TVS iQube and Bajaj Chetak battle revs up, sales gap less than 10,000 units in April-July

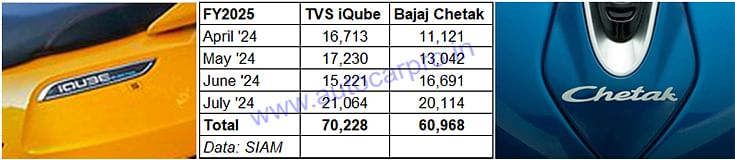

The ongoing battle between the two legacy players in the electric scooter market has turned intense. While TVS Motor Co has sold 70,228 iQubes in the first four months of FY2025, Bajaj Auto has dispatched 60,968 Chetaks to its dealers across the country.

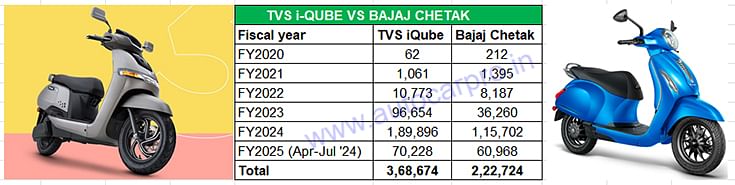

The battle between the two Indian two-wheeler legacy players – TVS Motor Co and Bajaj Auto – for supremacy in the EV market has grown intense in the first four months of FY2025. The wholesales (dispatches to dealers) gap between them at the end of July, for the April-July 2024 period, is less than 10,000 units. In FY2024, at the end of March 2024, the two OEMs were separated by 74,194 units, both having hit their all-time highs – TVS with 189,896 iQubes and Bajaj with 115,702 Chetaks.

In terms of cumulative sales, the TVS iQube maintains a huge lead over the Bajaj Chetak. Both EVs were launched in the same month: January 2020.

In terms of cumulative sales, the TVS iQube maintains a huge lead over the Bajaj Chetak. Both EVs were launched in the same month: January 2020.

In the current fiscal, TVS and Bajaj Auto, which entered the Indian electric two-wheeler industry in the same month (January 2020), have both registered new cumulative sales milestones for their electric scooters. While the TVS iQube surpassed the 300,000-units mark in early April 2024, Bajaj Auto topped the 200,000 milestone in June 2024, with the last 100,000 Chetaks sold in just eight months. Clearly, these two legacy players are making their presence felt in a field teeming with EV start-ups.

Cumulative wholesales-wise, the TVS iQube (368,674 units) maintains a huge lead of 145,950 units over Bajaj Auto (222,724 units) as a result of the big sales margins in FY2023 and FY2024 (see data table above). However, in the first four months of FY2025, iQube sales seem to have slowed down while those of the Chetak have perked up. In June, the Chetak (16,691 units) even went ahead of the iQube (15,221 units) and in July, clocked its best-ever monthly numbers of 20,114 units, hitting the 20,000 sales for the first time.

Nevertheless, the TVS iQube, which is currently retailed with three options – 2.2kW, 3.4kW and 5.1kW – and has five variants, has a strong resonance in the market. On the marketing network front, TVS Moor Co currently has around 750 dealers and sub-dealers spanning over 450 cities across India.

Meanwhile, demand for the Bajaj Chetak has risen with the introduction of the new Chetak 2901, priced at Rs 96,000 in June. This strategic move to drop below the Rs 100,000 pricing helps the Bajaj EV address the sub-Rs 100,000 segment, which accounts for nearly 50% of the overall e-two-wheeler market.

July was the best month for both TVS and Bajaj in the first four months of FY2024 albeit the sales gap between the iQube and Chetak is down to 9,260 units.

July was the best month for both TVS and Bajaj in the first four months of FY2024 albeit the sales gap between the iQube and Chetak is down to 9,260 units.

While the TVS iQube Celebration Edition features a dual-tone, orange-and-black colour scheme, the Bajaj Chetak 3201 is finished in black.

While the TVS iQube Celebration Edition features a dual-tone, orange-and-black colour scheme, the Bajaj Chetak 3201 is finished in black.

On the retail front though, TVS Motor Co maintains a sizeable lead. As per Vahan data for the April-July 2024 period, TVS clocked sales of 109,747 iQubes (up 25% YoY) compared to Bajaj Auto’s 84,225 units, up 213% YoY. This constitutes a difference of 25,522 units. Clearly, the battle between the two legacy OEMs has turned exciting.

Upping the EV ante with special editions

To celebrate Independence Day, TVS Motor Co has introduced a Celebration Edition of the iQube and iQube S priced at Rs 120,000 and Rs 129,000 (ex-showroom), respectively. It is worth mentioning that the standard iQube's prices haven't changed. Only 1,000 units of each variant are available. The Celebration Edition features a dual-tone, orange-and-black colour scheme on specific parts of the e-scooter, distinguishing it from the regular monotone iQube. There are no mechanical changes, with components such as the battery, motor capacity, chassis, suspension and brakes remaining unchanged over the standard iQube. The TVS iQube 3.4kWh variant develops peak power output of 4.4kW and 140Nm.

Meanwhile, Bajaj Auto has recently launched the Chetak 3201, a special edition available only on Amazon. Priced at Rs 129,000 (ex-showroom, Bengaluru), the Chetak 3201 is claimed to have a 136km range which is higher than the top-spec Chetak Premium. The limited-edition Chetak 3201 comes finished in black, along with ‘Chetak’ stickering on the side panels and a two-tone quilted seat. Bajaj Auto has equipped this model with a monochrome TFT as standard, but it can be upgraded to a colour TFT by purchasing the ‘TecPac’. The company hasn’t mentioned the cost of the TecPac but includes features like a TFT that supports Bluetooth connectivity, turn-by-turn navigation, and two riding modes (Sport and Eco). Additionally, the Chetak 3201 boasts a 3.2 kWh battery pack similar to the top-spec Premium variant but has a higher claimed range and charging time.

Festive season to drive up demand

With the festival season coming up soon, it will be interesting to see how growth stacks up for these two e-scooters. With demand growing strongly for e-two-wheelers in the country, expect both TVS and Bajaj to go out to accelerate sales. It is understood that TVS will launch a new electric two-wheeler in Q2 FY2025 (July-September 2024).

What is giving the Chetak new verve in the market is the ramped-up production and a growing dealer network, which is to be expanded from its existing presence in over 170 cities and 250 touchpoints to around 1,000 by September 2024. What's more, Bajaj Auto is also soon to further up the ante with the launch of a new mass-market e-scooter under the Chetak brand umbrella.

With stiff petrol prices and most Indian states offering plenty of incentives to accelerate electric mobility, both the Bajaj Chetak and TVS iQube should continue to see robust demand in the coming months. Ola Electric remains the e-two-wheeler market leader by car but in an expanding marketplace with new products, what ticks the boxes for both TVS and Bajaj is their strong brand image, reliable aftersales support and an expanding market launch strategy.

ALSO READ:

Electric two-wheeler sales in July cross 100,000 units after four months

RELATED ARTICLES

Suzuki Dispatches 703 e-Access Scooters in January, Delivers 201 Units to Customers

Suzuki Motorcycle India’s first electric scooter, priced at Rs 188,000 and among the most expensive two-wheeled EVs, reg...

Honda Sells 5,445 Activa-e and QC1 e-Scooters in 12 Months

Since February 2025, Honda Motorcycle & Scooter India has produced 11,168 e-scooters, dispatched 5,445 units to its deal...

Kia Carens Sells 277,000 Units in Four Years, Clavis And Clavis EVs Power 24% Growth in FY2026

The Carens MPV, which turns four years old today, accounts for a 27% share of Kia India’s sales of 10,43,126 utility veh...

15 Aug 2024

15 Aug 2024

25541 Views

25541 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi