EV retail sales cross 4 lakh mark

The surge in sales can be attributed to availability of more products in the market, high fuel prices, state subsidies and sops offered under FAME II.

Retail sales of electric vehicles clocked 429,217 units in FY22 as compared to 134,821 units in FY21, and 168,300 units in FY20, the Federation of Automobile Dealers Association said in a statement.

This increase is over 200 percent as compared to FY21 numbers and 155 percent over FY2020 numbers. The surge in sales can be attributed to availability of more products in the market, high fuel prices, state subsidies and sops offered under FAME II.

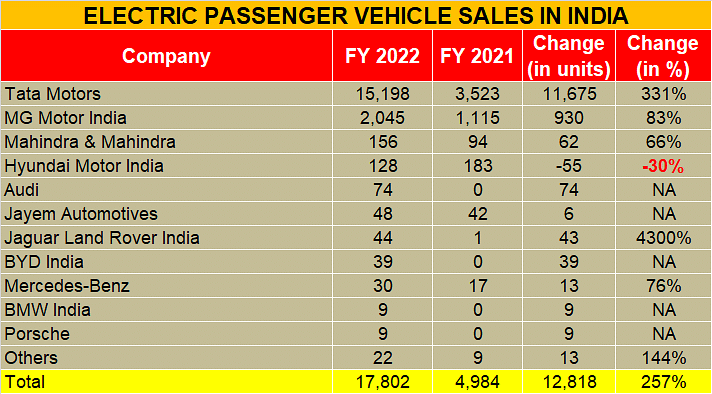

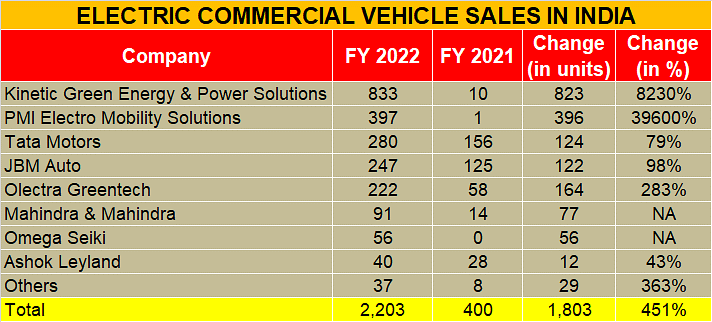

The two- and three segments led the growth in the fiscal with sales of 231,338 units and 177,874 units respectively. While the passenger vehicle tally was 17,802 units, 2,203 electric CVs were sold.

In the two-wheeler segment, the top five companies, Hero Electric (65,303 units), Okinawa Autotech (46,447 units), Ampere Vehicles (24,648 units), Ather Energy (19,971 units) and Pure Energy (14,862 units) accounted for 74 percent of marketshare.

Tata Motors led the passenger vehicle segment with 15,198 units sold followed by MG Motor with 2,045 units. While Tata has a trio of offerings which include the Nexon, Tiago and Tigor, MG Motor India has the ZS EV.

In the commercial vehicle segment, Kinetic Green (833 units), PMI Electro Mobility Solutions (397 units), Tata Motors (280 units), JBM Auto (247 units) and Olectra Greentech (222 units) were the top five CV makers in the country.

With fuel prices continuing to rise and charging infrastructure expanding its footprint, and solutions such as Battery as a Service (BaaS) becoming available, the EV segment could see further growth in the current fiscal.

Also read

CNG makes inroads in India’s auto sector

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

05 Apr 2022

05 Apr 2022

9506 Views

9506 Views

Shahkar Abidi

Shahkar Abidi