Electric 2W sales at 88,471 units in August up 41% but down 17% on July

August, the middle month of the extended EMPS subsidy, saw sales rationalise after July’s 107,472 units but should hit six figures again in September. In the first month of sales after its IPO, market leader Ola Electric sees its numbers drop to 27,500 levels even as the electrified battle between TVS and Bajaj Auto continues.

After July 2024’s 107,000-plus retail sales of electric two-wheelers, up 97% YoY, August didn’t really turn out to be an august or impressive month for EV manufacturers, given the high expectations the sector has set for itself. At 88,451 units, retails were up 41% YoY (August 2023: 62,778 units) but down 17% month on month. Put that down to the middle-month effect as a result of the three-month Electric Mobility Promotion Scheme 2024 (EMPS) scheme valid from July 1 through to September 30, 2024. So, if August numbers were somewhat tepid, then expect the EMPS-ending month of September to pump up the volume again . . . into six figures.

The e-two-wheeler segment though remains the biggest volume driver of the EV industry. In August, it accounted for 57% of total India EV Inc's volumes of 156,199 units (up 23% YoY), as per data published on the government of India’s Vahan website (as of September 1, 7am).

Electric two-wheeler OEMs sold 88,451 units in August 2024, up 41% YoY. Cumulative 8-month sales at 723,906 units are already 84% of CY2023’s record retails of 860,365 units.

Electric two-wheeler OEMs sold 88,451 units in August 2024, up 41% YoY. Cumulative 8-month sales at 723,906 units are already 84% of CY2023’s record retails of 860,365 units.

Like the e-three-wheeler industry, e-two-wheeler OEMs have been impacted by the now-reduced subsidy which saw most EV makers hike product prices. While this can somewhat dampen demand, the wallet-friendly long-term USP of an EV remains a big draw when compared to the high price of petrol, which currently costs Rs 104.19 a litre in Mumbai (on September 1).

This segment, which delivers the maximum volumes for India EV Inc and sold a record 860,365 units in CY2023, is well on its way to sell over a million units for the first time in a calendar year in CY2024. Eight months into the year, total retails at 723,906 units are up 31% YoY (January-August 2023: 553,102 units) and already 84% of CY2023’s record number.

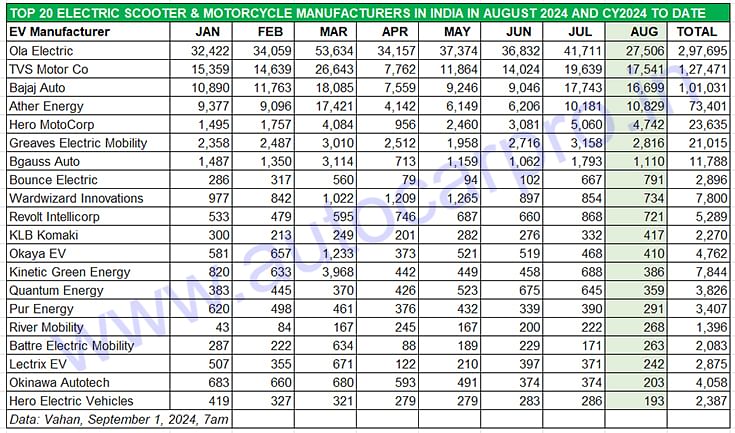

CY2024'S first eight-month retail sales data table above reveals that the lowest monthly sales in the year to date were in April 2024 – 65,540 units – following the closure of the FAME II subsidy scheme on March 31. This also explains why March 2024 with 140,318 units was the month with the highest-ever e-two-wheeler sales.

Let’s take a closer look at the top six movers and shakers of the industry in June and for the first eight months of CY2024.

OLA ELECTRIC – August 2024: 27,506 units, up 47% YoY

OLA ELECTRIC – August 2024: 27,506 units, up 47% YoY

Market share: 31%

Jan-Aug 2024: 297,695 units, up 81% YoY (Jan-Aug 2023: 164,228 units)

Market leader Ola Electric, which is the latest automotive start-up to be listed on the bourses, has had a surprisingly tepid August. The company’s retail sales of 27,506 units are its lowest in the calendar year to date. While the August 2024 numbers are up 47% YoY (August 2023: 18,749 units), they are down by 34% on July 2024’s 41,711 units.

Ola opened CY2024 with 32,422 units in January units, hit a high of 53,634 units in March and maintained stellar month-on-month growth right from April through to July until August. While Ola’s market share in July was 39%, the August share has dropped to 31 percent. Nevertheless, it remains well ahead of the competition – Ola’s cumulative eight-month sales (297,695 units, up 81%) give it an overall market share of 41%, up from 30% a year ago.

Ola Electric’s move to enter the mass-market segment with the S1 X portfolio has paid off. Available in three battery configurations (2 kWh, 3 kWh, and 4 kWh), the scooters are priced at Rs 74,999, Rs 84,999, and Rs 99,999, respectively. The company has also recently revised the prices of its S1 Pro, S1 Air, and S1 X+ to Rs 129,999, Rs 1,04,999, and Rs 89,999, respectively.

Last month saw Ola announce its entry into the electric motorcycle market with the Roadster X, Roadster and Roadster Pro. It will begin delivering these motorcycles by 2025, starting with the Roadster X.

TVS MOTOR CO – August 2024: 17,541 units, up 13% YoY

TVS MOTOR CO – August 2024: 17,541 units, up 13% YoY

Market share: 20%

Jan-Aug 2024: 127,471 units, up 24% YoY (Jan-Aug 2023: 102,972 units)

TVS Motor Co, the No. 2 EV player on two wheels, sold 17,541 iQube e-scooters in August, up 13% YoY (August 2023: 15,482 units) but down 10% on July 2024’s 19,639 units. This gives the company a market share of 20% for August. Cumulative January-August 2024 sales at 127,471 units are up 24% YoY and give it a 17.60% market share in the year to date.

On August 14, TVS launched a 1,000-units only Celebration Edition iQube and iQube S, priced at Rs 120,000 and RS 129,000 (ex-showroom respectively). The EV, which sports a dual-tone orange-and-black colour scheme, remains mechanically the same.

Earlier this year, on May 13, two years after the iQube got its first refresh, TVS launched more variants, both at the lower and upper end of the spectrum. The iQube line-up now starts with a base variant with a 2.2kWh battery, 75km real-world range, charging time of 2 hours from 0-80 percent with a 950W charger. This base variant is now the most affordable iQube at Rs 94,999. There is also a larger variant with a 3.4kWh battery. Both these models get a 5-inch TFT display with tow and theft alerts and turn-by-turn navigation.

The iQube ST line-up has expanded to include variants with two capacities – 3.4kWh and 5.1kWh. The iQube ST 3.4 variant (Rs 155,555) has a claimed real-world range of 100km. The range-topping ST 5.1 variant has the largest battery capacity of any Indian electric scooter and TVS claims a real-world range of 150km on a single charge. The iQube ST 5.1 also has a higher 82kph top speed, and the claimed charging time is 4 hours and 18 minutes from 0 to 80 percent. The ST 5.1 gets all the same features as the ST 3.4, but at Rs 185,373, it's the most expensive model in the line-up.

The company, which expects two-wheeler EV sales in India to reach 30% market penetration by CY2025, is targeting a big jump in the contribution of EV sales to its overall volumes over the next two years.

TVS EV portfolio is set to expand later this year. At the company AGM on August 6, managing director Sudarshan Venu said: “EV continues to be front and centre of our priorities going forward. In terms of new energy vehicles and in terms of embracing the future, we are making very strong investments and you will see more launches in terms of electric three-wheelers, and more affordable, yet stylish and aspirational electric scooters later this year."

BAJAJ AUTO – August 2024: 16,699 units, up 154% YoY

BAJAJ AUTO – August 2024: 16,699 units, up 154% YoY

Market share: 19%

Jan-Aug 2024: 101,031 units, up 201% YoY (Jan-Aug 2023: 33,497 units)

Bajaj Auto is hard on TVS’ heels to grab the No. 2 position and was just 842 units behind the Chennai-based OEM. In August, Bajaj retailed 16,699 Chetaks, which is a handsome 154% YoY increase albeit on a low year-ago base (August 2023: 6,582 units).

In the January-August 2024 period, Bajaj Auto’s total retails at 101,031 Chetaks are an additional 67,534 units more than the 33,497 units it sold a year ago, up 201% YoY. This stellar performance gives Pune-based auto major a market share of 19%, a big jump over its 6% share in the year-ago period, and just one percent behind TVS Motor Co.

The Chetak 2901, launched in early June at Rs 95,998, is the most affordable of the Chetak line-up and nearly Rs 51,000 cheaper than the top-end variant. The Chetak 2901, which shares its 2.9kWh battery with the mid-spec Chetak Urbane, has successfully taken the battle right into the rivals’ camp – TVS iQube, Ather Rizta S and Ola S1 Air. And the move is playing true with just what Bajaj Auto management planned.

In an analyst call in July, Rakesh Sharma, executive director, Bajaj Auto, said of the Chetak 2901: “It helps us to attack the sub-1 lakh segment, which is almost 50% of the e2-wheeler industry and will help us widen distribution. We were in 250 stores in June, should be in 500 by end-July and almost 1,000 by September. While our overall market share in Q1 was 12%, it should be noted that we were at 20% plus in the above 1-lakh segment and obviously almost nil in the sub-1 lakh segment. Hence, played the new segment, which is a sub-1 lakh segment and in new geographies, should combine and lift the Chetak business significantly.”

In July 2024, the Bajaj Chetak rode past the 200,000-unit wholesales milestone in the domestic market, news of which Autocar Professional broke. Launched just before the pandemic struck, Bajaj Auto’s first electric scooter took four years to achieve 100,000 sales. The next 100,000-unit dispatches though have come in a scant eight months as a result of new variants and an expanded retail sales network. July 2024’s 20,114 units have been the Chetak’s highest monthly dispatches yet.

ATHER ENERGY – August 2024: 10,829 units, up 51% YoY

ATHER ENERGY – August 2024: 10,829 units, up 51% YoY

Market share: 12%

Jan-Aug 2024: 73,401 units, up 0.32% YoY (Jan-Aug 2023: 73,160 units)

Smart e2W maker Ather Energy is the only one of the top six OEMs to register month-on-month growth in August. Its 10,829 units were up 51% YoY (August 2023: 7,157 units) and up 6% on July 2024’s 10,181 units. Ather’s market share in August 2024 was 12%, as compared to 11% in August 2023. Ather hit the 10,000 retails mark in July and August, this year to date.

Growth for the cumulative first eight-month sales at 73,401 units is flat (January-August 2023: 73,160 units), which could reflect the heat of growing competition for the company.

In April, Ather launched the Rizta family e-scooter (pictured above) at a starting price of Rs 109,999 (Rizta S) through to Rs 149,999 (Rizta Z). While the S version (2.9 kWh battery) has a 123km range, the Z variant (3.7 kWh) has a 160km range. Key highlights for the family e-scooter include the largest two-wheeler seat in India and storage space aplenty.

A reduced sticker price, particularly in view of rivals rolling out affordable EVs, is key to success and Ather has been making moves on this front. In early August, the start-up signed an MoU with Amara Raja Advanced Cell Technologies (ARACT), a wholly owned subsidiary of Amara Raja Energy & Mobility. Amara Raja will collaborate with Ather to develop and supply NMC (Nickel Manganese Cobalt) and LFP (Lithium Iron Phosphate) Lithium-Ion (Li ion) and other advanced chemistry cells, produced locally at ARACT’s upcoming Gigafactory in Divitipally, Telangana.

Tarun Mehta, co-founder and CEO at Ather Energy, said: “Our focus has always been on designing and building products from scratch in India, with most of our components, aside from cells, sourced domestically. Now, we're taking a significant step forward by promoting homegrown cell technology. This will help us optimize costs and enable us to source lithium-ion cells tailored to Ather's specific requirements, further enhancing our ability to innovate and scale efficiently.”

In June, Ather Energy announced plans to set up its third India plant in Maharashtra. The facility, which will come up in the Aurangabad Industrial City (AURIC), calls for an investment of over Rs 2,000 crore and will annually produce up to a million units of both EVs and battery packs.

HERO MOTOCORP – August 2024: 4,782 units, 418% YoY

HERO MOTOCORP – August 2024: 4,782 units, 418% YoY

Market share: 5.40%

Jan-Aug 2024: 23,635 units, up 487% YoY (Jan-Aug 2023: 4,025 units)

The world’s largest two-wheeler manufacturer and the last of the big legacy players to enter the EV market is seeing demand pick up for its Vida brand of e-scooters. The company, which sold 4,742 units in August, clocked 419% YoY growth on a low year-ago base of 915 units. Market share has risen to 5.40% from 1.45% in August 2023.

Hero MotoCorp has started scaling up brand presence for Vida and its network now stands at 203 touchpoints comprising 180 dealers across 116 cities. The company, which has the V1 Plus and V1 Pro EVs, plans to expand its portfolio – within the mid- and affordable segment – within FY2025. And it already has around 2,500 charging stations in collaboration with Ather Energy, in which Hero MotoCorp is an early investor.

Like all the leading EV OEMs, Hero MotoCorp too is focusing on reducing product cost. In an earnings conference call on August 14, Niranjan Gupta, CEO, Hero MotoCorp said: “We are working very aggressively, and on the powertrain side, to bring the costs down by technological improvements, by localization, obviously, by bringing scale. You will see that benefit coming out into our further launches as well. You'll see affordable products coming out later this year.”

GREAVES ELECTRIC MOBILITY – August 2024: 2,816 units, down 3.75% YoY

Market share: 3%

Jan-Aug 2024: 21,015 units, up 137% YoY (Jan-Aug 2023: 8,853 units)

Greaves Electric Mobility, which launched its new Ampere Nexus e-scooter (pictured above) on April 30, clocked retail sales of 2,816 units in August 2024, down 4% YoY (August 2023: 2,926 units). Its cumulative eight-month sales at 21,015 units are a sizeable 137% increase over the 8,853 units in the January-August 2023 period. Its market share is currently at 3%.

Targeted at families, the Ampere Nexus has been designed and developed in-house at the Ranipet facility in Tamil Nadu. Equipped with a 3 kWH LFP battery, the Nexus has a claimed top speed of 93kph and a certified range of 136km. Sold in two variants, prices start at Rs 110,000 (ex-showroom) and go up to Rs 120,000.

Greaves Electric Mobility too, not surprisingly, is focussing on cost optimisation. In a Q1 FY2025 earnings call on August 13, executive director and CEO K Vijaya Kumar said: “We have been able to make considerable inroads in terms of our costing of key components and products on one side. The other side is broadly we have looked at our cost, sort of a cost rationalization wherein we are getting closer to building our efficiencies much higher than where we were.”

GROWTH OUTLOOK: FESTIVE SEASON SHOULD REV UP SALES

GROWTH OUTLOOK: FESTIVE SEASON SHOULD REV UP SALES

Overall e-two-wheeler retails in August (88,451 units, up 41% YoY) have been the third highest in the year to date after March 2024 (140,318) and July (107,472). The sales momentum is clearly and of the top six OEMs, three – Ola, Bajaj and Hero MotoCorp – have already surpassed their entire CY2023 retails in the first eight months of CY2024 itself. Ola (297,695 units) will cross the 300,000 units milestone for the first time in a calendar year in the first few days of September. Bajaj Auto (101,301 units) has gone past its CY2023 total of 71,939 units, and Hero MotoCorp (23,635 units) has more than doubled its CY2023 sales of 11,140 units.

September 30 being the last day of the extended three-month EMPS subsidy scheme, which began on July 1, this month should ideally see retails of electric scooters and motorcycles cross the 100,000-unit mark again. While the first half of the month, with Ganesh Chaturthi in the first week and Onam on September 15, should see rapid sales movement, the second fortnight could likely be slower, given that ‘Pitru Paksh’ is from September 17 through to October 2. Nevertheless, as it happened in the FAME II policy-ending, September too should see accelerated marketplace momentum. Will it be a sales record-breaking month? We’ll simply have to wait till the end of the month.

ALSO READ: Hero MotoCorp and Honda retail sales battle heats up: separated by 6,000 units in August

TVS iQube and Bajaj Chetak battle revs up, sales gap less than 10,000 units in April-July

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

01 Sep 2024

01 Sep 2024

46914 Views

46914 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal