CNG price increases in recent times, adding to the total cost of ownership. This also means e-3Ws are eating into the CNG 3W market. Meanwhile, diesel 3Ws continue to see demand, what with 11,245 units sold last month to maintain their 11% share of the overall 3W market.

Similar to the e-two-wheeler industry, the e-3W segment too is witnessing fierce competition albeit the real fight is underway amongst the Top 6 players – Mahindra Last Mile Mobility (MLMM), Bajaj Auto, YC Electric Vehicles, Saera Electric Auto, Dilli Electric Auto and Piaggio Vehicles. And TVS Motor Co, which has plugged into this segment only recently, has already grabbed No. 6 rank. In what marks a maturing of this segment, legacy OEMs are impacting well-entrenched MSME players as buyers shift to well-established ICE-diversified-into-EV OEMs which have developed better-built e-3Ws and also have a stronger sales and service network. CLICK for Top 25 e-3W OEMs in May 2025

ELECTRIC PASSENGER VEHICLES: 12,384 units, up 54%

ELECTRIC PASSENGER VEHICLES: 12,384 units, up 54%

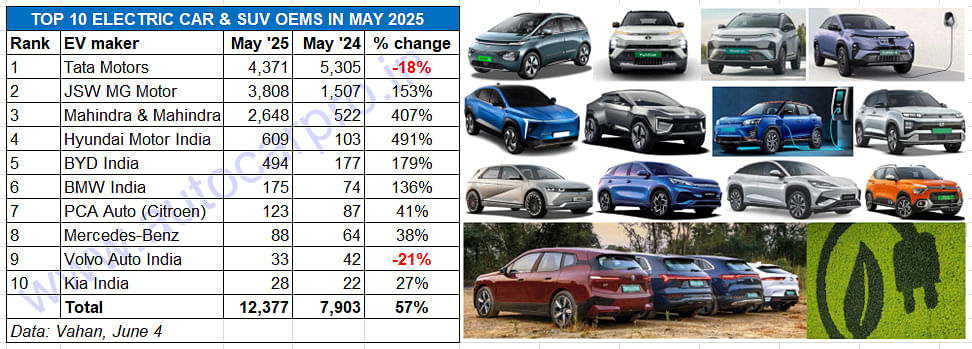

In a scenario similar to the two- and three-wheeler segments, demand for electric cars, sedans, SUVs and MPVs rose strongly to 12,384 units in May 2025. This is a YoY increase of 54% (May 2024: 8,015 units).

Market leader Tata Motors, which continues to feel the heat of the growing competition, sold 4,371 EVs last month – 934 fewer than the year-ago 5,305 units. This gives it a market share of 35% for the month, substantially down on the 67% the maker of the Punch EV commanded in May 2024. Tata Motors has, a few days ago, launched the new Harrier EV priced at Rs 21.49 lakh. The company, which is looking to regain a 50% share in the expanded e-PV market, will now focus on micro-segments, enhanced product value propositions and also by investing in charging infrastructure to drive long-term growth.

The company which has taken away market share from Tata is JSW MG Motor India which continues to witness surging demand, particularly for its Windsor EV. JSW MG sold 3,808 EVs in May 2025 – 2,303 units more than in May 2024 – up 153% YoY. This sees its market share jump to 31% from 19% a year ago.

Mahindra & Mahindra, which launched its two new e-SUVs – the BE 6 and XEV 9e – in February this year is benefiting from the demand for the tech- and feature-laden EVs. At 2,648 units, sales rose strongly by 407% YoY (May 2024: 522 units), giving M&M a market share of 21%.

The launch of the Creta Electric in mid-January 2025 helped Hyundai Motor India move ahead of BYD India in the e-PV numbers game. In May 2025, the Creta Electric and the Ioniq 5 together sold 609 units, up 491% YoY on a low year-ago base of 103 units. While the Creta remains Hyundai’s best-selling model and is also India’s No. 1 midsize SUV, the market is yet to warm up to the Creta Electric, which was expected to see four-digit monthly numbers. Nevertheless, with the Creta Electric’s entry, Hyundai’s e-PV share has risen to 5% from 1% a year ago.

BYD India, the local arm of China’s and the world’s largest electric PV manufacturer, is beginning to gain traction in India. The company, which sells the all-electric Atto 3 SUV, Seal sedan, eMax 7 MPV and the Sealion 7 SUV, sold 494 units in May 2025, up 179% YoY, making it the company’s best month ever since the Chinese OEM began e-PV sales in India.

BYD India, the local arm of China’s and the world’s largest electric PV manufacturer, is beginning to gain traction in India. The company, which sells the all-electric Atto 3 SUV, Seal sedan, eMax 7 MPV and the Sealion 7 SUV, sold 494 units in May 2025, up 179% YoY, making it the company’s best month ever since the Chinese OEM began e-PV sales in India.

The luxury EVs accounted for 301 units last month, with BMW India leading with 175 units, followed by Mercedes-Benz India (88 units) and Volvo Auto India (33 units). CLICK for OEM-wise e-PVsales in January-May 2025: 60,000 units, up 44%

ELECTRIC COMMERCIAL VEHICLES: 1,023 units, up 82% YoY

ELECTRIC COMMERCIAL VEHICLES: 1,023 units, up 82% YoY

Like the other three sub-segments of the EV industry, the electric commercial vehicle segment’s performance too was a robust one in May. Total retails were up strongly by 82% YoY (May 2024: 561 units). Sales of zero-emission passenger buses rose 40% to 345 units in the month, which also saw 36 heavy goods vehicles were also bought during the month.

The real growth for the e-CV category came from electric light goods vehicles which, with 642 units, accounted for 63% of e-CV retail sales and reflects the demand being generated from last-mile mobility and logistics requirements from across India.

Sona Comstar, one of the world’s leading EV traction motor manufacturers and which has produced over 500,000 such units, had red-flagged its concern of rare earth materials supply chain disruption in early May 2025. Image: Sona Comstar/X

Sona Comstar, one of the world’s leading EV traction motor manufacturers and which has produced over 500,000 such units, had red-flagged its concern of rare earth materials supply chain disruption in early May 2025. Image: Sona Comstar/X

SPOILER ALERT

SLOWDOWN IN SUPPLY OF RARE EARTH MAGNETS FROM CHINA

A supply shortage from China of rare earth magnets, which are a vital component in manufacture of EV motors like brushless BLDC and Permanent Magnet Synchronous Motor (PMSM), is likely to impact production across all EV segments substantially. In April this year, China, which commands an overwhelming 90% global share of rare earth magnet supplies, implemented new rules which call for import permits. This move, which was perceived as a response to the stiff 145% tariff imposed initially by the USA, is now rattling global automotive supply chains including India.

In end-April 2025, Rajiv Bajaj, managing director, Bajaj Auto was among the first in the industry to flag concern about the slowdown in the supply of rare earth magnets from China. Last month, Rakesh Sharma, executive director, said: “The rare earth situation is a very difficult one. An onerous process has been hammered together for import approvals. This involves end-use declaration about the usage of the rare earth not being in military use. And requires certification from multiple Indian ministries, the Chinese embassy, and ultimately, export clearance from Chinese authorities.”

He added, “Chinese authorities have said it could take 40 to 45 days from the time an application is made, but that loop has not yet got closed. Supplies and stocks are getting depleted. And if there is no relief and there are no shipments, then July production (for Bajaj Auto) will get seriously impaired. I think such is the case with the entire auto industry.”

EV motor manufacturer and supplier Sona Comstar too has, in advance, recognised the potential disruption caused by delayed supplies of rare earth materials. The company is among the few global suppliers (ZF, Valeo, Mahle, Vitesco Technologies) which have been working on developing magnet-less e-drives and motors.

In a Q4 FY2025 earnings call last month, Vivek Vikram Singh, MD and Group CEO, had said on May 5: “Global automotive production, and in this I include every market, may see disruptions due to supply chain complexities and high dependence on China, especially for rare earth materials. In India, while we are working with the industry and the government and the Chinese embassy to speed up the process of importing magnets from China, we're also evaluating alternate materials, including ferrite, different grades of magnets, different technologies, as well as different supply sources.”

Cognisant of the likelihood of automobile and EV production getting impacted, apex industry bodies SIAM and ACMA have urged the Indian government to expedite permits and get China to release rare earth shipments to India Auto Inc.

Lead collage images: courtesy Plug & Go and Sona Comstar

RELATED ARTICLES

TVS iQube Rides Past 800,000 Sales, 100,000 Units Sold in 3 Months

Launched in January 2020, the TVS iQube takes six years to hit the 800,000 sales milestone. While the first 300,000 unit...

Thar Roxx Races Past 100,000 Sales In 16 Months

Launched on September 25, 2024, the five-door Thar Roxx has been a huge success and helped propel the Thar brand into Ma...

India’s Top 30 SUVs, MPVs In CY2025 – Hyundai Creta Pips Tata Nexon To Top Spot

Of the 2.95 million utility vehicles sold in CY2025, the Top 30 models accounted for 2.82 million units (95% share). Mar...

05 Jun 2025

05 Jun 2025

16330 Views

16330 Views

Ajit Dalvi

Ajit Dalvi